No doubt investors are cautious as they enter 2025 given what some view as an overextended, and volatile, market.

But the right pivots may allow investors to take advantage of opportunities when they surface.

Lucas Ma of Envision Research, the Investing Group leader behind Envision Early Retirement, takes the “barbell” approach – dividing investments between high- and low-risk allocations that endure market swoons while also capturing growth opportunities. The strategy includes steady dividend investments along with exposure to growth areas such as AI, and adjusts depending on market direction.

Ma, who works with Sensor Unlimited at Seeking Alpha, shares ideas on sectors that should be under consideration along with areas to avoid in 2025. The 2025 Outlook is below:

Seeking Alpha: What are your expectations for markets in 2025? It was a big 2024 for Wall Street. Can investors expect more of the same next year?

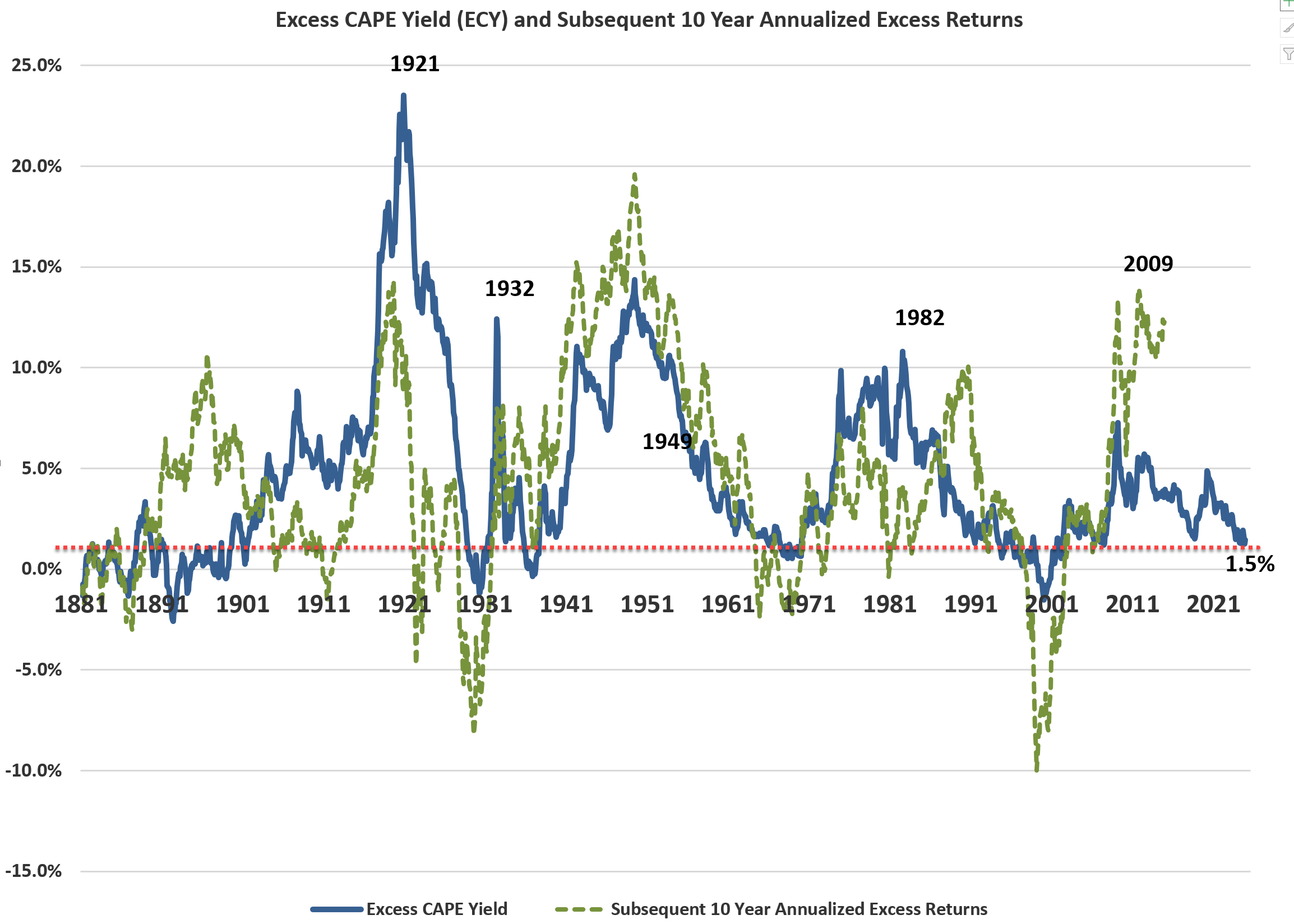

Envision Research: My short answer is no. My overall assessment for the broader markets is that it’s currently so expensive, by every measure, that I would feel lucky if it does not suffer a major correction (say 20% or more) in 2025. To keep my answer concise, I will just cite one metric – a most fundamental one in my view – the so-called Excess CAPE Yield (“ECY”) as detailed in Dr. Robert Shiller’s book Irrational Exuberance. The ECY captures all the key elements in equity valuation in my view: P/E, risk-free rates, inflation, etc.

Over the long term, historical data has demonstrated a clear correlation between the ECY and the subsequent return of the S&P 500. The reason behind this is very simple and timeless in my mind. A low ECY indicates that the S&P 500 is trading at a high valuation relative to risk-free rates (i.e., the real 10-year Treasury rates). Thus, I would expect lower odds for the S&P 500 to outperform Treasury rates, and vice versa. The ECY currently hovers around the thinnest levels in the S&P 500’s recorded history. Historically (say in the past 100 years), the ECY has been this thing only a couple of times, followed by poor S&P 500 returns in the subsequent years each time. I don’t expect this time to be different.

Robert Shiller

Seeking Alpha: Tech has enjoyed a big run higher in 2025, thanks mainly to AI. Maybe things are getting toppy for the sector? What do you recommend investors do with tech in 2025?

Envision Research: Before answering this one, let me digress a bit first and say a few words about my overall investing philosophy. Without the proper context, my response could be misleading. Also, this digression helps to prime my response to your next two questions as well.

A core idea underling my investing approach is the so-called barbell model. In this model, I divide my investible funds into two parts. Not necessarily equal parts. The allocation in each part changes with market conditions. Then I invest each part in the two extremes of the risk curve – kind of the two ends of a barbell – and avoid the middle risk spectrum. The low-risk extreme helps me to survive extreme market crashes, and the high-risk extreme helps me to capture growth. My experience with this approach (accumulated over 20-plus years and counting) has been successful, as it helps me to clearly isolate risks.

Under this context, I’m not too concerned that AI stocks are getting toppy under current conditions. I still have sizable exposure to AI-related stocks. But again, a key reason I feel comfortable with my exposure is that I have enough funds allocated in the other extreme of the risk curve (which will be detailed in my response to your next questions). I’m bullish on the expansion of AI in the long term and consider many stocks reasonably priced given their growth potential. Examples include Apple (AAPL), Microsoft (MSFT), Nvidia (NVDA), etc. But note that I don’t own all of them, and see the disclosure at the end of the article for my specific holdings.

Many investors, even growth-oriented investors, may find their current P/E (in a range of 30x to 40x) offsetting. But I’m OK with such multiples for these high-quality compounders with secular growth prospects. Thinking like an owner (and I do intend to hold on to my shares in the long term), their current valuation can still provide robust total return. Many of these companies have an enviable ROCE (return on capital employed) above 70%. At 70% ROCE, a 10% investment rate would provide 7% organic real growth rates (i.e., before inflation adjustments). A P/E of 40x would at least provide 2.5% of earnings yield. Thus, combining the growth rate, even at 40x P/E entry, the total annual return could still be in the double digits in the long term.

Seeking Alpha: You also focus on dividend investing. Your approach to finding high-quality dividend ideas for next year?

Envision Research: Yes, I do. And the fundamental reason is, as aforementioned, these stocks help to anchor the other end of the barbell for me. In terms of screening methods, I like a top-down approach. To be more explicit, I have developed tools that help me to track various market sectors (readers interested can see and download my sector dashboard in this Google sheet as one example of these tools). Attractively valued sectors then provide a starting point for me to further research promising stocks.

As for some specific ideas, currently, my reading is that dividend stocks – especially in traditional value segments – are quite attractive. For example, if you just check out the dividend yield of the Schwab U.S. Dividend Equity ETF (SCHD), you would see that its current yield is not only above its historical average substantially but also is hovering among the highest levels in at least 10 years. This provides strong motivation – and also a promising starting point – to further study the holdings in this fund. I have indeed identified and established positions in several of its constituting holdings, such as Altria (MO) and Chevron (CVX).

Seeking Alpha: What are the sectors investors may be missing that could present opportunities?

Envision Research: I invite investors to take a look at the communication sector, as represented by the Communication Services Select Sector SPDR ETF Fund (XLC). My observation of other investors around me is that both tech and value investors tend to overlook XLC. The name gives the impression of traditional telecommunication stocks and thus may not get the attention of many tech-oriented investors. For value investors, XLC does not provide clear “value.” Value investors typically look for companies with low P/E ratios and high dividend yields. XLC as a whole won’t pass either screening with its ~20x P/E and ~0.88% dividend yield as of this writing.

However, I like XLC for a couple of reasons and urge you to take a closer look at its actual holdings. In a nutshell, about half of XLC assets are allocated to three companies: Google (GOOG) (GOOGL) (about 20% of the fund’s total assets), Meta Platforms (META) (another 20%), and Netflix (NFLX) (about 7%). And the other half is allocated toward the more traditional telecom businesses- the likes of T-Mobile (TMUS), Charter Communications (CHTR), and AT&T (T). All told, the top 10 holdings represent almost three quarters of the total assets, which is a plus for me, as I like concentration. I can only understand a handful of tickers in depth.

And I feel I do in this case of XLC, and have written on many of XLC’s holdings recently. I feel positive about the return potential for most of them. Plus, XLC is an excellent example – and simple implementation – of the above barbell model in my mind by dividing its assets into high-growth and high-risk holdings and more boring (which is good under this context) holdings.

Seeking Alpha: And the areas to avoid?

Envision Research: I’m cautious about utilities. They’re traditionally considered a safe haven, and many investors might turn to them given the high valuation of the overall market and the many ongoing uncertainties. However, I think their risk premium is quite high currently, either benchmarked against their past historical levels or against the current risk-free rates.

I’m also very cautious about speculative bets. I’m against such bets in general, and especially against them amid an expensive market. If there’s a time to make speculative bets, that would be amid market bottoms, not near market tops, in my book. Under this guideline, I won’t touch stocks with absurd P/E ratios (with Palantir Technologies (PLTR) and its ~200x P/E being a notable example) or stocks with no profits and/or marketable products yet (with many of the early phase quantum chip stocks being notable examples) no matter how promising their business models are.

Credit: Source link