Jessie Casson/DigitalVision via Getty Images

Investment overview

I give a hold rating for Toll Brothers (NYSE:TOL) as valuation multiples have already priced in the near-term upside. However, I want to highlight the positive demand trend that should last for the foreseeable future given the favorable housing supply situation and lower rate outlook. Positive revenue growth should translate into higher EPS growth as margin benefits from lower rates and better operating efficiencies.

Business description

TOL is in the business of designing, building, and selling luxury homes in the United States. TOL’s product offerings range from spec (speculative house) to customized single and attached homes. A part of TOL’s strategy is also to provide incentives to attract buyers. The company reported its latest 3Q24 earnings two weeks ago, and it was a splendid one, where operating EPS of $3.60 beat consensus estimate by a big margin. Driving the beat was total revenue of ~$2.73 billion, gross profit of ~$775 million, and EBITDA of ~$517 million. All of these were better than what the street expected at $2.71 billion, ~$730 million, and ~$513.8 million, respectively. One of the key growth metrics to monitor—orders—also saw very healthy growth of 11%.

Given the strong 3Q24 performance, management raised their FY24 guidance, now expecting closings of 10,650 to 10,750 (implied y/y growth of 11-12%) up from the prior target of 10,400 to 10,800 (implied y/y growth of 8-13%); ASPs of $975K vs. prior target of $960k to 970K; adj gross margins of 28.3% (vs. 28% prior). Coupled with these are lower SG&A (now expected 9.4% as a percentage of sales vs. prior 9.6%); and a higher share buyback target of $600 million vs. $500 million previously. All in all, the guide implies a much stronger EPS growth, and management has raised operating EPS guide to a range of $14.50 to 14.75 vs. the prior target of $14.

Business should continue to see robust demand

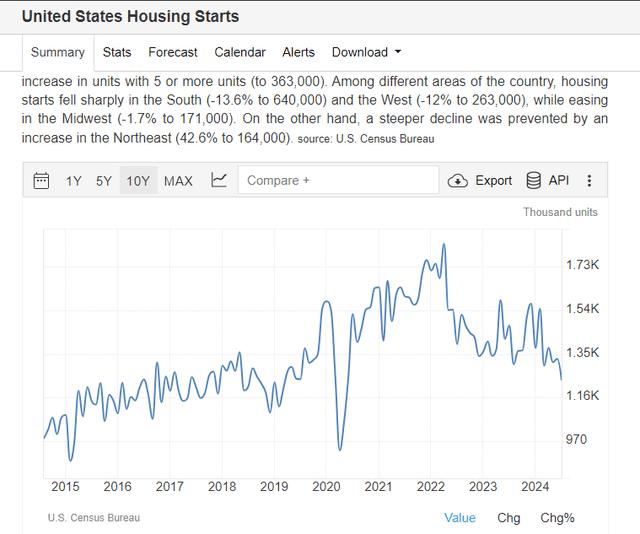

US census NAR

In my opinion, the current US macro conditions continue to favor TOL. I believe the US is still in an undersupply situation, which benefits new home builders like TOL. Given that the rate of housing starts has continued to fall, it appears that this undersupply situation is going to last for the foreseeable future. The counterview to this is that mortgage rates have gradually fallen due to the expectation of a rate cut (which the Fed seems very likely to do so), and that has resulted in existing home inventories to start coming back online (elevating the undersupply situation). I agree with this counterpoint, but note that a sizeable amount of US homeowners have their mortgages below 4%. Which means there is still a stretch before mortgage rates become attractive enough to incentivize the majority of home owners to list their homes for sale. To be clear, I am not saying this is not going to happen, but I think it is very unlikely to happen in the near term (say over the next 12 months). On the other hand, a lower mortgage rate is an instant boost to housing demand, especially given the housing affordability situation.

Indeed, the demand trend seen in 3Q24 was in line with my view, in that demand slowed through June but accelerated in July due to lower rates. The acceleration in demand was so strong that it continued into August (first three weeks of August). Hence, this instills confidence that management guidance for 4Q24 to see 2,490 unit orders is achievable. Notably, the demand strength was led across the majority of TOL key markets. Specifically, strong demand was led by New Jersey, Pennsylvania, Washington, DC, South Carolina, Georgia (Atlanta), Las Vegas, and California. While certain parts of Texas saw softer demand, the demand trend followed how the company fared as a whole, improving demand in August.

One more point regarding the increasing number of resale homes. While this represents competition to new home sales, I believe TOL will stay competitive in the near term given its inventory of spec homes (3,400 at quarter-end, including 750 finished) and ability to offer incentives, including buying down mortgage rates to 4.375% for the first year and 5.375% for the next 29 years (way cheaper than the >6% mortgage rates today).

Positive profit margin outlook

Looking ahead, the decline in mortgage rates should also provide TOL the ability to better price its homes (i.e., better pricing power), as home buyers have a much larger purchasing power. Additionally, lower rates should also drive ease the gross margin pressure from the incentives that TOL is providing (management noted the cost of buydowns will ease in line with housing affordability). All these, coupled with TOL’s improving cycle times and ability to unlock operating efficiencies (one of the key reasons that drove margin upside in 3Q24), I would think that margins will stay healthy for the foreseeable future. For what it’s worth, EBITDA margin peaked at ~28% in 2005, and it is ~23% over the last 12 months, so there is certainly room to expand.

Problem is that valuation has priced in the above

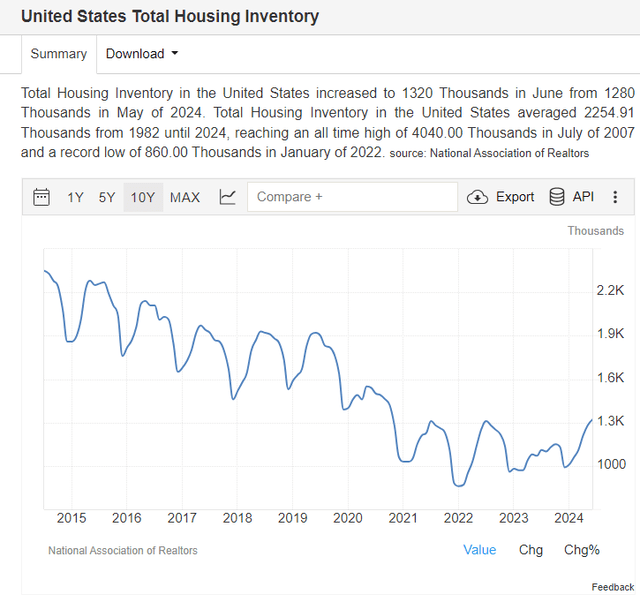

Unfortunately, it seems to me that valuation has already priced in all the upside at this point. Relative to history, TOL has seen its forward PE ratio recover from the trough of ~4x forward PE in 2022 to ~10x today (this is the 10-year average). This positive revision can be seen across other homebuilders as well, where industry multiple has trended back to ~10x. As such, I don’t think there is a strong upside from a valuation multiple perspective. Upside from here is going to be driven by EPS growth. However, using consensus estimates as a benchmark, which TOL has historically outperformed over the past 5 years, it implies TOL stock to be worth ~$146 (~2% above current share price) based on FY25 EPS estimate of $14.63. Therefore, my view is neutral for the stock (but bullish fundamentally).

Bloomberg Peers set (Bloomberg)

Conclusion

I give a hold rating for TOLL. I agree that TOL should continue to see robust demand in the near-term, driven by a favorable housing supply and lower interest rates. However, valuation has already factored in much of the upside, considering that forward PE has recovered to historical average (peers have also recovered with the same trend). Any upside from here needs to come from strong earnings growth, which, based on consensus EPS estimates, implies the stock is trading at where it should be.

Credit: Source link