Bloomberg/Bloomberg via Getty Images

Investment thesis

The Advanced Micro Devices, Inc. (NASDAQ:AMD) Instinct MI300 series was promised to be the company’s fastest product, with sales reaching $1 bln. Now the number of orders for the Instinct MI300X is off the charts, so AMD has raised its guidance for data center GPU revenue from $2 billion to $3.5 billion in 2024. Judging by the announced specifications, Instinct MI300X, deliveries of which began by the end of Q4 2023, is ahead of the latest Nvidia (NVDA) chips, while costing much less than its H100/H200. Thus, it is the Instinct MI300X series that is AMD’s key (but not the only) revenue driver.

We have covered AMD stock before, and in this report we’ll focus on the Instinct MI300 series and compare it to the competition, but we’ll also break down AMD’s other segments and explain why we assign the HOLD rating.

Data Centers segment: driving AMD’s revenue

Revenue in the Data Center segment totaled $2.3 bln in Q4 2023 (+38% y/y and +43% q/q) compared with our forecast of $1.8 bln. This rapid expansion of revenue in the Data Center segment was driven by the start of sales of AI accelerators of the Instinct series, and consistently strong sales of EPYC processors of the fourth and third generations.

At the beginning of December 2023, Instinct processors were officially unveiled (and ROCm 6 software update was announced) at the AMD’s Advancing AI Event. Previously, the company’s management expected the sub-segment of data center GPUs to contribute $400 mln to the revenue of AMD’s data center segment in 4Q 2023. However, the results exceeded the company’s expectations, and AMD raised its guidance for the sub-segment from $2 bln to $3.5 bln for 2024. Probably, most of the revenue growth was due to the start of Instinct MI300 sales and the volume of expected orders for these processors in 2024, which, according to some estimates, exceeds 400 thousand units.

The Instinct MI300 series was promised to be the company’s fastest product, with sales reaching $1 bln. Although this number is not as impressive as it could be, compared with competition from Nvidia, what matters here is how the specifications of the released products compare with the other latest processors on the market.

Shipments of Instinct MI300A hybrid processors began in November to support the launch of the upcoming El Capitan exascale supercomputer, and AMD plans to begin regular shipments of Instinct MI300X graphics accelerators to leading cloud services and OEMs in the coming weeks.

The first cloud service to utilize the Instinct MI300X was Microsoft (MSFT) Azure, with its new services to be powered by the MI300X paired with Intel Xeon Sapphire Rapids processors. The unveiled MI300X accelerator has 153 bln transistors, 192 GB of memory and a memory bandwidth of 5.2 terabytes per second. Because memory size and bandwidth are very important for AI-related tasks, it was the Instinct MI300X that Microsoft chose over Nvidia’s Hopper GPUs, as even its newest and most powerful chip, the H200, has “only” 141 GB of memory per GPU, not to mention the 80 GB of memory in the H100 chip. The performance of the MI300X makes it suitable for much larger models, compared with Nvidia’s chips, as was demonstrated by the Falcon-40B, the first time when a model of this size was powered by a single GPU. This memory capability is a key distinguishing feature, as NVIDIA will take time to come up with similar specifications, which as we can see hasn’t yet materialized.

So, here’s what the MI300X will provide:

- 2.4 times the memory density and 1.6 times the memory bandwidth of the NVIDIA H100 Hopper;

- 1.36 times the memory density and 1.08 times the memory bandwidth of the NVIDIA H200 Hopper.

This means AMD is still ahead of Nvidia in terms of making advanced chips, and the company’s order book is expanding significantly. At the Advancing AI Event, AMD’s largest partners – Microsoft and Oracle – of course provided positive reviews about the quick and successful adoption of the Instinct. One of the other potential customers, Tesla (TSLA), recently announced its intention to purchase AMD chips to develop AI. As part of supplier diversification, AMD, with a highly competitive product, is able to build up its share of the GPU market at the expense of Nvidia.

According to the Citi’s research, the price of the Instinct MI300X is $10 thousand for Microsoft and $15 thousand for other customers, while prices for the latest Nvidia GPUs exceed these levels, sometimes by as much as 4 times. It raises a certain alert that AMD, while stating that its products feature the best performance in the industry, supplies Instinct processors at a much lower cost.

Until the results of independent tests are available, we will be cautious about the company’s guidance and expect revenue in the sub-segment of GPUs for data centers to reach $3 bln in 2024, and remain at the same level in 1Q 2024 as it was in 4Q 2023, before rising steadily afterward. We don’t rule out that the forecast could be revised upward in the future in the event of the release of independent studies that confirm the performance of the GPU model.

The upswing in demand for AI doesn’t let up

Capital expenditures to develop the data center segment are expected to climb by 11% y/y in 2024, with priority given to investments in the development of infrastructure for accelerated computing, which means, among other things, more orders flowing to Nvidia, AMD and Intel.

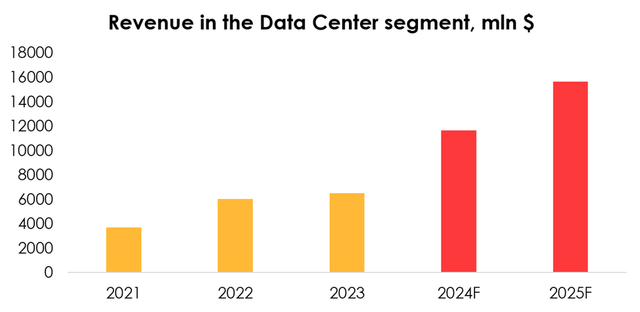

Given the consistent demand for the existing portfolio of processors and the rapidly increasing sales of the Instinct MI300, whose specifications put it in competition with Nvidia’s H100/H200, we expect AMD’s Data Center revenue to grow to $11.7 bln (+80% y/y) in 2024, and $15.7 bln (+34% y/y) in 2025.

Invest Heroes

In AMD’s Client segment, the key drivers for near term are the development and promotion of PCs with embedded AI (AI PCs). The company is developing processors that are optimized for AI. For example, in January 2024, AMD unveiled Ryzen 8000 CPUs, which AMD estimates offer 60% more AI performance than the previous generation. Such companies as Acer, ASUS, HP, Lenovo, MSI, and others have become AMD’s partners in this matter.

The manufacturers of laptops and AI-optimized processors realize that the transition to AI PCs will take time and will not happen suddenly, yet it has been several quarters now since OEMs started to undertake R&D efforts and release chip models that serve as a starting point for these future products. It is likely that adoption of AI PCs will be taking place incrementally as users with increased AI needs will go through the cycle of replacing old hardware. Canalys estimates, based on announced investments in the industry, that 60% of PCs will support artificial intelligence by 2027, and a substantial upturn in demand, according to various estimates (including AMD’s), will occur in 2025 rather than 2024.

Revenue in other segments

Client segment revenue totaled $1.46 bln (+62% y/y and +1% q/q). AMD continues to steadily chip away at Intel’s share in the market of central processors. Along with the recovering worldwide shipments of PCs, this supports the segment’s revenue. We expect the segment’s revenue to grow to $1.57 bln in 1Q 2024.

Gaming segment revenue totaled $1.37 bln (-17% y/y and -9% q/q). Given the ample inventories held by vendors, we expect the sales of gaming GPUs to fall by 9% q/q. However, console sales will probably continue to rise in 2024, which will help reduce inventories and bring AMD’s revenue in the gaming segment back on the path of consistent growth.

Revenue in the Embedded segment totaled $1.1 bln (-24% y/y and -15% q/q). AMD confirmed at the Barclays Global Technology Conference that the correction of inventories in this segment follows the pattern of correction of inventories in the PC market with a lag of one year. The company expects that the sequential declines of revenue in the Embedded segment will end in Q1 2024, giving way to a rebound. Consequently, we expect the revenue in the Embedded segment to be $899 mln for 1Q 2024 and expect a recovery afterward over the second half of 2024.

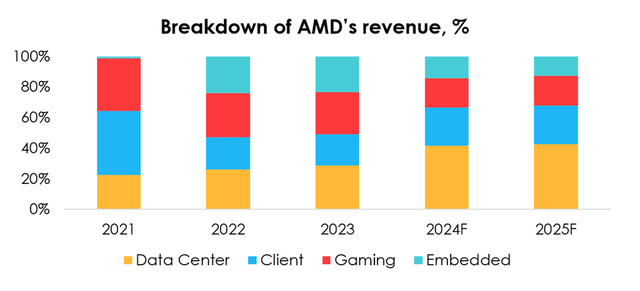

Therefore, given the generally lower results in the aforementioned segments and the outlook for them to hold steady – or in some cases take a dip for 1-2 quarters – we are lowering the forecast for revenue in the segments, excluding Data Center, for 2024 and 2025. We expect the share of the Data Center segment’s revenue will rise to 42% of the total (+13 pp), and the Client segment’s revenue to 25% of the total (+4 pp), given that there are major growth drivers in these two particular segments.

Invest Heroes

AMD’s financial results

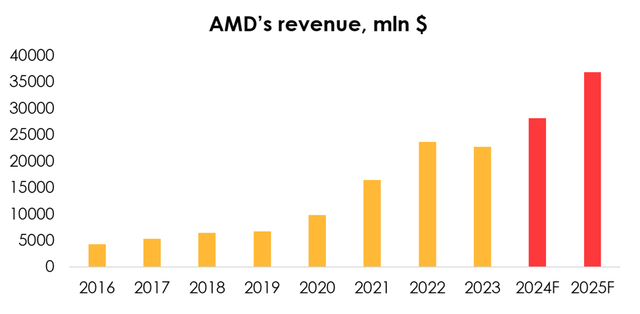

We expect AMD’s revenue to reach $28.1 bln (+24% y/y) in 2024, and $36.9 bln (+31% y/y) in 2025 as the forecast for revenue in AMD’s Data Center segment is expected to grow to $11.7 bln (+80% y/y) in 2024, and to $15.7 bln (+34% y/y) for 2025, a move that was partially offset by lower forecasts for all other segments.

Invest Heroes

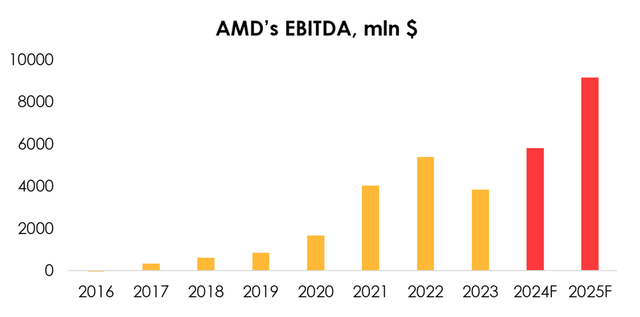

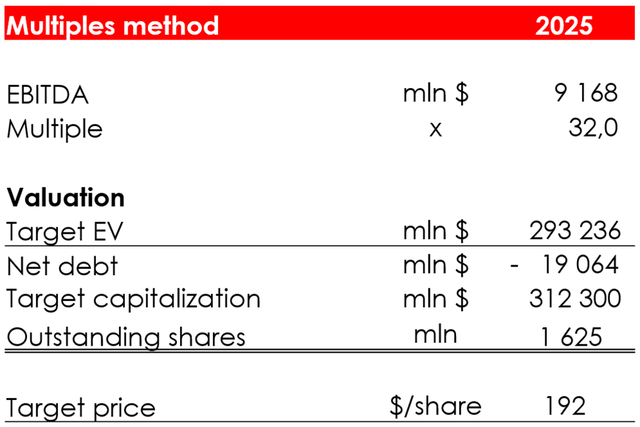

We previously based our forecast for the company’s operating income on the outlook for gross revenue and operating costs. In order to provide high-quality analysis of changes in the profitability of each of the company’s segments, we have shifted to forecasting operating income by segment, which has prompted the forecast to climb due to the upward revision of the forecast for revenue in the high-margin Data Center segment. We forecast EBITDA to reach $5802 mln (+51% y/y) in 2024, and $9168 mln (+58% y/y) in 2025.

Invest Heroes

The outlook for the company’s free cash flow (FCF) is $6116 mln (+446% y/y) for 2024 and $8892 mln (+45% y/y) for 2025. That puts FCF Yield at 2.2% and 3.2%, respectively.

Valuation

We set the target price of AMD shares at $170, which was achieved by computing the target price based on estimated financial results for 2025, and discounting it to the FTM price at the rate of 13% per annum.

Based on the new assumptions, we are assigning a HOLD rating to AMD stock.

Invest Heroes

Conclusion

The emerging trend of re-equipping data centers with accelerators to serve AI-driven technologies improves the potential for the industry’s future growth, which is positive for AMD. In the gaming space, AMD still has the best graphics card in terms of price/performance ratio, but Nvidia has gained a lead in the realm of professional solutions.

Currently, Advanced Micro Devices, Inc. stock is extremely overbought – a result of upward revisions of the company’s potential by major investment houses. As the market was expecting a strong guidance from the company, the stock reached new all-time highs. However, AMD issued a modest outlook for the Instinct MI300, and share prices have been sliding back since then. We believe shares are currently being traded at their fair value. With an entry point like this, they are not a buy. The AMD rating is HOLD.

Credit: Source link