David Becker/Getty Images News

Our differentiated investment thesis on Advanced Micro Devices, Inc. (NASDAQ:AMD) stock continues to play out; we remain sell-rated on the stock post Q1 2023 earnings results. We expect further downside risk into 2H23 due to the weaker-than-expected PC Client and data center end-market demand coupled with moderating share gain against Intel Corporation (INTC).

The stock is down roughly 17% since our downgrade from buy to sell in mid-March, underperforming the S&P 500 (SP500) by 22%. We see further downside risk to AMD’s financial performance toward the end of the year on the back of the softer cloud/enterprise spending as well as moderating share gain. We recommend investors count their profits and exit AMD stock at current levels before the stock dips further.

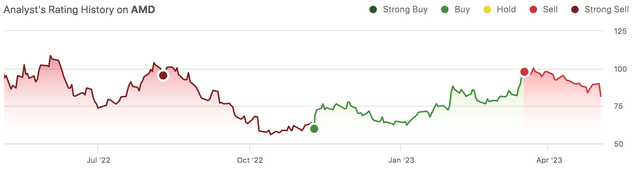

The following graph outlines our rating history on AMD.

SeekingAlpha

Q1 2023 & Downside Risks Through H2 2023

AMD beat on top and bottom lines in Q1 2023 but confirmed our expectations of weaker-than-expected PC Client demand and moderating share gain against INTC. AMD reported revenue of $5.35B, down 9.2% Y/Y, and Non-GAAP EPS of $0.60. The company’s gross margin also shrank this quarter to 50% on a Non-GAAP metric from 53% in 1Q22. AMD stock dropped 6% in extended trading on Tuesday after reporting guidance for 2Q23; we believe the company’s outlook reflects the softer spending environment amid market uncertainty. AMD expects revenue growth to remain relatively flat at approximately $5.3B, plus or minus $300M, lower than the consensus of $5.52B and Non-GAAP gross margin of 50%. We continue to see further downside through the second half of the year due to the following:

1. Softer Cloud/Enterprise Spending

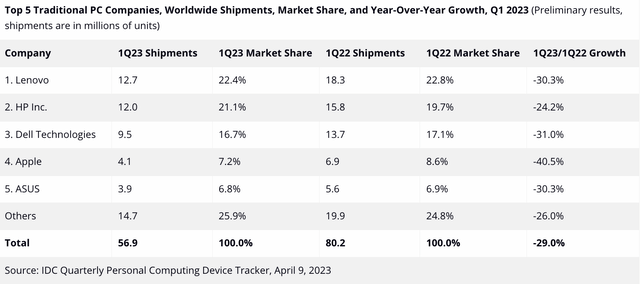

AMD’s PC Client net revenue dropped 65% Y/Y this quarter to $739M from $2,124M, signaling just how bad the demand slump really is. We’ve seen PC shipments decline significantly in 1Q23; Gartner reported worldwide PC shipments collapsed 30% Y/Y this quarter. To further drive the message of weaker demand home, the following graph outlines PC shipments by the largest PC companies.

IDC Quarterly Personal Computing Device Tracker

We believe PC vendors are under-shipping demand to push along inventory correction cycles for PC end-markets. Still, see the PC slump continuing into 2H23 due to the worsening macroeconomic climate. AMD CEO Lisa Su commented on the PC slump on the earnings call saying, “We believe the first quarter was the bottom for our client processor business.”

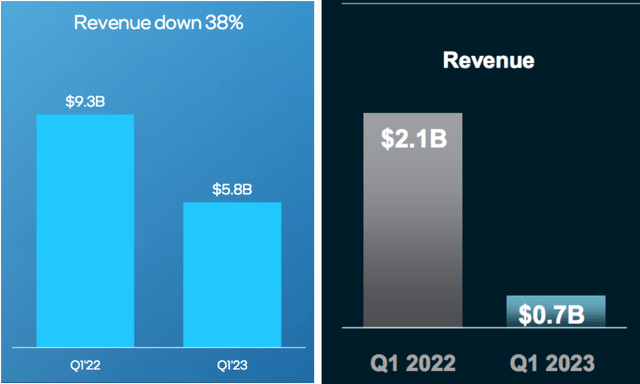

Even if this is true, AMD’s 1Q23 results highlight an additional issue aside from the weaker end-market demand: moderating share gain. AMD underperformed INTC in its PC Client revenue, validating our concern that share gains against INTC have entirely stalled. INTC’s 1Q23 earning results reported a 38% Y/Y drop in Client Computing Group revenue, while AMD reported a steep 65% Y/Y decline. The following outlines both companies’ 1Q23 earning results for Client Computing Group and Client segment revenue, respectively.

INTC & AMD 1Q23 earning presentation, respectively

We also expect AMD’s share gains in the data center market to moderate toward the end of the year and in 2024 due to INTC’s future generation server CPUs, including Sapphire Rapid CPU and INTC’s Xeon series CPU roadmap shown during the DCAI Investor Webinar. AMD and INTC have been head-to-head on the server front; in 2022, AMD took leaps forward, expanding its server market share from 10.7% in 4Q21 to 17.6% in 4Q22, while INTC’s share contracted to 82.4% in 4Q22 from 89.3% a year earlier. We’re now seeing INTC come back with a competitive advantage; we expect INTC’s new offerings to close the gap against AMD’s offering. AMD’s data center segment reported flat revenue growth Y/Y at $1.3B but reflected a sequential decline from $1.7B in revenue for 4Q22. Still, AMD is not staying static- the company expects to grow its cloud and enterprise footprint on the back of fourth-generation EPYC processors, EPYC 9004 codename, Genoa, and upcoming cloud-native CPUs, code-named Bergamo and EPYC CPUs, Genoa-X.

Current macro headwinds are pressuring cloud/enterprise spending, but still, Gartner raised its forecast for IT spending this year to 5.5% this April, compared to lower projections of 2.4% growth in January. We expect cloud providers to pull back on spending as hyperscale cloud service providers underwent an aggressive expansion cycle for the past three years straight under a rough macroeconomic environment. We believe enterprises are more cost-conscious than before and believe this will be reflected in IT budgets, including cloud spending. We see the softer cloud/enterprise spending environment persisting toward the end of the year.

2. Too late for the AI boom

In Artificial Intelligence (AI) server acceleration, AMD is late to the game for the 2023 design cycle. We believe AMD’s AI GPU/CPU MI300 offering is modest in comparison to NVIDIA Corporation’s (NVDA) H100 chips in both AI training and inference of large language models. We believe NVDA has clearly taken the lead on the AI front and retains a competitive advantage to expand its serviceable available market (SAM) going forward and benefit from AI demand tailwinds. We expect NVDA has already cast too wide a beachhead and is far ahead of AMD in terms of the 2H23 and 1H24 design cycles.

AMD’s AI accelerators are improving, but they cannot keep up with NVDA, and we see little room for further improvement before the company can reaccelerate revenue growth. AMD CEO Lisa Su considers AI “one of the keys to its [AMD’s] future market expansion.” However, we don’t see this happening toward 2H23 and recommend investors don’t give in to market noise around AMD’s AI potential in the near term.

Valuation

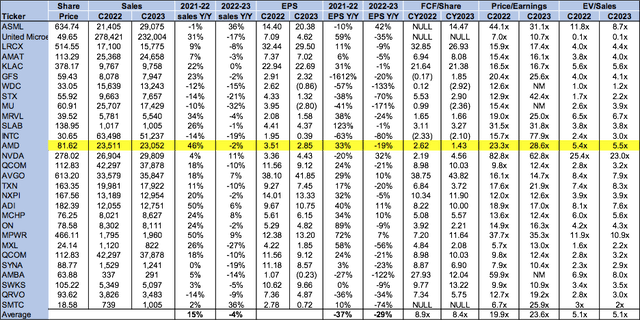

AMD is relatively expensive despite the downside risk apparent for 2H23. On a P/E basis, the stock is trading at 28.6x C2023 EPS $2.85 compared to the peer group average of 19.9x. The stock is trading at 5.5x EV/C2023 Sales versus the peer group average of 5.1x. AMD stock is trading higher than the peer group average on all metrics; we recommend investors count their profits and exit AMD stock at current levels.

The following chart outlines AMD’s valuation against the peer group.

TechStockPros

Word on Wall Street

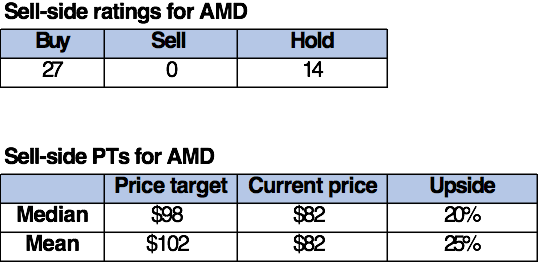

Wall Street consensus strongly leans toward a bullish sentiment on AMD stock. Of the 41 analysts covering the stock, 27 are buy-rated, and the remaining are hold-rated. We believe many investors and Wall Street analysts remain too bullish on the stock. We attribute Wall Street’s bullish sentiment to AMD’s growing position in the PC and data center end-markets, gaining share against INTC significantly over the past year. Still, we believe the bullish sentiment is misplaced as AMD’s financial performance is pressured by downside risk in the near term. AMD stock is currently priced at $82 per share. The median sell-side price target is $98, while the mean is $102, with a potential 20-25% upside.

The following charts outline AMD’s sell-side ratings and price targets.

TechStockPros

What to Do With the Stock

We continue to be sell-rated on AMD into 2H23; we see downside risk pressuring AMD’s financial performance from the softer spending environment and moderating share gains. We also don’t expect AMD to meaningfully benefit from the AI server acceleration as the company is late to the game for 2023 design cycle wins.

Advanced Micro Devices, Inc. stock is trading roughly 25% lower than its 52-week-high of $109.57; we don’t think it’s too late to exit AMD stock at current levels. We recommend investors sell Advanced Micro Devices, Inc., as we see the stock re-rating lower through 2H23.

Our Investing Group, Tech Contrarians, will be launching on June 1st with a significant discount on the annual subscription for the life of the service. We cover everything software/hardware and semiconductors as engineers turned top analysts. Keep reading our work to see more of what’s ahead.

Credit: Source link