J Studios

Introduction

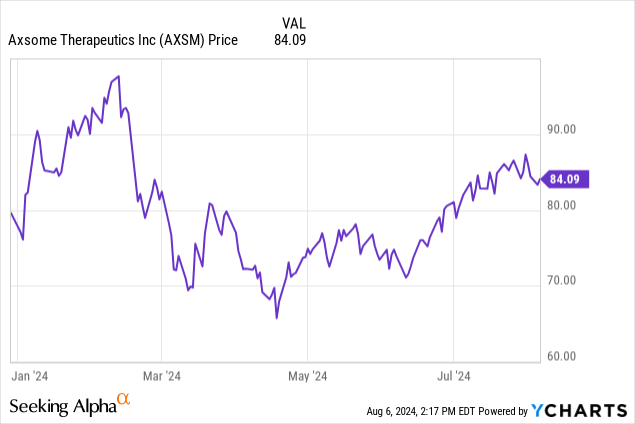

My last look at Axsome Therapeutics, Inc. (NASDAQ:AXSM) followed their Q4 2023 earnings report, in which Auvelity (dextromethorphan-bupropion), the company’s lead asset targeting depression, achieved $49 million in revenue for the quarter and $130.1 million for full-year 2023. However, I pointed out that, despite these revenue increases, Axsome’s losses were widening as SG&A expenses doubled. My final recommendation was “hold,” noting “strong revenue growth and solid market sentiment, but balanced against financial and operational risks.” Since the February recommendation, Axsome’s stock has remained relatively unchanged.

Axsome Therapeutics: High Hopes and Higher Risks

Flash-forward to Q2 2024, where Axsome reported total revenues of $87.2 million. Auvelity’s net product sales were $65 million (135% year-over-year growth). Axsome’s treatment to improve wakefulness for excessive daytime sleepiness due to narcolepsy or obstructive sleep apnea, Sunosi, saw modest growth (16% year-over-year), recording $22.1 million for the quarter.

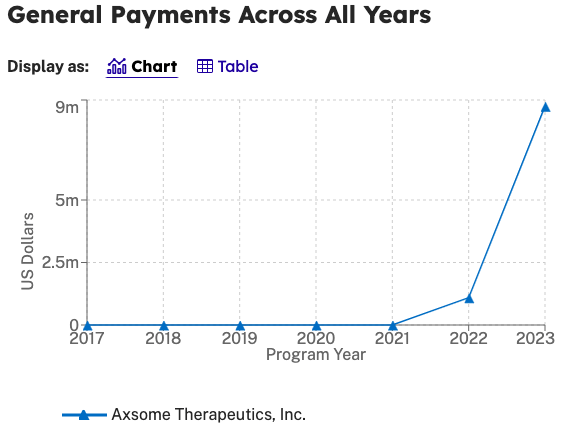

Recall that Auvelity was approved in August 2022 for the treatment of major depressive disorder in adults. This is a market that is anticipated to be valued at nearly $10 billion by 2029. It is also a heavily contested market, with many drugs available for treatment. Auvelity is considered an “atypical antidepressant.” Atypical antidepressants, like Wellbutrin or Remeron, are typically utilized following treatment failure with SSRIs (e.g., Prozac) and SNRIs (e.g., Effexor). While Auvelity is thought to provide more benefits than bupropion (Wellbutrin) alone, it has not been compared to other antidepressants. So, while Auvelity has entered a large market, its position within it remains uncertain. It is a third- or fourth-line treatment for major depressive disorder, among other drugs, but does not distinguish itself from, say, Remeron. Keep in mind that many of the drugs on the market have been available for decades. They are well-established and affordable ($5 for a 30-day supply with insurance). According to Amazon Pharmacy, Auvelity costs approximately $30 for a 30-day supply with insurance and hundreds of dollars without insurance. So, Auvelity is not a drug that will “sell itself.” That is one of the reasons why we are seeing significant increases in SG&A expenses. Moreover, Axsome is spending a considerable amount of money in general payments per CMS Open Payments Data, including $8.746 million split among 72,832 payments in 2023 alone, with nearly $2 million towards “food and beverage.”

CMS

This is not an atypical practice, but it does indicate, in my view, that Axsome is potentially incentivizing providers, in excess of what I am used to seeing, to prescribe Auvelity. I point this out to provide evidence for my assertion that Auvelity isn’t a drug that markets itself.

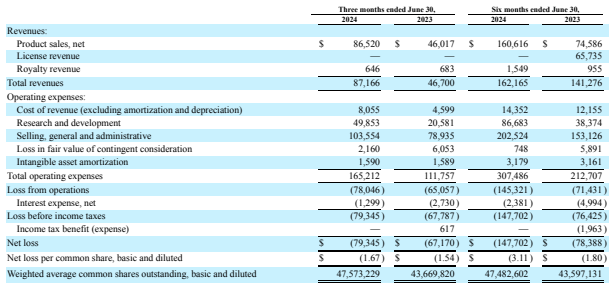

Turning to Axsome’s income statement, it was “more of the same” in Q2.

Axsome

SG&A expenses continue to rise, owing in part to general payments, and Axsome’s net losses continue to widen despite revenue growth. It is worth noting that this is primarily due to a doubling of R&D investments.

Axsome’s pipeline includes numerous candidates for indications such as migraine (NDA), Alzheimer’s disease agitation (Phase 3), smoking cessation (Phase 2), fibromyalgia (Phase 3), and ADHD (Phase 3). However, these indications suffer from high attrition rates (e.g., AD-related agitation, fibromyalgia) or are highly competitive (e.g., migraine, smoking cessation, ADHD). There’s nothing in it, to me, that is particularly intriguing. For instance, their migraine treatment (AXS-07) is just a combination of meloxicam, a popular NSAID, and rizatriptan, a triptan that is already utilized for migraine headaches. In fact, many of Axsome’s assets are just generic drugs repackaged as combinations in my view. Although this method can prove successful (e.g., Gilead’s repackaging of existing antivirals for HIV treatment), it is not particularly innovative and can be operationally risky, as detailed by Axsome (page 75).

Generic forms of the active ingredients of our product candidates, including dextromethorphan, bupropion, meloxicam, rizatriptan, and reboxetine, are available in the United States and abroad and could be used off-label. Any such off-label use could adversely affect our profitability and have a negative effect on our operating results and financial condition. For example, even though meloxicam is not currently approved for the treatment of acute migraine, we would not be able to prevent a physician from prescribing it for such treatment. Nor could we prevent a payor from offering favorable coverage for such a product and disadvantaging our product candidates, even if the generics would be used off-label.

Although AXS-07 may be superior to rizatriptan alone, physicians already routinely combine triptans, such as rizatriptan, with NSAIDs in treatment recommendations. So, in my opinion, there is no reason to use Axsome’s “proprietary” combination, and this appears to be another drug that will necessitate extensive marketing efforts.

Financial Health

As of June 30, Axsome reported $315.657 million in cash and cash equivalents. Total current assets were $463.027 million, while total current liabilities were $186.57 million. This is good for a current ratio over 2, which indicates Axsome can readily cover short-term obligations. Axsome does owe $179.33 million in “loan payable-long-term.”

Because Axsome is not profitable, I will estimate the cash runway using historical data. In the first six months of 2024, Axsome “burned” $83.577 million in cash for operating activities. If we divide their cash and cash equivalents by this figure, it suggests around 2 years of cash runway.

AXSM Stock – Risk/Reward Analysis and Investment Recommendation

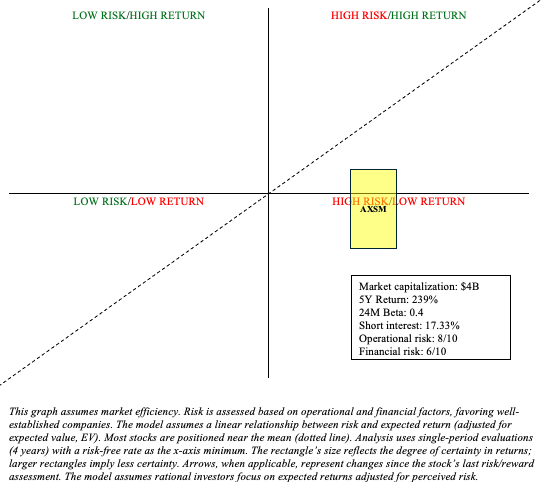

In conclusion, Axsome poses considerable operational and financial risk. Auvelity faces fierce competition in the depression market and assets such as AXS-07 for migraine lack differentiation. Financially, significant marketing and R&D investments in high-attrition indications are contributing to increased net losses. Axsome’s cash is running low, and if nothing changes operationally within the next year or two, they may be forced to take on more debt or raise equity.

It’s difficult to envision good returns from here (at a market capitalization of $4 billion), especially relative to its risk profile. As such, I believe AXSM lands in unfavorable territory within my risk/reward chart.

Author

As a result, I believe it is prudent to downgrade my rating to “sell” due to the lack of financial improvements and the company’s risky strategy.

There are some risks to my sell recommendation, including opportunity costs if AXSM outperforms the market (my chart does indicate a reasonable chance of doing so, although it favors underperformance). I might have underestimated their pipeline. They could have a breakthrough on the horizon that I have not anticipated. Finally, while the costs of launching a new depression treatment like Auvelity in comparison to its revenues may be high in the early stages of marketization, Auvelity has the potential to be a very profitable drug.

Credit: Source link