PM Images

Thesis

Over the last year of market turmoil, LendingClub (NYSE:LC) has been incorrectly bundled into a group of unprofitable fintech stocks. This has resulted in an over 50% decline in the stock’s price and left many investors searching for greener pastures.

Nevertheless, LendingClub remains the leading digital marketplace bank for unsecured personal loans in the U.S and is poised to not only maintain its share and profitability at the current bottom of the credit cycle, but is also ready to increase its share by expanding its balance sheet online deposit growth, selling a larger percentage of its loans to the market, and expanding its product offering to both borrowers and market lenders.

Revenue Segmentation/Business Segmentation

LendingClub’s revenue comes from two places- its marketplace and its bank:

Its marketplace revenue consists largely of origination fees charged to borrowers at roughly 5% of the loan value and servicing fees charged to investors of LC’s loans it sells in the marketplace with the latter being a very high-margin business. Costs associated with the marketplace segment are largely marketing and back-end customer support for sourcing and approval of borrowers, along with G&A for the lending side and R&D.

Any loans not sold are retained by LC bank and put onto its balance sheet where they are funded by retail deposits. Besides interest expense from its deposit base, the primary expenses are minor due to it being entirely online, thus it is just the standard G&A along with any marketing for deposits and R&D for platform development and maintenance.

Competitive Advantage

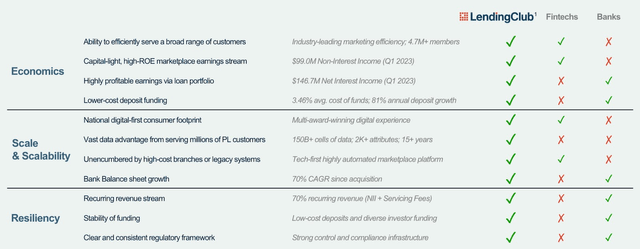

LC serves primarily the prime credit range for personal loans which gives it a superior market position as many other traditional banks and fintechs like SoFi tend to target the super prime credit range while almost all other fintechs tend to go into the subprime credit range. This gives LendingClub an advantage in terms of marketing efficiency with them only spending 1% – 1.5% of Loan Volume on marketing and the fact that the prime market contains many High Income (100k+) individuals with average LendingClub Borrower having a 720 FICO score, 120k income, and 20% DTI (debt-to-income).

The second competitive advantage LendingClub has is its bank. LC bank, unlike marketplace-only lenders such as Upstart, allows the company to fund and benefit from its loans while making sure its loan marketplace can also grow. This differs from fintech bank competition like SoFi which routinely use warehouse credit facilities at higher costs of capital and thus lower NIM to find loans.

LendingClub Q1 2023 Investor Presentation

Credit Market and Tailwinds

Rising Interest Rates and the worsening state of consumer balance sheets due to inflation have hurt the consumer credit market significantly and resulted in personal loan delinquencies seeing ranges of 4%-4.5%, though LendingClub has accurately provisioned for these losses and they still maintain on-target.

In terms of the entire credit market, Credit Card debt has reached 1.1 trillion and unsecured personal loan debt has reached 225 billion which are both record highs. This acts as a tailwind not only because many credit card borrowers will refinance at a lower rate, but due to the likelihood of slowing rate hikes, loan yields will rise and match deposit rate growth allowing for net interest margin (NIM) to increase.

Financials

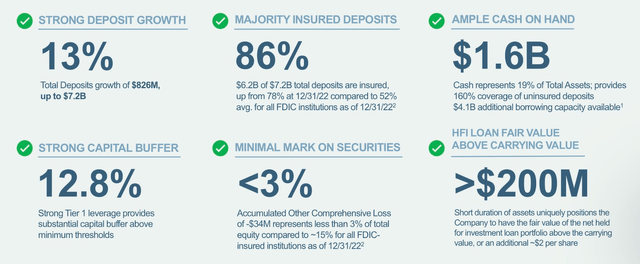

With a historically low NIM of 7.5% as of Q1 2023, LC bank has been able to grow deposits from 2.7B to 7.2B in 2 years and its loan portfolio a similar proportion. This unusually high NIM is due to the high coupon rates of its loans along with the nice 1.5yr – 2.0yr loan duration reducing the effect of rising interest rates.

The company maintains a strong level of liquidity, holding more than 20% of its deposits in cash as a precautionary measure amid the current banking environment. Additionally, the company employs the CECL (Current Expected Credit Losses) methodology for loss provisioning, which requires them to record expected losses on their balance sheet loans as soon as they are put on the books. As a result, their GAAP earnings which include these loss provisions are abnormally suppressed along with the fair value of their loans exceeding their carrying value.

A CET1 ratio of 15.60% and Tier 1 Leverage of 12.80%, show a strong capital buffer and the possibility of future share repurchases once the current economic problems pass.

LendingClub Q1 2023 Investor Presentation

Marketplace revenue is the more cyclical segment as it is related to loans sold to the marketplace versus retained and current credit. Though the marketplace has been declining as % of net revenue, it has a largely variable cost structure and has likely maintained profitability due to efficient marketing expenditure and cost reduction

Over the last year and a half, in preparation for economic issues, the company restricted its credit acceptance to largely prime and super prime borrowers and thus origination volume has fallen accordingly and yields have been compressed. As of the most recent quarter, the company produced 0.13 EPS or 0.51 per share annualized, with the current share price of 8.20 and the Tangible Book Value per share being 10.23 and when adjusting for the fair value of loans, it is 12.39.

Key Catalysts

LendingClub may not initially seem a strong buy, but the upside is hidden and will be strengthened due to the following:

-

Due to the company having to provision for losses under the CECL methodology, it takes a majority of a loan’s credit losses immediately when it’s put on its sheets and thus if the balance sheet grows rapidly, earnings are suppressed in the near term.

-

With deposits growing 10% in the last quarter and 72% of it going to fund liquidity (cash position), LC stated in its earnings call that it will cut marketing spend, and as broker term deposits (CDs and sweep accounts) flow out gradually, the normalized cost of capital will lower naturally over the coming year.

-

Though earnings are currently suppressed, in the coming quarters, yields will rise as new loans replaced matured ones and once the current economic situation levels out, LendingClub will invest excess liquidity into more loans.

-

The Company’s new structured loan program will allow for increased demand for LC loans in its marketplace and create Secured Notes that can be retained or sold, reducing risk and increasing revenue.

Valuation

LendingClub is one of the only large-scale marketplace banks in the industry and thus there are not many peers to compare to, and because it is in banking and credit, a valuation based on earnings multiple and Book Value is the logical method.

As such, I am going to create a base case with the following elements:

-

Deposit growth of 15% over the next year is composed of a 4% decrease in checking, a 30% increase in HYSAs, a 20% decrease in CDs, and no change in non-interest-bearing deposits. This growth estimate is based on the withdrawal of brokered deposits, maturity of CDs, continual decline in checking, and growth of online HYSA and Money Market inflow due to attractive yield for consumers.

-

Besides yield increases being accounted for from the past months (35BP adjustment), a 50BP increase is also included along with similar cash reserves of 20% of deposits, slightly lower than for continued precautionary liquidity measures.

-

Yields on personal loans grow to 14% from 13.15% due to planned rate increases on prime customers while maintaining current credit standards.

-

$3B in total originations (35% retained) equivalent to 2019 normalized levels and due to credit card refinancing, roughly 1.30% marketing efficiency, 5% increase in customer operations expense due to increased originations, along with minor adjustments to other operating expenditure, and constant credit provisioning.

This results in quarterly net revenue of $328.7M with 51.3% of that being from the banking segments and the rest being the marketplace. Using a 27% effective tax rate, we get an EPS of 0.46 or 1.85 annualized.

Though this is a base case, it assumes a continuing slow deterioration of consumer balance sheets through moderate rate increases and credit card refinancing.

Thus I give it an 8x earnings multiple or 1.5 TBV. This multiple reflects not only a conservative figure but an acknowledgment that even though LendingClub has a large banking segment, it is still dependent on the credit cycle of consumer lending. This yields a valuation of $14.72 and with a current price of $8.80 as of June 2nd, LendingClub has an upside of 70%+.

Risks

-

A full-blown recession occurs in the next year resulting in the Fed being forced to drop rates substantially. Though this will result in mass refinancing by consumers, the company will have to stay cautious with its credit standards and limit itself to high prime/super prime borrowers and will likely not see origination volume growth. I believe in this scenario, the downside is limited by loan duration and having its banking segment warehouse the majority of loans originated.

-

Fintechs begin to enter more into the prime credit market, though this is mitigated by the large growth in subprime and near-prime borrower demand, and super-prime lenders are mainly traditional banks.

Conclusion

Lending Club’s unique business model as one of the only digital marketplace banks makes it attractive through the consumer credit cycle and with the tailwinds of credit card refinancing and lagging loan yields giving current suppressed earnings, LendingClub is poised for growth over the next year and into the long-term.

Analyst Recommendation by: Blake G. Skolnick

Credit: Source link