filo

Annaly Capital Management Inc. (NYSE:NLY) solidly covered its dividend with distributable earnings in the second quarter last week. The mortgage real estate investment trust, however, also suffered a small decline in its book value as well, but second quarter results were solid and continue to support the investment thesis, in my view.

Annaly Capital Management’s net interest margin was positive for the first time in the last year and with the central bank poised to lower short-term interest rates in 2024, I think the mortgage trust will be able to expand its net interest margin.

This, in turn, could translate into a higher margin of safety for Annaly Capital Management’s dividend and make the stock more appealing to passive income investors.

My Rating History

Annaly Capital Management received a stock classification of Buy in May as prospects for net interest margin growth improved considerably. With the net interest margin turning positive again in 2Q24 and with the central bank soon slated to take action on interest rates, the outlook for Annaly Capital Management is favorable.

Portfolio, Net Interest Margin And Rate Cuts

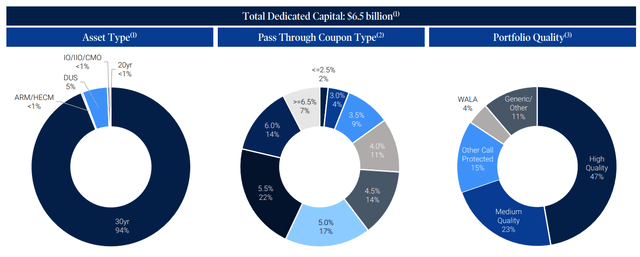

Annaly Capital Management is the largest mortgage real estate investment trust in the world with investment assets of $90.3 billion. The biggest investments in the trust’s portfolio are Agency mortgage-backed securities which had a total value of $66.0 billion in 2Q24, up 2% QoQ, and which consisted mainly of 30-year fixed-rate mortgages. Besides Agency mortgage-backed securities, the mortgage real estate investment trust own residential credit assets as well as mortgage servicing rights.

These mortgage servicing rights are attractive from an investment angle during periods of rising interest rates as they tend to increase in value during such times.

However, the largest asset are mortgage-backed securities which are particularly attractive investments when interest rates fall which is due to the inverse relationship between interest rates and the value of fixed income investments like mortgage-backed securities.

Total Dedicated Capital (Annaly Capital Management Inc.)

Periods of high interest rates economically hurt mortgage real estate investment trusts which borrow money short-term in order to invest in mortgage securities for the long-term. Consequently, their net interest margins contract (or go negative altogether) during such periods, creating downward pressure on book value and valuations.

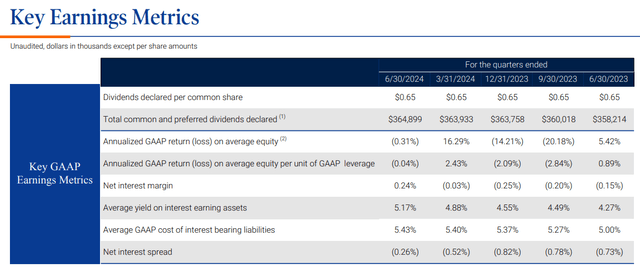

Annaly Capital Management’s net interest margin soared to negative 0.25% in the fourth quarter of 2023, but, for the first time in a year, turned positive again in the last quarter. In 2Q24, Annaly Capital Management had a net interest margin of 0.24% and with the central bank poised to lower short-term interest rates later this year, the mortgage trust could make further gains here.

A widening of Agency mortgage-backed security spreads was a headwind for Annaly Capital Management in the second quarter, but the outlook, given the changed inflation trajectory and reversal in the NIM, is a positive one, in my opinion.

Key Earnings Metrics (Annaly Capital Management Inc.)

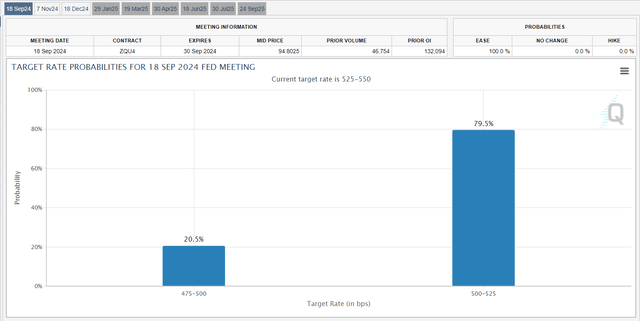

The market expects a near-term catalyst which could put mortgage trusts like Annaly Capital Management back on the map with passive income investors. According to the CME Fedwatch Tool, the central bank is anticipated to slash rates at its September meeting which could provide a catalyst for a substantial net interest margin uplift for Annaly Capital Management. The probability of a 25 basis point September rate cut has risen to 80%.

Target Rate (CME Fedwatch)

Anticipate MSR Sales

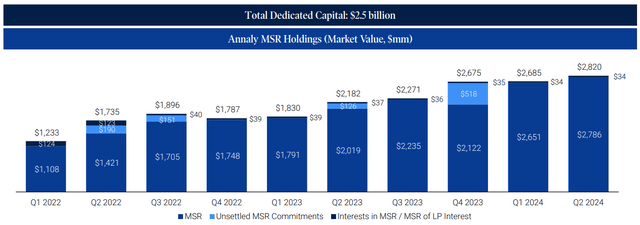

Besides Agency mortgage-backed securities, Annaly Capital Management other investments such as Residential Credit and owns a $2.8 billion portfolio of Mortgage Servicing Rights. These instruments have value for mortgage trusts in a rising-rate environment because their valuation multiples grow.

In the second quarter, the mortgage trust profited from an increase in MSR valuations, but with rate cuts being on the horizon, I think investors are going to see a shift in investment strategy and potential Mortgage Serviving Rights sales.

Specifically, Annaly Capital Management may sell MSRs and allocate investment proceeds to mortgage-backed securities which have valuation upside in a falling-rate environment.

MSR Holdings (Annaly Capital Management Inc.)

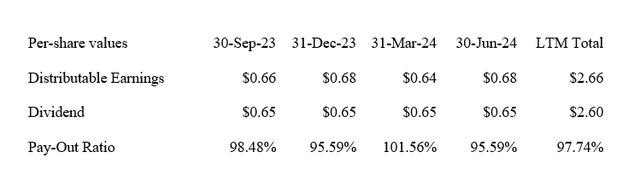

Less Than 100% Dividend Pay-Out Ratio

Annaly Capital Management fully earned its $0.65 dividend with distributable earnings in the second quarter, after under-earning it by 1 cent in the prior quarter. The mortgage trust’s dividend pay-out ratio in 2Q24 was 96% and the trust covered its dividend with distributable earnings in three out of the last four quarters.

Annaly Capital Management’s distributable earnings are mainly backed by the company’s substantial interest income it receives from its Agency MBS portfolio. The trust’s GAAP interest income in 2Q24 amounted to $1.18 billion, up 28% YoY. At the same time, Annaly Capital Management’s GAAP interest expenses rose to $1.12 billion, up only 18% YoY.

With a rate cut on the horizon, these metrics could further improve (meaning the trust’s interest expense could actually decrease) and quite possible equate to an increase in Annaly Capital Management’s margin of safety moving forward.

With a twelve months dividend pay-out ratio of 98%, I think that the dividend has a moderate margin of safety and I do not anticipate a cut to the dividend in the short-term. As a matter of fact, I think that more support can be expected from the central bank in the latter half of the year as rate cuts should benefit Annaly Capital Management’s net interest margin and coverage.

With Annaly Capital Management paying a $0.65 per share dividend, the mortgage real estate investment trust’s stock pays shareholders a solid (covered) 13% yield that I expect to be sustainable for the remainder of the year.

Dividend (Author Created Table Using Trust Information)

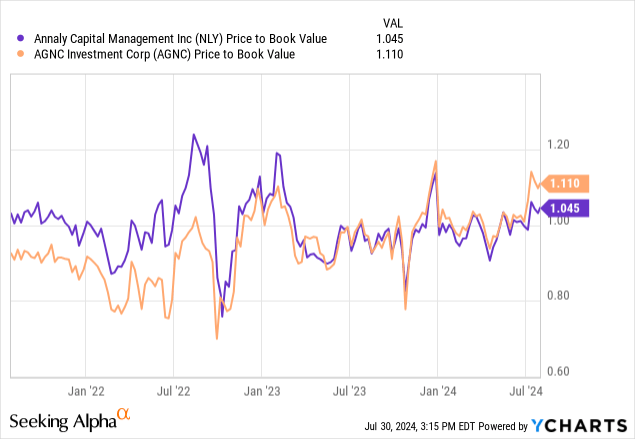

Premium To Book Value

Annaly Capital Management’s stock book value, as of June 30, 2024, was $19.25, reflecting a QoQ drop of 2.4%. The stock price of $19.98 thus reflects a premium to book value of 4%.

AGNC Investment Corp. (AGNC), which is an exactly the same Agency mortgage-backed security business as Annaly Capital Management, is selling for an 11% premium to book value.

Annaly Capital Management also has the opportunity to sell its Mortgage Servicing Rights and invest proceeds into mortgage-backed securities in a low-rate environment which would be a catalyst for interest income growth and potentially a higher net interest margin.

Both Annaly Capital Management and AGNC Investment, taking into account that the central bank is poised to create a catalyst for lower borrowing costs and a higher net interest margin, could sell for 1.10x book value, in my view, which reflects an intrinsic value for NLY of $21.40.

Since Annaly Capital Management’s stock is cheaper than AGNC Investment Corp., I think the 13% yield is particularly compelling for passive income investors.

Why The Investment Thesis Might Not Work Out

Things can go wrong and while the market now factors in at least one rate cut in 2024, if consumer prices were to unexpectedly rise again, I think the central bank may decide to postpone relief in the form of lower interest rates for mortgage real estate investment trusts.

If the central bank delays its rate cut timeline, Annaly Capital Management might not profit from an improved net interest margin (lower borrowing costs) and a re-rating to intrinsic value may correspondingly not occur.

My Conclusion

Annaly Capital Management is selling for a premium to book value and I am optimistic that the mortgage trust can produce stronger financial results in the future and grow its book value multiple as well.

With its net interest margin turning positive again in 2Q24 and the central bank poised to slash short-term interest rates, I think the outlook for a higher net interest margin and book value growth is favorable.

Though the stock is now selling for a 3% premium, the central bank should be able to catalyze improving economics for mortgage trusts which should benefit the largest mortgage trust in the country. Buy.

Credit: Source link