10’000 Hours

We discussed buying Zoom (NASDAQ:ZM) several months ago, as the stock traded around extreme lows ($55-60 level). Zoom had fallen out of favor with investors, and the market had become too pessimistic on the company. Therefore, Zoom had a high probability of outperforming and surpassing analysts’ estimates.

Zoom reported earnings on August 21st, blowing away the consensus estimates and providing solid guidance suggesting an improving growth image. This dynamic enabled Zoom’s stock to surge from a low of about $55 around mid-August to a high of around $72 in recent days (31% increase).

While we’ve seen a considerable jump in Zoom’s stock price, it remains cheap. Zoom’s P/E ratio is only around 13, and the analyst community has no growth factored into Zoom’s future earnings despite the company beating top and bottom-line estimates and providing better-than-expected guidance.

Therefore, Zoom could surpass future estimates, which may cause analysts to lift their earnings, growth, and stock price estimates regarding Zoom as we advance. Due to this dynamic, we may see higher-than-anticipated earnings, multiple expansions, and a higher stock price in the coming years.

Zoom’s Earnings: Much Better Than Expected

Zoom reported fiscal 2025 Q2 earnings, which were substantially better than expected. Zoom announced EPS of $1.39, beating the consensus estimate by 17 cents (14% outperformance). The company reported $1.16B in revenues, a $10M beat. However, while the earnings report was solid, it’s the guidance that really shined.

Zoom’s Guidance – Excellent

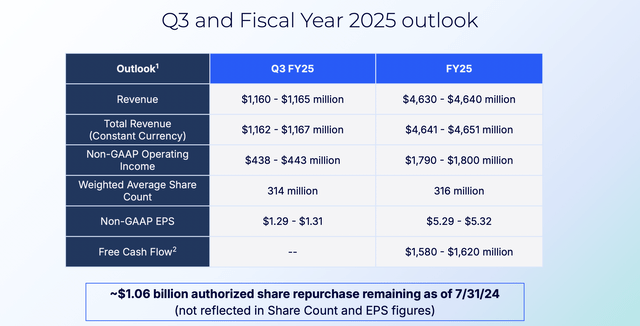

Guidance (static.seekingalpha.com )

For fiscal Q3 2025, Zoom expects sales between $1.16-1.165B vs. the $1.16B consensus estimate. Non-GAAP EPS is expected to be around $1.30 instead of the $1.24 consensus. Full-year revenues are expected between $4.63-4.64B compared to the $4.62B consensus estimate. Perhaps most impressively, Zoom expects full fiscal year EPS of $5.29-5.32, vs. the $5.06 consensus estimate.

The Earnings Takeaway

Zoom’s profitability is improving more than anticipated. Moreover, Zoom’s growth story may be turning around. Also, Zoom’s growth could continue improving as the economy improves, rates come down, growth increases and other constructive factors materialize in the broader economy. $5.30 in EPS is substantially better than $5.06, and Zoom may be sandbagging, suggesting it could report $5.35 or better in EPS this year. With the stock around $70, Zoom trades at just about 13 times earnings estimates, and we could see EPS growth continue instead of being stagnant, as many current estimates suggest.

Zoom Consistently Beats Estimates

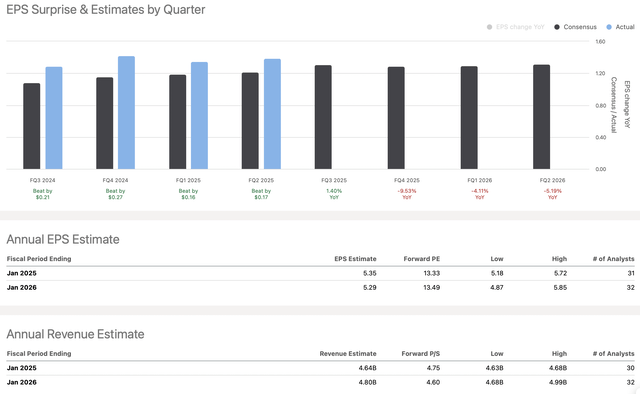

EPS vs. Estimates (seekingalpha.com )

Zoom has surpassed EPS estimates in each of its last twenty quarters. In fact, I don’t believe Zoom has missed a quarter profitability-wise since going public in 2019. Therefore, based on Zoom’s distinct ability to surpass consensus estimates, it will likely outperform as we advance.

While the TTM consensus EPS estimate was $4.64, Zoom delivered EPS of $5.45, a substantial outperformance rate of 17.5%. Despite expected revenue growth of around 3-5%, solid guidance, and improving profitability, next year’s EPS estimates are only $5.29, below this year’s $5.35 estimate.

Next year’s estimates seem overly pessimistic, and Zoom will likely continue its outperformance. If Zoom achieves a modest 10-15% outperformance rate over next year’s consensus estimates, it may provide EPS of around $5.82 – $6.08 next year. This dynamic implies that Zoom could be trading around 11.5-12 times next year’s EPS estimates, relatively cheap for Zoom’s stock.

Zoom’s Growth Likely To Improve

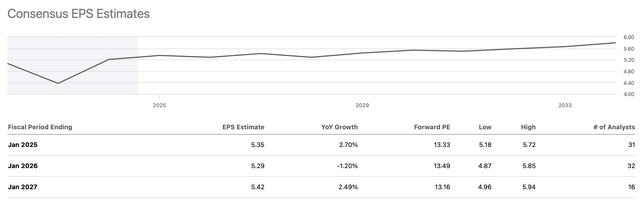

EPS estimates (seekingalpha.com)

It’s not just next year’s EPS growth that’s lowballed. Most of Zoom’s estimates appear stagnant in the $5-6 range. Analysts may be underestimating Zoom’s growth prospects and profitability potential. While Zoom’s sales growth could be limited to about 5% in the near term, it could increase to 5-10% in future years. Moreover, AI and other factors should help boost efficiency, improve profitability, and increase EPS. Zoom could achieve considerably higher EPS in the intermediate and long term, and its stock will likely appreciate in the years ahead.

Wall Street – Too Pessimistic

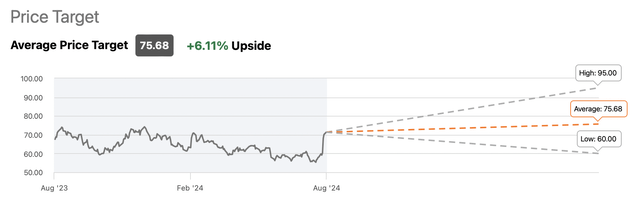

Price targets (seekingalpha.com)

Judging by the rock-bottom price targets, Wall Street is still too pessimistic on Zoom. This implies that we will probably see more upgrades in the future as analysts chase increasing EPS and revenue estimates. The average price target may increase to the $85-95 range, suggesting about 20-35% upside potential from current levels.

A Good Time To Buy Zoom?

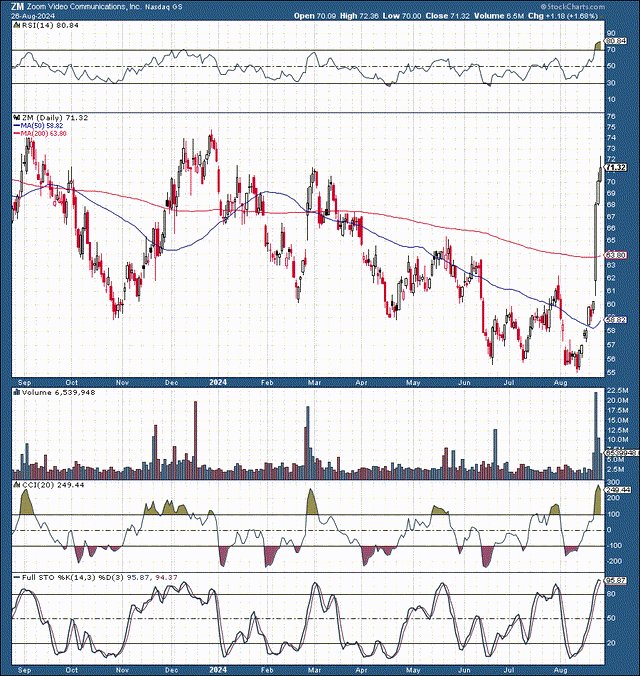

ZM (stockcharts.com )

Zoom has had a substantial jump recently, and I prefer not to chase the stock here. The RSI is above 80, and other technical indicators illustrate that Zoom is highly overbought technically in the near term. Thus, we could see a pullback, and I am willing to buy Zoom on a dip. An appropriate area may be around $65-60.

Of course, Zoom may not have a substantial correction from here. Nonetheless, I am keeping my optimal buy-in level around the $65-60 zone. For investors with intermediate and longer-term outlooks, it may be appropriate to open initial/partial positions in the $70-68 range.

Where Zoom could be in future years

|

Year (fiscal) |

2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $4.65 | $5 | $5.4 | $5.85 | $6.25 | $6.65 |

| Revenue growth | 4% | 7% | 8% | 8% | 7% | 6% |

| EPS | $5.50 | $6 | $6.50 | $7 | $7.70 | $8.40 |

| EPS growth | 6% | 9% | 8% | 9% | 10% | 9% |

| Forward P/E ratio | 15 | 16 | 17 | 18 | 18 | 17 |

| Stock price | $90 | $104 | $120 | $140 | $152 | $165 |

Source: The Financial Prophet

I used relatively modest estimates to achieve my projections. Zoom’s sales and profitability growth could improve more than expected, and we may see 10-20% EPS growth in a more bullish case scenario. Moreover, we may see more robust multiple expansions leading to higher share prices more rapidly than my model suggests. Still, relatively modest growth may enable Zoom’s stock price to appreciate substantially in the next several years.

Risks to Zoom

Despite my bullish assessment, Zoom faces risks. There is substantial competition in the online meeting/webinar segment. Prominent market-leading companies like Microsoft, Google, and others are also active in the segment. Zoom must continue innovating to remain ahead of its competition. Moreover, Zoom should make increasingly good use of AI and needs to improve sales growth. Zoom also faces macroeconomic factors like a slow global economy, cuts in consumer spending, high interest rates, and other factors. Investors should consider these and other risks before investing in Zoom.

Credit: Source link