coryz/E+ via Getty Images

Overview

Real estate has been heavily suppressed over the last two years due to elevated interest rates. While this hasn’t been great for returns, it has helped reveal which REITs are well-maintained and of higher quality. Alpine Income Property Trust, Inc. (NYSE:PINE) remains a solid option for high-quality real estate exposure as they own a portfolio of commercial net lease properties. However, there are some vulnerabilities that stand out to me and make me reconsider my prior strong buy rating. I previously covered PINE back in August 2023 and would like to provide an updated valuation, review of their portfolio, and cover the financial strength. Most importantly, I want to cover some points that make me a bit less enthusiastic about PINE going forward.

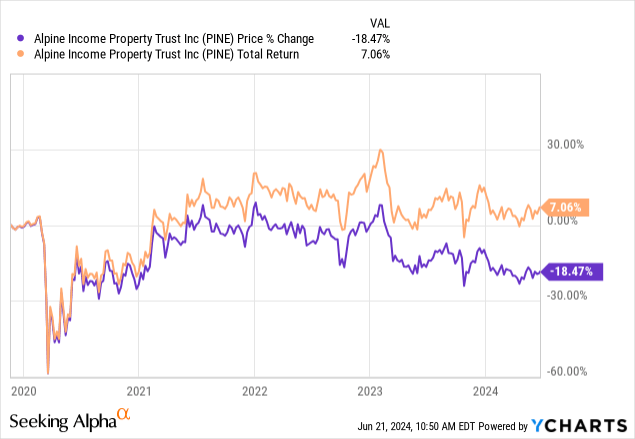

We can see that PINE’s price still remains suppressed below its pre-pandemic level. However, the continued distributions help boost the total return into positive territory. The current dividend yield sits at 7%, which is enticing enough to offset the poor price performance. This high yield can enable the growth of dividend income for an investor who prioritizes a reliable source of income from their portfolio. While PINE’s performance history only dates back to its recent inception in 2019, I believe that PINE is positioned to continue growing dividends over time.

Additionally, PINE has been heavily affected by the rise of interest rates. If we look past this headwind, I think that PINE has some great upside potential. This opens the opportunity to capture a total return that’s comprised of both capital appreciation and dividend income. However, I would first like to start by reviewing their portfolio of tenants and identify some strengths and potential weaknesses.

Portfolio

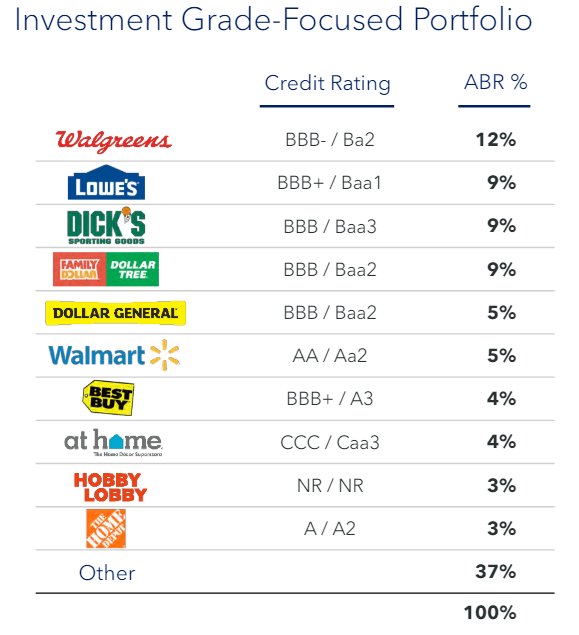

One of the aspects that I have always liked about investing in REITs is that the tenants of the business don’t necessarily need to be thriving. As long as they are paying rents without issues and have a large enough cushion of revenue to cover slight annual rent increases, there usually isn’t a problem. For me personally, this has always made the investment experience of REITs a bit easier to see where vulnerabilities and strengths lie. In the case of PINE, I automatically dislike the fact that the largest percentage of their annualized base rent is coming from Walgreens Boots Alliance, Inc. (WBA).

Walgreens has been suffering from shrinking revenues and how trades are at its lowest level since 1998. Business has become so bad that they are closing over 150 stores over the course of 2024 in an effort to reduce capital losses and increase liquidity. If you want to learn more about WBA’s conditions, I highly recommend reading my fellow Seeking Alpha analyst’s article, ‘Walgreens: Another Dividend Cut Could be Coming Soon’. We can see that PINE’s annualized base rent consists of a 12% exposure to Walgreens and I would love to see efforts to reduce this number over the course of 2024 as I believe it presents a major vulnerability. If conditions surrounding Walgreens worsens, this may threaten their ability to pay rent and may lead to lower earnings for PINE.

PINE Q1 Presentation

The rest of PINE’s portfolio looks solid as they maintain a focus on having tenants that are investment grade rated. Their leases have an average term of 6.9 years, with most of the rollovers happening after 2031. This ensures that the next 7 years’ worth of revenue can be projected and forecasted and gives us an idea of how well PINE’s actual performance aligns with the estimates. The portfolio of tenants are diverse in nature and consists of exposure to a ton of different sub-sectors such as dollar stores, pharmacies, home furnishing stores, and groceries just to name a few. 65% of their total portfolio consists of annualized rent coming from tenants that are rated investment grade.

PINE Q1 Presentation

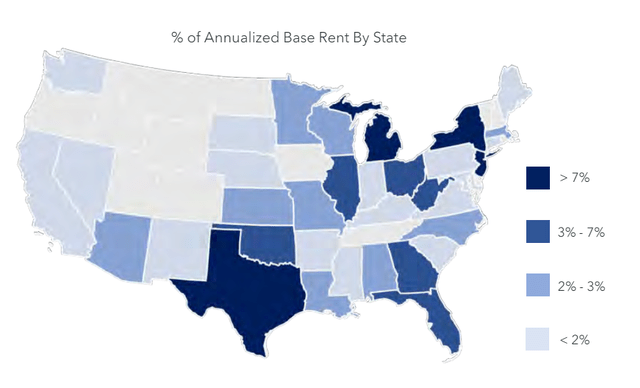

Lastly, taking a look at the portfolio breakdown by state reveals that PINE is lacking exposure to the West Coast markets, especially California. While I have no problem with the current spread of focus areas, I feel that the lack of exposure to the West Coast of the US presents additional opportunities for expansion. PINE’s focus is to maintain properties within areas of the country that have above-average incomes. For instance, PINE’s properties in their top ten markets have a weighted 5-mile average household income of $114,850. For reference, the average household income in the US is about $88,000.

Financials

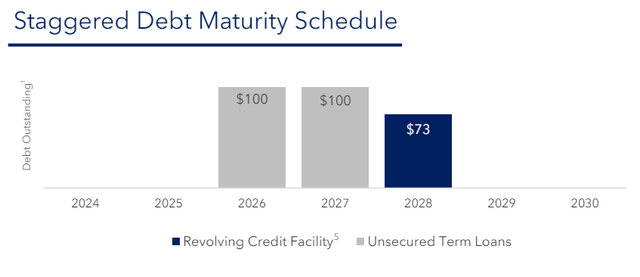

PINE reported their Q1 earnings in mid-April and the results were strong. Revenue grew by 11.7% on a year-over-year basis, amounting to $12.47M for the quarter. This was followed by FFO landing at $0.41 per share, which beat expectations by $0.03. Despite interest rates being at decade highs, PINE has a solid balance sheet at the moment, but debt levels can be improved.

PINE is a smaller REIT with a market cap of $228M, so their cash and cash equivalents total approximately $5.1M. However, this is offset by a large long-term debt total of $272M, which I believe to be chewing into operating profit margins due to a higher level of debt maintenance.

PINE Q1 Presentation

On the positive side of this, there are no debt maturities until 2026 which means that PINE has plenty of time to stack cash. $100M is due in both 2026 and 2027, but this isn’t concerning due to the high revolving credit facility that PINE has on hand. While cash and equivalents only total $5.1M, total liquidity totals closer to $185M when we include the undrawn credit commitments available if needed.

Additionally, PINE has been trying to expand upon their portfolio, but the volume of deals that are attractive in this higher interest rate environment makes it difficult. Over the last earnings call, we received confirmation of this from the CEO.

While we were actively pursuing traditional acquisitions, we have found sellers reluctant to transact at prices that reflect the current interest rate environment. We are anticipating that the market for traditional acquisitions will become more attractive as the markets continue to adjust to higher for longer rates – John Albright, President and Chief Executive Officer

However, PINE is managing this environment quite well and maintains an occupancy rate of 99% throughout its portfolio. During the quarter, PINE originated one first mortgage investment that had funding commitments totaling $7.2M, of which $3.6M was completed over Q1. If interest rates start to come back down, I believe that we will see an increase in the investments made to grow the size of their total portfolio. Right now, PINE seems to be focusing on efficient capital management, as proven by the lower operating expenses that fell from $10.2M in Q4, down to $9.9M in the most recent Q1.

Dividend

As of the latest declared quarterly dividend of $0.275 per share, the current dividend yield sits at 7%. While the dividend history is short, at least I can feel assured that it’s safe. As previously mentioned, FFO per share landed at $0.41. This represents a very large cushion of coverage at 149%. This means that we are likely to see increased dividend raises going forward, as well as a very small chance that the dividend will be reduced throughout the course of the year. Therefore, PINE may be a great choice if you are a long-term investor looking to build a reliable income stream from REITs.

PINE hasn’t really established much of a growth history yet because it’s been around for about 5 years. However, the growth that has been delivered so far is more than sufficient. Including this year, the dividend has increased at an average CAGR (compound annual growth rate) of about 8% since 2021. This level of growth is pretty impressive for a REIT that already has a yield of 7%.

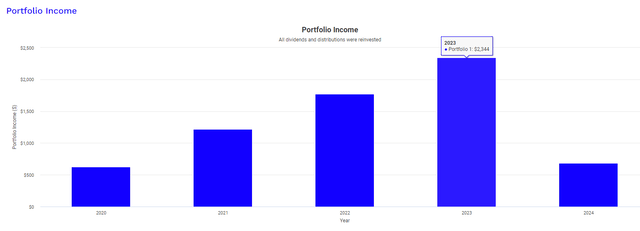

Therefore, you have the ability to build a solid stream of dividend income over time with PINE. To prove this, I ran a back test using Portfolio Visualizer. This visual assumes an original investment of $10,000 at the start of 2020. It also assumes a fixed contributed amount of $500 per month throughout the entire holding period. Lastly, it also assumes that all dividends received were reinvested back into PINE to accumulate more shares.

Portfolio Visualizer

As a result, in 2015 your dividend income would have totaled $628. Fast-forward to 2023 and your dividend income would now total $2,344, a nearly 4x increase in dividend income over a short holding period of 4 years. As conditions improve, I believe that this growth is likely to continue over time, which is what makes it a great holding if you value income growth.

Valuation & Vulnerabilities

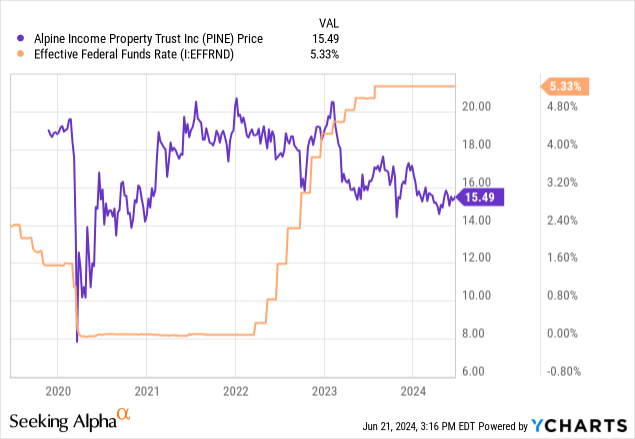

Although PINE’s history is short, we can see that the REIT has also been reactive to interest rate changes. When rates were cut to near zero levels in 2020, PINE’s price initially reacted to the downside because of the uncertainty of Covid. However, shortly after the initial drop, it started to rapidly appreciate in value. Interest rates near zero levels mean that debt could be accessed more readily, and it was cheaper to acquire debt as a means to fund acquisitions, expansion efforts, and different growth initiatives.

On the flip side of this, when interest rates started to rapidly get hiked at the start of 2022, we saw PINE’s price change course to the downside. As it became less attractive to acquire debt and more expensive to maintain debt balances, growth started to slow and caused PINE to consistently fall to the downside. This doesn’t necessarily mean that anything is fundamentally wrong with PINE’s business as a whole, especially when we consider that the entire real estate sector followed the same price patterns as this. This only demonstrates how vulnerable and sensitive PINE is to interest rate changes, and it’s something to keep in mind as a long-term investor.

With that being said, I believe that the tides are shifting and conditions are starting to improve as the market gets accustomed to the ‘higher for longer’ environment. Future interest rate cuts may serve as a strong catalyst for PINE and the real estate sector’s price recovery going forward. Initially, the Fed was waiting for more economic data to roll in around inflation, consumer spending, and the labor market. As inflation started to cool down in May and the unemployment rate slowly ticks above the 4% level, we may finally see interest rate cuts happen over the next 6-month period.

So how much of an impact will interest rate cuts have on PINE’s upward price movement? There’s no way to tell for sure, but there are some valuation metrics that we can reference to get an idea about a fair value. PINE currently trades at a price-to-FFO ratio of 10.14x, which undercuts the sector median price-to-FFO ratio of 12.7x. Additionally, Wall St. has an average price target of $18.25 per share, which represents a potential upside of 17% from the current level. The highest price target sits at $19.50 per share and the lowest price target is at $16 per share. It’s always a nice bonus when the lower price target still remains above the current trading price.

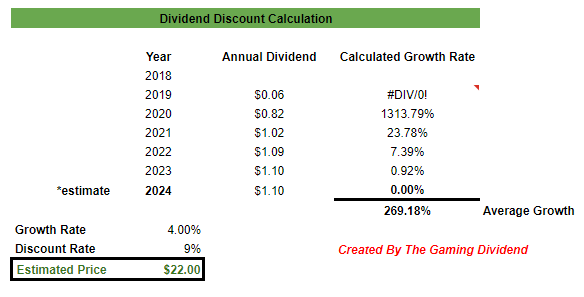

Additionally, Seeking Alpha’s Quant gives PINE a Strong Buy rating with a score of 4.73 out of 5. In order to get another source of reference for a fair value estimate, I decided to conduct a dividend discount model as well. I started by compiling the annual payout amounts dating back to the fund’s inception in 2019. The dividend growth may look large because, for the year 2019, PINE only issued 1 dividend payout during Q4. Additionally, I thought that an estimated growth rate of 4% would be appropriate here since year-over-year revenue growth averaged 3%. In addition, the sector median forward FFO growth sits at about 2%. PINE should be able to outpace this growth, considering that their 3-year average FFO growth sits closer to 6%.

Author Created

With these inputs in mind, I calculate a fair value estimate of approximately $22 per share. This would represent a large upside of 41.5% from the current levels, assuming that PINE can achieve a 4% growth rate. When macro-conditions improve surrounding interest rates, and PINE can more effectively invest in the growth of their portfolio, this growth isn’t too far-fetched.

Takeaway

In conclusion, PINE still remains a solid REIT that has been well-managed in this unfavorable interest rate environment. FFO per share covers the distribution by a large enough margin that eliminates any fear of reductions or lack of dividend raises. In addition, assuming that they can achieve a modest growth rate of 4%, I estimate a large double-digit upside to an estimated fair value of $22 per share. However, the large annualized base rent percentage coming from Walgreens is a bit of a vulnerability at the moment. Walgreens has been struggling, and I fear that this will translate to some of PINE’s base rent being threatened, unless they can offset this through continued growth and reduced exposure. Therefore, I am rating PINE as a Buy at these levels.

Credit: Source link