Uladzimir Zuyeu/iStock via Getty Images

Air Lease Corporation (NYSE:AL) stock tumbled almost 14% on Friday getting caught in a combination of negative market sentiment and the declines of peer AerCap (AER). I strongly believe that airplane lessors provide attractive long-term investment opportunities and with that in mind I am revisiting Air Lease Corporation to discuss the company’s most recent earnings and assess the price target.

Air Lease Corporation Margins Are Under Pressure

Air Lease Corporation

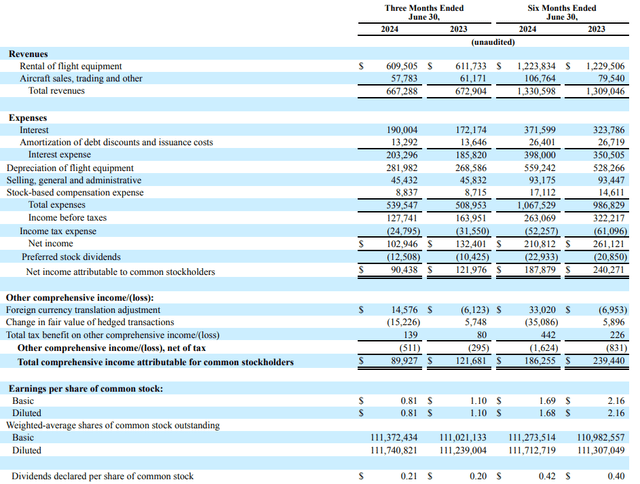

Total revenues decreased -0.8% to $667.3 million. This was driven by a 5.4% decrease in aircraft sales and a -0.4% decrease in rental revenues. Revenues continue to be impacted by airplane delivery delays while the airplanes that are being delivered go on lease at rates agreed two years ago. So, the higher market value of airplanes that drives lease rates is currently not reflected in the revenues. Aircraft sales declined driven by mix and volume.

Total expenses increased 6% to $539.5 million driven by a 10.4% increase in interest, while depreciation of flight equipment increased by 5% on a higher asset base. SG&A and stocked based compensation were stable. As a result, pre-tax earnings dropped 22% to $127.7 million indicating EBIT margin dropping from 24.3% to 19.1%.

What we are basically seeing is the lack of growth due to the OEM delays and the absence of new leases that reflect the higher market price of airplanes. Lease agreements do include interest rate and inflation escalators, so that portion is covered, but the higher market value is not.

Interest Rates Hurt Lessors But Could Lead To Market Share Expansion

We see that higher interest rates are currently putting a damper on margins and that is because the high interest rates are in the system and they are also passed on to the lessor, but the higher financing costs are amortized over a year. That means that the interest rate escalation does not apply to all leases, but only to the leases that are less than a year old. This exposes Air Lease Corporation to the transient effect of interest rates as well as market value fluctuations for its assets. The composite interest rate increased to 3.99% up from 3.49% a year ago.

|

Q2 2024 |

Q2 2023 |

|

|

Assets held for operating lease |

$ 26,789.37 |

$ 25,157.74 |

|

Basic Lease Rent |

$ 609.51 |

$ 611.73 |

|

Interest Expense |

$ 190.00 |

$ 172.17 |

|

Depreciation and amortization |

$ 281.98 |

$ 268.59 |

|

Spread |

$ 137.52 |

$ 170.97 |

|

Annualized net spread |

2.05% |

2.72% |

The annualized net spread, which reflects the ability of a lessor to extract value from its flight equipment after interest expense and depreciation and amortization, shows a reduction to 2.05% from 2.7% a year ago. You can consider it as a margin on the asset base. What we are seeing is that depreciation is growing faster than lease rent and the flight equipment market value increase which drives up depreciation as well as the interest expense. Both items decrease the spread, while the lower lease revenue has the same effect. So, most definitely, we see that there is pressure. However, we should also note that the current increased interest expense also finances future aircraft deliveries, which should bring better lease rates. I am also not too worried because leasing contracts tend to have inflation rate escalators embedded, and the high-interest rates could make leasing more attractive for airlines as lessors have lower cost of debt compared to airlines.

Air Lease Corporation Has Double Digit Upside Based On Book Value Valuation

|

Valuation Air Lease Corporation |

|

|

Common shareholder’s equity in $ millions |

$ 6,229.95 |

|

Common shares outstanding in millions |

111.38 |

|

Book value per share |

$ 55.94 |

|

Implied share price (5-year price-to-book) |

$ 49.78 |

|

Upside |

21% |

|

Implied share price (5-year price-to-book (pre-pandemic)) |

$ 53.17 |

|

Upside |

29% |

I value airplane lessors according to the price-to-book value by calculating the book value per share and applying a typical discount to book for the stock. The book value per share for Air Lease Corporation is $55.94, implying 21% upside. From there, I have to deviate a bit from the 5-year price-to-book multiplier that I normally use, as the 5-year figure is heavily skewed due to the pandemic. Therefore, I am applying the pre-pandemic figure which would imply a stock price target of $53.17 implying 29% upside.

Air Lease Corporation Stock Also Has Upside Based On Enterprise Value

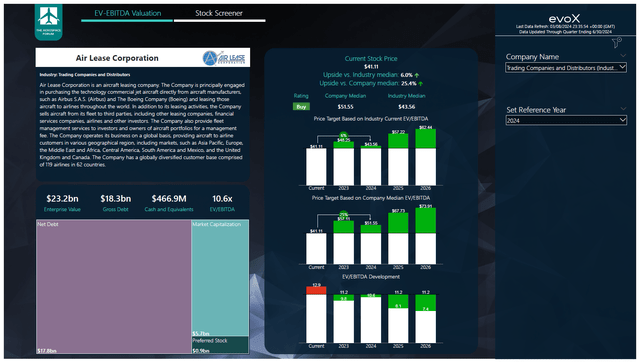

The Aerospace Forum

The Aerospace Forum has developed a tool to provide multi-year price targets on stocks. Currently, that tool includes more than 100 names primarily in the aerospace & defense and airline industries, but also includes lessors. I have a preference to value lessors according to a price-to-book method, but looking at the EV/EBITDA method also does not hurt. With the most recent projections, we would see that there is 6% upside to $43.58 based on valuing the company with 2024 earnings in mind at an EV/EBITDA multiple in line with peers. Using the median for Air Lease Corporation over the past years, we would get a $51.55 price target or 25%.

Wall Street analysts have a $56.67 price target for Air Lease Corporation implying 38% upside. With that in mind, I feel comfortable with my price target based on the price-to-book ratio.

Conclusion: Air Lease Corporation Is A Buy Despite Recession Fears

I believe that Air Lease Corporation stock remains a buy. Currently, we are seeing that recession fears are putting pressure on stock prices. A recession could soften the market for aircraft sales. Those sales are currently providing an offsetting factor for the lower than expected number of airplanes delivered from the OEMs for lease. So, a recession wouldn’t be great for that part of the business. On leases, the impact will be less severe as the business of Air Lease Corporation centers on long-term leases. Lessees cannot walk away from those easily. So, if a recession would hit the economy, it would hit the aircraft sales part of the business but not so much the leasing business and we could see the FED reduce interest rates faster to prevent the economy from cooling down which would be a good thing for financing of the airplanes.

Admittedly, a recession would reduce airplane values if it is a severe recession and that would mean that Air Lease Corporation has a compression on the timeframe in which it can benefit from the lease agreements with higher airplane values in mind but overall this is a business that provides long-term opportunities and any recession fear or actual recession to me would be a buying opportunity.

Credit: Source link