Thapana Onphalai

A tech correction has begun, but that doesn’t mean that investors should shy away from buying shares of high-quality companies at a discount. These volatile moments, in particular, often have the impact of severely dislodging companies’ valuations from their underlying performance.

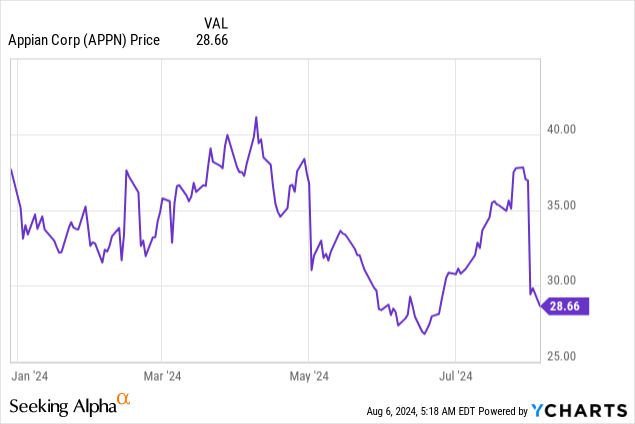

This seems to be the case for Appian (NASDAQ:APPN), a software company whose platform focuses on delivering a low-code (i.e., with business users at the wheel instead of IT departments) method of automating manual work processes. In early August, the company reported strong Q2 results that featured accelerating growth and robust adoption of its AI solutions. Even so, Appian’s stock has fallen sharply since reporting Q2 results (in tandem with the broader market), bringing YTD losses above 20%, where Appian has dramatically underperformed the S&P 500 despite healthy fundamentals.

I last wrote a bullish note on Appian in July, when the stock was trading around $31 per share. Owing to the confluence of a share price that’s now ~10% lower on top of a strong recent earnings print, I’m reiterating my buy rating on this stock.

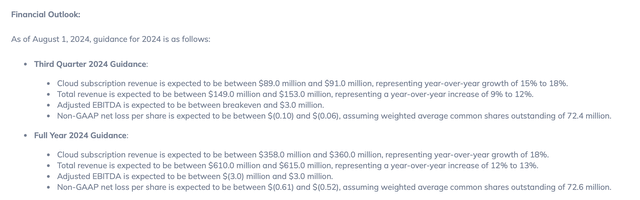

We note that Appian has shown a tremendous capacity to balance growth and profitability, despite investing heavily in rolling out successful AI tools. The company said that while growth remains its top priority, in Q2 it enacted a broad operational review and sliced several “non-strategic expenses.” As a result of this, the company is now guiding to a midpoint of breakeven adjusted EBITDA for the full year FY24.

Appian outlook (Appian Q2 earnings release)

Valuation is the other major merit for investing in Appian, even more so, as a result of the stock’s precipitous decline. At current share prices near $28, Appian trades at a market cap of $2.07 billion after we net off the $149.1 million of cash and $254.0 million of debt on the company’s latest balance sheet, Appian’s resulting enterprise value is $2.18 billion.

Against the midpoint of this year’s guidance range, Appian trades at just 3.6x EV/FY24 revenue. And for next year FY25, Wall Street analysts are expecting the company to generate $684.4 million in revenue, or 12% y/y growth, putting the stock at a 3.2x EV/FY25 revenue multiple.

Meanwhile, against its modest valuation and burgeoning profitability, here are all of the long-term reasons to stay long Appian:

- Recurring-revenue business with strong net retention rates – Appian is boasting net revenue retention rates near 120%, indicating that install base customers are expanding at a rapid clip. This tendency toward expansion gives Appian a “cheap” source of revenue growth that will help it scale toward meaningful profitability.

- Business process re-engineering has a natural tie-in to AI, and it won’t be crowded out by AI investments – Appian focuses on software that helps to eliminate manual processes, which is a core tenet of AI (and the company is developing its own take on AI automation through a product called Private AI).

- Landing government deals at both the federal and local level – Appian is FedRAMP certified and has customers across various levels of government, including federal and state agencies. As software investors are aware, public-sector contracts represent some of the largest deals in the industry, giving Appian an excellent route to market.

- Scaling gross margins and headed toward breakeven adjusted EBITDA – Though the company had poor gross margins at the time of its IPO, it has since reduced its reliance on low-profit professional services revenue. The result is a mid-70s gross margin profile that rivals most of its software peers, allowing Appian to scale toward its goal of adjusted EBITDA breakeven in FY24 with additional opex cost cuts.

Stay long here and hold out patiently for a rebound.

Q2 download

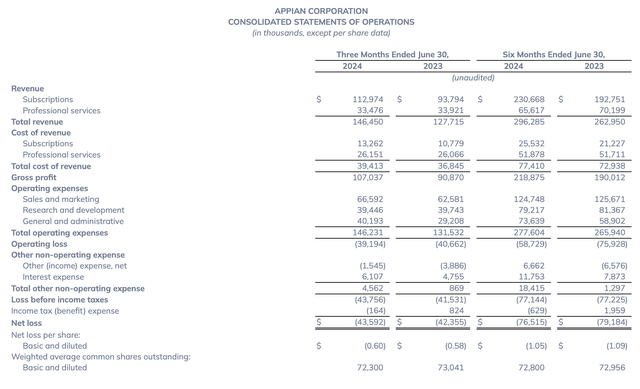

Let’s now go through Appian’s latest quarterly results in greater detail. The Q2 earnings summary is shown below:

Appian Q2 results (Appian Q2 earnings release)

Appian’s revenue grew 15% y/y to $146.5 million, ahead of Wall Street’s expectations of $142.9 million, or 12% y/y growth, by a significant three-point margin. We note as well that revenue growth accelerated four points versus 11% y/y growth in Q1, primarily driven by roughly flat y/y performance in professional services revenue (which we should use as a barometer for new deal activity, but as a reminder Appian performs this consultation work for very low margins) whereas Q1 had a large double-digit y/y headwind.

Underlying subscription revenue, meanwhile, grew 20% y/y to $118.0 million (also accelerating one point versus 19% growth in Q1), while cloud subscription revenue grew 19% y/y.

We note that one of the possible concerns for Appian exiting Q2 is the deceleration in cloud subscription growth from 24% y/y in Q1. However, we have to balance that against the fact that total subscription growth still accelerated. On the whole, I don’t find it particularly meaningful if Appian’s consumption mix tilts a bit toward term licenses and on-premises deployments. Revenue is still mixing away from professional services and toward total subscriptions, which is the major margin driver (as a result of this, gross margins in Q2 hit 75%, two points better y/y). We also note the fact that cloud dollar-based net retention rates remained high at 118%, indicating that cloud customers are still expanding at a healthy pace.

Healthy government sector activity continues to represent a major growth catalyst for Appian, and in Q2, the company tacked new AI-powered procurement features into its government suite. Per CEO Matt Calkins’ remarks on the Q2 earnings call:

Public sector is one of our most successful verticals. We have momentum with our GAM suite, Government Acquisition Management, GAM suite. Agencies use GAM to manage their detailed processes for procuring goods and services. We are broadening our investment in the suite because adoption has been strong. GAM bookings more than doubled in the first half of this year compared to the same period last year.

To build on this momentum, we launched a service this spring to complement GAM. ProcureSight is an AI-driven website that consolidates major public procurement data sets. Government professionals can use it to synthesize past procurements and generate new procurement documents. Dozens of federal agencies use ProcureSight today.”

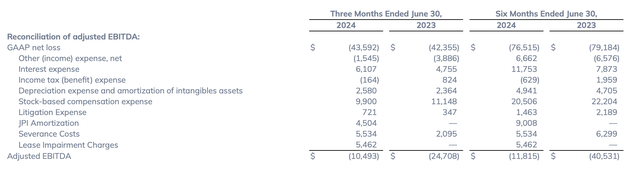

On the profitability front, the company’s adjusted EBITDA improved significantly to a -$10.5 million loss, or a -7% margin: vastly improved over a -19% margin in the year-ago quarter. In my view, the headcount reductions and cost actions that Appian is taking this quarter to get full-year EBITDA to breakeven will be another important and appealing catalyst that can spark a rebound here.

Appian adjusted EBITDA (Appian Q2 earnings release)

Key takeaways

With sweeping cost reduction efforts and improving profitability, healthy subscription growth trends, government deal momentum, and robust attach rates on its AI products, there’s a lot to like about Appian at just a ~3x forward revenue multiple. Take advantage of the post-earnings dip as a buying opportunity.

Credit: Source link