Justin Paget

Dear readers,

Canadian Solar (NASDAQ:CSIQ) is a global vertically integrated solar power company, one of the largest producers of solar panels in the world and a major player in the energy storage space.

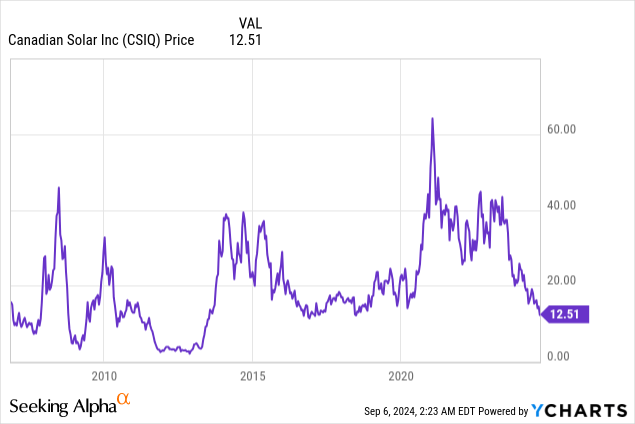

It is a company that I have studied extensively and covered many times here on Seeking Alpha. And I can tell you that the one thing you need to know before investing in this one is that CSIQ is highly cyclical.

While the cyclicality should be evident from price action alone, there are fundamental reasons why the stock has seen wild run-ups and crashes but has ultimately failed to grow over time, despite significant growth of the two industries it operates in.

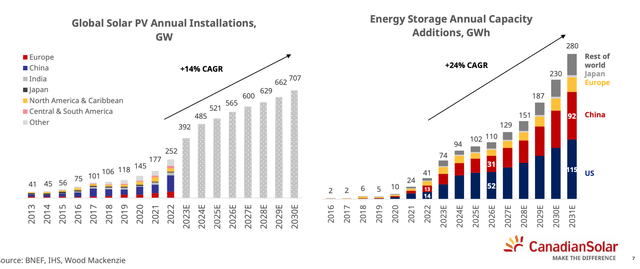

CSIQ IR

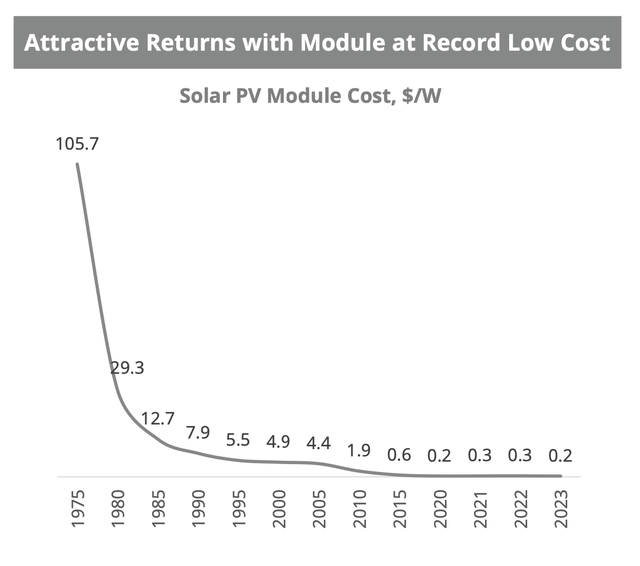

I explained these reasons in detail in one of my past articles. In short, solar panels are all more or less the same, which means that there is fierce competition in the space and the product has become rather commoditized. This has been good for the consumer as the price of solar panels has plummeted over time (see chart below), but not so much for the producers which spend Millions on R&D and especially new production capacity in an effort to capture demand when it’s high, only to see inventory pile up when demand inevitably falls.

CSIQ IR

Because of this inherent cyclicality, I have warned against buying the stock at $30+ per share last year, and have only started accumulating shares slowly when the price started to decline. The last time I wrote about the stock, post Q1 earnings, the stock was very cheap, trading at only a fraction of the value of its holdings in the publicly traded Chinese subsidiary CSI Solar Co. I concluded that the stock was a buy, but I also presented a number of significant risks to consider. Simply put, I saw CSIQ as a high-risk, high-reward play.

Frankly, the performance since May has been poor with a negative RoR of 33%, compared to a slight RoR of the S&P 500 (SPX) index over the same period. This underperformance was likely caused by (1) worse-than-expected Q2 2024 results, (2) lowered guidance, and (3) a macro environment that continues to be challenging for the industry.

Regardless, I have continued to slowly average into the stock, which now accounts for just under 0.75% of my portfolio.

SA

Q2 2024 Results and Guidance

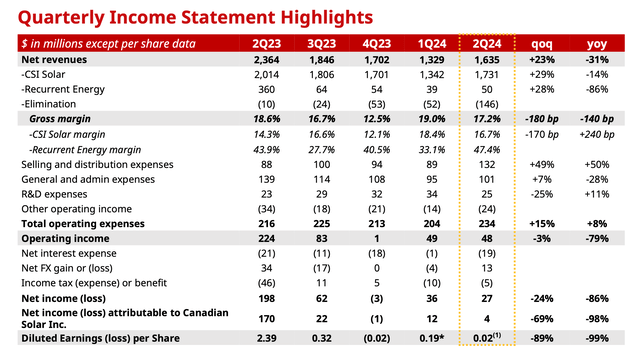

Canadian Solar reported their most recent results in late-August. The company posted a slight revenue beat, but a significant earnings miss with actual EPS of only $0.02 per share, well short of expectations of $0.10 per share.

That’s very low considering that just 12-months ago, the company was able to make more than $2 a share in earnings, and is entirely a result of low demand for solar panels which saw a 14% YoY decline in revenues.

CSIQ IR

Demand has been significantly lower than expected over the past year, primarily due to a tough macroeconomic environment, which has also resulted in continually declining forward guidance.

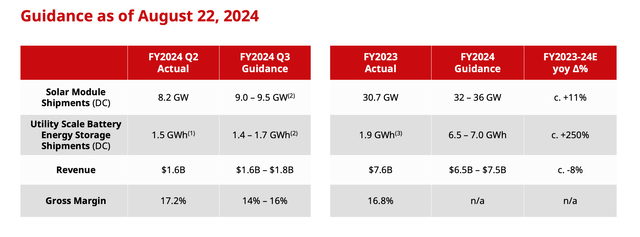

Back in January, management was guiding towards 2024 solar panel shipments of 42-47 GW (up 50% YoY), by the end of the first quarter that guidance was reduced to 35-40 GW (up 25% YoY), and now it stands at just 32-36 GW (up 13% YoY).

With 17 GW shipped during the first half of the year, I do see the low end of guidance as achievable, although it will depend heavily on macro and specifically the path that interest rates take from here.

CSIQ IR

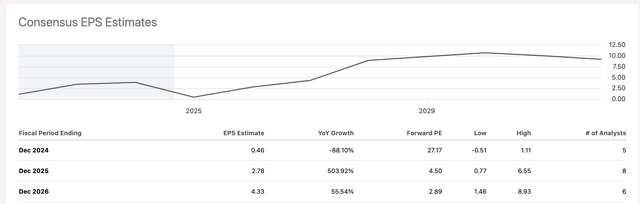

Going forward, consensus calls for a miraculous recovery with 500% YoY growth in 2025. That would make the stock a no-brainer buy with a current forward P/E of just 4.4x. Unfortunately, this recovery is far from guaranteed.

SA

Headwinds are Likely to Persist for Quite a While

The solar panel market has suffered over the past 12-18 months, primarily due to high interest rates. The reasoning here is that investment in solar generally has a payback period of 20 years, or analogously an annual ROI of 4%. That may be of interest to a lot of people in a low interest rate environment, especially when we consider the ever-growing cost of electricity, but when interest rates are at 5%+, it’s simply not an appealing investment. As a result, demand for solar panels for both residential and industrial use has fallen off a cliff.

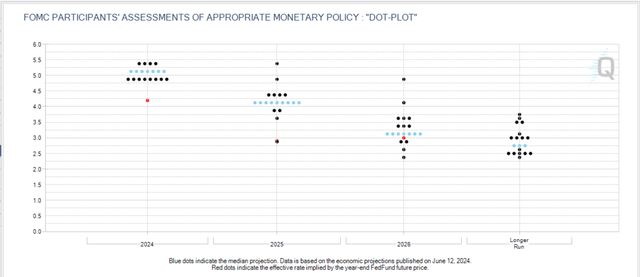

These days interest rates seem destined to decline with at least one certain 25 bps cut in September. And likely 100 bps of cuts by the end of the year.

But the Fed’s dot plot assumes only a gradual decline in interest rates beyond this year. And a faster drop in rates would likely only happen if we get a recession, which would be just as bad for the solar market as high rates.

Therefore, I don’t expect the solar panel market recovery to be quick.

Fed Watchtool

Too Cheap to Ignore

I expect CSIQ to struggle to make significant positive earnings in 2024 and 2025. At the same time, however, I see a lot of potential beyond as (1) interest rates decline over time, and (2) we work through the current economic uncertainty. In particular, there is a lot of potential for solar long term, as the technology continues to be heavily pushed by governments around the world as part of their green agenda.

Timing the bottom is impossible, but it’s hard to argue that now is not a good time to invest in cyclical solar power companies, which are trading near their decade lows.

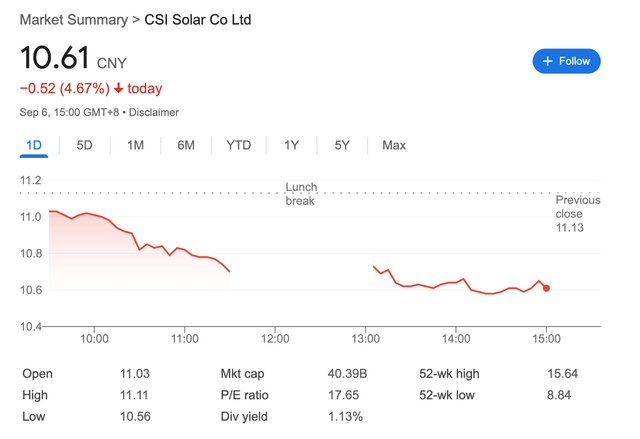

In the case of Canadian Solar, the buy thesis is reinforced by the fact that the Canadian-based company continues to trade at only a fraction of the value of its stake in the CSI Solar Co. subsidiary. The subsidiary trades on the Shanghai exchange with a market cap of 40 Billion Yuan, which is roughly $5.6 Billion. Therefore, the 62% stake owned by CSIQ is worth almost $3.5 Billion, roughly four times more than the current market cap of CSIQ of $800 Million.

Google Finance

While I do recognize that there is elevated risk related to China, which I spoke about extensively in my last article, it’s hard for me to grasp, why the market has placed such a big discount on CSIQ. As a result, I continue to slowly accumulate shares at these decade-low prices in an effort to build up a 1% position in the stock. I don’t expect the recovery to be nearly as fast as predicted by consensus, but once the solar market takes off, I see significant triple-digit RoR potential.

Therefore, I reiterate my Spec buy rating for this high-risk, high-reward investment.

Credit: Source link