sasha85ru/iStock via Getty Images

Nanophase Technologies Corporation (OTC:NANX) is a little-known materials technology company that is growing like gangbusters. NANX has solved a significant, known, problem with its proprietary formulation of an FDA-approved, invisible to the eye, sunscreen for use in face creams and cosmetics. Being invisible, aka avoiding “ghosting,” is/was a holy grail for the skin care industry. NANX’s product line, artfully called Solesence, is sold as an ingredient to major skin care/beauty companies. Sales, backlog, and production capabilities have all grown rapidly recently. In 2024, NANX expects to achieve $50 million in sales for the first time, and perhaps more importantly, has installed the equipment and systems to profitably produce its much in-demand products.

Innovation

Highlighting its product innovation, in July Solesence won the prestigious Formulation Award at Cosmopack North America for the third year in a row, an achievement not even multi-billion companies have achieved. And earlier this year, they also won the Alle Awards in Toiletry and Beauty- a second win.

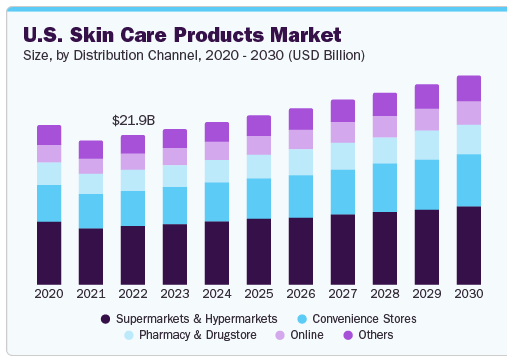

The Market

Skin care is a $23 billion market (retail, end customer sales-not ingredients), growing faster than the overall economy as an increasing number of us, the author included, seek to preserve our appearance and avoid skin cancer.

US Skin Care Products Market (Grandview Research)

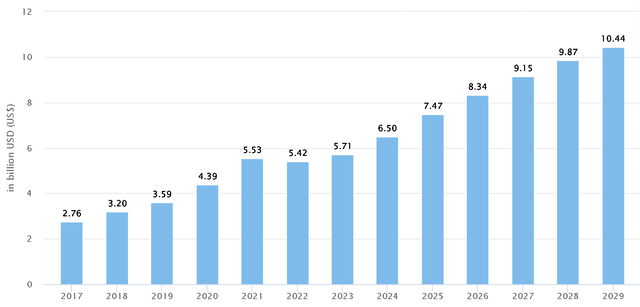

Solesence is most often used in the Prestige segment of skin care, which, at $6.5 billion, represents about 28% of the market. Importantly, it is also the fastest-growing segment, with a 9.9% CAGR expected through 2029.

Prestige Skincare Revenue (Statistica Market Insights)

As an ingredient, not a sold-to-end consumer product, NANX can focus on what it excels at- product development and delivery. Furthermore, as an ingredient, the relative cost of Solesence compared to the selling price of the final product is minuscule, providing a degree of pricing power. The Company’s products and capabilities are unique. There are many generic “formulation houses,” but none that I am aware of can provide the clean application/no-ghosting application of Solesence. That is why Solesence continues to win awards, that is why sales (and backlog) are growing rapidly, and that is why NANX’s future is only limited by its ability to execute.

The FDA Weighs In

The FDA published a “deemed final order” for over-the-counter sunscreens, which identified safe and unsafe ingredients in products claiming SPF protection. Zinc oxide, Nanophase’s skin-care products base, along with titanium dioxide, were deemed safe. Many products sold today use ingredients not deemed “Generally Recognized as Safe and Effective” (GRASE). This knowledge is trickling down to consumers, who are voting for Solesence’s formulations with their wallets. For customers (the skin care manufacturers), beyond being a safe, zinc oxide-based product, what truly sets Solesence’s products apart is the unique, and IP-protected, ability to deliver sun protection without leaving a white pallor, or “ghosting” on users’ skin.

Solesence and Other Products

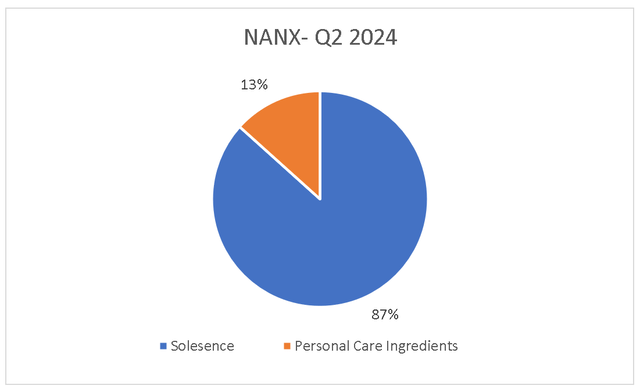

NANX- Q2 2024 Revenue Split (Nanophase)

In addition to its Solesence business, which, in the most recent quarter, represented 87% of sales, the Company has a Primary Care Ingredients business, largely comprised of sales to BASF. However, the Company is all about Solesence, which is on a tear, with sales jumping 51% in the first six months of 2024.

In 2022, due to rapid growth in the Solesence business, the Company was challenged to meet its product obligations to BASF, and the German company sued. Earlier this year, the litigation was settled on favorable terms. BASF remains a client, a material management distraction has been removed, and the associated uncertainty has been eliminated. A legacy business, Advanced Materials, which spiked during COVID-19, is being maintained.

The Future Looks Bright (Apply Solesence)

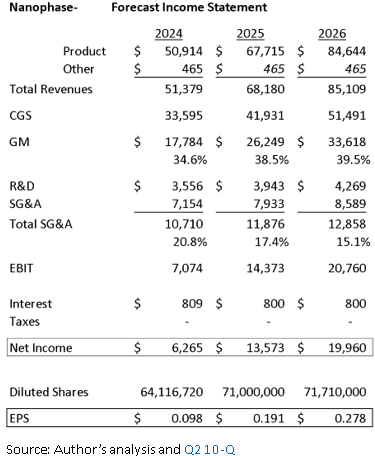

In 2022 and 2023, EPS was disappointing ($0.09) and ($0.05), respectively, as operational issues, the BASF litigation and management distractions hurt throughput and margins; sales stagnated at $37 million. In 2024, sales are projected to increase 38% to over $50 million, leap 33% to $68 million in 2025, and grow 25% to $85 million in 2026. For the record, NANX COO Kevin Cureton is stretch-targeting a 50% sales increase in 2025; my forecasts represent a conservative take.

Equally important as sales growth is margin expansion. Recently, the Company struggled to efficiently manufacture products, and gross margins suffered, coming in at a disappointing 21.0% in 2022 and slightly less disappointing 22.4% in 2023 (in 2020, during COVID, GMs were 35%). However, in 2024, significant investments in equipment, systems, and personnel are bearing fruit, and GM is forecast (by the author) to hit 34.6% for the full year. As NANX further refines its systems, and key operations and purchasing hires materially impact the operation, gross margins should continue to grow, hitting 38.5% in 2025 and 39.5% in 2026.

Higher sales and improved operating margins should drive tremendous earnings growth. EPS for 2024 is forecast at $0.10/share, growing rapidly to $0.19/share in 2025 and $0.28/share in 2026.

NANX – Forecast Income Statment (Author)

Debt and Manufacturing

As a manufacturing company with over 300,000 ft (ca. 91 km)2 of facilities, debt has been used to fund the acquisition of capital equipment and (growth) working capital. As of the most recent 10-Q, the Company has about $8.5 million in debt (excluding operating lease obligations), down from $10.8 million at the end of 2023. The Company has indicated, that going forward, operating cash flows could/should fund capital needs and allow it to pay down debt.

Valuation Thoughts

Even for a small company, it is hard for me to rationalize a company with NANX’s earnings potential worth less than 25x 2025 forecast earnings. Hence, the opportunity.

Ownership

For better or worse, the ownership of NANX is highly concentrated, with Bradford Whitmore, directly and through his beneficial holdings, controlling 71.3% of the Company per the 13/D filed in June. Mr. Whitmore has supported the Company through related-party loans. Mr. Whitmore’s sister Janet sits on the Company Board.

Some Risks

Virtually unknown to the investing public, and trading on the “pink sheets,” NANX is waiting to be discovered and properly valued. Liquidity is poor, with an average recent daily trading volume under 9,000 shares. Management has discussed “uplisting” the company, but the timing is uncertain. And while a better listing will certainly create shareholder value and improve liquidity, the real value will come from soaring earnings. However, investors should consider poor liquidity and occasional large bid-ask spreads to be a risk.

As mentioned above, the Company is effectively controlled by Mr. Whitmore. While he has historically been supportive of the Company, as majority owner there is the risk that he exercises influence that causes the Company to be operated, from a shareholder perspective, in a suboptimal way. He may also elect to take the Company private at a low valuation.

Executives and other employees have significant stock options which historically have been exercised with the underlying shares sold in the open market. This negative-for-shareholder behavior has moderated recently, but there is the risk of management “dumping” shares into the market in a legitimate desire to exercise options before expiration.

The Company has had issues with inventory write-downs and other “one-time” issues in the past, including a $500,000 writedown this past quarter. The Company expresses confidence, due to an increase in internal expertise and systems, that these issues are in the past, however, this is a small company and the risk of future one-time events is always a possibility.

Earlier this year, the Company settled, on what appear to be favorable terms, litigation with BASF. The litigation was driven by the Company’s inability to properly satisfy orders as Solesence sales boomed. In the unlikely event the Company is unable to satisfy BASF’s production demands, it could be forced to transfer equipment to the German company and lose production capacity.

Four companies, per the latest 10-Q, comprise 60% of the Company’s sales. While the Company has a strong backlog, the loss of any one of these customers could have a material impact on the top and bottom lines.

The Company has invested significant capital in expanding production activities by hiring efficiency experts. While these efforts appear to be bearing fruit and are expected to result in expanding gross margins, failure to optimize these investments could lead to disappointing margins and hence results.

NANX is led by CEO Jess Jankowski and COO Kevin Cureton. The pair have been working together for several years. If one or both of these individuals were no longer performing their duties, there is uncertainty as to the impact on the Company. Mr. Cureton’s responsibilities have been supported by an increasing cadre of functional experts; Mr. Jankowski, who also holds the role of Chief Accounting Officer, has been supported by a recently hired Controller.

At The End of The Day

NANX is a tremendous, undiscovered growth story. Assuming sales grow as projected and investments in capital equipment, systems, and personnel continue to bear fruit, the Company is forecast to earn $0.10/share in 2024 and $0.19 in 2025 (and $0.28 in 2026). At the time of writing, NANX is $1.39/share, or 7.3x 2025 earnings, implying a PEG of 0.076. That seems awfully low to me.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Credit: Source link