William Thomas Cain/Getty Images News

Back in January we discussed why we liked Sinclair Broadcast Group (NASDAQ:SBGI) and how it appeared that the market might be undervaluing the company as the sum-of-the-parts appeared to be worth far more than the market value of the company. Management believed that their investment portfolio alone was worth $1.2 billion, or close to $17/share, and while that was an estimate it seemed reasonable us. Since our last article, Sinclair has decided to undergo a reorganization which will see a new parent company with two main subsidiaries; Sinclair Broadcast Group and Sinclair Ventures (which will hold all of the non-broadcast assets) – which is explained in a little more detail here.

Sinclair’s most recent conference call, where management discussed the reorganization plan and quarterly results, was informative and shed light on the fact that the majority shareholders want to close the gap between what they believe the company is worth and where it is trading on the market currently.

Reorganization

On the conference call, management explained that they believed this reorganization will provide the market with more transparency which will create an easier to understand entity for the market. Management believes that with a clearer picture of the company, investors will be able to assign it a higher valuation – at least that is the hope.

We thought it was pretty telling that part of the discussion centered around the regulatory environment, which appears to be one of the main drivers of this plan. It seems that management believes that with the FCC’s recent actions pertaining to the TEGNA (TGNA) takeover by Standard General that there might not be much more M&A activity for the large broadcasters to do moving forward; including transactions out on the margin. Splitting into two segments, one being the boring, cash cow broadcast assets and the other appearing to focus on growth initiatives within the media industry (along with all of the private equity holdings), looks to be setting the table for a potential future split between what would be the new holding company’s new subsidiaries.

Structuring these so that they could both issue their own debt, and stand on their own also creates “silos” – which is not the most efficient way to run a business with interrelated parts but does enable one to make clean breaks if the debt documents contain the correct language and the company has self-sustaining cash flows (and management stated they believed this that each would be able to generate enough FCF for their own funding needs). While management is not currently discussing this scenario, it appears clear to us that they understand that they need to be investing in growth initiatives and that someday we might see many of these broadcasters do what the newspaper companies previously did – split no growth and growth up to maximize shareholder value and create pureplays.

Share Repurchases

Lucy Rutishauser, Sinclair’s CFO, discussed share buybacks that the company did during the quarter, as well as subsequent repurchases after quarter-end:

During the quarter, we repurchased approximately 3.6 million common shares under a 10b5-1 stock buyback program, and an additional 5.2 million shares since March 31, representing approximately 13% of the total shares outstanding at the beginning of the year. Our total share count at the end of the quarter was 68 million.

While the share count may have been 68 million at the end of the quarter, on May 5th it stood at 63,038,970 shares outstanding (Class A and Class B, combined) due to the additional 5.2 million shares repurchased after the quarter ended.

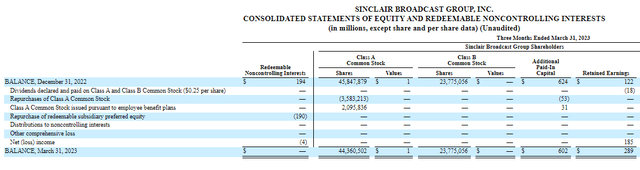

The company continues to repurchase the Class A Common Stock. (Sinclair 10-Q SEC Filing)

While the math is pretty close from quarter end to May 5th, we would point out that there are some reconciling issues from the company’s annual filing to this quarterly filing. While the company ended the year with 69,564,683 shares outstanding (Class A and Class B, combined), the employee retirement plan saw 2,095,836 shares issued (which was over 1 million more than last year in this same quarter). That figure should help those who keep up with this sort of thing go from the 69 million+ from year-end figure to the current shares outstanding figure factoring in the buybacks.

Why does all of that matter? Well first, it shows that even with a large debt load that the management team feels that the shares are undervalued. It also shows that they believe that the company’s ability to generate FCF moving forward is still strong as they are directing these funds to share buybacks and not repurchasing their debt (which trades below par). Lastly, it shows that the controlling family is interested in continuing to solidify their grip on the company by focusing on Class A share repurchases when they already controlled 80%+ of the voting rights.

Sinclair repurchased a decent amount of shares in the quarter, but they also issued over 2 million shares for the employee benefit plan. (Sinclair 10-Q SEC Filing)

Big Year For Investments

Sinclair has not provided full-year guidance at this time, but we do know that Q2 adjusted EBITDA “is expected to be between $84 million and $104 million,” as stated by Lucy Rutishauser – which would be down $100 million from last year’s $184 million if they hit the bottom of the range. Ms. Rutishauser also said that adjusted FCF for Q2 “is expected to be negative $6 million to positive $16 million.” So that guidance, coupled with the company’s focus on share repurchases and major investments should see cash on the balance sheet shrink.

Sinclair is also spending $75 million on “infrastructure” this year, which includes moving to the cloud, their NextGen tech rollout and their proprietary marketing services platform (which could be a hidden gem in the future). While this outflow for infrastructure will be a drag over the next few quarters as the company builds out and revamps, the spending will stop and should provide an additional tailwind along with political spending in 2024.

Even with the spending and what appears to be lower spending in the ad market, Sinclair expects to be FCF positive in FY 2023.

Keep An Eye On Diamond’s Bankruptcy

Credit investors can be ruthless, especially when it comes to gaining control of an asset or seeking to make themselves whole. With Diamond’s bankruptcy and the poor state of affairs for the regional sports networks, or RSNs, there is growing speculation that the creditors might look to Sinclair to extract value for themselves. We have not seen a lot of details on this, but the thinking is that Sinclair offloaded the risk by making some maneuvers to avoid any recourse on the debt if Diamond did have to go through the bankruptcy process and that creditors may view that as a potential point of attack to get some cash. Sinclair is a ripe target due to the cash on their balance sheet and large investment portfolio, so we do think that this is something to keep one’s eye on.

Our Current Positioning

We are currently long the stock, however we have a ‘Hold’ on it. We do not want to be large buyers of the shares right now as we mostly have equal weightings to our targets. However, we are buyers to maintain that target allocation on new inflows when the variance has gotten outside of our allocations between rebalancing dates. We like the fact that the company has taken a multi-pronged approach to returning capital to shareholders and believe that increased dividends and share buybacks create the most value for all shareholders.

We would move to a ‘Buy’ if we got clarity on the Diamond Bankruptcy exposure and could quantify that any potentially liabilities would be minimal.

Credit: Source link