Bjoern Wylezich/iStock Editorial via Getty Images

Here at the Lab, we have good coverage of Industrial gas companies, and Air Products and Chemicals (NYSE:APD) is a top pick in our investment portfolio. For our new readers, the company has a $12 billion annual turnover and provides specialty gases to healthcare facilities, industrial manufacturers, and energy companies. These gases are delivered by pipelines with on-site production units or in liquid or tanker trucks. In addition, for smaller customers, gas might be supplied with cylinders.

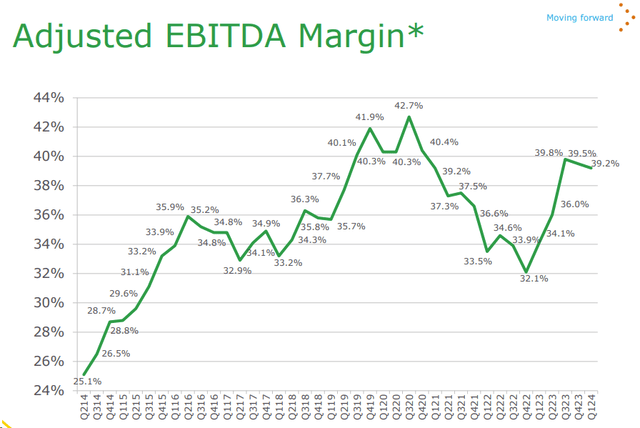

That said, our supportive buy rating target is based on 1) an impressive project backlog to drive the energy transition and hydrogen revolution, and 2) a dividend aristocrat status coupled with a solid balance sheet. In addition, industrial gas companies are least sensitive to the economic environment and trade at a higher valuation than other chemical players. Indeed, the EBITDA margin is around 40%. Despite that, in our last assessment, we also emphasized two ongoing negative debates: 1) the company’s succession plan and 2) business performance relative to peers.

Earnings Results

Q1 2024 results were a miss. In numbers, APD adj. EPS was up 7% year on year; however, this came 6% below the Wall Street consensus estimate. In detail, the company’s volumes were up 3% (vs. consensus at +4%) with a solid contribution from the Old Continent with its Uzbekistan onsite project start, and pricing was at plus 1% (aligned with consensus). Weaker Asia volumes and higher-than-expected corporate costs drove the unfavorable variance in earnings. The corporate cost had a negative variance of approximately $40 million due to higher temporary costs and new projects. We believe some of these headwinds are one-offs. But, we see corporate cost pressure in the last three to accommodate energy growth investments. Here at the Lab, we believe this negative output will likely be carried out into Q2.

Looking at APD from a high-level perspective, GAAP EPS increased to $2.73 with a net income margin of 20.7%. Going up to the P&L, we see an adjusted EBITDA of $1.2 billion, resulting in a margin of 39.2% (Fig 1), up 510 basis points from the previous year’s numbers.

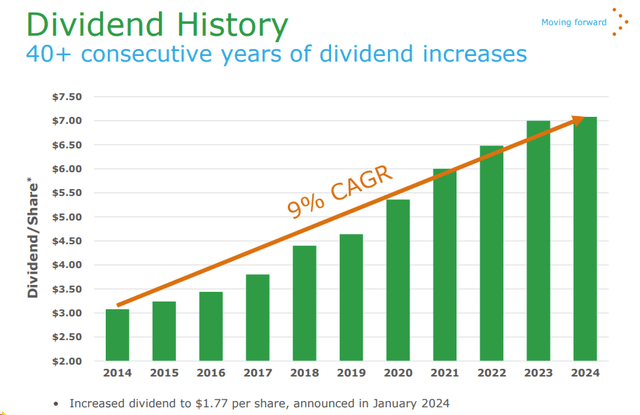

And (again), aligned with our downside protection thesis, the company increased its quarterly dividend per share to $1.77 (Fig 2). This marked the 42nd consecutive year of increases. Also related to our buy rating, the company backlog increased to $19.6 billion from $19.4 billion in the prior quarter.

APD EBITDA evolution

Source: APD Q1 Results Presentation – Fig 1

APD dividend evolution

Fig 2

Changes in Estimates

APD’s supportive equity story remains intact and is based on a depressed valuation. Again, we anticipated numerous growth earnings drivers coupled with pricing power in its traditional gas business. Before providing our changes, it is critical to report that the US election is coming this year. This might pose a risk to APD’s IRA credits (45V, 45Q). Despite that, our team sees limited risk from ongoing hydrogen tax credits under different election scenarios.

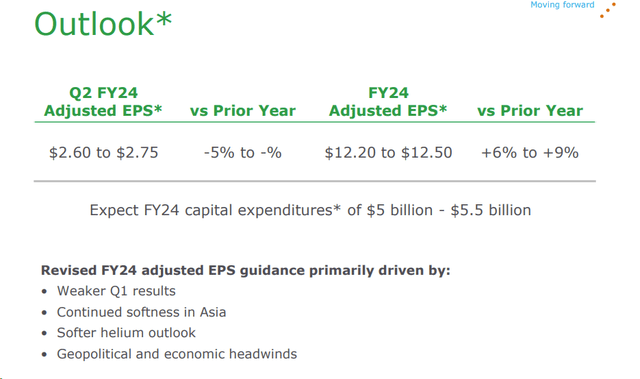

As a reminder, the APD CAPEX trajectory is at the forefront of the blue/green hydrogen revolution (Fig 3). However, our last publication reported that “the new projects should add $1.4 per share EPS growth over the next year.” We also forecasted EPS growth of 12% in 2024. APD’s Q1 2024 earnings underlined a 5% earnings miss at the core operating profit, suggesting that future growth costs are becoming apparent before their P&L benefits.

APD Order Backlog

Fig 3

Following the weaker Q1 results, APD lowered its EPS growth estimates (Fig 4). The adjusted EPS is guided down 2-3% from the previous target. In numbers, we have now arrived at an EPS mid-point of $2.68. The full-year outlook is only reduced in H1; this implied an H2 2024 aligned with our previous estimates (up 12% on a yearly basis).

APD EPS Outlook

Fig 4

Before moving to the valuation, we still believe there are four additional reasons to buy APD’s equity story:

- There is a valuation discrepancy with Linde. On our internal estimates, Air Products trades at 12.0x 2024 EBITDA versus Linde at 15.7x;

- We believe that the project backlog carried fewer risks. By management’s admission, we know that blue and green ammonia projects will not come online until 1.5 years. However, there is an unjustified discount on new energy projects. We estimate these mega projects are not valued correctly as specialty chemical players. This pipeline assumes Air Products as the market leader in a new energy area. We believe there is at least a double-digit EPS CAGR to price;

- We believe the company’s base business is solid compared to an adverse market view. Indeed, there is an ability to generate an EPS of 6-8% per year. Therefore, even in a depressed market scenario, APD will be able to deliver a ROIC above its WACC in our view;

- Related to the new CAPEX, the company thinks of Europe as a primary end-market. The Old Continent is rapidly moving towards green hydrogen adoption. APD NEOM project has a clear mandate to sell clean fuels in the EU. Looking at the details, the EU revised renewable energy use to 42.5% by 2030, up from 32% in the 2018 revision. Looking at the APD CAPEX, the company will be the only large commercial-scale industrial producer of green hydrogen within the 2030 time frame. This first-mover advantage cannot go unnoticed. According to our estimates, NEOM industrial output would account for less than 10% of the EU requirements. The EU green hydrogen market is developing, and we have also clear support from the latest tender offer from TotalEnergies.

Valuation: too much discounted

Here at the Lab, we consider APD a long-standing buy. That said, it is now more evident that it is an H2 stock opportunity, and the company might suffer short-term volatility. This pushes our investment timeline further. Our team is looking for better core performance, and the company could consider a co-investment opportunity to de-risk its significant mega projects investment. This might imply selling a minority equity stake in the current project backlog, providing a positive catalyst for fully valuing the ongoing CAPEX expense. Before moving forward with the valuation, there are three key considerations:

-

APD’ shares have significantly decreased and now trade at a 17x P/E on 2025 number. This leaves the company as the cheapest in the large-cap industrial gases business. Air Liquide and Linde trades at 22.7x and 24.7x, respectively. We see this cheap valuation as an invitation to a contrarian long-idea, fully supported by APD’s existing business resilience;

- Secondly, using a pro forma 2030 EBITDA baseline of $1.8 billion generated from the energy transition investments and assuming no growth in the base business (which is not the case), this implied a single-digit valuation on the EBITDA multiple. Currently, Linde trades at current at an EV/EBITDA of 15.7x in 2025;

- Forward P/E multiples for Air Product and Linde have moved together before a year ago. There is now a 10x spread, which we believe is not justified, and we expect it to close in the following quarters, as companies guide for EPS growth this year, which many investors question for APD.

We previously valued APD at 12% EPS growth in 2024. Today, we decided to decrease our EPS estimates to reflect slightly higher corporate costs and lower margins in the APAC region. Rolling forward our valuation to Q1 2025, we arrive at an NTM EPS of $13.2 (including better estimates in H2 2024). We still implied an upside from the current 2024 APD guidance (Fig 4).

Considering the large project ramp-up, we decided to lower APD multiple to a ten-year average of 24x. For this reason, our target price moved from $330 per share to €316.8 per share. APD yield is almost 3% and is supported by an industry-leading backlog. Air Liquide and Linde trade at a higher P/E; both companies guide high single-digit EPS growth this year (similar to APD). This valuation discrepancy is unjustified.

Risks

Downside risks include 1) CAPEX project execution with cost inflation associated risks, 2) inability to increase the price, 3) unplanned plant outages, 4) raw materials price volatility, Grey, Blue, and Green Hydrogen adoptions, and 4) earnings disappointments could often result in material stock price volatility as happened in Q4 2023 and Q1 2024 results. In addition, we also include lower margins in Asia helium volume.

Conclusion

There is a lower EPS to consider, and investors must regain confidence. However, higher DPS year-on-year while investing for growth and maintaining an A rating on the balance sheet must be noticed. H2 earnings normalizing and APD’s long-term exposure in blue/green hydrogen projects are encouraging. Even if we lower the target price, we still believe in the APD growth trajectory. It is true that Growth Has A Price, but we are still supportive. Therefore, we decided to confirm our strong buy recommendation.

Credit: Source link