wishispower

The US credit card industry has seen significant continual growth over the past two decades as more people shift from physical money to digital. Total US credit card debt is at a record level today, with roughly $1T in total outstanding card debt and $1.25T in total revolving consumer debt. Inflation has accelerated this growth as household spending rises with higher consumer prices and savings slips, causing more people to rely on credit cards. Despite relatively weak household financial stability, credit card default rates have been relatively low since the stimulus growth in 2020; however, there has been a sharp increase in defaults and charge-offs over recent months, indicating that the trend may be reversing.

One of the more interesting companies in the credit card industry is American Express (NYSE:AXP). American Express credit cards are notoriously popular for their attractive rewards programs, fueling a 65% increase in the company’s sales per share and a 150% rise in its EPS over the last five years. Most analysts are bullish on AXP stock, with an SA rating of 4.1X, mainly driven by its strong profitability and decent growth record. AXP trades at a forward “P/E” of 14X and a TTM “P/E” of 16X, around 10-20% lower than its typical valuation over the past five years. However, the stock is much more expensive than most of its peers, many of whom are banks that have suffered significant declines in recent months due to falling deposits.

Unlike Mastercard (MA) and Visa (V), American Express is both a bank and a credit card issuer. Accordingly, the company bears the burden of a rise in defaults and increases in interest deposit costs, both of which are potential risk factors facing the stock today. American Express has no direct exposure to the “off-balance sheet loss” crisis compared to traditional banks since it does not have significant securities assets. However, growing competition in the deposit market will increase its interest expense and likely hamper its net interest margin. Further, if enough banks face the strain, then it is expected that even those with less exposure, like AXP, will suffer to an extent due to the immense interconnectedness of the global financial system today. However, I believe the most significant overall risk facing AXP today is a rise in defaults, which seems to be signaled in today’s consumer data. With this in mind, it is an opportune time to take a closer look at the company and its economic exposure to better assess its risk and reward potential.

AXP’s Deposit Growth Comes with Costs

There are plenty of articles illustrating the positive aspects of AXP, mainly focusing on its growth, customer retention, and its reasonable valuation. In most respects, American Express is a solid “growth at a reasonable price” stock. My aim is not to negate the positive aspects but more clearly illustrate the fundamental risk factors facing AXP that could cause it to face larger-than-expected losses. Readers averse to assessing stock risks, be warned. American Express is a financial company, so it is liable to meet the “rise like an escalator, fall like an elevator” of all other financials due to its significant leverage demands.

For any depository institution today, the primary risk factor investors must assess is deposit losses. As detailed in excess in various articles, total US bank deposits are likely to continue to trend lower as long as interest rates are elevated, savings levels are low, and, most importantly, the Fed allows its balance sheet to run off. The massive QE program in 2020 created excessive new money that flowed into banks and then into the economy via lending and asset purchases. Today, the “QT program” is destroying money, directly lowering the amount of total money that can be deposited in banks. It is extremely simple, and all depository institutions must compete to maintain deposits or risk being forced to sell assets at a discount to maintain appropriate leverage.

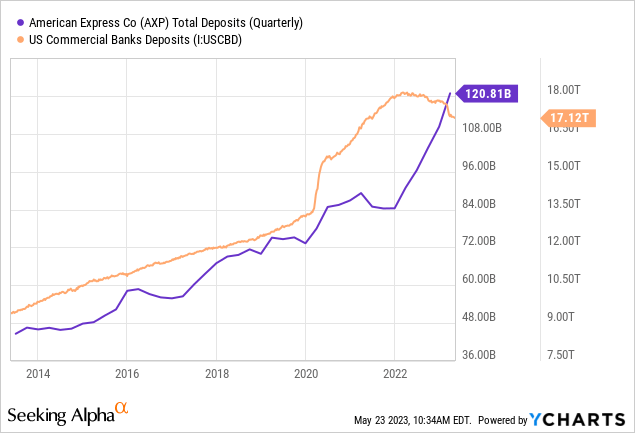

Fortunately, American Express is among the few financial companies that have seen its deposits soar as total US bank deposits reverse. Indeed, AXP’s deposits grew faster, just as total deposits peaked in early 2022. See below:

The peak in deposits coincides with the initial increase in interest rates and the end of QE. Before this, there was virtually no competition for deposits as all financial companies paid zero interest. Today, there is immense competition as the total money to be deposited is declining, and interest rates are much higher, causing banks to compete with 5%+ yielding T-bills. Most large banks have avoided increasing savings account deposit rates to avoid losing net interest margins. However, American Express has dramatically increased its savings account rate to an APR of 3.9%. It is also worth noting that over 90% of the company’s deposits are FDIC insured and, therefore, at lower run-risk.

On the one hand, American Express’s much higher savings account rate boosts total deposits. On the other, it has a negative impact on its interest expenses. Last year, credit card APRs rose by ~5% to over 20% across the industry in direct response to the increase in interest rates. Initially, most lenders saw no rise in interest costs as many kept savings rates low, causing those banks to suffer more significant deposit declines. Since AXP has led the pack on savings deposit rates, it has had greater deposit growth but could see its NIM fall back 1-3% this year as savings as CD deposit rates continue to catch up. In my view, this change could cause its net interest income to slip to 2022 levels, which are around 20-30% lower than its Q1 23 level; however, this will not have a considerable impact on the stock since it generates most of its net revenue (~75-80%) from discount revenue (charged to merchants) and fees.

Rewards Competition Hampers Margins

American Express’s discount revenue rose 16% over the past year to $7.95B in Q1 23 from $6.8B in Q1 22. The costs associated with those rewards increased by 21% YoY to $3.8B from $3.1B YoY. The net reward operating income is still rising; however, we are seeing associated costs accelerate more quickly, indicating the trend may not continue. One critical factor is American Express’s Delta Sky Club program which is a major driving factor for its cards, particularly among the military, due to its fee waiver. Since so many AXP members have been overfilling Delta’s Sky Club in airports, Delta has dramatically increased restrictions and costs for non-AXP card members. This deal likely comes with the caveat that American Express will pay Delta more for the program.

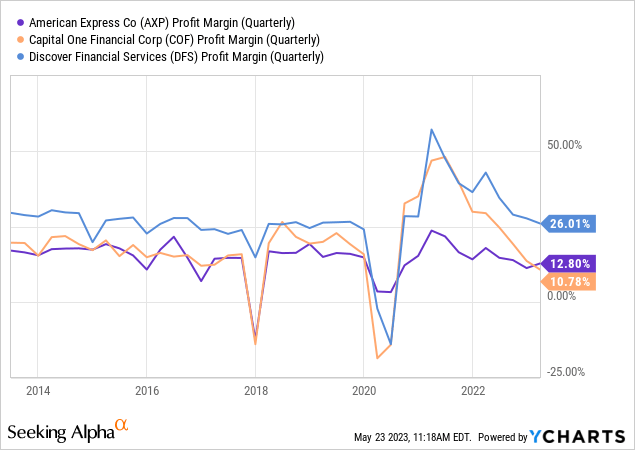

American Express, and its competitors, are facing growing costs disproportionately to increase net revenues despite significant increases in credit card growth and historically low charge-off rates. For AXP, the most significant increase is in card member services and employee salaries; however, the company is also seeing substantial cost growth in marketing, service costs, and business development expenses. The result is a notable decline in the company’s profit margins. See below:

AXP’s margin is still within the historically normal range, but its trend is notable. This is primarily associated with growing competition for rewards among credit card issuers, creating negative competitive pressures on profit margins. Importantly, if charge-off rates normalize, their profit margins would be below the historically normal range today. This indicates competition and growing inflation in rewards costs (airfare, etc.) is a net negative for AXP’s forward profit outlook.

Default Rates are Likely To Rise

In my view, the two risks above, falling NIMs and reward-program competition, could negatively impact AXP’s profits by 10-30% if the sector’s margins continue to slip at the current pace. Since total US consumer credit growth is slowing rapidly, I do not believe American Express will continue to see net revenues increase due to rising demand. Thus, investors have little fundamental reason to assume AXP’s strong EPS growth will continue. Further, I believe a rise in defaults and charge-offs may have a larger-than-expected negative impact on the stock this year.

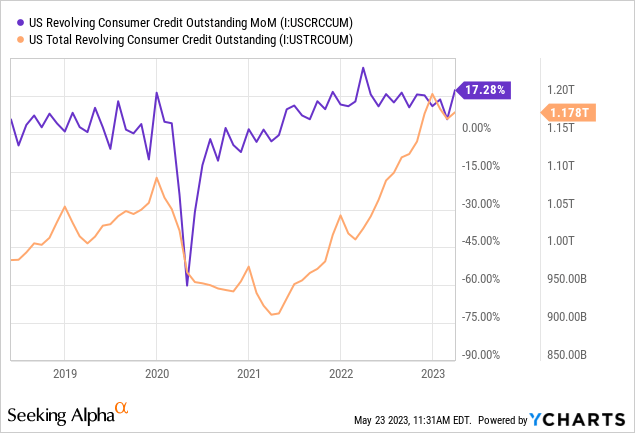

During 2020, most Americans’ credit card debt declined as people reduced spending due to lockdowns. Unsurprisingly, credit card usage soared in 2021 and 2022 as people’s spending habits returned to higher consumer prices. More recently, there has been a notable slowdown in revolving debt growth; see below:

Although the most recent data showed a rise in revolving debt growth, overall revolving debt has stagnated over the past three months. This shift will likely lower the potential growth for AXP as there is a lower influx of credit card usage, the primary factor benefiting the stock since 2020. Further, this slowdown could increase customer competition, creating more negative pressures on margins as reward costs grow.

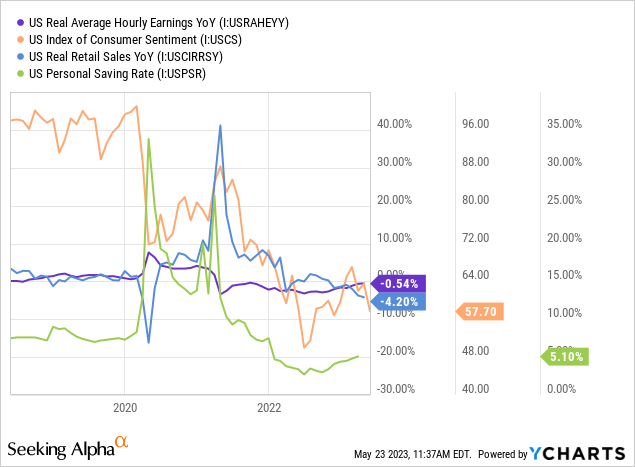

Of course, we must as why consumer credit card growth is slowing. Put simply, household financial stability is objectively poor today due to the sharp increase in consumer prices, particularly compared to incomes. Since 2020, there has been a record decline in consumer sentiment despite savings growth during that year. Since mid-2021, there have been more significant declines in personal savings levels and negative trends in real retail sales as households reduce extraneous spending. See below:

This data clearly show that US consumer stability is weakening as higher prices cause most to lower spending. Last year, many households aggressively borrowed via credit cards to maintain spending standards; however, the stagnation in revolving credit use indicates that many cannot borrow more. Indeed, the reality is that the strains may be larger than are suggested by the “official” data, as actual inflation experienced by people could be 3-5% above CPI inflation. If so, then real retail sales and hourly incomes are much weaker than official metrics suggest, potentially explaining the record decline in consumer sentiment surveys since 2021.

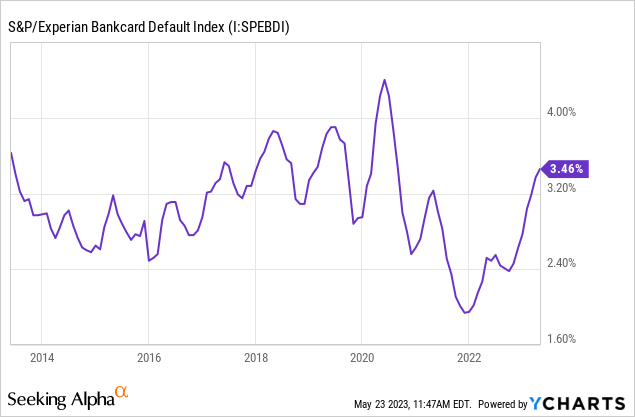

The significant declines in consumer debt spending and the increase in personal savings dramatically lowered credit card defaults in late 2020, lasting until 2022. This key measure for American Express is lagging behind the economic fundamentals, so it would be unwise for investors to extrapolate current default rates driven by much older economic fundamentals. That said, the default rate on most credit cards is now back in the historically normal range and is rising quickly. See below:

Accounting for the sharp deterioration in consumer fundamentals, I believe it is quite likely that credit card defaults will soon rise at an abnormally high level. On a seasonally adjusted basis, the default rate is growing at a very rapid pace, which is indicative of a recession that particularly impacts consumer stability. This risk factor could significantly impact American Express and may quickly wipe out much of its 2023-2024 EPS if it rises in a typical recessionary fashion. While some may say that American Express’s customers are typically in safer income brackets, it should be noted that the current wave of layoffs and income reductions is the largest for the highest income brackets today. Accordingly, AXP may have a more extensive negative exposure than its competitors to a recession since we’re seeing an abnormal trend that negatively impacts white-collar workers while blue-collar workers are still seeing their financial position improve.

The Bottom Line

Overall, I am bearish on AXP and believe it is mildly overvalued today. Based on the data, it looks pretty likely that AXP’s earnings growth will be much lower than in recent years. Critical drivers of that slowdown are a decline in NIMs, competitive increases in member expenses, and a general stagnation in total US credit card usage. Historically, the stock has traded at a “P/E” of 12-14X during periods of no EPS growth; while it could still have some EPS growth during Q2, I doubt its 2023-2025 EPS growth will be notable based on the fundamental shift. Interest rates are also higher today, lowering all stocks’ “fair” valuation. Accordingly, AXP may be overvalued by around 15-20% today based on a lower EPS growth outlook.

More speculatively, I believe AXP is relatively likely to see a more considerable increase in charge-offs than most currently expect. In my opinion, the bulk of consumer data clearly indicates a sizeable impending increase in credit card defaults. If so, AXP could fall more significantly as it faces some impairment due to defaults. Assuming default rates lag consumer financial stability (wage growth, retail spending, savings, sentiment, etc.) by around 12-18 months, I suspect AXP’s charge-offs will accelerate dramatically over the coming quarters. In my view, this is the most significant potential negative catalyst for AXP today. That said, based on the immediate data, I do not believe AXP is so overvalued that it is a short opportunity; however, I may become more bearish if my speculative outlook regarding charge-offs begins to be realized in the data.

Credit: Source link