mirza kadic

REIT dividend yields have expanded very significantly since the beginning of 2022.

Today, it is not uncommon to find REITs yielding as much as 12%.

Such a high yield would typically suggest that the dividend is at high risk of getting cut, but as odd as it may sound, I actually think that some of these high dividends are sustainable.

Why are dividend yields suddenly so high?

There is a simple reason:

REIT share prices have collapsed even as most REITs kept growing their cash flows and hiking their dividend over the past year. A lower share price coupled with a higher dividend payment results in a higher yield, and in some of the most extreme cases, this has led to >10% dividend yields.

We think that this is an opportunity and in today’s article, we want to highlight two such high yielders that we are currently accumulating at High Yield Landlord:

Vornado Realty Trust Series M Preferred Shares (VNO.PM)

Vornado Realty Trust is a REIT that owns mainly office and retail properties in NYC. It recently gained a lot of attention because it suspended its common dividend until the end of 2023, and also announced a stock buyback program:

Seeking Alpha

But we are not interested in the common stock.

We are buying the preferred equity, which is senior to the common equity, and since the dividend is “cumulative“, the company cannot at its own discretion just cancel dividend payments to favor buybacks instead.

As of right now, the preferred shares are so heavily discounted that they offer a 12% dividend yield and have more than 100% upside potential to return their par value of $25 per share.

Now, it goes without saying that the company is facing some real challenges. The outlook for both, the office and retail property sectors, is highly uncertain because a lot of people are still working from home, tenants are reconfiguring their offices, we may be approaching a recession, and then the surge in interest rates is only adding more fuel to the fire.

That’s worrying for the common shareholder, but we think that the preferred equity should be fine. Here are 3 reasons why:

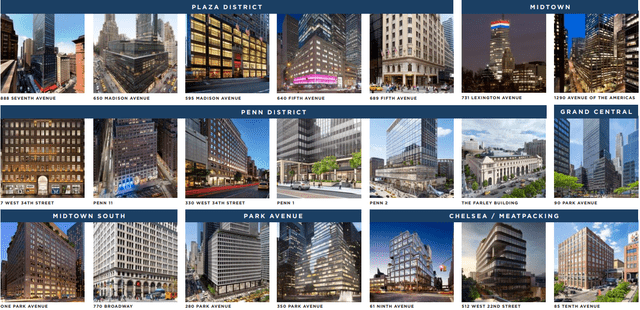

- Reason #1 – Class A assets: VNO is not immune to the pain of the office and retail sector, but it is less impacted because it owns prime assets that remain in high demand. As companies reconfigure their office space and adapt to this new work environment, they are leaving behind their Class C or B large office footprints and consolidating that into smaller Class A buildings. They are favoring nicer and newer buildings that offer better amenities for when they come to the office. This helps convince their teams to make the effort to come to the office at least part of the time. This explains why just recently, the company’s CEO started their conference call by saying that: “Our business is performing well in this environment. Our outlook hasn’t changed since last quarter.” The company’s same property NOI actually rose by 1.5% in the first quarter and new leases were signed with higher rents.

Vornado Realty Trust

- Reason #2 – Strong Balance Sheet: The preferred equity is a relatively small slice of the capital stack and it has a significant common equity buffer. The debt is also structured in a way that mitigates risks and the company has very significant liquidity, especially following the recent suspension of the common dividend. Here are the management’s comments from the latest conference call: “We had $2.2 billion of liquidity, including $1.3 billion of cash and treasury bills. We have over $8 billion at today’s markdown values of debt-free unencumbered assets. PENN1 and PENN2 fairly are all unencumbered. The remaining capital program to complete PENN2 has been prefunded and will be paid for out of cash balances. These buildings have significant future embedded earnings growth and as PENN2 rents up, that incremental income will do wonders for our debt metrics. We rely primarily on project-level non-recourse debt, old-fashioned mortgages. Only 2.5% of our debt is recourse and that with well-laddered maturities. We have no maturities this year, limited property level maturities next year, and no corporate maturities in 2025 with sufficient capacity on our line that matures in December 27, so that we don’t have to reach asset finance at current — in the current hostile market.”

Vornado Realty Trust

- Reason #3 – Shareholder-friendly management team: They have very significant skin in the game, they have acted in a shareholder-friendly way in the past, and they just recently announced a share buyback program. Following the suspension of the common dividend, they appear to have enough liquidity for buybacks so that clearly tells you that they also have enough liquidity for the preferred dividend. I would add that a director of the company just recently bought $150,000 worth of preferred shares for his kid. That’s $400,000 in total for the kid so far.

For these reasons, we think that the 12% yield on the preferred equity should be sustainable. We own a small position and may buy more shares after we meet the management at the REIT Week conference in a couple of weeks.

NewLake Capital Partners (OTCQX:NLCP)

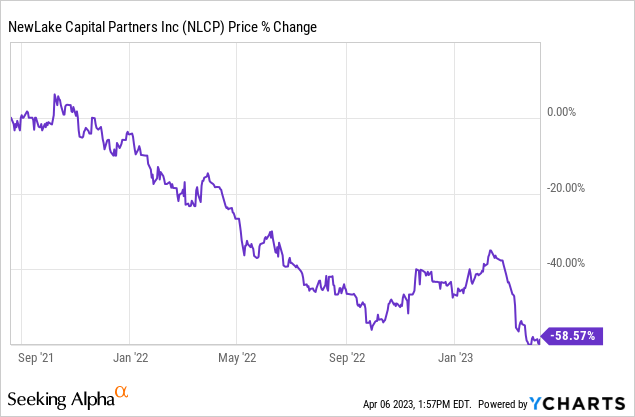

NewLake is a small-cap REIT that invests mainly in cannabis cultivation facilities. In that sense, it is similar to Innovative Industrial Properties (IIPR) but it is a lot smaller because it IPOed in 2021.

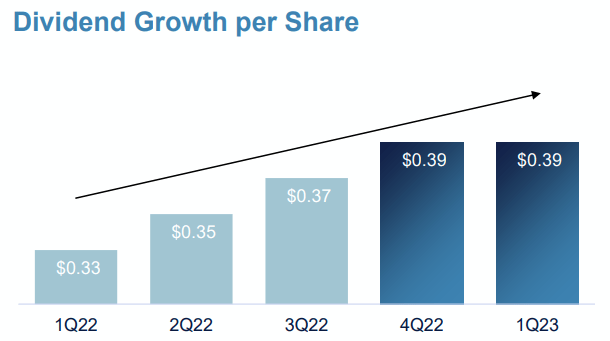

Since then its share price has only kept dipping lower even as the company kept hiking its dividend, quarter after quarter:

YCHARTS

NewLake Capital Partners

As a result, its dividend yield has now reached 12% – an all-time high for the company.

The market appears to be pricing NLCP at such a high yield level because it is grouping it with other cannabis stocks and the market sentiment for these “riskier growth companies” is today very low.

I agree that the cannabis sector is risky.

But where I don’t agree with the market is its apparent lack of differentiation between the risks of a cannabis company and a cannabis landlord like NLCP.

NLCP’s tenants are riskier than those of most other property sectors and so it will suffer occasional lease defaults, which are inevitable.

But it is still a lot safer than a regular cannabis company because NLCP’s business is to sell the “picks and shovels” to the industry. They own mission-critical assets in limited-license states and these licenses are tied to the properties. If one tenant cannot make money and defaults on its lease, then it can be replaced with another tenant. It may lead to a temporary disruption in cash flow, but if you are well-diversified, that’s not the end of the world.

NewLake Capital Partners

Today, the demand for cannabis keeps on growing at a rapid pace, and while the industry is going through some difficulties related to oversupply, the demand will eventually catch up to the supply.

NLCP is well-positioned in this challenging environment because:

- Its properties are almost exclusively in limited-license states.

- Its tenants are large companies like Curaleaf (OTCPK:CURLF).

- It has a strong balance sheet with no debt and significant liquidity.

Here are some interesting recent remarks from the CEO:

“We are very pleased with our Q1 results and the business continues to perform well and to our expectation. Our dividend is well covered even with rent collection issues at a major asset of ours in Massachusetts.

We have essentially no debt with the lowest leverage public REIT that I’m aware of. And we have $89 million of undrawn capacity on our debt capital facility, which is very interactively priced. So we sit in a very good position for a difficult operating environment.

Also, as you see in our press release, we have a stock buyback, which we’ve been implementing that’s a sign of a well-run company that is in a — that we are in a position to buyback our stock at these levels, because we’ve had a very conservative management of our balance sheet over the last several years, which allows us to be in a position to do that.

… we focus on quality properties in quality jurisdictions with quality tenants.” [emphasis added]

So we think that NLCP is undervalued and its dividend is sustainable. The market is grouping it with all other cannabis stocks, failing to recognize that this is a safer business, and it has resulted in a high-yielding opportunity for REIT investors.

We own a small position in our Core Portfolio at High Yield Landlord and expect to keep accumulating more shares in the coming quarters.

Bottom Line

The REIT market now offers a lot of high-yielding investment opportunities. The average yield of our Portfolio is 7% and our dividend payments are well-covered by growing cash flow.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Credit: Source link