Dr_Microbe

Introduction

Established in 2006, Ascendis Pharma (ASND) is a biopharmaceutical entity originating from Denmark, dedicated to pioneering advanced therapeutic solutions for currently unaddressed medical requirements. Among the products it offers is Skytrofa, a hormone replacement therapy administered via an autoinjector, intended to treat growth hormone deficiency (GHD). The company’s range of treatments also covers pediatric and adult GHD, Turner syndrome, hypoparathyroidism, and achondroplasia. In addition, Ascendis Pharma is conducting ongoing research into therapies designed for intratumoral and systemic delivery.

Recent developments: The FDA rejected Ascendis Pharma’s TransCon PTH drug due to manufacturing control concerns, despite no issues with the clinical data. Ascendis plans to discuss a way forward with the FDA, with a European decision expected in Q4 2023.

Q1 2023 Earnings

Let’s first review the company’s most recent earnings report. Ascendis Pharma’s Q1 2023 revenue was $36.96 million, primarily from Skytrofa sales, a significant increase from $7.48 million in Q1 2022. R&D costs rose to $116.71 million due to higher oncology program costs. SG&A expenses were $73.15 million, an increase mainly due to Skytrofa’s commercial expenses and organizational growth. Ascendis reported a net loss of $121.99 million and held cash and equivalents of $644.27 million.

ASND Stock Assessment

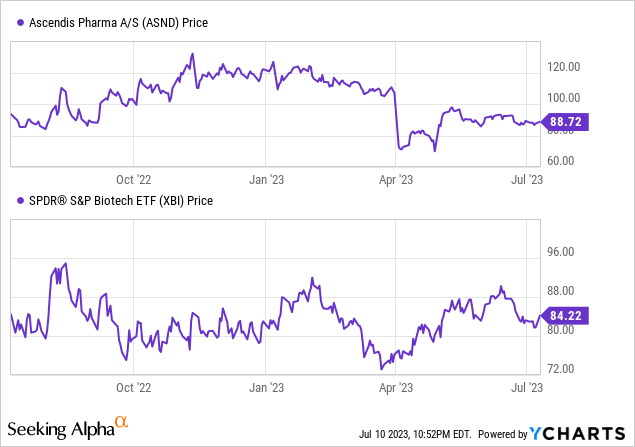

Based on DATA from Seeking Alpha, ASND shows mixed financial indicators. Projected earnings and sales for the next three years indicate a positive trend, with expected annual growth in earnings per share [EPS] of 4.51% in 2023, 19.17% in 2024, and 47.16% in 2025, and sales projected to increase from $184.96M in 2023 to $645.48M in 2025, showcasing strong growth potential. The majority of earnings revisions are positive, suggesting increasing analyst optimism. However, valuation metrics present less favorable signs, with unmeasurable forward and trailing P/E ratios, a high Price/Book ratio of 27.16, and an elevated EV/Sales ratio of 57.24, indicating possible overvaluation. The company exhibits robust growth metrics, with significant year-over-year (YoY) revenue growth of 462.3% and a three-year compound annual growth rate [CAGR] of 97.05%. Momentum is mixed, with recent outperformance compared to the S&P 500 but underperformance over longer timeframes. The capital structure reveals a substantial market cap of $4.93B, significant debt of $548.2M, and a strong cash position of $635.36M.

TransCon PTH: Addressing FDA Concerns for Hypoparathyroidism Treatment

The FDA’s concerns outlined in Ascendis’ Complete Response Letter [CRL] for TransCon PTH, an investigational once-daily hormone replacement therapy, were chiefly regarding the manufacturing control strategy, particularly the variability of the delivered dose in the combination drug/device product. There were no issues raised about the clinical data and no request for further preclinical studies or Phase 3 trials, implying that the FDA’s concerns lean towards quality control and manufacturing processes rather than the drug’s safety or effectiveness.

Ascendis is geared towards working with the FDA promptly to address these concerns. This proactive stance combined with no requests for additional safety or efficacy trials from the FDA suggests a feasible path towards resolution. Moreover, the continuing treatment of 145 out of 154 clinical trial participants with TransCon PTH for up to three years and the ongoing enrollment in the U.S. Expanded Access Program underlines the sustained confidence in the drug.

Upon approval, TransCon PTH could serve a substantial need in treating adults with hypoparathyroidism, a condition that often leads to various health complications such as muscle cramps, fatigue, and heart-related issues. The current standard of care involves patients taking several doses of medication daily. A novel treatment option could potentially offer an immense improvement to patient’s quality of life. According to Frontiers In Endocrinology, Hypoparathyroidism impacts approximately 60,000-80,000 people in the United States, and over 70,000 in the European Union. Given this, the potential market opportunity for TransCon PTH is significant.

It’s also worth noting that a decision from the European Commission is expected by Ascendis in Q4 2023, with an initial EU launch in Germany in early 2024. This signifies an expanded market potential for TransCon PTH beyond the U.S., further enhancing its potential commercial success.

My Analysis & Recommendation

In conclusion, Ascendis Pharma offers a unique blend of opportunities and challenges for potential investors. The company’s demonstrated track record of strong revenue growth, underscored by the robust performance of Skytrofa and its burgeoning product portfolio, suggests a promising upside. Projected earnings and sales over the next three years reveal a promising upward trend, with particularly robust growth expected in earnings per share in the next few years. The potential market opportunity for TransCon PTH, especially if manufacturing issues are promptly addressed and approval is secured, further enhances the company’s revenue prospects. This is reinforced by the company’s considerable cash position and ongoing R&D investments, indicative of a commitment to sustainable growth.

However, several caveats warrant cautious optimism. Firstly, the company’s substantial debt and net losses are areas of concern. Investors should also consider the company’s overreliance on Skytrofa sales for revenue and the uncertainties surrounding the FDA’s approval of TransCon PTH, even if concerns chiefly revolve around the manufacturing control strategy.

In terms of the investment recommendation, I give Ascendis Pharma a “Hold” rating. It exhibits significant potential for growth and progress in biopharmaceutical innovation. Nevertheless, the company’s high valuation and financial concerns coupled with the regulatory challenges on the horizon suggest a prudent approach. Investors should closely monitor the company’s forthcoming interactions with the FDA and the anticipated European decision on TransCon PTH, which could potentially shift the risk-reward balance. Furthermore, any additional diversification in the company’s revenue streams and progress in reducing debt should also be taken into consideration for future investment decisions.

Credit: Source link