imaginima/E+ via Getty Images

We started covering InterContinental Hotels Group PLC (NYSE:IHG) in April this year noting at the time that shares appeared fully valued. Since then, shares have modestly declined while the S&P 500 index (SPY) increased about 5%. More importantly, the company reported strong financial results for the first half of fiscal year 2024 and updated investors on its business initiatives.

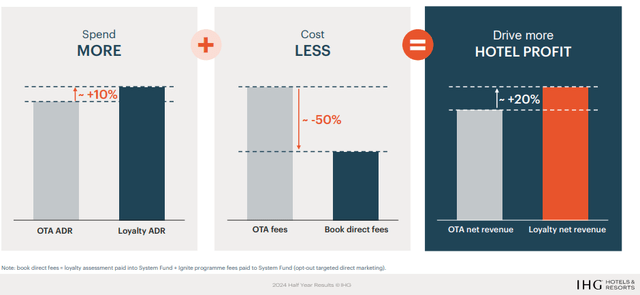

We were impressed by the momentum some of these initiatives are gaining, and we see the company strengthening its competitive moat beyond its brands. In particular, we like the increased emphasis on creating synergies between the different brands and bypassing online travel agencies (“OTAs”) such as Booking Holdings Inc. (BKNG) and Expedia Group, Inc. (EXPE) in favor of direct booking through its own IHG branded app. We were surprised to see that it has a 4.9/5.0 rating on the Apple Inc. (AAPL) App Store, and 4.8 stars on the Alphabet Inc.’s (GOOG), (GOOGL) Google Play Store with more than 5 million downloads. The company is marketing its apps more explicitly in the hotels, and shares some of the money it saves on commissions as reward points with customers, further increasing loyalty. Another similar initiative that is gaining momentum is the co-branded credit cards which generate fees for the company and its hotel partners, and further strengthen the InterContinental Hotels ecosystem.

Apple App Store

We appreciate companies with a strong competitive moat that are working to further increase it, as well as companies that possess multiple growth vectors. Finding ways to generate recurring revenue makes growth more sustainable and stable, and we particularly appreciate when there is a flywheel effect. We believe IHG is reaching a scale where it can attract new hotels to its brands given the benefits of participating in its network, further growing its ecosystem, and becoming even more tempting to other hotel owners to join. The revenue growth flywheel appears to be working given that the company reported record enrollment in its rewards program, up 10% year-over-year to reach 130 million members. Engagement is also quickly increasing, with the company reporting that more than 60% of room nights are booked by members.

First Half of 2024 Financial Results

Given that there have been increasing signs of consumer weakness in places like the U.S., Europe, and China, we had modest expectations for the financial results of the first half of fiscal year 2024 for the company. Still, results came in solid, with the company delivering revenue per available room (“RevPAR”) growth of 3% in the first six months, and 3.2% in Q2, which shows positive momentum. The company also grew the size of its ecosystem, with net system growth of 3.2% year-over-year. The pipeline also grew very meaningfully by 15% year-over-year, and operating leverage helped the company deliver a fee margin expansion of 1.8%. Adjusted earnings per share (“EPS”) grew by 12% to $2.03, which we see as outstanding in the current economic environment.

Future Growth

While InterContinental Hotels has a very strong position in the U.S., its future growth will probably depend on the international markets for the most part. In particular, countries where the middle class is growing rapidly and starting to travel and vacation more. Some of this growth is already in the pipeline, with the company having more than 10% of the industry’s rooms under construction, considerably above its current mid-single-digit percentage of global hotel rooms.

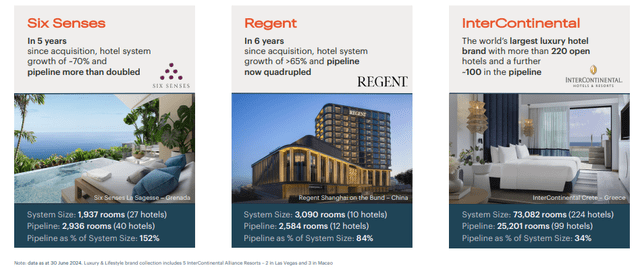

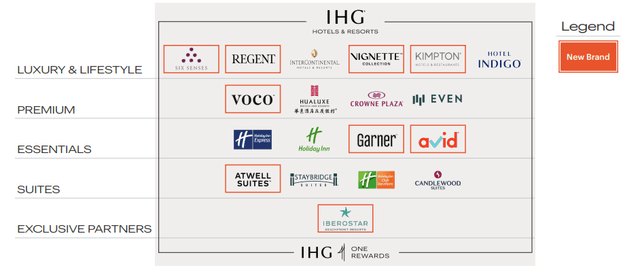

The company is also adding strong brands in the luxury and lifestyle segments, which tend to deliver good profitability and where customers are less affected by economic cycles. The company currently has 517 properties in this segment, and has 365 in the pipeline, representing future growth of roughly 50% in this key part of the business.

InterContinental Investor Presentation

Management sounds confident that they can deliver double-digit earnings per share growth in the coming years. Between RevPAR growth and new hotels added to the ecosystem, the company believes it can achieve high-single-digit fee revenue growth. Operating leverage could add between 1% and 1.5% to reach approximately 10% compound annual growth rate (“CAGR”) for its earnings before interests and taxes (“EBIT”). Adding dividends and share buybacks, total returns for shareholders could exceed 12%. We believe this potential can be achieved, especially with the focus on delivering value to hotel owners. InterContinental Hotels is also making use of data science and machine learning to deliver insights and recommendations to hotels to help them improve their operations and profitability, and they are adding best-in-class technology platforms to help with reservations, revenue management, and property management.

InterContinental Investor Presentation

Network Effects

InterContinental Hotels already has a competitive moat from owning some of the most trusted and well-known hotel brands, including the Holiday Inn brand. Still, some initiatives the company is working on further increase the moat, such as its revamped rewards program IHG One Rewards. According to management, the company’s rewards members are also the most profitable as they spend about 20% more on average, book more stays, and are more likely to sign up for additional products like co-branded credit cards. Margins tend to be better as well, as bookings are direct through the company’s app or website, bypassing expensive commissions typically charged by the likes of Booking and Expedia.

InterContinental Investor Presentation

Of course, for this network effects moat to really work the company needs enough scale. As it adds more brands to its portfolio and grows the system size, there are more incentives for customers to make the effort to join the program. As the program grows, more hotels will be interested in moving to an InterContinental brand. It appears the company is reaching critical mass, as enrollment in the program has accelerated, with the company reporting record sing-ups in the first half of 2024. It now has more than 130 million members who are responsible for more than 60% of the nights booked. The company is also leveraging its hotel network to promote the rewards program creating what they call the “billboard effect” of displaying information in more than six thousand hotels and on different places such as the exterior, the front desk, etc.

InterContinental Investor Presentation

We think that the co-branded credit cards further improve the moat, as they not only generate high-margin incremental revenue for the company and its partners, but they also create customer ‘stickiness’. Once a customer has gone through the trouble of getting an IHG-branded credit card, they will be highly motivated to book most of their trips with the company, increasing switching costs. When combining all of these business initiatives, we can see why more hotels are considering moving to the IHG brands. A great example is the recent agreement signed with hotel owner NOVUM Hospitality in Germany, which will result in the number of IHG hotels in Germany basically doubling.

InterContinental Investor Presentation

Balance Sheet

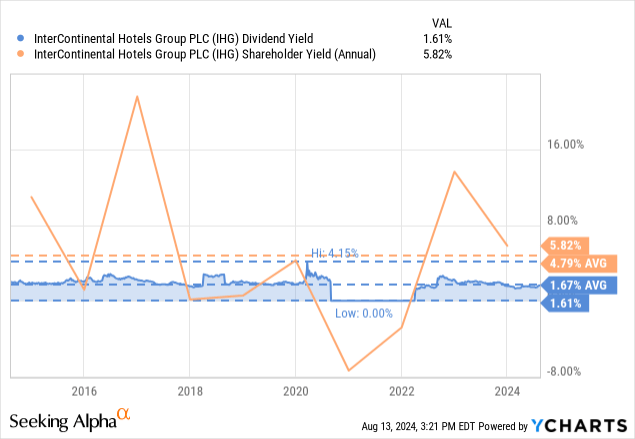

InterContinental Hotels has a strong enough balance sheet so that it can use most of the free cash flow it generated to either reinvest in the business, pay dividends, or buy back shares. The company ended June with net debt of roughly $2.8 billion and trailing 12 months EBITDA of $1.14 billion, putting its leverage at approximately 2.4x.

In fact, the company has been returning significant amounts of capital to shareholders. While the dividend yield looks relatively low, it is close to the historical average, and once the buyback yield is added, the shareholder yield looks more attractive.

Valuation

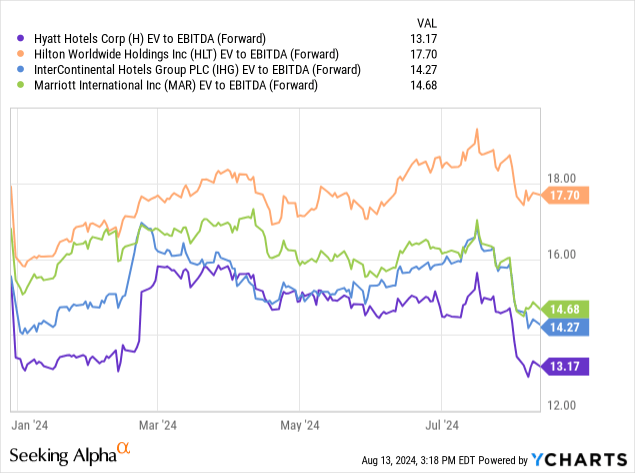

InterContinental Hotels and Marriott International, Inc. (MAR) are trading with a very similar forward EV/EBITDA multiple of close to 14x. Hilton Worldwide Holdings Inc. (HLT) is trading a few turns higher, while Hyatt Hotels Corporation (H) is slightly lower. We think the valuation multiples are close enough so that other considerations are probably more important when deciding which one to choose.

We like InterContinental Hotel’s growth initiatives, strong pipeline, and business initiatives, but a case can be made for the other companies as well. They all share an asset-light business model and have respected hotel brands. For example, InterContinental typically converts more than 100% of its earnings into free cash flow.

Based on our updated future earnings estimates, we calculate a net present value for the shares of roughly $103. This is using a 10% discount rate and assuming 3% terminal growth. With shares currently trading close to $95, we see a reasonable margin of safety, which is why we are moving our rating to ‘Buy’, but would require a bigger discount to consider the shares ‘Strong buy.’

| EPS | Discounted @ 10% | |

| FY 24E | $4.53 | $4.12 |

| FY 25E | $5.24 | $4.33 |

| FY 26E | $6.27 | $4.71 |

| FY 27E | $6.87 | $4.69 |

| FY 28E | $7.52 | $4.67 |

| FY 29E | $8.23 | $4.65 |

| FY 30E | $9.01 | $4.63 |

| FY 31E | $9.87 | $4.60 |

| FY 32E | $10.81 | $4.58 |

| FY 33E | $11.83 | $4.56 |

| FY 34E | $12.96 | $4.54 |

| Terminal Value @ 3% terminal growth | $169.07 | 53.87 |

| NPV | $103.95 |

Risks

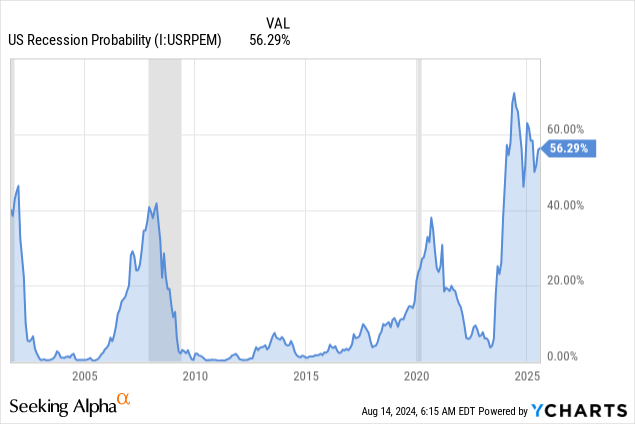

We see two big risks regarding InterContinental Hotels for investors. One is the rapidly weakening consumer in the U.S. and the elevated risk of recession. So far, the company has continued delivering positive growth, but this could quickly change if the economy experiences a rapid deterioration. The other risk to consider is that the company has high exposure to China, where growth has already turned negative regarding RevPAR and occupancy levels. With roughly one-third of the pipeline based in China, we see cancellation risks if occupancy continues to trend down in China. Finally, we see alternative accommodation providers such as Airbnb, Inc. (ABNB) continuing to take market share from hotels in some markets.

These risks are mitigated by the strong business model and high profit margins the company has, as well as its healthy balance sheet. Risks are also mitigated by the geographic and business segment diversification the company has, including its rapid expansion in the luxury and lifestyle segments which we view as more resilient. Still, should the U.S. economy enter a recession we would not be surprised to see further weakness in the share price.

Conclusion

There are many things to like about InterContinental Hotels’ business model. These include the asset-light strategy with most hotels being franchised, strong brands across different customer segments, and geographic diversification. Among hotels, branded operators are gaining market share, and IHG has a very strong pipeline, which means there is a line of sight to future growth. While the company has about a 4% share of the global room supply, it has an approximately 10% share of the hotel pipeline.

The company is also widening its competitive moat through its loyalty program and co-branded credit cards. These increase customer switching costs, lower commissions paid to online travel agencies, and provide funds to reward its best customers. The company also has significant operating leverage as it does not need to grow its fixed costs very much as revenue growth, which results in operating leverage adding between 1% and 1.5% margin expansion per year. The company has a number of growth vectors, including RevPAR growth, system growth, and ancillary revenues such as co-branded credit card fees. While there are several risks to take into consideration we view shares as reasonably priced at the moment, although they would likely decline further if the U.S. economy goes into recession.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Credit: Source link