Eloi_Omella

“Fear is not in the habit of speaking truth; when perfect sincerity is expected, perfect freedom must be allowed; nor has anyone who is apt to be angry when he hears the truth any cause to wonder that he does not hear it.” – Tacitus

Seeing French president Macron driving up the Champs Elysées on the 8th of May for Victory day while the crowd was kept away, this event added more fuel to our French pre-revolutionary mindset, therefore, when it came to select our title analogy we obviously had to go for “Tacitus Trap”. The “Tacitus Trap” is a political theory named after Roman historian Tacitus, which describes a situation where an unpopular government is hated no matter what it does and whether it is right or wrong. Tacitus, a Roman historian and politician, known for his work “Histories”, gave a vividly moral account of the events that transpired in Rome in 69 AD; when fearing a revolution against him, Nero, the then emperor, fled the country. This led to installing Galba as the emperor by civil and military authorities disconnected from the ground realities. Galba was challenged by Claudius Macer and Fonteius Capito, two loyal generals of Nero who cut off the food supply to Rome. The crisis unfolded when Galba ordered their execution which led Tacitus to comment that indeed when a ruler becomes unpopular, all his deeds be they good or bad, tell against him. The theory was brought up in a 2007 book by Professor from the School of Journalism and Communication at Nanjing University. Since China’s paramount leader and General Secretary of the Chinese Communist Party Xi Jinping’s use of the term in 2014, it has become increasingly popular in journalism and academia in China. State-run media. State-run media in China, such as People’s Daily online, summarized that since the 18th National Congress of the Chinese Communist Party, Party general secretary Xi Jinping has described three traps that China might fall into, that is, Tacitus Trap, Thucydides Trap and middle-income trap. The most obvious rising trap to us, is indeed the “Thucydides Trap”, in which the Greek Historian Thucydides explained the causes of the Peloponnesian War between Sparta and Athens. In Thucydides opinion, one great power (Sparta) was so alarmed by the rise of a rival (Athens under Pericles) that conflict was inevitable. A clear parallel is drawn to the relations between the superpower of the United States (Sparta) and the rising influence of China (Athens) under President Xi Jinping. When it comes to China falling into the “Tacitus Trap”, the jury is still out there. As far as France is concerned, we believe French president Macron has indeed fallen into the Tacitus Trap in earnest following his pension reform, but, as you know by now we like to ramble.

In this conversation, we would like to discuss bond allocation of the Japanese Lifers and consequences for US Treasury Notes as a follow up on our conversation “The Cheshire Cat”. As well we want to look at the latest quarterly Fed Senior Loan Officer Opinion Survey (SLOOs).

Dilemma in Japan

As we pointed out in our March conversation “The Cheshire Cat”, tracking the changes in Japan’s monetary policy is paramount. We mentioned the problematic issue of the Japanese defense budget for 2023 in the face of rising global security concerns. We opined at the time of our conversation that Japan needs to invest an additional 2% of GDP on top of planned increase just to offset one decade of underspending. As pointed out recently by Ryosuke Hanada in Asia Times on the 18th of May in his article entitled “The fight to finance Japan’s historic defense splurge”, Japan is poised to become the world’s third largest military spender by 2027. The big issue of course as we discussed in our March musing is where the money is going to come from:

“In the next five years, Japan plans to spend 43 trillion yen ($330 billion) on defense. In 2027, the defense budget will reach 9 trillion yen ($66 billion), equivalent to 2% of Japan’s gross domestic product (GDP) in 2023.

Though this means that Japan might not achieve its 2% GDP goal in 2027, Japan is poised to become the third-largest military spender in the world.

Internationally, US President Joe Biden’s administration welcomes such Japanese efforts, and there are already voices requesting more. But domestically Kishida is carefully balancing Japan’s wallet and bullets.

To cover the new defense spending increases, the Kishida administration squeezed 4.8 trillion yen ($35 billion) out of the 2023 financial surplus, spending cuts and non-tax revenues in the 2023 financial year.

Out of these 4.8 trillion yen, 1.4 trillion yen ($10.3 billion) were allocated to the 2023 budget and the other 3.4 trillion yen ($25 billion) are being saved for spending over the next four years.

The Japanese government runs on a single fiscal year basis, which is incompatible with saving money for the future. Hence the government is trying to pass a “bill on special measures for securing financial resources for the substantial reinforcement of Japan’s defense capabilities.”

With this legislation, the government is now able to establish a Defense Reinforcement Fund, which will pool non-tax revenues for future defense spending.

While the Ministry of Finance does its best to fund the defense budget within its rights, it cannot be said that these revenue sources are reliable.

The Public Finance Law requires that at least half of the budget surplus in each fiscal year be allocated for the redemption of government bonds and the remainder has traditionally been used to finance the following year’s supplementary budget.

While the budgetary surplus has increased recently due to the unused emergency Covid-19 fund, there is no justification to appropriate unnecessary items to intentionally make a surplus.

Spending cuts will get harder due to aging society and increasing social welfare spending. Kishida also promises to double the child-related budget. One of the government’s non-tax revenue sources, the Foreign Exchange Fund, recorded a surplus because of the depreciation of the yen last year and the increasing interest rates in foreign currencies.

Still, as this account’s purpose is to buffer the damage of volatility in foreign exchange, it is not guaranteed to increase the defense budget. Other non-tax revenues, including the Fiscal Investment and Loan Program or capitalizing government properties, are also unsustainable.

The funding of defense expenditures has caused an ongoing struggle between the tax hike faction and the debt financing faction within Kishida’s ruling Liberal Democratic Party (LDP). In December 2022, the Kishida administration announced that it mobilized one-quarter of the defense budget increases from newly raised taxes following the Ministry of Finance line.

This announcement frustrated LDP politicians who have criticized tax hikes and instead called to issue additional national bonds. Chairman of the LDP Policy Research Council Koichi Hagiuda said that the government has to do its best to find non-tax means before discussing taxation.

LDP politician Shigeharu Aoyama also argued that a tax hike for the defense budget is not justifiable, saying that national defense is the responsibility of the state, not a beneficiary liability. Aoyama also dismissed the government’s labeling of tax revenue as a stable source of income, saying that it is heavily affected by economic circumstances.” – Ryosuke Hanada in Asia Times on the 18th of May

As we pointed out in our March conversation, if the Bank of Japan allows Japanese yield to rise, Japanese investors would most likely repatriate their cash and liquidate their foreign holdings, meaning drawing down on its net foreign assets. As well in this previous conversation of ours we also stressed the importance of tracking the “flows” of Japan’s GPIF (Government Pension Investment Fund) and its friends the Japanese Life Insurance companies (Lifers).

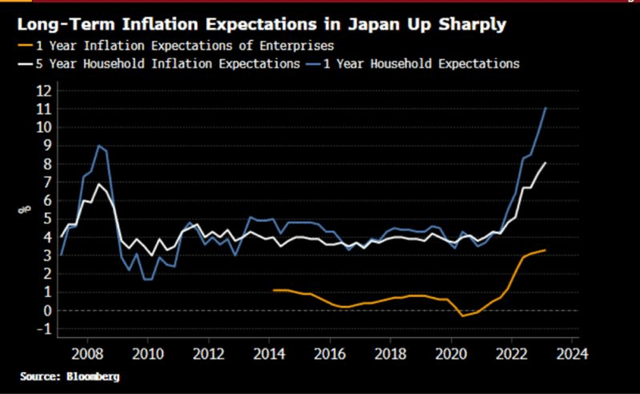

The Japanese government has only two choices in the light of its defense spending, raising taxes or debt financing. As well the Japanese government is facing higher inflation rates in the case of debt financing:

Japan inflation expectations (Bloomberg – Twitter)

What is of interest to us is that as indicated in Nikkei Asia on the 10th of May, both Nippon Life and Dai-Ichi Life executives are discussing possible rate shifts and stronger yen in an article entitled “Fewer Treasurys, more JGBs in the card for Japan life insurers”:

“Two major Japanese life insurers are planning to reduce their U.S. Treasury holdings in favor of Japanese government bonds in fiscal 2023 as they grow wary of high currency hedging costs and the risk of a stronger yen.

Dai-ichi Life Insurance plans to cut its holdings of currency-hedged Treasurys, and Nippon Life Insurance also plans a more cautious approach to unhedged foreign debt. This comes amid a broad trend in Japan’s life insurance industry toward buying more JGBs, anticipating a change in policy by the BOJ.” – Nikkei Asia

In this article Akiko Osawa, managing executive officer at Nippon Life indicated that investing in US Treasurys has no appeal in terms of yield after accounting for hedging cost. As such Lifers like Nippon Life are likely to reduce their holdings of hedged Treasurys and invest more in US corporate debt that offers at least some returns.

When the yen strengthens, foreign bonds without currency hedging for Lifers results in foreign exchange losses. If yen strengthens following an adjustment in the monetary policy of the Bank of Japan, Lifers will most likely reduce their holdings of open bonds. As such Lifers and the GPIF would most likely increase their JGB Holdings with rates rising. As a reminder Japan pension whale GPIF posted its longest loss streak in 20 years due to higher interest rates and rising yen in the period of October to December 2022 ($14.1 billion loss). Yen appreciation hurts the value of foreign assets in yen terms. GPIF has four allocation targets of 25% each for domestic and foreign bonds. GPIF overall lost 4.8% for 2022.

We pointed out in previous musing of ours during the course of 2022 about the very tight relationship between the US10 Year US Treasury Notes yield with the Japanese Yen. Beginning of 2023, the Japanese Yen strengthened during the month of January and as since weakened towards 138 level against the US dollar. The relationship between both the USTs and the Japanese yen has been tightly correlated since March 2020 at the start of the COVID crisis (graph below since March 2020):

UST10 vs USD/JPY since March 2020 (Macronomics – TradingView)

If indeed we have reached peak level for the US Treasury 10 year yield, then indeed, if the relationship still stands, there is indeed a risk for yen strengthening, which would again put pressure on foreign holdings of the GPIF and Lifers alike (graph below one year chart):

UST10 vs USD/JPY 1 year (Macronomics – TradingView)

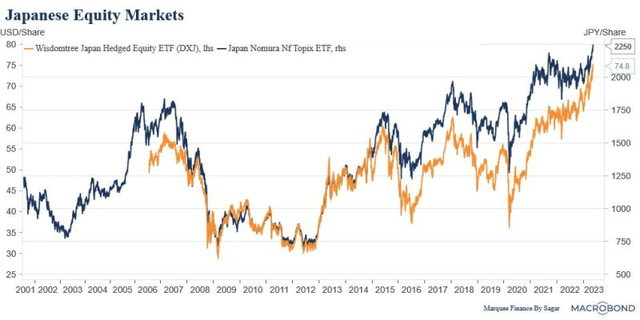

As well what we find of interest is the significant outperformance of Japanese equities over US equities in recent months, attracting as well significant foreign flows:

TOPIX vs S&P500 (Bloomberg – Twitter)

Also as Sagar Singh Setia pointed out on LinkedIn, one might wonder if Japan, is finally becoming the land of the rising equity market following a long deflationary spell:

“On The Cusp Of Massive Bull Run?

The only equity market in the world that continues to hit fresh multi-decadal highs is none other than Japan.

The TOPIX today touched fresh 33-year highs, and DXJ: The hedged Japanese ETF is also hovering around ATH.

Yesterday, the Japanese GDP smashed all expectations and surprised on the upside.

The imported inflation is helping the nominal earnings of the companies, and if we witness persistent inflation, it will be a significant tailwind for earnings.

Furthermore, Japanese equities remain historically cheap, and a rerating can further boost the returns.

Is the tide changing for the most ignored equity market in the world?

Probably yes, in the short-medium term!” – Sagar Singh Setia

Japanese Equity Market ( Marquee Finance by Sagar via Macrobond)

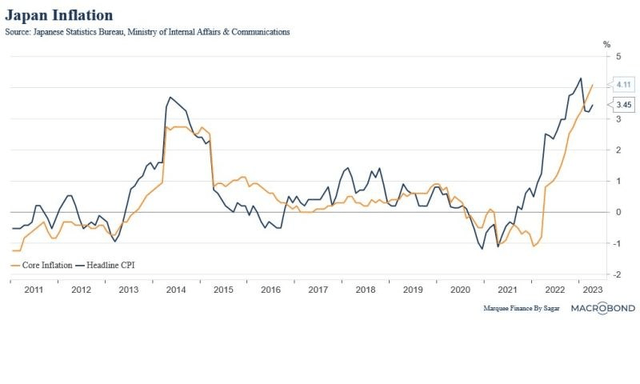

Is Japan definitely out of the “deflation wood” this time around? Again Sagar Singh Setia points the following:

“The 30-Year Wait Is Over!

It took a pandemic, a war, and trillions of dollars of monetary easing, to finally end the three decades of deflation in the land of the rising sun.

Yes, folks, Japan has now entered a sustained inflationary regime (at least for the medium term).

While the headline inflation came in at 3.45%, the core inflation continued its climb and has now reached 4.11%, indicating that inflation is getting entrenched.

This should prompt the BoJ to stick to their guidance of ending the YCC and normalising the policy.

While higher inflation is catastrophic for the pensioners, it’s helping the nominal earnings driving “cheap” Japanese stocks higher.

Nevertheless, as I have mentioned earlier, the end of YCC and rising yields will have unintended consequences for the bond markets in the West.

Always join the dots!” – Sagar Singh Setia

Japan inflation ( Marquee Finance by Sagar via Macrobond)

Following up on Japan’s defense budget dilemma, we have to agree with Sagar Singh Setia, that, a Bank of Japan tweak in its monetary policies as well as the changes in allocation of the GPIF and its Lifers friends could have significant consequences on bond demand on a global scale, including the United States depending on the trajectory of course of the Japanese yen.

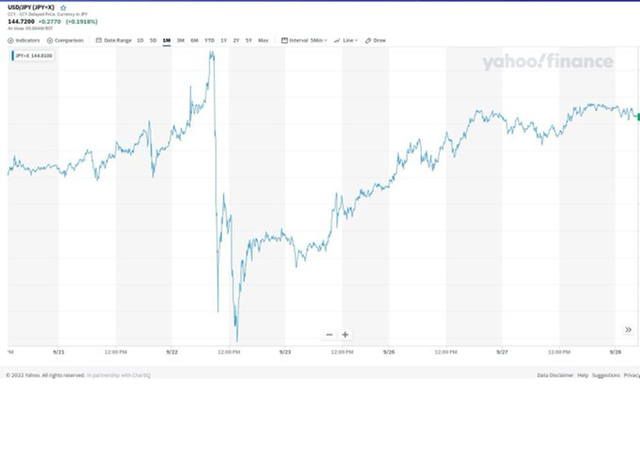

Hopefully the Fed can avoid the nasty sell-off surprise which occurred in September 2022 as pointed out by our astute friend Geoffrey Fouvry (@GraphFinancials on twitter). The Bank of Japan dumped some US Treasuries at the time, which also led to a blow up in British gilts in the process:

“On September 22nd, the sale of US Treasuries of $19.2 bn was not coordinated with Yellen. (Kyodo news http://bit.ly/41cgSGC).

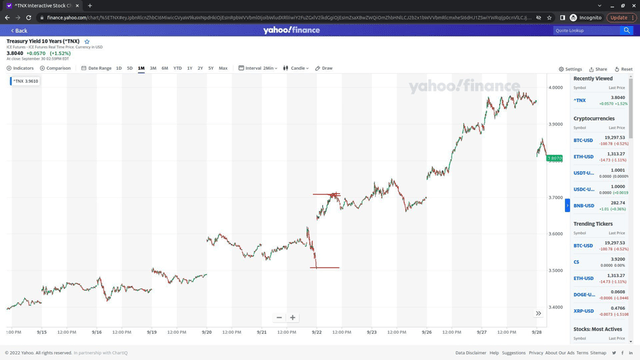

USD/JPY 22nd of Sep 2022 (Geoffrey Fouvry – Yahoo Finance)

At the same time that Japan was whacking the MOMO yield pigs, US Treasury yields gapped up massively. Same exact time. Gilts were trading inside and blew up. This produced the highest spike in US Treasury Notes in yields intraday, with a big gap in the morning:

UST 10 year 22nd of Sep 2022 (Geoffrey Fouvry – Yahoo Finance)

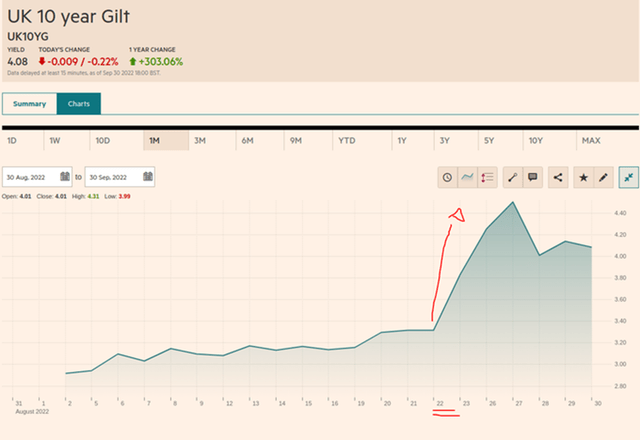

The United Kingdom Gilt yield started spiking on that very day, creating a chain reaction with margin calls on UK pensions. UK Gilts were trading inside US Treasuries (lower yields) despite higher inflation, and there was no more support to buy those bonds with QT (Quantitative Tightening) on top.

The Gilt yields spike, the detonation was triggered by the Bank of Japan:

10 Year Gilts – 30th of Sep 2022 (Geoffrey Fouvry – FT)

As pointed out by our wise friend, in September 2022, both the US Fed and the Bank of England got sucker punched by the Bank of Japan.

Furthermore, Bondzilla the “bond monster” is made in Japan. GPIF and Lifers have significant allocations when it comes to the world of global Fixed Income.

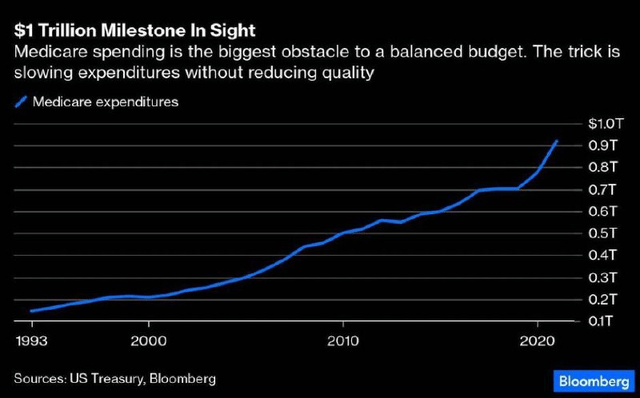

We will not delve too much in the ongoing US debt ceiling debate but, as we pointed out in our previous conversation, the Fed is in a very difficult position given its negative equity position and the trajectory of the US budget deficits:

Medicare expenditures (Bloomberg – Twitter)

The United States is facing a QFD situation (Quasi Fiscal Deficit), which is, traditionally as we pointed out in our previous musing an Emerging Market Central Banking disease. Given the rising probability of a US recession in the light of various economic indicators, then to repeat ourselves, the fiscal position of the United States would be expected to deteriorate further as growth weaken and unemployment rises:

“A US recession is a virtual certainty and the Federal Reserve may lower interest rates by the third quarter as growth loses momentum, according to JPMorgan Asset Management.” — Bloomberg

For more on QFD issues we highly recommend watching Geoffrey Fouvry quick take on Graph Financials, part 1 and part 2.

No loans, no CAPEX, no CAPEX, no jobs growth

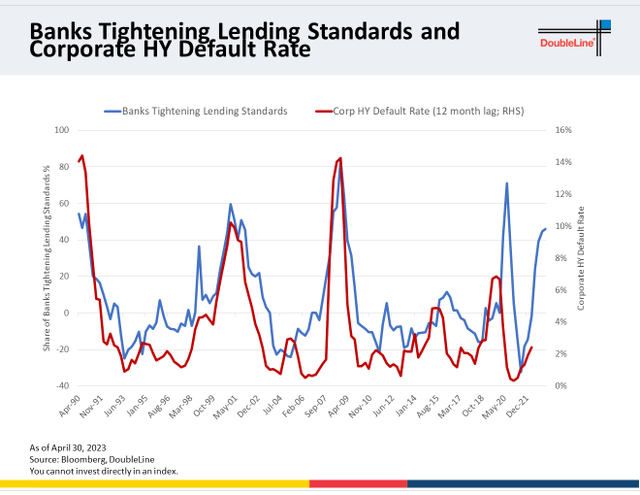

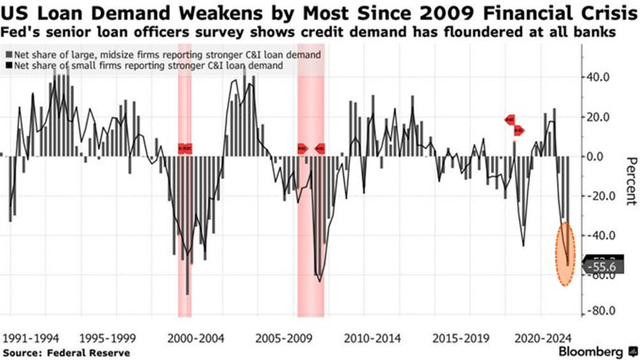

We believe that the most predictive variable for default rates remains credit availability and if credit availability in US dollar terms vanishes, it could portend surging defaults down the line for stretched companies. As pointed out in the past by Bank of America, you can use the following three main criteria to forecast High Yield default rates, the Senior Loan Officer Opinion Survey (SLOOs), credit migration rates and real rates in the economy. When you combine these three inputs, you get an 85% correlation over the next 12 month trailing default rate at any given point in time.

High Yield is most sensitive to change in lending standards as reported by the quarterly Fed SLOOs. The survey reflects the ability of medium sized enterprises (annual sales greater than $50mn) to get funding from their regional banks. Since High Yield issuers fit this criterion, this survey is also well correlated with their ability to tap the bank lending market:

SLOOs and HY (DoubleLine – Twitter)

The Fed SLOOS report does a much better job of estimating defaults when they are being driven by a systemic factor, such as a turn in business cycle or an all-encompassing macro event:

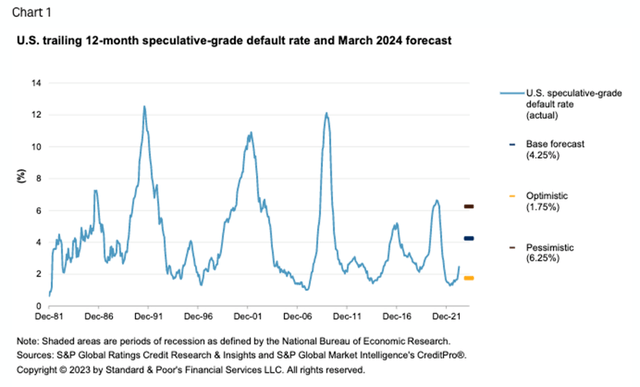

US trailing 12 month HY default rate (S&P Global – Twitter)

“Expect U.S. trailing-12M speculative-grade corp default rate to reach 4.25% by Mar ’24, from 2.5% in Mar ’23. Higher interest rates combined with elevated input costs has started to erode cash flow at a time we expect the economy to dip into a short recession.” – S&P Global Ratings

Also as indicated by Morgan Stanley, credit conditions tend to closely correlate with earnings growth:

US Loan demand weakens (Bloomberg – Twitter)

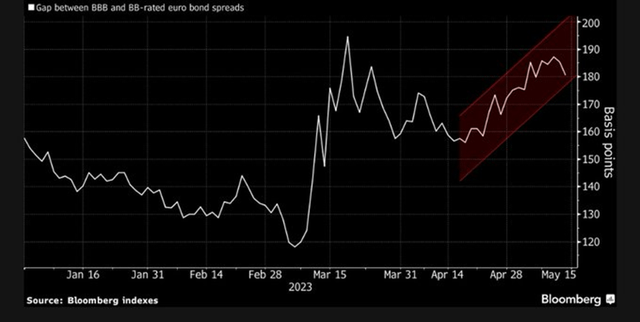

No surprise therefore in seeing spreads between BB and BBB also in Europe widening again. Gloomy macro narrative is reinstating a premium to High Yield as it tends to perform poorly in recessions:

Gap between BBB and BB- rated euro bond spreads (@KillinGswitCH98 – Bloomberg – Twitter)

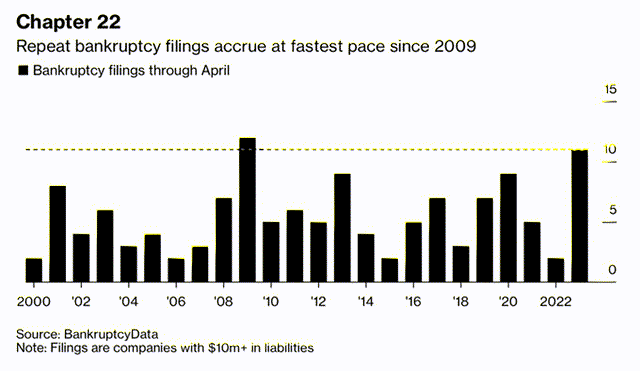

No wonder we are already seeing rising bankruptcy filings with credit tightening:

Chapter 22 (Bloomberg – Twitter)

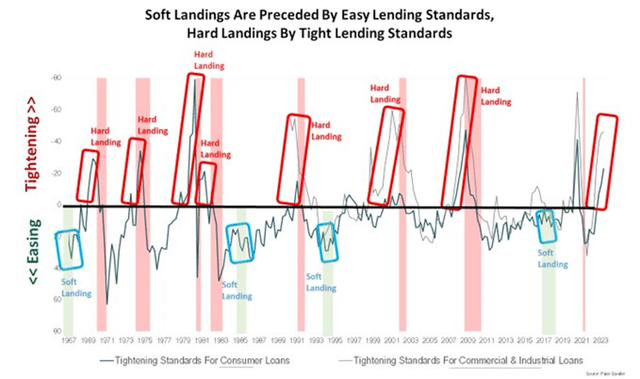

So no matter what Jedi tricks the Fed is trying to play on us with their “soft landing” narrative, we are not buying it, like we did not buy the “transitory inflation” narrative, given SLOOs have a decent track record (100% historically) for determining soft and hard landing after a Fed tightening cycle as shown in the below Piper Sandler chart from Michael Kantro:

Hard landings by tight lending standards (Michael Kantro – Piper Sandler – Twitter)

Banks with less than $250 billion in assets account for 50% of commercial and industrial lending. Small banks account for almost 70% of all commercial real estate loans outstanding. Fed hiking cycles always break something and as pointed out recently by Hartnett from Bank of America, this time it has been the US regional banking system. Tighter credit leads to weaker job market and as a reminder from our Twitter profile:

- Firms with less than 20 employees make up 90% of all companies in the US

- Small and medium-sized firms employ half of all workers in the US

- Small and medium-sized firms generate half of all revenue in corporate America

- Small firms create around 3mn jobs every year

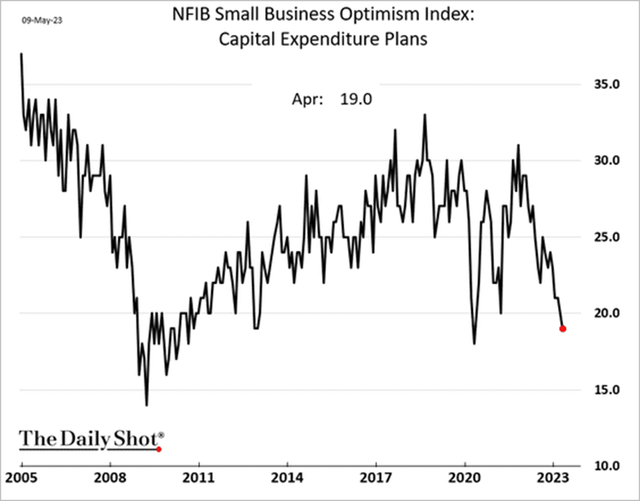

If US Regional banks are in a bind due to their large Commercial Real Estate (CRE) exposures, then indeed, it doesn’t bode well for Small and medium-sized firms access to “credit”:

NFIB Small Business Optimism Index (The Daily Shot – Twitter)

Small Businesses are the life blood of the US economy as such the “soft landing” narrative from the Jedis of the Fed doesn’t convince us. No loans, no CAPEX growth, no CAPEX growth, no jobs growth…

“All enterprises that are entered into with indiscreet zeal may be pursued with great vigor at first, but are sure to collapse in the end.” – Tacitus

Credit: Source link