Alfio Manciagli

The Q2-24 Earnings Season for North American precious metals companies has finally ended, while Australian producers like Northern Star (OTCPK:NESRF) and Evolution Mining (OTCPK:CAHPF) have reported their year-end fiscal 2024 results. Overall, the results were solid across the board, benefiting from a much higher gold/oil ratio and higher metals prices in general, which offset some one-time hiccups from a few producers. Fortunately, mid-tier producer Coeur Mining (NYSE:CDE) was not one of those companies that suffered an operational hiccup, putting together a solid Q2-24 overall with higher gold and silver production.

Meanwhile, Coeur Mining has completed the ramp up of its much-awaited Rochester Expansion and has come out of a multi-year period of elevated capex, setting up a return to free cash flow generation in the second half of this year. Simultaneously, the company is now hedge-less and able to take advantage of higher metals prices, with it previously weighed down by hedges. In this update, we’ll dig into the Q2-24 results, recent developments, and whether Coeur Mining (“Coeur”) is a name worthy of investment.

Rochester Mine Operations – Company Website

All figures are in United States Dollars unless otherwise noted. G/T = grams per ton (of gold or silver). GEOs = gold-equivalent ounces. AISC refers to all-in sustaining costs. Adjusted CAS per ounce = costs applicable to sales per ounce, and adjusted CAS margins = costs applicable to sales margins.

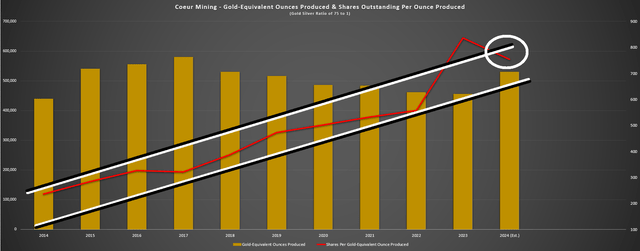

Q2 Production & Sales

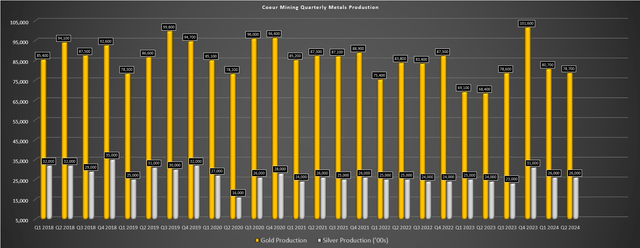

Coeur Mining released its Q2-24 results last month, reporting quarterly production of ~78,700 ounces of gold and ~2.6 million ounces of silver. This translated to a 15% increase in gold production and an 8% increase in silver production year-over-year, benefiting from lapping easy comps at Kensington, higher grades at Palmarejo and from the ramp-up of the major Rochester Expansion (since complete). Unfortunately for shareholders, the increased production was not felt on a per share basis, with Coeur’s share count up 20% (333 million shares -> 400 million shares) year-over-year. In fact, gold-equivalent production per share fell ~5% year-over-year. Similarly, cash flow per share slid from ~$0.12 to ~$0.04. Let’s take a closer look at the results below:

Coeur Mining Quarterly Gold & Silver Production – Company Filings, Author’s Chart

Beginning with the company’s Palmarejo Mine in Mexico, Coeur produced ~25,500 ounces of gold and ~1.60 million ounces of silver, translating to a 10% increase in gold production and 1% decline in silver production. Higher gold production was related to significantly higher grades (0.066 oz/t of gold vs. 0.056 oz/t) offset by lower throughput, while silver production also benefited from higher grades.

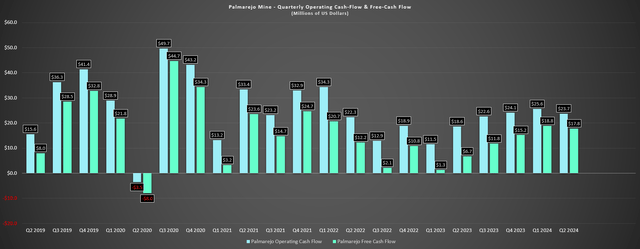

Given the stronger operational quarter, higher metals prices and lower capex, free cash flow improved to $17.8 million (Q2-23: $6.7 million). Finally, the Mexican mine did a solid job holding the line on costs, reporting adjusted costs applicable to sales per gold ounce of $1,006 vs. $1,023 in the year-ago period, translating to a CAS margin of $738/oz (42.3%) based on Palmarejo’s average realized selling price of $1,744/oz for gold. As it stands, Palmarejo is sitting at ~59% of its annual guidance midpoint for gold production, suggesting the potential for a softer H2-24 operationally.

Palmarejo Mine – Quarterly Operating Cash Flow & Free Cash Flow – Company Filings, Author’s Chart

Moving over to its Rochester Mine in Nevada, Coeur shared that the commissioning and ramp-up is now complete, with the operation achieving throughput rates of 88,000 tons per day. Importantly, this has kicked off a trend higher in gold and silver production, with Rochester producing ~8,000 ounces of gold (+27% year-over-year) and ~973,000 ounces of silver (+42% year-over-year). And while mine-site free cash flow remains negative ([-] $33.4 million vs. [-] $65.3 million in Q2-23), we should see a massive H2-24 for the mine with its FY2024 production guidance midpoint implying H2-24 production of ~4.0 million ounces of silver and ~30,000 ounces of gold.

As for costs, they remained elevated, with adjusted CAS per ounce of silver of $21.58 and adjusted CAS per ounce of gold of $1,813/oz. Additionally, the company has revised its cost guidance higher at Rochester for the year, with its new guidance midpoint for adjusted gold and silver CAS per ounce coming in at $1,600/oz and $19.00/oz, respectively. These figures are up from previous guidance of $1,300/oz and $15.00/oz. That said, the benefit of economies of scale and a much higher denominator with will transform the cost profile of this asset in 2025, so I don’t see any reason to get hung up on the higher Q2-24 and FY2024 costs.

Kensington Mine – Coeur Mining Video

Looking at Coeur’s Kensington Mine in Alaska, production came in at ~23,200 ounces of gold, a material increase from ~13,200 ounces in the year-ago period. However, it’s important to note that Kensington was lapping extremely soft year-over-year comps, impacted by paste backfill challenges and water inflows from spring runoff that impacted the mining of stopes and led to significantly lower grades (higher proportion of development ore milled vs. stope ore).

Although production was higher, costs remained well above the industry average at $1,734/oz (Q2-23: $2,927/oz). And not surprising given its weak margin profile and being in a period of elevated underground development, the asset has continued to see free cash outflows, with mine-site free cash flow of [-] $23.7 million in Q2-24. However, looking at the bigger picture, exploration success has improved the outlook for this asset in terms of extending its mine life and a path to returning to free cash flow generation in H2-25 following a period of significant investment in the past twelve months ($60.7 million).

Lastly, Coeur’s Wharf Mine had a solid quarter overall despite lower output year-over-year, generating $15.8 million in free cash flow on the back of ~22,000 ounces of gold production. This continues as a steady free cash flow generator for the company and growth in reserves from new targets (Juno and North Foley) would be a very positive development if they come to fruition and help to extend the life of this asset which unfortunately sits at just six years currently. Both of these targets sit adjacent to or encompass historical pits at Wharf, and the hurdle for adding reserves is certainly a little lower given the incredible move we’ve seen in the gold price year-to-date.

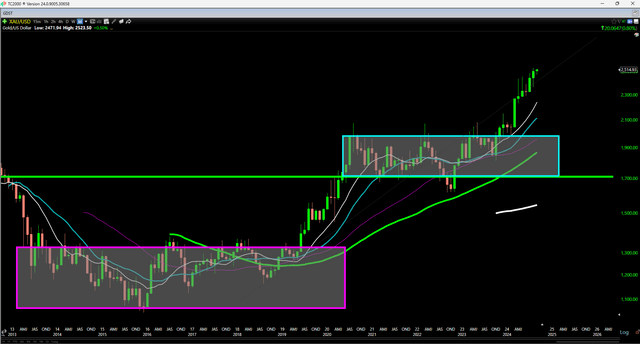

Monthly Gold Price Chart – Worden

Financial Results

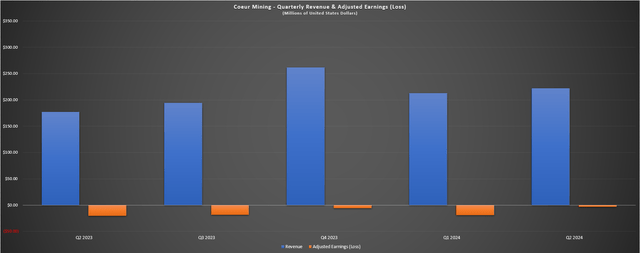

While Coeur benefited from higher GEO production and metals prices year-over-year ($2,003/oz gold, $26.20/oz silver), revenue increased only 25% due to the impact of delivering into hedges in Q2-24. And while the significant step-up in revenue was a positive sign, it did not translate to positive earnings, with Coeur continuing to report net losses, with an adjusted net loss of $3.4 million in Q2-24 (Q2-23: adjusted net loss: $20.2 million). This was related to higher G&A costs (+14% year-over-year), increased exploration spending and significantly higher interest expense ($13.2 million vs. $6.9 million).

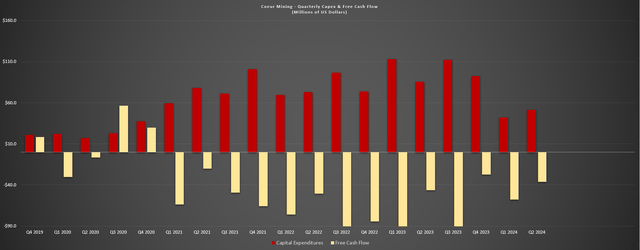

Coeur Mining – Quarterly Revenue & Adjusted Earnings (Loss) – Company Filings, Author’s Chart Coeur Mining Quarterly Capex & Free Cash Flow – Company Filings, Author’s Chart

On a positive note, Coeur is now unhedged, set to see a material step-up in production at lower costs and will see a trend lower in capital expenditures, suggesting a significant increase in free cash flow and earnings once it’s able to see the fruits of this labor and put a dent in its significant debt position (~$630 million).

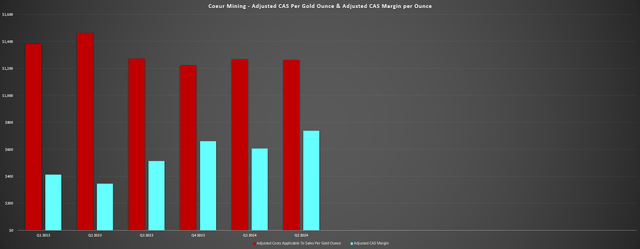

Costs & Margins

Moving over to costs and margins, Coeur reported adjusted gold CAS of $1,264/oz in Q2-24, an improvement from $1,464/oz in the year-ago period. This was helped by lower costs at Palmarejo and Kensington year-over-year, and resulted in an adjusted CAS margin of $739/oz (36.8% vs. 19.1%) or a 114% increase year-over-year even with the lowest average realized selling price I’m aware of among its peers at $2,003/oz (impact of hedges plus Palmarejo gold stream). Meanwhile, adjusted silver CAS of $17.71/oz was ~7% higher year-over-year, but adjusted silver CAS margins improved to $8.49/oz on the back of higher silver prices (Q2-23: $7.14/oz).

Coeur Mining – Adjusted CAS Per Gold Ounce & Adjusted CAS Margin Per Gold Ounce – Company Filings, Author’s Chart

Recent Developments

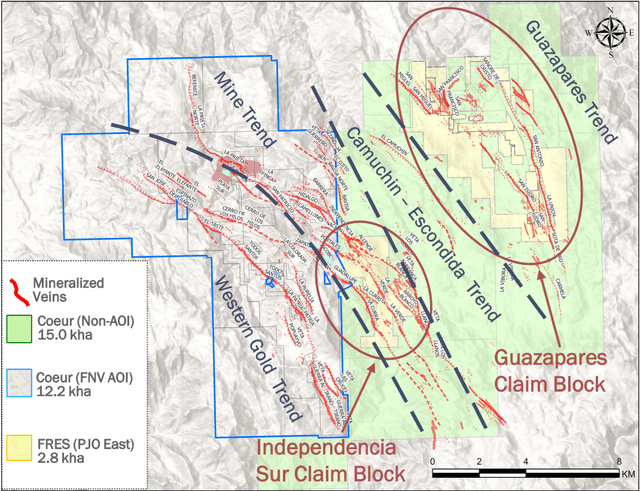

As for recent developments, the bulk of them were positive. For starters, Coeur closed a deal in early July ($10 million cash paid on closing) with a subsidiary of Fresnillo (OTCPK:FNLPF) which significantly increased its land holdings at Palmarejo with the addition of two new claim blocks. Importantly, these new concessions lie outside of the area of interest where Coeur is saddled with a 50% gold stream, making any ounces on these new contiguous claims quite valuable. Coeur noted that its near-term focus is on the Independencia Sur claim block, with it stating the following in its Q1-24 Conference Call:

The new Independencia Sur claim block highlighted in the red oval in the center of the map, contains the Southeast extension of the mine trend. It sits directly adjacent to our existing mining infrastructure and contains the continuation of a number of key veins, including Independencia and La Nación. Fresnillo conducted drilling on this block, and we are hopeful that with additional exploration, we can outline new resources in the very near term.”

– Coeur Mining, Q2-24 Conference Call

(*) Consideration for the new Palmarejo concessions includes an additional $10 million payment in 2025, $5 million in 2026, and a future royalty on ounces discovered. As noted by Coeur, this will be an inflation-adjusted royalty payment of $25/oz for each new resource GEO discovered between 450,000 and 2 million GEOs or up to ~$40 million in contingent consideration assuming 2 million ounces are discovered (*)

Palmarejo New Ex-Stream AOI Concessions – Company Website

While this acquisition should ultimately help Coeur to increase cash flow generation from Palmarejo, I would be surprised to see any meaningful production from these new areas until at least 2027, meaning Coeur will continue to see a much lower average realized gold price than its peers. Additionally, Coeur has shared that ongoing litigation (if unsuccessful) with the Mexican government associated with enforcing water rights could impact Coeur’s ability to access new water sources. So, while I am optimistic on the company’s ability to find new resources and increase production off AOI ground (29% sold under stream in Q2-24), Mexico as a jurisdiction continues to be challenging, and it’s not clear if this ultimately impact Coeur’s operations down the road.

As for Coeur’s capital allocation plans and debt load, we saw some progress with net debt to EBITDA dipping under 3x for the first time in two years with a period of rapid de-leveraging on deck. Coeur’s focus is on aggressively paying down debt with a goal of getting to 1.0x total debt to EBITDA, and it continues to invest heavily in exploration across its portfolio, including Silvertip – a development asset in British Columbia, Canada. So far, exploration success at Kensington and Silvertip has been quite encouraging, but like the new claim blocks at Palmarejo, Silvertip looks like a 2027 opportunity at the earliest given that it will require significant investment to restart.

Perhaps the most significant development for Coeur, though, is the recent increase in metals prices. As it stands, gold has averaged $2,450/oz quarter-to-date, while silver should enjoy another quarter above $27.00/oz. This is a massive deal for Coeur from a margin standpoint given that while its peers will see a ~25% increase in the gold price year-over-year vs. the softer quarter for gold prices in Q3-23, Coeur will see a 35%+ increase year-over-year. And for a highly leveraged producer, higher prices are a welcome development that might finally allow the company to stop the bleeding when it comes to consistent share dilution (most recent financing in Q1-24) which has severely impacted the company’s per share metrics.

Valuation

Based on ~404 million fully diluted shares and a share price of US$5.70, Coeur trades at a market cap of ~$2.30 billion and an enterprise value of ~$2.86 billion. Typically, this would be a very reasonable valuation for a diversified ~500,000 ounce producer on a gold-equivalent basis. However, Coeur is not the average precious metals producer and boasts one of the worst track records of per share growth among its peers. This is evidenced by the below chart, with a consistent trend higher in the shares an investor needs to hold to maintain exposure to the same level of GEO production. And as we can see, production per share has fallen off a cliff, with ~4 times as many shares needed to get exposure to the same level of production.

Coeur Mining – GEOs Produced & Shares Outstanding Per GEO Produced – Company Filings, Author’s Chart & Estimates

In addition, while Coeur has multiple Tier-1 jurisdiction operations, it’s important to note that ~40% of its revenue came from Mexico year-to-date, a jurisdiction which is not looking any better and should result in a discounted multiple relative to Tier-1 peers. Second, Coeur’s margins are inferior to its peer group even post-expansion and the company is extremely sensitive to commodity prices and extremely leveraged, making its share price much more vulnerable to corrections than its peers. Third, Coeur’s mines are average to lower-quality on balance relative to its mid-tier peers, and its best mine is weighed down by a massive stream (50% of gold production at $800/oz).

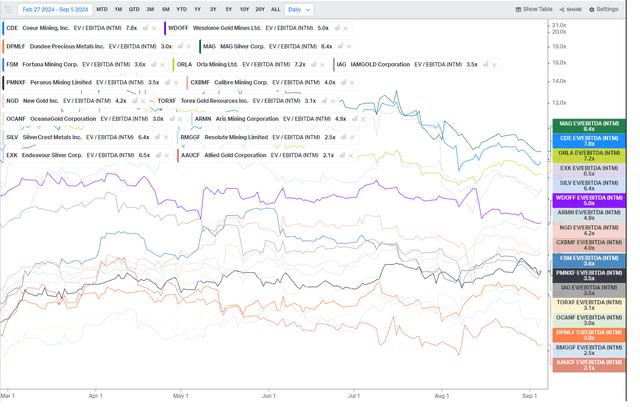

CDE Valuation vs. Peers – Koyfin

So, unless Coeur can build a mine life off stream ground at Palmarejo and materially extend its mine lives at Wharf and Kensington, it’s tough to argue that it should trade at the premium valuation that it does today. And to illustrate this point, the above chart highlights that CDE is trading at the 2nd highest multiple among its small to mid-tier peer group sampled above, with there being zero reason that Coeur should trade at a premium to higher-margin, far higher-quality and more diversified producers like Barrick Gold (GOLD), regardless of the premium assigned to those with silver exposure.

So, what’s a fair value for the stock?

Using what I believe to be generous multiples of 10.0x FY2025 cash flow estimates ($2,250/oz gold price assumption) and 1.2x P/NAV and a 65/35 weighting to P/NAV (6%) vs. P/CF, I see a fair value for Coeur Mining of US$5.50. This suggests zero margin of safety for the stock at current levels, making it an inferior bet from both an absolute and relative value standpoint to its peers at ~15x FY2025 EV/FCF estimates. And when there are miners out there today with far better track records trading at less than 5x FY2025 EV/FCF estimates, I see no reason to stoop to owning the laggards and those that have consistently destroyed shareholder value.

Summary

Coeur Mining had a decent Q2-24 and is finally set to see a return to free cash flow generation which will help it to de-lever. However, the company has a long road ahead with ~$630 million in debt and while the company is quick to tout its growth, the benefit has not flown through to shareholders which have been diluted by ~4x since 2014 (~103 million shares –> ~400 million shares) on a relatively flat production profile. And when it comes to producers that are seeing consistently declining per share metrics, they are swing-trading vehicles at best, not investments.

Assuming one has a bullish outlook on gold and silver prices, Coeur is certainly a name that will benefit, but that same thesis applies to all precious metals producers. Besides, if the play is to buy Coeur from a swing-trading standpoint, the time to own it is when it’s hated and significantly off its highs, not when it’s tripled off its lows in a span of six months. To summarize, I continue to see Coeur Mining as an Avoid in favor of other gold producers, and I see it as one of the least attractive ways to buy the dip sector-wide.

Credit: Source link