Olga Kaya

Tyler Technologies (NYSE:TYL) has positioned itself as a prominent player in integrated software and technology services to the public sector. With a storied 25-year track record, the company has undergone transformative shifts that have solidified its presence as a market leader. This article examines the “Buy” case for Tyler Technologies by delving into its Business Model Fundamentals, Financial Growth Prospects, and Capital Allocation Priorities.

Business Overview

Tyler Technologies is a pioneer in delivering integrated software, hardware, and maintenance solutions to the public sector and holds a storied legacy forged by strategic shifts and continued innovation. Today, Tyler Technologies boasts an impressive footprint, serving customers across all 50 US states, Canada, the Caribbean, the UK, and Australia. With over 40,000 client installations in over 13,000 locations, it caters to approximately 15,000 government entities, counties, and school districts.

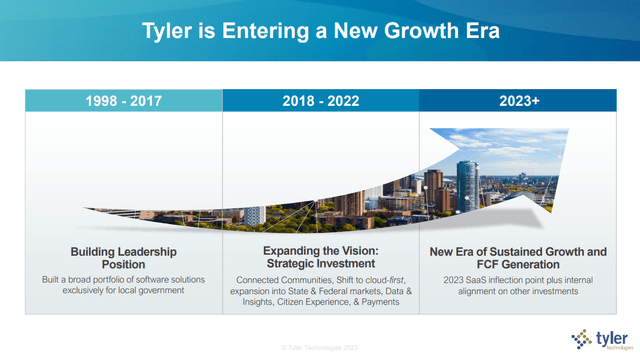

The company’s strategy in its early years focused on providing software solutions exclusively for local governments by offering cloud solutions hosted in Tyler’s private cloud. Beginning in 2019, the company shifted its approach from “cloud agnostic” to a “cloud-first,” with a preference to provide its core products in both an on-premise license model and a cloud-based, or SaaS, subscription model. Tyler estimates that the lifetime value of a cloud customer is almost twice that of an on-premise customer. Looking beyond 2023, Tyler has entered a new era of sustained growth and free cash flow generation and has identified a clear path to delivering recurring revenues of 90+%, expanding operating margins to 30%, and FCF margins in the high 20s% by 2030.

2023 Investor Day Presentation

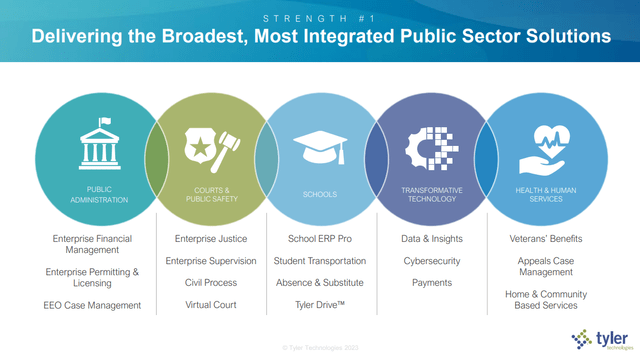

Tyler Technologies operates in several key business units focusing on different segments within the public sector. These units provide a range of software solutions, including:

- Financial management, planning, regulatory, and maintenance for education entities and municipal courts.

- Courts, justice, and public safety.

- Data and insights.

- Appraisal & tax, land & vital records, property appraisal.

- Development platform (case and business process management).

- Digital government and payments.

2023 Investor Day Presentation

Tyler’s customer base primarily comprises county and municipal agencies, school districts, and local government offices. Currently, Tyler services about 15,000 local governments and schools and targets a market of around 88,000 local governments in the US. A typical customer has 2-3 products installed. However, the company aims to increase this number to at least 5 in the longer term. Additionally, Tyler is expanding its footprint among state and federal-level clients.

Tyler’s strategic partnership with Amazon Web Services (AWS) has been critical to this cloud-centric model, facilitating the efficient deployment of its products in the public cloud. Over 10,500 entities, representing more than 60% of Tyler’s clients, are leveraging its cloud-based solutions, with over 300 clients switching from on-premise to cloud in 2022 alone.

Financial Overview

Tyler Technologies has demonstrated a robust financial profile with significant growth in revenue and profitability over the years. The company’s revenue has grown at a CAGR of 16% since 2012, accompanied by a significant increase in profitability, with the FCF margin expanding from 11% in 2012 to 18% in 2022. During this period, EBITDA and FCF grew at CAGRs of 20% and 22%, respectively.

Tyler has grown organically over the past five years by 8-9%. The management has raised mid-term growth guidance for organic revenues from 8-10% per year to 10-12%. This acceleration is expected to be driven by the need for governments to transition to new platforms, a shift to a SaaS model, and more active upselling to existing customers. Management expects to sustain organic growth in the low teens over the long term.

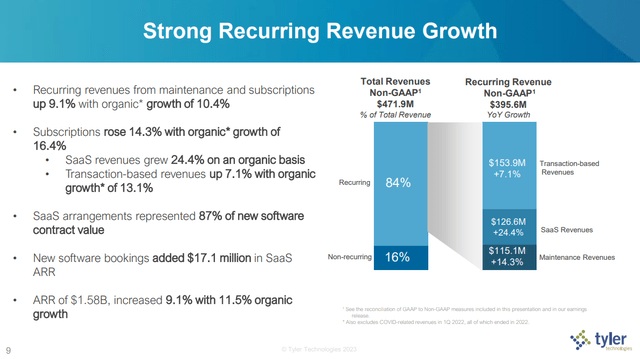

Additional revenue highlights from Q1 2023 earnings include:

- Recurring revenue constituted 84% of the total revenue.

- SaaS revenues grew organically at 24.4%, representing 87% of new software contract value.

- Subscriptions made up 59% of total revenues, and Maintenance accounted for 25%.

- License revenue declined 39%, driven by the shift to SaaS.

Q1 2023 Earnings Presentation

Tyler’s gross margin, which stands at approximately 43%, is relatively low compared to other U.S.-based companies in the application software industry of 65%. This can be partially attributed to the cost allocation strategy and Tyler’s diverse products. As Tyler moves towards cloud-based solutions, standardizing products can help improve profitability by reducing the expenses of maintaining multiple versions of the same product.

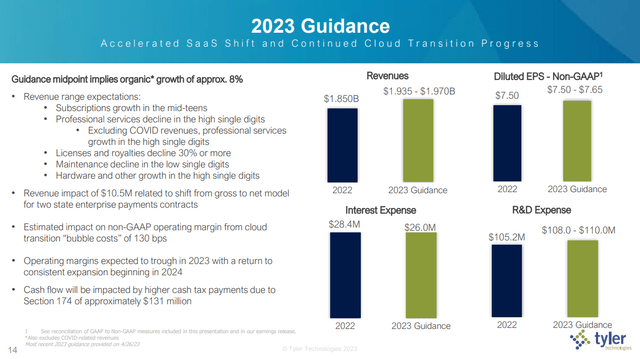

For the full year of 2023, Tyler Technologies projects its 2023 revenues to range from $1.94B to $1.97B, marking an increase from $1.85B in 2022. The company expects its diluted non-GAAP EPS to be between $7.50 and $7.65, nearly flat as in 2022. Tyler’s interest expense is anticipated to decrease to $26M, compared to $28.4M in 2022, while R&D expenses are projected to rise to $109M. The company forecasts operating margins to reach their lowest point in 2023 before starting a steady expansion in 2024. Accelerated SaaS shift and continued cloud transition progress are key underlying factors.

Q1 2023 Earnings Presentation

Capital Allocation Priorities

Tyler Technologies has identified three capital deployment priorities to effectively utilize its financial resources, which are:

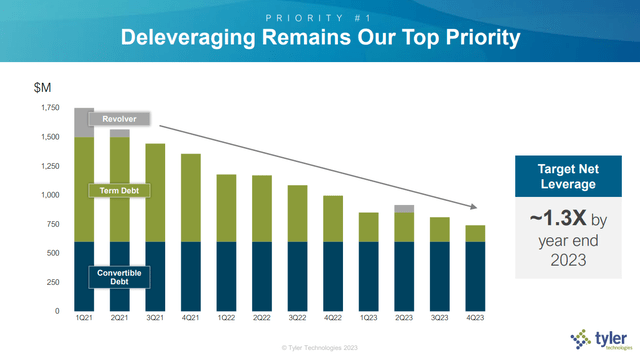

- Debt Reduction: Following the acquisition of NIC in 2021, which was partly financed by debt, Tyler has made debt reduction its top priority. As of the end of Q1 2023, the company had gross debt of $860 million and cash & investments of approximately $160 million. This resulted in a leverage ratio of around 1.5x (based on trailing 12-month pro-forma EBITDA), a reduction from the 2.2x leverage ratio in Q1 2022. Management has set a net leverage goal of 1.3x by 2030.

2023 Investor Day Presentation

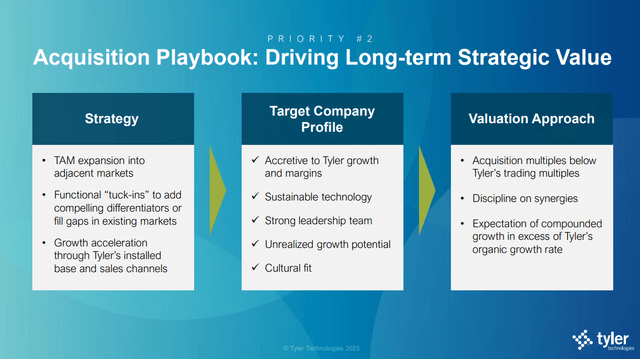

2. Accretive M&A Transactions: M&A is the company’s second priority for capital deployment. Tyler has been a serial acquirer throughout its history, having completed over 55 acquisitions since 1998 and building momentum since 2018 by investing 77% of its free cash flow to complete 17 acquisitions. The acquisition of NIC for $2.3 billion in 2021 was one of its largest. Tyler intends to continue pursuing tuck-in acquisitions to complement its existing product and service offerings. Additionally, it is looking to enter new markets related to the public sector and expand geographically.

2023 Investor Day Presentation

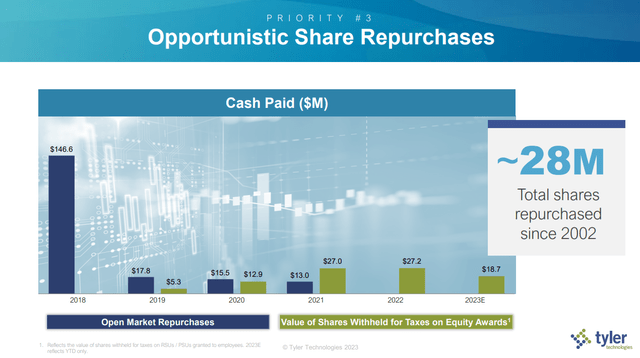

3. Opportunistic Share Repurchases: Tyler engages in opportunistic share repurchases as its third priority for capital allocation. Since 2002, Tyler has repurchased about 28 million shares. In the past five years, it has spent $193 million to buy back 1.8 million of its shares. The repurchase program was initially announced in 2002 and has been amended several times. As of 2023 Q1, the company is authorized to repurchase up to 2.3 million shares of common stock.

2023 Investor Day Presentation

Risks

Investing in Tyler Technologies, like any investment, comes with its own set of risks that must be carefully weighed against the potential rewards. One of the primary risks is the company’s ability to deliver on its medium-term and long-term financial targets. At its 2023 Investor Day, Tyler laid out financial goals through 2025 and 2030, claiming to have a high level of visibility into industry demand trends. Given the top management team’s credibility and track record, failure to meet these targets could negatively affect investor confidence leading to lower stock prices.

The economic climate is another critical factor. Tyler’s focus on local governments and schools has traditionally insulated it from economic downturns, as funding sources like property taxes remain relatively stable. However, with the acquisition of NIC, Tyler has increasingly catered to state and federal governments. This diversification exposes Tyler to macroeconomic volatility, as these entities may experience funding pressures during recessions due to reduced income and sales taxes.

Lastly, Tyler’s aggressive acquisition strategy could be a double-edged sword. While acquisitions can fuel growth, failure to successfully integrate these businesses could result in diseconomies of scale and be margin dilutive.

Final Thoughts

Tyler Technologies is a compelling investment opportunity with its specialized government-centric solutions in a fragmented market. Its robust financial outlook, characterized by accelerating revenue growth and high free cash flow, coupled with a strong M&A strategy and disciplined capital allocation priorities, positions the company for sustainable long-term growth. Management’s focus on cloud migration, product standardization, and addressing the evolving needs of government clients adds to the favorable “Buy” thesis.

Although Tyler appears to be overvalued at 37x forward EBITDA, my philosophy is that entry multiples matter less when investing in high-quality businesses over the long term. If management can deliver on its 2030 goals, Tyler’s stock should see multiple expansions from its current levels. My strategy is accumulating more shares during price dips, employing a dollar-cost averaging approach.

Credit: Source link