Lan Zhang/E+ via Getty Images

Investment Thesis

American Woodmark Corporation (NASDAQ:AMWD) faces near-term headwinds in both repair and remodeling as well as new construction business. The current high-inflation environment is impacting consumers’ budgets for repair and remodeling and they are preferring small-sized projects over large projects like kitchen remodelling. On the New Construction side, the company is facing tough Y/Y comparisons over the coming quarters. The margin performance has been good but I see little upside from these levels. While the valuation is low, I would prefer to remain on the sidelines given the near-term revenue headwinds. Hence, I have a neutral rating on the stock.

Revenue Analysis and Outlook

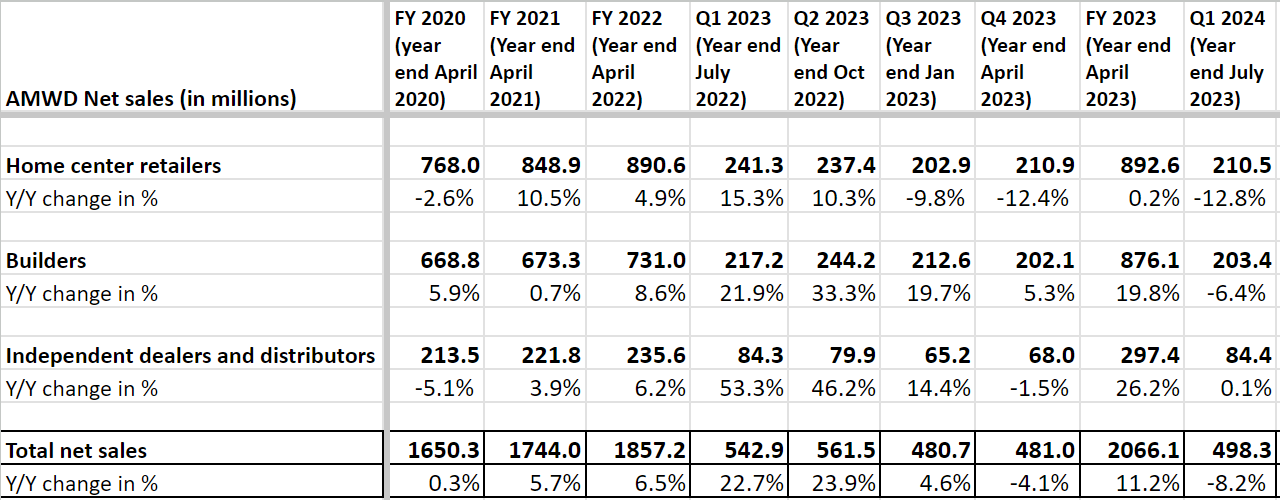

The company has seen slowing demand in its repair and remodel as well as new construction business in the last couple of quarters. In the first quarter of 2024, the company’s Repair and Remodel business, which consists of the independent dealer and distributor channel and home center retail channel, saw a 9.5% Y/Y decline in sales with the home center retail sales decreasing by 12.8% Y/Y and independent dealers and distributors sales increasing by 0.1% Y/Y. AMWD witnessed a decline in demand for the company’s made-to-order and stock kitchen business due to lower in-store traffic rates and consumers’ preference towards smaller-sized projects. The company’s new construction business, which consists of the builder channel, saw a 6.4% Y/Y decline in sales due to a decline in housing starts. Due to the weakness in the Repair and Remodel business and New Construction business, the company’s revenue declined 8.2% Y/Y to $498.3 million.

AMWD’s Historical Revenue Growth (Company data, GS Analytics Research)

Looking forward, the company continues to face near-term revenue headwinds. The remodeling business is expected to continue declining thanks to the inflationary environment, which is impacting the consumer’s budget. Further, a kitchen remodel is a high-ticket project and, according to management, there has been a shift in consumer preference towards low-ticket smaller projects. This is in line with historical patterns where larger ticket activities like kitchen remodeling see a steeper decline during a slowdown and take more time to recover than say a smaller ticket category like plumbing etc. So, I expect the demand for this category to continue to remain muted in the near to medium term. Further, there is a risk of inventory destocking as well in this category given the declining demand.

On the new construction side, there have been some early signs of improvement as housing starts turned positive in July. However, one should note that the company sales last year benefitted from elevated new construction backlog levels as the company fulfilled these orders. With backlogs at normal levels that benefit would not recur this year leading to some Y/Y headwind for sales.

Further, in recent quarters, the company’s revenue has benefited from the carry-forward impact of the pricing increase implemented last year. However, as AMWD has already lapped these price increases, management is not expecting any additional benefits. Below is what the company’s CEO Scott Culbreth commented on the last earnings call,

… the only thing I would add to that is just on the pricing piece, I would tell you that we’ve really lapped the increases that we put into the business a year ago. So we’re not expecting additional gains in pricing to benefit year-over-year going forward.”

Usually, the company doesn’t have significant pricing power as its key customers and channel partners are large homebuilders and retail chains like Home Depot (HD) and Lowe’s (LOW) which are tough negotiators. The company was able to increase prices in recent years due to extraordinarily high inflation, which resulted in price increases across all manufacturers. But I don’t expect much help from pricing moving forward. So, I have a muted outlook for the company’s revenues in the coming quarters.

Margin Analysis and Outlook

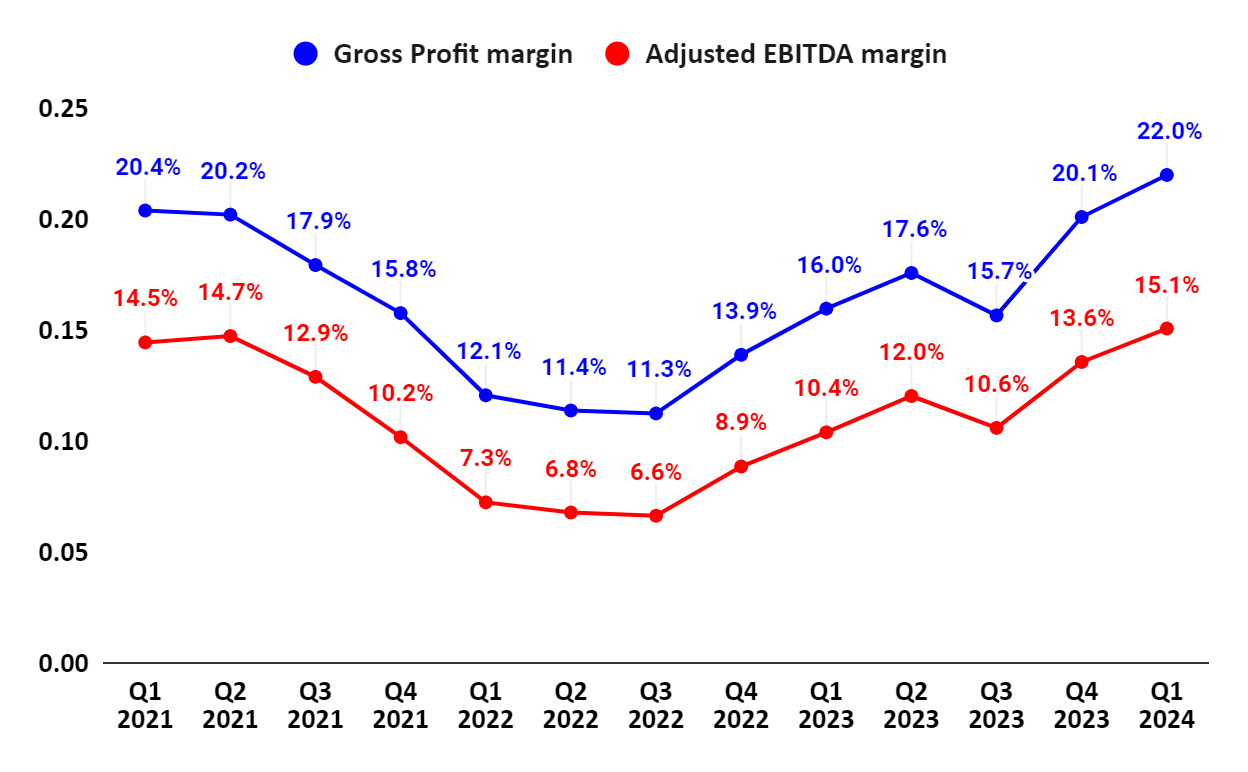

During 1Q24, the company saw a 600 bps Y/Y improvement in gross margin to 22%, driven by a better mix, improved efficiencies in the manufacturing facilities, strong pricing, and stability in the supply chain, partially offset by a $4.9 million pre-tax charge incurred in this quarter. The improvement in the gross margin led to a 470 bps Y/Y increase in adjusted EBITDA margin to 15.1%.

AMWD’s Gross margin and Adjusted EBITDA margin (Company Data, GS Analytics Research)

The company’s margin performance has really been impressive and surprised many investors including me as it has quickly recovered its adjusted EBITDA margins to mid-teen levels. However, with margins already around normalized levels, there is little room for sequential margin improvement in the coming quarters. While the company can still post Y/Y growth due to easing comparisons, I don’t expect much improvement from the levels we have seen in Q1 FY24. In fact, the margins might see a sequential decline due to volume deleverage in Q2 and Q3 as we return to normal seasonal patterns with Q4 and Q1 being the highest in terms of revenues and Q2 and Q3 witnessing lower volumes. In the last couple of years, this seasonal pattern was disrupted due to high backlogs, manufacturing disruptions, supply chain constraints, COVID-related shutdowns, etc. but I expect this year to be closer to the seasonal pattern that the company used to see in pre-COVID days. Further pricing has been a big driver for the company’s margin improvement in recent quarters, and it won’t help in the coming quarters, as explained in the revenue section. In addition, volume deleverage continues to be a headwind and the company will also incur ~$8 mn in start-up cost associated with its Mexico and North Carolina facility in the back half of this year. So, while I am really impressed with what management has achieved in terms of margin improvement in the last few quarters, I don’t see this trend continuing.

Valuation and Conclusion

AMWD is trading at 9.63x FY24 consensus EPS estimates of $8.10. This is a discount compared to its 5-year average forward P/E of 11.68x. The stock is not pricey but given the revenue headwinds this year, I prefer to sit on the sidelines. Given the large ticket nature of the company’s product which usually sees a steeper slowdown in demand in the remodeling category and is slower to recover than small ticket items, I would not be in a hurry to buy it and wait for sales to bottom first. The margin upside is also limited from here in my view. So, I have a neutral rating despite the cheap valuation.

Credit: Source link