anyaberkut

Apollo Global Management, Inc. (NYSE:APO) has just reported its first quarter earnings and the management was keen to report on the past 2 years when they started to move into the private credit market. The company reported good first quarter results, with growing AUM, growing FRE, and SRE. Thanks to the consequences of the recent banking crisis and APO’s stock price decline, it might be an attractive buy for investors.

Apollo Global Management Business Model

63% of APO’s revenue came from interest income in the first quarter of 2023. This segment usually provides between 50-70% of the company’s revenue. Since the start of the aggressive rate hikes in the second half of 2022, this segment’s share of revenue grew from 50-55% to above 60%. The company could also grow its management fees during 2022 and I expect this trend to continue in 2023 as well. The asset management fees usually provide approximately 10-12% of APO’s revenues.

Q1 Earnings

In the quarter ended, the FRE amounted to a whopping $397 million, and fee-related earnings were up by almost 30% Y-o-Y. This was made possible by excellent management fee growth and tremendous capital solutions fees. Investors have seen a rise of $688 million in the SRE as Athene’s portfolio expanded and net spread profitability remained appealing. The total AUM grew to $598 billion by the end of the first quarter compared to $548 billion at the end of the last quarter.

2 Main Strategies

The management has put a lot of effort into private credits since 2021. They chose to aggressively move towards this market and it seems that the risk is paying off. It’s usually assumed that private credit involves heavily leveraged loans and is below investment grade, however, APO only invests in the investment grade version. APO reported that its yield AUM was $440 billion this quarter; the greatest of all private credit businesses. Nevertheless, that figure is still very small compared to the $40 trillion private credit market. Investors should be aware that APO’s private IG franchise operates on a different level than typical banks. They focus on acquiring assets, not clients. That is the major difference between APO and banks because banks are after the clients rather than the assets to upsell or cross-sell to them products and services. APO does not provide additional services, so they don’t want clients. Its goal is to attain the assets without taking on the liabilities or extra responsibilities that come with client relationships.

The management’s other main focus is the safety of the yield. Its insurers Athene and Athora require safe yield and safe yield could be a replacement for fixed income investments such as publicly traded IG. The inflows into the insurance business were $12 billion in the first quarter, roughly about the same as in 2022. The management sees a bright 2023 for the insurance business. APO expects Athene’s second quarter inflows to surpass $17 billion, helping them exceed their last year’s record annual inflow of $48 billion. Athene unveiled an exceptionally high normalized net spread of approximately 160 basis points in the first quarter, higher than it has been in the past 10 years. In addition, investors could see $30-40 billion of annual originations in 2023. The company is also expanding to Japan, with this market, I am confident that APO will be able to make around $4.5-5 billion per year from flow reinsurance. This year, the management anticipated it to be the most successful in APO’s history with between $9-10 billion of flow reinsurance.

APO Stock Valuation

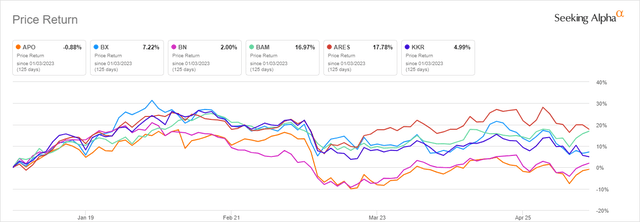

APO suffered the most adversities due to the presence of its colossal insurance arm, Athene. Although Athene is part of the life insurance industry, it specializes in providing retirement services. Fundamentally, this type of venture is prone to a bank run in the same way as SVB did; thus, APO has experienced greater losses than other alternative managers. Such a move is penalized severely and does not make any financial sense in my opinion. Annuities are a popular savings option for retirement and the money is not expected to be withdrawn until it’s needed.

Price return of asset managers (Seeking Alpha)

However, annuity owners may decide to surrender but the vast majority of it is transferred to another policy otherwise it triggers tax payments. A major component of APO’s portfolio, 80%, is non-redeemable or safeguarded from market value modifications, and incurs surrender costs. During and shortly after the run on Silicon Valley Bank, Athene’s call center volume, and surrender activity did not change. This means that the business is stable and also presents a good buying opportunity for the stock in my opinion.

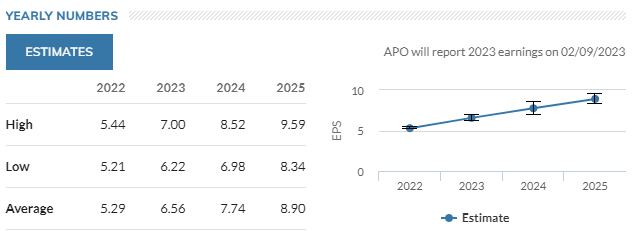

The EPS forecast strengthens the buying opportunity thesis. 16 analysts cover APO and even the lowest EPS estimates from 2023 to 2025 suggest a CAGR of 16.6% until 2025. On the other hand, there are some risks to buyers. The current valuation is fair, and it could be called slightly overvalued based on its P/E ratio which is 20% higher than the sector median. If the 16% CAGR is hurt by some external factor such as the slowing of the insurance business, less AUM growth over the years, or some bank failures that affect APO the share price could stay within the $60-70 range longer than expected. In my opinion, short-term investors should weigh this risk more than long-term APO investors.

APO EPS estimates (marketwatch.com)

Dividend

The management is planning for dividend payments and one of its main priorities is to provide a stable and secure dividend for shareholders combined with occasional special dividends and continuous share buybacks. From 2022 to 2026, a total of $5 billion has been allocated to finance the base dividend rate of $1.60 per share. The organization has allocated a total of $10 billion, with $5 billion being directed towards opportunistic buybacks and dividend increases, and the remaining amount towards strategic growth investments in the next 4 years. APO invested $160 million to take advantage of market conditions and purchase back shares in the first quarter of 2023. The management has been constant with these statements in the previous earnings calls. On the latest call, Martin Kelly – CFO emphasized:

“We expect our free cash flow to be utilized to fund the base dividend, return incremental capital to shareholders through opportunistic buybacks and dividend increases, and invest in strategic growth.”

APO’s management is aiming to generate a yield that is similar to, or better than the S&P 500. As of now, the index is yielding around 1.7% while APO’s stands at 2.8%. It seems that its payout ratio and cash flow will be able to support its dividend in the upcoming years. The current payout ratio stands at 30%.

Summary

Apollo Global is standing strong in the current economic environment and despite the share price drop due to the banking crisis, the company is not affected by it. With the 16% CAGR and fair valuation APO might provide a good buying opportunity for investors.

Credit: Source link