PM Images

Ahh, large-caps. The core of most portfolios. And the most overcrowded part of the marketplace. I don’t like large caps, and I think they are due for a large correction. But what I think relates more to short-term dynamics than long-term investing. If you want exposure to a more balanced large-cap fund than what you would otherwise get from the S&P 500 for long-term positioning, then you may want to consider the Schwab Fundamental U.S. Large Company ETF (NYSEARCA:FNDX). Launched in mid-2013, this fund takes a fundamental approach to large-cap investing, allocating weights not based on market cap but rather multiple variables. These variables include adjusted sales, retained operating cash flow, and dividends plus buybacks.

The RAFI Fundamental High Liquidity US Large Index is at the heart of FNDX’s investment process. This proprietary index developed by Research Affiliates selects and weights companies using fundamental size (expressed by the aforementioned fundamental metrics) and weighs companies that score well on each fundamental metric. In doing so, the index attempts to identify companies that are of good value, have strong fundamentals, and/or those that are currently out of favor due to poor/low stock prices.

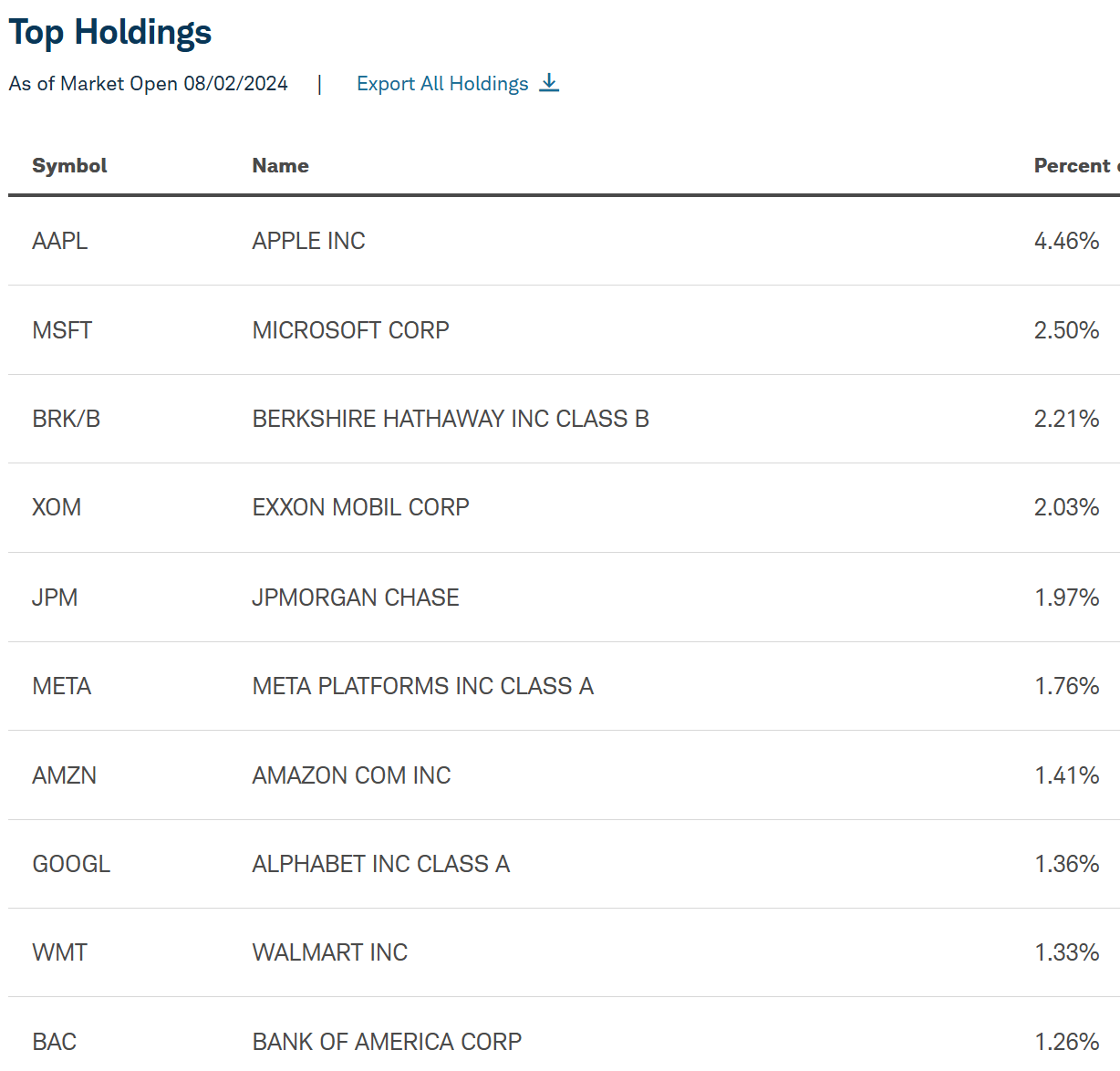

A Look At The Holdings

When we look at the top 10 holdings, we see all the familiar large-cap names found at the top of most large-cap funds. The key difference lies in the weightings. This is not as top-heavy of a large-cap fund as seen in the S&P 500, which to me makes it quite attractive, given my views around a “concentration bubble” in large-cap tech driving headline averages.

schwabassetmanagement.com

I like the mix here, the sector diversification, and the weightings. And guess what? Nvidia is nowhere to be found at the top. Funny how that works when you focus on fundamentals.

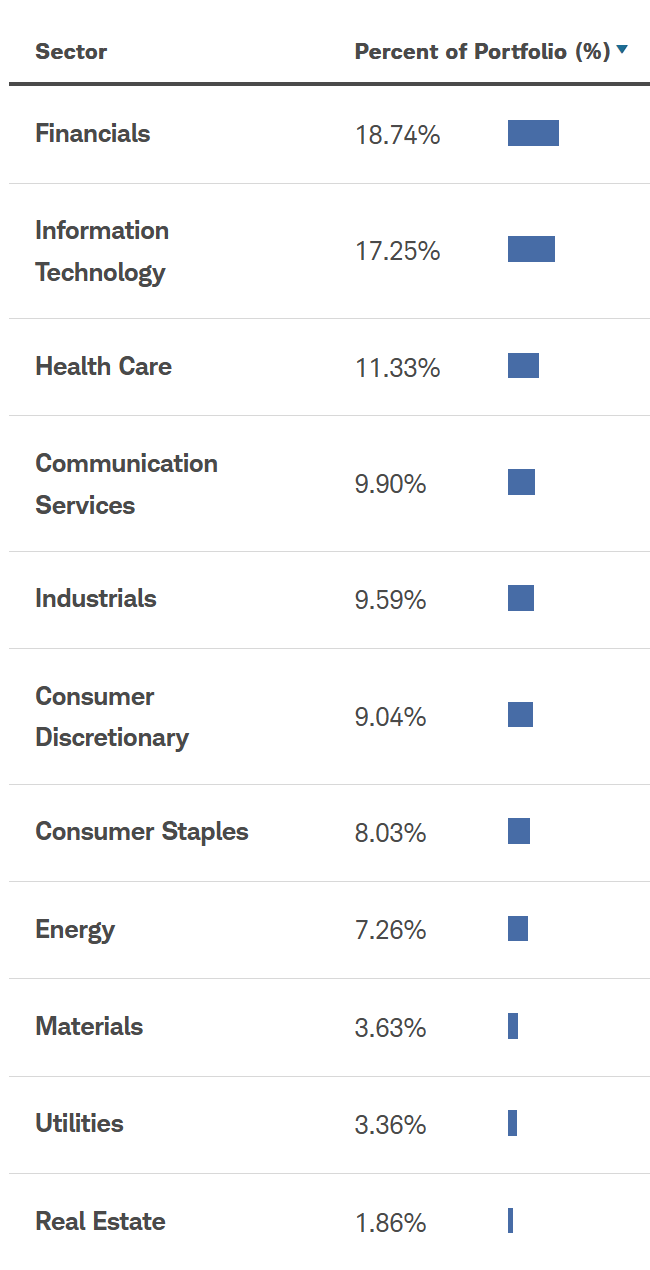

Sector Allocation

As a value-oriented fund, FNDX’s sector allocation, thankfully, does NOT have Tech at the top.

schwabassetmanagement.com

This sector allocation shows a bias toward value-yielding sectors (financials and industrials) while retaining a meaningful position in the tech sector, which has historically provided the best growth opportunities. Candidly, I love the positioning here. It’s far more balanced than most large-cap core equity funds are.

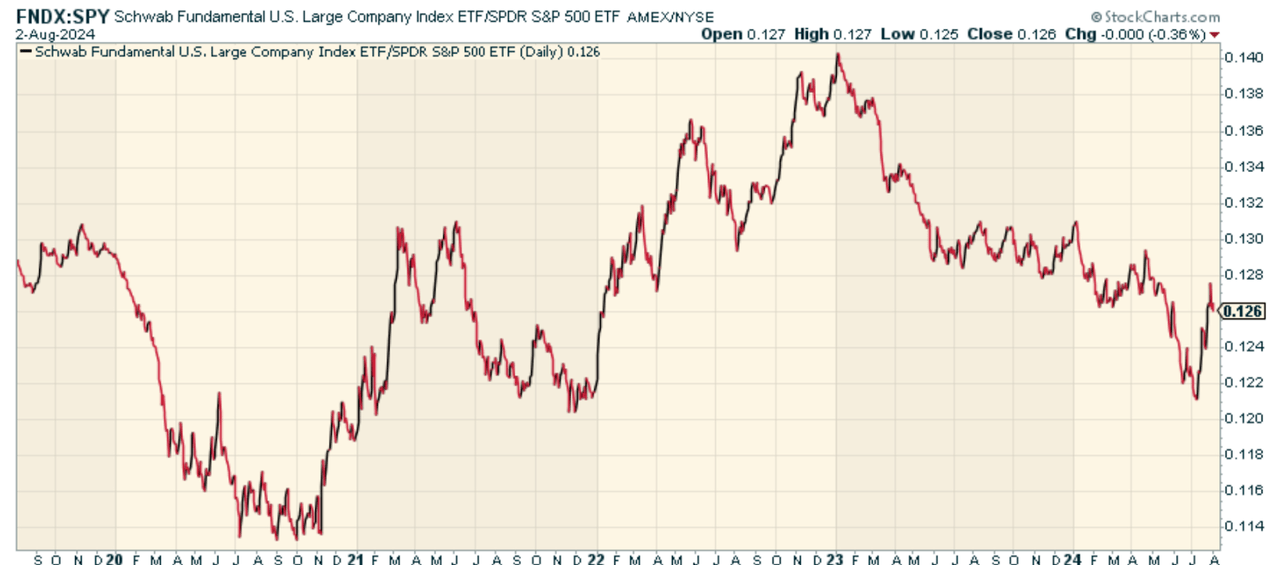

Peer Comparison

One good peer to compare FNDX to is the market-cap weighted S&P 500 itself, as noted earlier. We all know that the S&P 500 is very Tech heavy, with some outsized weightings in the top 10 being big drivers of momentum. When we look at the price ratio of FNDX to the SPDR® S&P 500 ETF Trust (SPY), we find that the two funds have performed in line with each other since 2019 roughly with some big swings. It does look like FNDX could be turning the corner short-term, resulting in outperformance.

StockCharts.com

Pros and Cons

On the positive side? The fund provides investors with a rules-based, systematic way to access the large-cap value area of the US equity market. Its fundamental indexing approach searches for firms with attractive valuations, consistent cash flows, and solid balance sheets. Its portfolio construction process also eliminates the need for stock pickers, ensuring that no one’s subjectivity or emotional influences creep into the process.

But of course, there is a risk with FNDX. While the fund’s strategy has tended to hold up well during market downturns, there’s no assurance that will continue into the future. And the value tilt of FNDX, as well as its focus on dividend-paying stocks, leaves it open to the possibility of underperformance if growth stocks have good returns, as has been the case since 2023. And, of course because FNDX’s portfolio is made up of equities, investors in the fund face market volatility, economic cycles, and company-specific risk.

Conclusion

If I had to be in large-cap equities, I’d choose this given the sector mix, well-balanced weightings, and fundamental valuation tilt. I think it’s quite a good fund, and if you prefer a value tilt with a less risky overall weighting across the top 10, FNDX is worth considering. You still have exposure to Tech, but much less so, and that will matter in my view in the months ahead.

Credit: Source link