Jonathan Kitchen

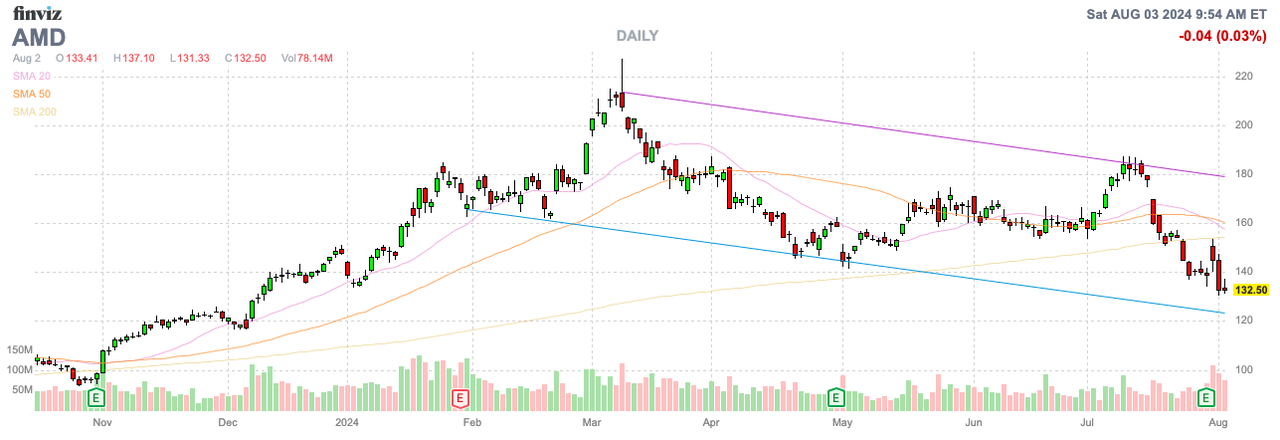

AMD (NASDAQ:AMD) (NEOE:AMD:CA) had limped through in the early part of 2024 with AI GPU sales disappointing, hoping for big sales gains. The chip company finally appears on an accelerated path in the 2H, with chip sales reaching an inflection point in Q2. My investment thesis is ultra-Bullish on the stock, following the massive dip in the last couple of weeks from a high over $180.

Source: FINVIZ.com

GPU Ramp Is Finally Here

The chip company reported a slight beat for Q2’24, not exactly impressive for the results produced by AI GPU competitor NVIDIA (NVDA):

- Q2 Non-GAAP EPS of $0.69 beats by $0.01.

- Revenue of $5.84B (+9.0% YoY) beats by $120M.

AMD did beat analyst estimates by $120 million, but the company only grew sales 9% YoY. Nvidia has grown sales over 200% in the last 3 quarters.

AMD did guide to Q3 revenues of $6.7 billion, above consensus of $6.61 billion. While the guidance is for revenues to jump sequentially by nearly $1 billion, the company is only guiding to ~15% YoY growth in the September quarter.

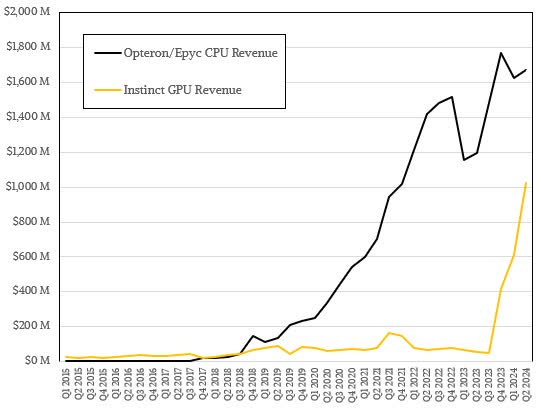

The big story is the AI GPU sales ramp, where revenues topped $1 billion in Q2. AMD has now produced $1.6 billion worth of GPU sales in 2024 and boosted guidance for the year to $4.5 billion, up from a previous target of $4.0 billion.

Source: The Next Platform

In essence, AMD is now guiding to GPU sales of $2.9 billion in the 2H and investors shouldn’t be surprised if the company further hikes estimates to $5.0 billion for the year. AMD would average ~$1.7 billion in sales per quarter in the 2H.

The company still appears very supply constrained according to CEO Lisa Su on the Q2’24 earnings call:

On the supply side, we made great progress in the second quarter. We ramped up supply significantly, exceeding $1 billion in the quarter. I think the team has executed really well. We continue to see line of sight to continue increasing supply as we go through the second half of the year. But I will say that the overall supply chain is tight and will remain tight through 2025. So under that backdrop, we have great partnerships across the supply chain. We’ve been building additional capacity and capability there. And so we expect to continue to ramp as we go through the year. And we’ll continue to work both supply as well as demand opportunities, and really that’s accelerating our customer adoption overall, and we’ll see how things play out as we go into the second half of this year.

While impressive, Nvidia has added billions in additional quarterly GPU sales each quarter. In the last 5 quarters, Nvidia has added $20 billion in additional quarterly sales from AI GPUs. AMD should top $2 billion in Q4 GPU sales, potentially setting up for a big 2025.

The big question is the size of the GPU pie next year. AMD had some forecasts for GPU sales in the $8 to $9 billion range this year, and the view has now shifted towards $5 billion.

If AMD ends 2024 with a $2 billion GPU quarter, one would have to assume an $8 billion run rate to start the year. The question is whether the chip company can ultimately reach $12 to $15 billion in GPU sales in 2025 with the latter providing $10 billion upside the 2024 level.

Back in Q2’24, CEO Lisa Su again emphasized the MI350 to be released in 2025 is expected to be competitive with the Blackwell GPUs from Nvidia:

We are on track to launch MI325 later this year. And then next year, our MI350 Series, which will be very competitive with Blackwell Solutions. And then we’re well on our way to our CDNA Next as well.

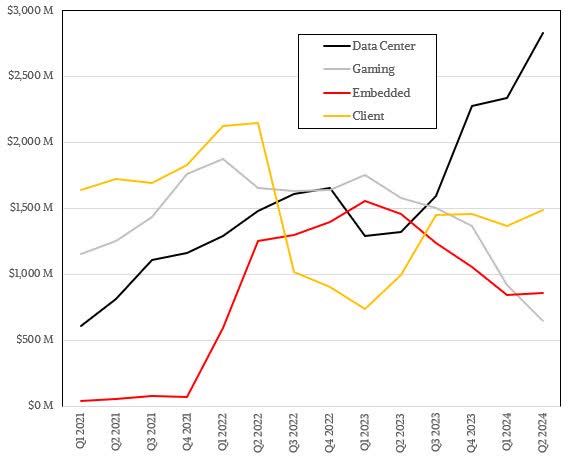

The opportunity continues to exist for sales from other divisions to rebound following a very tough few quarters. The Embedded sales slumped 41% to only $861 million, while the Gaming unit is now down over 59% to only $648 million.

Source: The Next Platform

The Gaming segment isn’t expected to turn around anytime soon, but the Embedded segment hit bottom back in Q1. The category saw design wins in the 1H grow 40% YoY to $7 billion in a sign this segment will see a big rebound.

EPS Surge Ahead

The earnings picture should improve dramatically in 2025. AMD is still guiding to a 53.5% gross margin for Q3, with GPU chips holding down the margin total for now in the initial ramp phase.

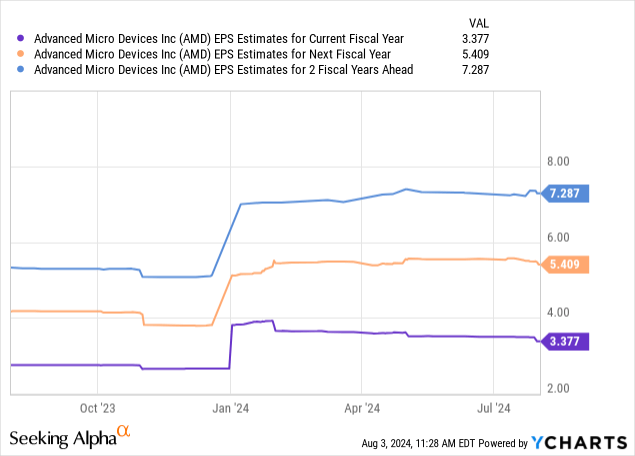

The current consensus estimates have EPS surging from $3.38 this year to $7.29 in 2026. The stock trades at ~25x 2025 EPS targets of $5.41 and the path to much higher numbers is firmly in place now with AI GPU sales ramping up now.

The current earnings estimates are based on revenues rising to $33 billion in 2025, up only ~$7 billion from the 2024 level. AMD appears to have more opportunity to boost GPU sales next year, only requiring the other segments to remain flat in order to grow sales by $10 billion.

AMD has the potential to generate a much higher EPS in 2025 with revenues reaching $36 billion based solely on the $10 billion boost in AI GPU sales with margins pushing towards 60% as follows:

- 2025 Revenue = $36.0B

- Gross Profits @ 58% = $20.88B (peaked at 54% in Q2’22)

- OpEx @ 23% = $8.28B (24% of revenues in Q2’22)

- Operating Income = $12.6B

- Taxes @ 13% = $1.64B

- EPS = $10.96B/1.64B shares = $6.68

The only major risk to the $6.68 EPS target is AMD ramping up operating expenses via investing in the GPU roadmap. The chip company spent at a $1.85 billion rate in Q2, and limited expense growth would push the company close to the $2.08 billion quarterly rate in 2025 in order to hit the 23% OpEx rate target.

The stock initially jumped on the solid earnings and signs of the AI inflection. AMD might have some more downside risk in the short term, but the stock is ultimately headed higher with an EPS surge on the way.

Takeaway

The key investor takeaway is that AMD is finally hitting the AI GPU inflection point. The rest of the company is struggling, but the chip company is set up for a big data center year in 2025.

The stock trades at only 25x EPS targets for 2025 and our view is that AMD has EPS upside of up to $1 next year. Investors should use this weakness to again load up on the stock.

Credit: Source link