The Federal Reserve on Tuesday voted to scrap a near-$2 trillion asset cap imposed on Wells Fargo over a 2016 scandal that uncovered millions of fake accounts and other consumer abuses.

The decision closes the door on a decade of regulatory woes for the nation’s fourth-largest lender and is a major victory for Wells Fargo CEO Charlie Scharf — allowing the bank to pursue growth by boosting loans, stepping up its Wall Street business and doing deals.

Scharf was hired in 2019 to clean up the mess after the firm was hit by billions of dollars in fines.

The Fed said in a statement that the removal of the $1.9 trillion asset cap, imposed in 2018, “reflects the substantial progress the bank has made in addressing its deficiencies.”

It was one of Janet Yellen’s final actions during her tenure as chair of the Federal Reserve. She would go on to serve as Treasury Secretary in the Biden administration.

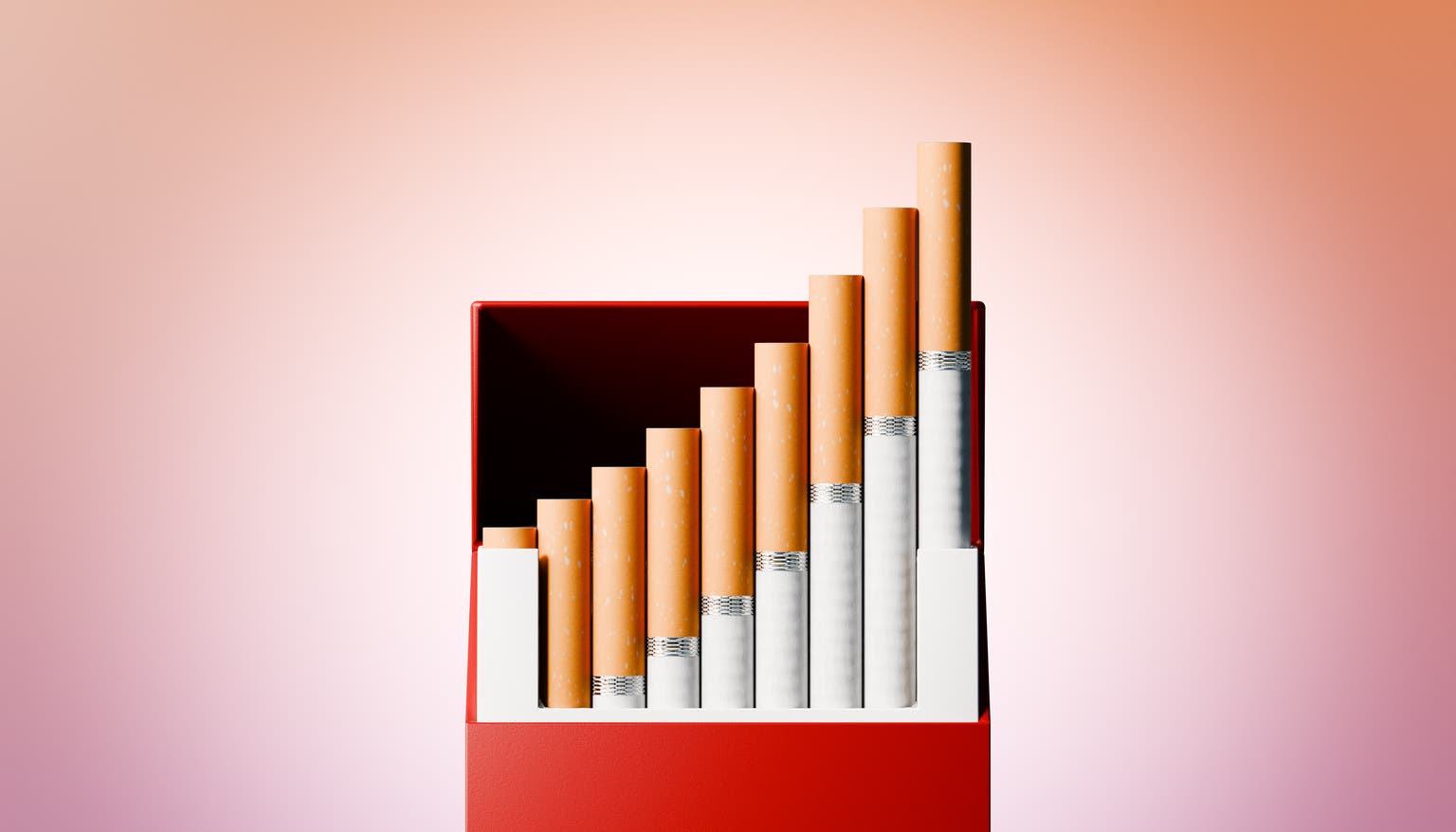

Wells Fargo stock soared more than 2% in after-hours trading following the announcement. Shares had closed at $75.65, up from $59.34 a year ago.

The bogus accounts scandal toppled two Wells Fargo chief executives. John Stumpf was let go in 2016 when news of the unauthorized accounts first broke.

His successor, Tim Sloan, quit just over a year after the asset cap was put in place.

Some elements of the Yellen-era enforcement order will remain in place, meaning the bank will still face increased scrutiny from regulators.

“Removal of the asset cap represents successful remediation to the required standard based on focused management leadership, strong board oversight, and strict supervision holding the firm accountable,” said Fed Governor Michael Barr, who quit as vice chair for banking supervision earlier this year.

“All three will need to continue for the firm to have a sustainable approach,” he added.

Credit: Source link