Kuzmik_A/iStock via Getty Images

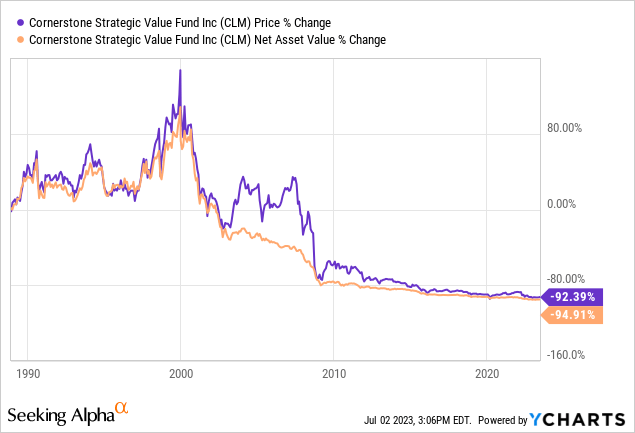

Cornerstone Strategic Value Fund (NYSE:CLM) seems to be one of those funds that has a polarizing effect on investors. On one side, the fund’s share price has been eroding ever since its inception and will continue to do so for the foreseeable future (partly due to its massive dividend yield of 20% unless the stock market rises at least 20% every year). On the other hand, the fund has a 4-star rating with Morningstar and it resulted in great returns for some investors as long as they reinvested their dividends at NAV. This is also where the fund’s performance comes from because it has been trading at a significant premium to its NAV and investors benefited greatly from being able to reinvest their dividends at NAV. As long as this continues, the fund will continue to deliver results but there is no guarantee that this will continue forever.

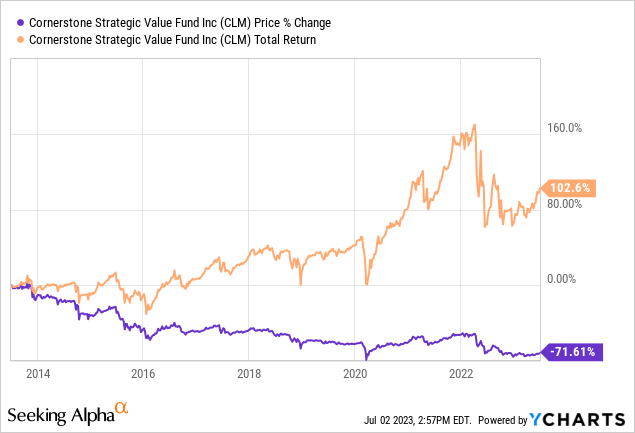

In the last decade, CLM’s share price dropped 72% even though its total return came at 102%. As a matter of fact even that 102% figure is an understatement because it assumes that people reinvested their dividends at the share price level even though the fund allows people to reinvest their dividends at the NAV level which often provides a deep discount. For investors who participated in NAV-reinvestments (most major brokerages in the US offer it), the total return would have been significantly higher.

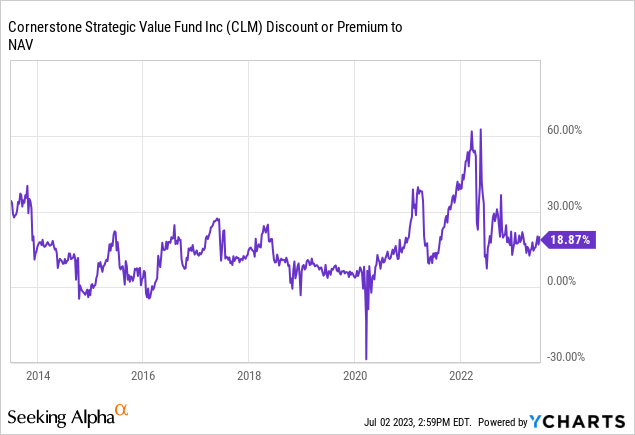

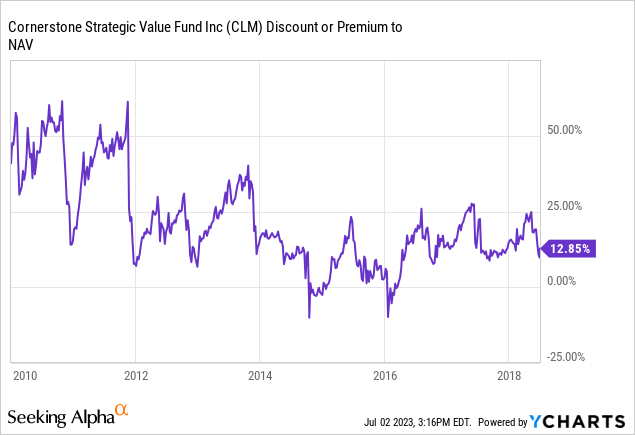

In the last decade, CLM traded at an average premium of 15-20% against its share price which meant that when investors are reinvesting their CLM dividends at NAV, they are reinvesting them at 15-20% discounts. This allowed them to be able to buy more shares and collect better dividends next time. This has worked nicely in the last decade but it can only be maintained if this premium continues and there is no guarantee of that. If the fund were to suddenly trade at NAV level or even at a discount (which only happened in a couple instances in the last decade), the reinvestments wouldn’t be as lucrative for investors anymore and they would quickly start underperforming.

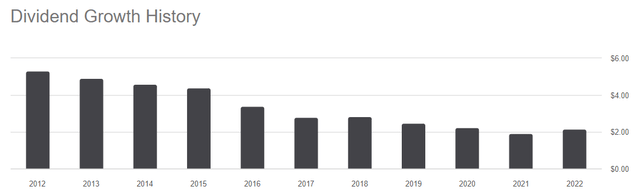

Basically when you are putting your money in CLM you are putting faith that it will trade at a nice premium forever (or for as long as you are going to remain long in this fund). The fund has an 18% dividend yield most of which comes from fund posting capital gains or issuing return of capital (i.e., returning your own money to you). Meanwhile its dividend payments keep eroding along with its NAV and investors have to keep reinvesting dividends just to keep afloat if they don’t want their dividend payments to shrink year after year.

CLM dividend history (Seeking Alpha)

In addition the fund also does rights offerings and further dilutions which wouldn’t benefit most investors who aren’t reinvesting their dividends at NAV.

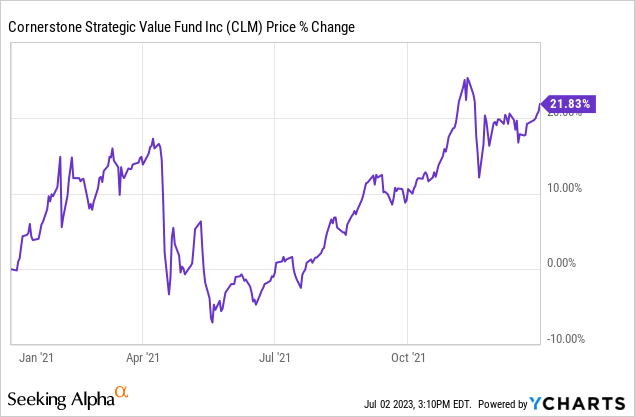

So this fund mostly works for specific type of investors who invest in a very specific way which is reinvesting all dividends at NAV and this only works assuming that the fund will continue to enjoy a premium pricing against its NAV forever. Investors have to be very comfortable with this type of approach as well as the fact that this fund’s share price will continue to decline due to its high dividend distributions unless the stock market has monster returns of +20% year after year. For example in 2021 when S&P 500 was up more than 20%, this fund also had a strong performance even with high dividend distributions. This is not a typical performance however as you can see from the chart above.

There was a time in early to mid-2010s when this fund was trading at pretty large premiums, as high as 60% at one couple points. This had both benefits and risks for investors. For a benefit, they were able to command deep discounts as high as 50-60% when reinvesting their dividends at NAV. On the risk side, they could (and did) see their share price drop significantly when the premium dropped from 60% to 20%. As you can see below, the fund’s premium dropped significantly from early 2010s to late 2010s and stabilized around 10-15% range where it still is.

There is no telling how much of a premium this fund will be able to command over its NAV in the future. It could go back to its glorious days of having 40-50% premium or it could give up its remaining premium as well. Investors should be prepared for either scenario when they invest into CLM because this is going to play a huge role in determining how much return they can get out of this fund. This fund’s NAV premium in the future will be mostly determined by investor sentiment and we all know how difficult (if not impossible) to predict future sentiment of investors.

When investors buy this fund from their broker they should pay really close attention to how their dividends are getting reinvested. Since most of the fund’s performance comes from its NAV premium and being able to reinvest at NAV price, it is very important for them to make sure that their broker supports reinvestments at NAV price. If their broker only supports reinvestment at share price, perhaps this fund isn’t best for them (or they could look into changing their broker if they wanted to invest in this that badly). Once you get your monthly dividend you can look at what price it reinvested. Typically NAV price is about 15% below the share price so that’s where your reinvestment should have occurred.

Moving forward, it is also beneficial for investors to pay attention to this fund’s NAV premium situation because it will be what drives this fund’s outperformance or underperformance for them.

Credit: Source link