metamorworks

Investment Thesis

Earlier this year, I covered Akamai Technologies, Inc. (NASDAQ:AKAM) in a research note where I noted the positive developments Akamai, the maker of network delivery optimization and security products, was making in growing its security business portfolio at a 20% compounded growth rate. Akamai has been growing the Security and Compute segments of its business portfolio at healthy rates, which I noticed in its Q1 FY24 earnings report as well.

However, all that growth in its Security and Compute segments, unfortunately, stood in contrast to a meaningful slowdown in its Delivery business. The Q1 FY24 report posted revenue deceleration rates, which surprised me by falling faster than I expected.

To add to the pain the Cambridge, MA-based company is still seeing in its Delivery business there were some sharp comments coming from management that have now forced me to re-evaluate Akamai with a dose of caution.

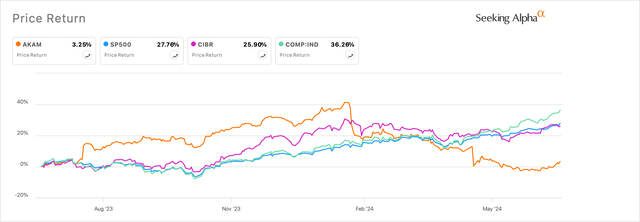

Exhibit A: Akamai versus market indices and sectoral benchmarks (Seeking Alpha)

Based on my analysis of Akamai’s network business so far, I have downgraded this name to a Hold.

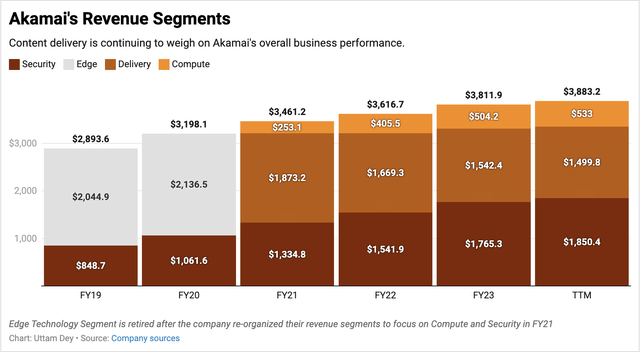

Akamai’s Delivery Segment Is Expected To Further Slow Down

To start with, the company continued to demonstrate robust growth in its Security business, as I had previously discussed, with its Security business portfolio growing 21% y/y in Q1 FY24 to ~$491 million. This was bested by the performance in the company’s Compute portfolio, which grew even faster by ~25% y/y to $144.5 million in the same quarter. Revenue from both of these segments outpaced the total revenue growth rate that Akamai posted in Q1, growing 7.8% y/y to ~$987 million.

The company is continuing to benefit from some smart acquisitions Akamai made over the past few years, with its Guardicore acquisition being key to leading the growth within Akamai’s Security business. I had mentioned this in my previous coverage, where I said, “I believe the Guardicore acquisition boosted their prospects towards continuing their double-digit growth momentum in Security services.”

On the Q1 earnings call, Akamai’s management said strong growth in Security was driven by continued demand for their Guardicore Segmentation Solutions. In addition, they also provided a few anecdotes about the traction the company is seeing in their ZTNA (Zero Trust Network Access) solutions, citing examples such as winning over the U.S. Army as their ZTNA customer.

In addition, Akamai recently completed the acquisition of Noname Security, a startup that specializes in API security solutions. The acquisition is expected to add $20 million in additional revenue to Akamai’s top line.

However, the company saw increased pressure in their Delivery business, with revenue falling ~11% y/y to $352 million. This was larger than the single-digit declines that I was expecting, and I now have reason to believe the pain is not going to end here for Akamai’s Delivery business.

The streaming media and social media business has started to ramp up their efforts to improve their network optimization and content delivery costs. I believe these will create headwinds not just for Akamai but for most CDN (content delivery network) operators, such as Cloudflare, Inc. (NET) as well.

At a conference in May this year, The Walt Disney Company’s (DIS) CEO, Bob Iger, explained how they’re investing in technology with the aim of bringing down the costs of operating its streaming business and making it profitable. His comments point to an immediate future where I see streaming companies like Disney doing much of their content delivery requirements in-house rather than using Akamai’s CDN services.

On Akamai’s earnings call in May, management revealed that another large social media customer was also reigning in their network costs on Akamai’s Delivery platform:

Our delivery revenue was less than expected in Q1 due to slowing traffic growth across the industry and a large social media customer that is now optimizing their business to reduce costs.

In a year when I would expect its Delivery segment’s revenue deceleration to at least moderate, given the tailwinds that I see due to streaming needs arising from the Euro, Copa America, and Olympics sports events, Akamai’s management warned there is still further room for its Delivery business to slow down.

In addition to the tailwinds that I initially expected would aid Akamai’s Delivery business, I also believed higher utilization due to increased social media activity due to those events. Additionally, various elections are occurring in many countries around the world, including the U.S., that should add a boost to the moderation in Akamai’s revenue deceleration. Unfortunately, management does not see these tailwinds in their business, which is worrisome despite the strength in their other business segments.

Exhibit B: Akamai’s revenue trends by year (Company filings)

As a result, management has now revised its outlook for FY24 based on the visibility arising from the following factors:

-

Due to the spend optimization patterns exhibited by Akamai’s large social media customer base, management now expects $40-60 million less in revenue for FY24 than previously anticipated.

-

In addition, I note that video streaming services are also seeing a drop in downloads and streaming activity, based on this research note from Bank of America. Due to the lower traffic as a result, management expects another $20-$30 million headwind for FY24.

-

The headwinds due to the slowdown in Akamai’s Delivery segment were far more than I anticipated, and I believe this will weigh on my outlook for Akamai, as explained below.

Akamai’s upside looks uncertain for this year

When I factor in the combined headwinds from the commentary that I highlighted at the end of the previous section, I estimate a $60-90 million impact on Akamai’s business just from decelerating sales in Akamai’s Delivery business this year. Further, management also sees a ~$40 million impact due to a stronger U.S. Dollar (DXY).

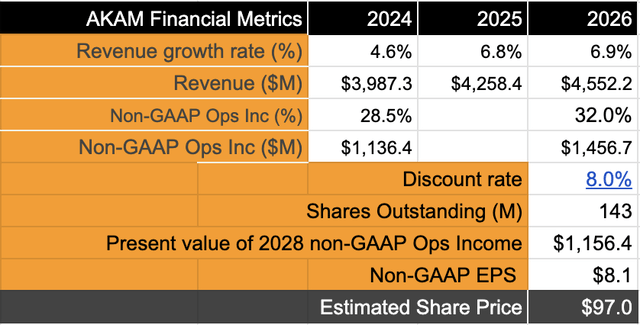

On a positive note, the company expects to see a lift of about $3-4 million due to higher network utilization from streaming content due to the Olympics in Q3. Plus, the acquisition of Noname Security is expected to add another ~$20 million to Akamai’s security business. Per my estimates, Akamai should be growing FY24 revenue by 4.6% to $3987 million, slightly above the midpoint of management’s own FY24 guidance range of $3950-4020 million. With the information I just shared, I now expect Akamai’s top-line growth to post ~6.1% CAGR through FY26.

Akamai’s operating margin is also expected to take a 1.5% hit in FY24 with the severe slowdown in Delivery. Management believes they can now deliver 28-29% operating margins in FY24 on an adjusted basis. The top-line slowdowns due to weakness in Delivery will also impact its adjusted operating income, which I now expect to grow at ~6.4% through FY26.

Over the same investment horizon, I believe it will continue to return capital to shareholders via buybacks, lowering the outstanding share base by a compounded growth rate of ~2.5%. Discount rates of 8% have been applied through the model below as necessary, based on these assumptions.

Exhibit C: Akamai’s upside is fairly uncertain in FY24 (Author)

Based on the 6.4% earnings growth rates, I believe a forward earnings multiple of ~12x would be appropriate in Akamai’s case if I compare this to the long-term earnings growth rate of the S&P 500. This implies a low-to-mid single-digit upside.

With some meaningful risks lurking in the shadows, I believe investors should err on the side of caution with Akamai.

Risks & other factors to consider

I have already mentioned the risks to Akamai’s business so far in terms of the deceleration in its Delivery business. To add to all the risks mentioned in terms of slowdown in network delivery as well as spend optimization patterns being exhibited by Akamai’s customers, the competitive landscape is also continuing to bear down on Akamai. Cloudflare has also reported some slowdown in their business amidst an uncertain economic backdrop, per their management.

On a positive note, if Akamai’s security business can grow fast enough to dispel the weakness being seen in Delivery, it could arrest the overall slowdown seen in the company. For example, Akamai’s Noname acquisition gives it legs in the API security space, which, according to IDC, is expected to grow in strong double digits.

Takeaway

The upside now looks capped for Akamai Technologies, Inc.’s stock, given the meaningful slowdowns in its Delivery business, which overshadow the strength in its Security and Compute businesses. Management has so far been less than encouraging when detailing its outlook on the health of its Delivery business, pointing to further pain ahead.

I believe investors must err on the side of caution when it comes to Akamai, and I am downgrading this name to a Hold.

Credit: Source link