ISerg

Many REITs remain bargains despite the recent uptick in price in anticipation of a rate cut in September. That’s likely because the market is still latched onto high-flying growth stocks that pay investors little to no yield for holding on to them.

A better idea may be to get both meaningful income and growth at the same time. This brings me to Rexford Industrial (NYSE:REXR), which currently offers a 3.3% yield and growth prospects to boot.

I last covered REXR in February, noting its strong track record of value creation, fortress balance sheet and undervaluation by historical standards. It appears the market hasn’t yet agreed with my thesis, as the stock has declined by 3% since my last piece (-1.5% total return including dividends), surpassed by the 12% rise in the S&P 500 (SPY) over the same timeframe.

In this article, I revisit REXR including its business performance, outlook, and discuss whether the stock and its preferred remain attractive, so let’s get started!

REXR: A Great Bargain With Up To 6.4% Yield

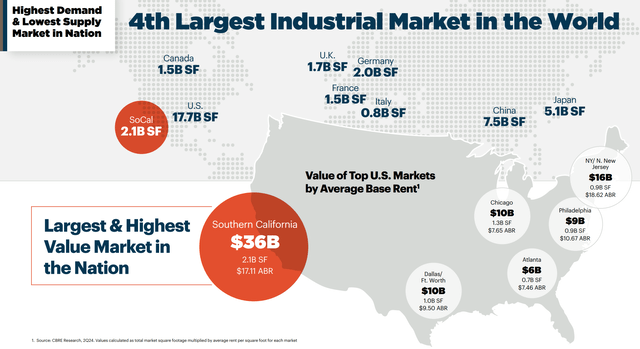

Rexford Industrial remains one of my favorite industrial REITs due to its unique focus on the infill Southern California market, which has a low vacancy rate of just 3.9%. This market also carries far higher base rents than other Tier 1 markets around the U.S., at $17.11 per square foot, as shown below.

Investor Presentation

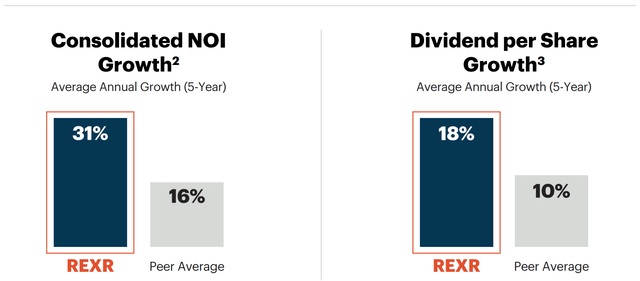

This results in barriers to entry for new entrants, making the market available only to well-capitalized players like REXR. At present, its high-quality portfolio consists of 422 properties with 49.7 million square feet of rentable space. REXR’s strategy has worked out well with sector leading NOI growth of 31% annualized over the past 5 years, beating the 16% peer average, as shown below.

Investor Presentation

This was driven in large part by high lease spreads and operating leverage through an economy of scale. It’s achieved consistently high rent spreads of over 60% since 2021, and has grown its NOI margin by 220 basis points to 77.7% since 2018.

Meanwhile, REXR has continued to demonstrate strong operating fundamentals, achieving 2.3 million square feet of leasing during Q2 2024 at a 68% on a net effective basis (49% cash basis), sitting ahead of the 66% average since 2021. Occupancy rose by 70 basis points on a sequential QoQ basis (unchanged YoY) to 97.3%.

Also encouraging, REXR is demonstrating positive operating leverage, with net operating margin rising by 50 bps YoY to 77.7%. These factors contributed to Consolidated NOI growth of 21% from the prior year period and FFO per share growth of 11% YoY to $0.60.

Management is guiding for full year FFO per share of $2.33 at the midpoint of range, representing 7% growth from 2023. This is based on the expectation that same-property cash NOI will grow at a healthy 7.5% rate this year. Over the next three years, REXR expects to drive cash NOI growth by 35% due in large part to value-add initiatives.

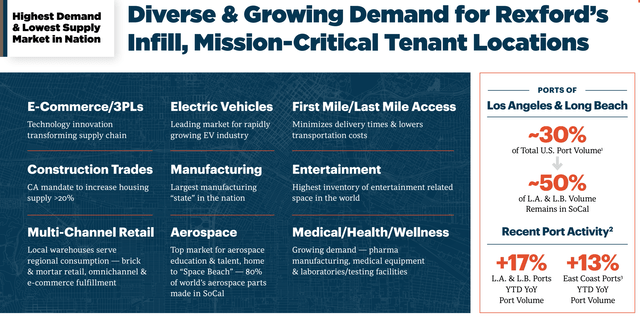

This includes the modernization, repositioning, and redevelopment of older, underutilized properties in SoCal to fit the needs of multitude of industries ranging from E-commerce to Aerospace, as shown below.

Investor Presentation

Plus, supply and demand trends are expected to continue to be in favor of REXR, as noted by management during the recent conference call:

The long-term outlook for our infill Southern California market remains very positive due to a virtually incurable long-term supply/demand imbalance. The near-term outlook for market rents may continue to reflect a nominal level of volatility.

However, we believe the foundation for market rent growth is inherent within our markets. Our tenants are indicating through their behaviors that they expect to pay higher rents in the future.

They are expressing its expectations through their proactive renewal activity and through the average compounding 4% annual contractual rental rate increases we are embedding within our leases.

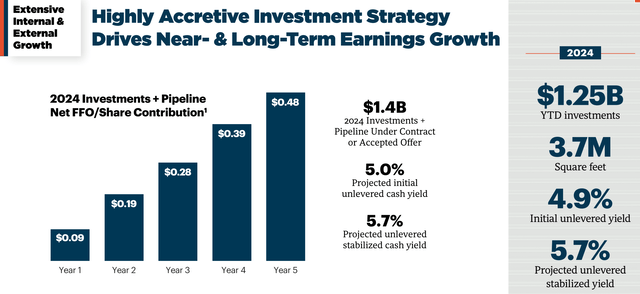

As shown below, REXR has $1.4 billion in investments plus pipeline under contract that’s expected to generate $0.48 net FFO per share gain by year 5, compared to $2.33 per share expected this year. This FFO per share accretion would be on top of the 4% average embedded rent steps in YTD executed leases and rent spreads on new and renewal leases.

Investor Presentation

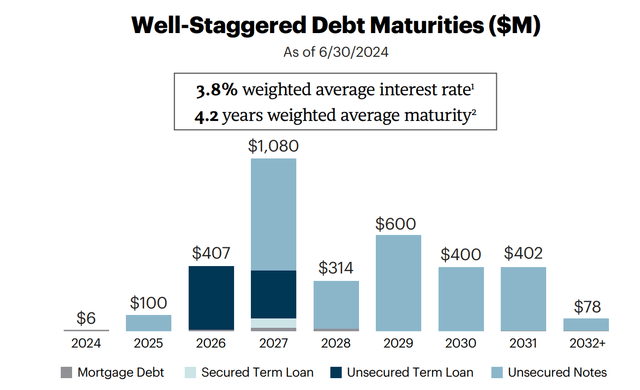

Importantly, REXR carries a fortress balance sheet with BBB+/Baa2 credit ratings from S&P and Moody’s to execute on its long-term plan. This is supported by a net debt to enterprise value of just 24% and a low net debt to adjusted EBITDA ratio of 4.6x. REXR also has $2.0 billion of liquidity, and as shown below, it has just $6 million of debt maturing and just $100M maturing next year.

Investor Presentation

At the current price of $50.92, REXR carries a respectable 3.3% dividend yield that’s well-covered by a 71% payout ratio. The dividend has a 5-year CAGR of 18% and was raised by 10% this year.

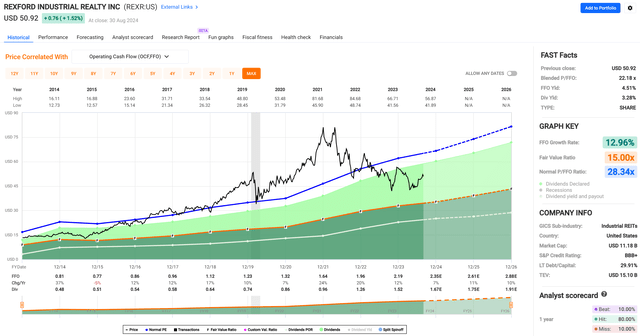

While REXR isn’t cheap on the surface with a forward P/FFO of 21.6, it does sit far below its historical P/FFO of 28.3, as shown below.

FAST Graphs

I believe REXR’s current valuation remains attractive considering analyst forward expectations for 10-14% annual FFO per share growth in the 2025-2027 timeframe, which, I believe, is reasonable considering the high lease spreads, external growth, and internal development opportunities as noted earlier.

More conservative investors may want to consider the Preferred Series C Stock (NYSE:REXR.PR.C), which currently trades at $22.10 and yields 6.4%. This series is cumulative, which means that any missed payments must be made up so long as the company is financially solvent.

While it does have a call date of 9/20/24, the market does not appear to believe that it will be called considering the 12% discount to par value of $25, with less than 30 days before the call date. In the meantime, investors get to collect a 6.4% yield on this issue at a discount to call value.

Risks to REXR’s common and preferred stock include the potential for higher interest rates, which could make external acquisitions more expensive from a cost of capital perspective. Higher rates could also put down downward pressure on both the common and preferred stock, with the latter being more regarded as a bond proxy. In addition, near term industrial property pricing could be softer than expected, leading to rental price volatility in the short term.

Investor Takeaway

Rexford Industrial offers a decent blend of income and growth potential, supported by its unique focus on the high-barrier, low-vacancy Southern California industrial market. REXR continues to demonstrate strong operational performance, with robust NOI growth, high lease spreads, and a well-covered dividend with an impressive growth trajectory.

While the stock isn’t cheap on the surface, its current valuation remains attractive relative to its historical P/FFO levels and strong forward growth prospects. Additionally, the preferred Series C stock offers a high yield with an even safer dividend than the common shares, making it an appealing option for more conservative investors.

Credit: Source link