Sundry Photography

CrowdStrike Holdings, Inc. (NASDAQ:CRWD) investors have had a robust first half in 2023 so far as CRWD continued its recovery from its January 2023 lows, outperforming the S&P 500 (SPX).

Accordingly, dip buyers returned to scoop up CRWD in early January, as it fell to a low of $92. Riding the tech-driven recovery, CRWD has surged nearly 70% from its January lows, stunning bullish and bearish investors, despite its premium growth valuation.

There’s little question that CRWD is expensive when assessing its P/E multiple. Based on S&P Cap IQ data, CRWD last traded at a forward adjusted P/E of 66.6x, relative to its peers’ median of 20.6x.

King of SaaS and arch-rival Microsoft (MSFT) last traded at a forward adjusted P/E of 34.5x. On the other hand, leading cybersecurity players like Fortinet (FTNT) and Palo Alto Networks (PANW) last traded at forward adjusted P/Es of 45.4x and 44.4x, respectively.

As such, investors who decided to buy into CRWD now need to ask themselves whether the company’s medium-term growth drivers are sufficient to justify its valuation?

I think it should be clear to CrowdStrike investors by now that the company is the foremost leader in the endpoint security space. Its industry-leading endpoint detection and response or EDR is well-regarded and recently won accolades from Gartner, IDC, and Forrester.

Management stressed at an investor conference in April that CrowdStrike has been expanding its scope and product modules, capturing more market share in the process.

Notably, the critical underpinning of its overall strategy is based on its leadership and competitive moat in EDR. CEO George Kurtz articulated:

Just to give you an idea of why the endpoint is the epicenter of the enterprise. It’s because 80% of the most valuable security data collected comes from the endpoint. This is where productivity happens. This is where the attackers are actually focusing their efforts. And as I always like to say, the most valuable real estate in all of security is the endpoint. I really want you to think outside the box of the endpoint as a form factor that opens up all these additional adjacencies within the platform. – CrowdStrike Investor Conference

Also, investors must consider that CrowdStrike’s cloud-native platform is designed for modern workloads, especially as the multi-cloud initiative gains momentum. In addition, CrowdStrike has been using AI-powered tools from its beginnings instead of signature-based protection favored by legacy players.

CrowdStrike’s strategic approach has underpinned the success of its business model, as the company highlighted that “80% of attacks use compromised identities and 71% of attacks are now malware-free.”

As such, CrowdStrike’s AI-driven platform has a significant economic moat that improves as it collects more user data. Therefore, CrowdStrike’s data advantages give the company substantial leverage to maintain its competitive edge as “the value of its AI-powered platform grows as more data is collected and analyzed.”

Management highlighted the benefits, indicating that CrowdStrike can leverage a “virtuous cycle of data value.” Accordingly, the company’s platform improves its robustness for its customers through this cycle, as CrowdStrike gains “increased visibility and value from their data.”

Therefore, I believe CrowdStrike bulls could justify the company’s competitive moat against its peers, particularly the legacy players, as CrowdStrike attempts to gain more share.

However, the critical question is whether CRWD remains an attractive proposition at the current levels after its sharp recovery from its January lows?

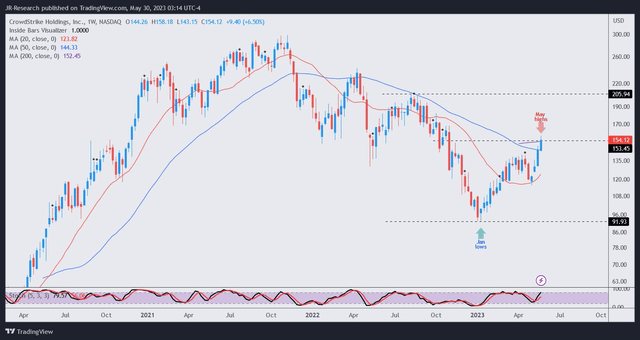

CRWD price chart (weekly) (TradingView)

CRWD re-tested levels last seen in November 2022 recently, but it remains in a medium-term downtrend. Moreover, its recent price action suggests some caution is warranted, as it looks like a bull trap in the making (but not yet validated).

I assessed CRWD’s valuation as fairly balanced now, with higher risks pointing toward the downside. Seeking Alpha’s Quant rated CRWD’s valuation with a “D-” grade, suggesting it isn’t attractive.

With an aggressive valuation, CRWD is undoubtedly priced for growth, bolstered by its competitive moat. Therefore, I assessed that CrowdStrike needs to put up much better guidance at its upcoming earnings release on May 31 to help encourage more buyers chasing momentum to jump on the bandwagon.

However, the recent rally has likely baked in significant near-term optimism, reflecting better-than-expected guidance in the second half. Therefore, a tepid guidance could inflict pain on recent buyers who chased the surge but open up opportunities for dip buyers looking for a more attractive risk/reward on CRWD’s secular opportunities.

Rating: Hold (Revised from Buy).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Credit: Source link