William_Potter

AMZN stock: Q2 results met market selloff

I last covered Amazon.com, Inc. (NASDAQ:AMZN) stock about a month ago (on July 10, 2024, to be exact). At that time, I published an article entitled “Amazon: Swimming In Catalysts.” As the title suggests, the goal of that article was to provide an overall view of the various catalysts afoot at the company. More specifically, I argued that:

I see a multitude of catalysts that can drive the company’s earnings. To recap, the top 3 catalysts in my mind are the improvements of its fulfillment centers, AWS, and its vast and sticky user base. Besides driving EPS, these catalysts, especially the synergies among them, can further solidify its competitive moat in the long term.

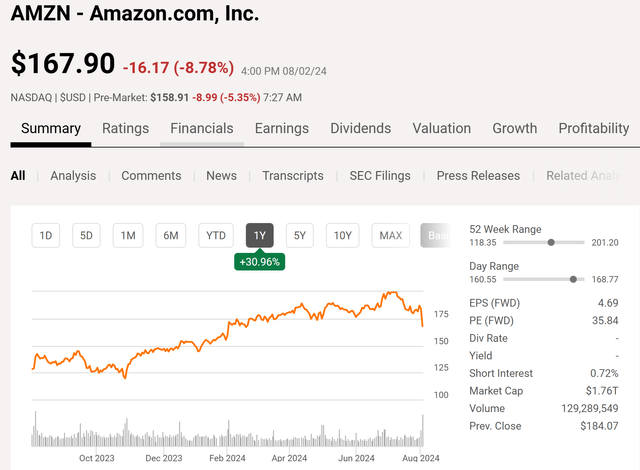

Since that writing, the stock has released its 2024 Q2 earnings report (“ER”). The ER showed some mixed results, but was overall robust in my view (more on this in a minute). The share prices went down by ~7% during after-hours trading after the ER, as illustrated by the chart below. In the remainder of the week since the ER release, the stock was caught up in an overall market selloff and its prices kept trending downward. The market’s fear (over a possible AI bubble burst and hard landing) brewed more over the weekend, and the selling pressure further intensified today. In Monday’s pre-market trading, Nasdaq futures are down more than 5% and AMZN stock prices are down more than 5.3% as you can see in the chart.

These developments have reminded me of the timeless wisdom of being greedy when others are fearful. In the remainder of this article, I will argue a buy thesis for AMZN stock, with a focus on its Q2 results and earnings outlook. I will explain A) whatever the AI bubble baked into its pre-ER prices has already deflated, and B) the stock now offers a very skewed return/risk profile.

Seeking Alpha data

AMZN stock: Q2 recap and AI bubble

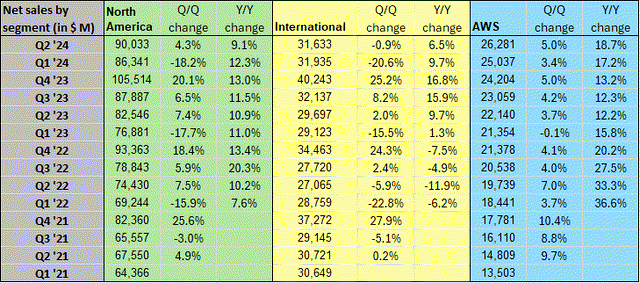

Overall, the company reported a solid quarter in my view, although the Q2 results contained some unevenness. In terms of EPS, AMZN earned $1.26 per share, almost doubling the $0.65 figure a year ago and exceeding market expectations. Revenue came in at $148B, slightly missing market consensus by $760M. Notably, AWS grew 18.7% YOY to a $26.3B segment, as demonstrated by the chart below. The growth rates exceeded Wall Street guidance of +17.6%.

Seeking Alpha data

The market, however, was (has been) on high alert recently due to the concern over a potential AI bubble. The current situation certainly shows a few key bubble signs considering the combination of valuation premium, mixed growth results (e.g., Microsoft just reported disappointing Azure results before AMZN’s ER), and the continued requirement of large CAPEX investments.

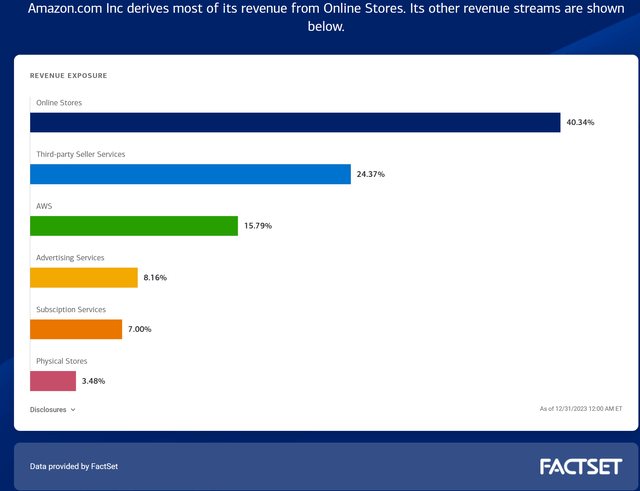

My view is that AMZN has a well-balanced set of revenue streams and thus is the least sensitive to the AI bubble. The chart below shows Amazon’s revenue breakdown as of December 31, 2023. As seen, Online Stores generated the most revenue, accounting for 40.34% of the total. Third-party Seller Services came in second and contributed 24.37%. The top 2 sources thus contributed about ¾ of its total revenues. AWS came in third with a contribution of 15.79%, sizable but not dominant in any way.

Next, I will argue that whatever the AI bubble baked into its pre-ER valuation multiples has already been deflated by the recent price corrections.

FACTSET data

AMZN stock: valuation and return projection

At the pre-market stock price as of this writing (about $153), AMZN’s FWD P/E is about 33.1x, certainly not cheap by any standard. However, as detailed in my earlier articles, accounting P/E ratios are misleading for AMZN’s valuation due to its substantial use of lease accounting and growth CAPEX investment.

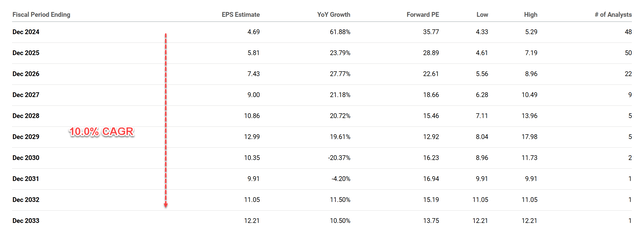

Thus, here, I will rely on its FCF (free cash flow) for valuation purposes. More specifically, I will apply a two-stage discounted FCF model to assess its fair price and return potential. In this model, the 1st stage captures its growth in the next 10 years and the 2nd stage captures the terminal growth rate after that. For the growth rate in the 1st stage, I will rely on the consensus EPS estimates for AMZN, as shown in the chart below. As seen, the estimates project a notable growth trajectory despite the market’s concerns over its Q2 results, with EPS anticipated to rise from $4.69 in 2024 to $12.21 in 2033. Overall, the forecasted Compound Annual Growth Rate (CAGR) is 10.0% for this period.

Seeking Alpha

For the terminal growth rates, my method is detailed in my early articles, and here I will just quote the results directly:

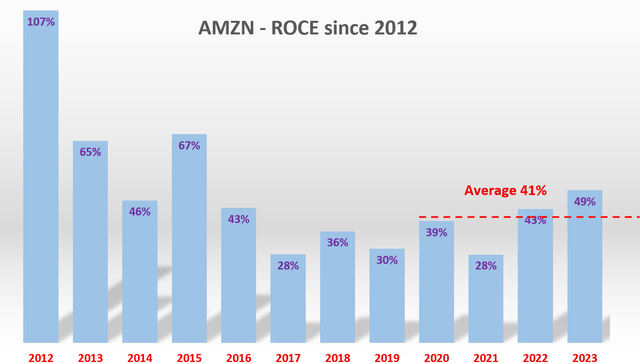

The approach involves the return on capital employed (ROCE) and the reinvestment rate (“RR”). The ROCE for AMZN is around 41% as seen in the chart below. AMZN’s reinvestment rate is about 10% on average, higher than the average for other major tech firms largely due to its aggressive use of lease obligations. With these inputs, AMZN’s perpetual growth rate would be ~4.10% (41% ROCE x 10% reinvestment rate = 4.10%). Note this number is the real growth rate without inflation. To obtain a notional growth rate, I added an inflation escalator of 2.5%, resulting in a notional growth rate of 6.6%.

Author

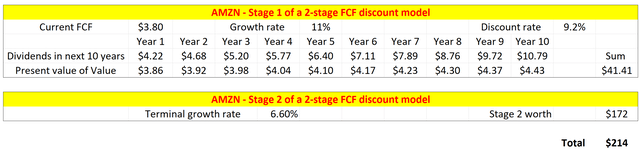

Finally, for the discount rate, I use the WACC (weighted average cost of capital). The WACC is the average rate that a business pays to finance its assets, including both equity and debt. For AMZN, my calculation indicates that the WACC has been on average 9.2% in the past 3 years.

With all these above inputs, the following table shows the results. As seen, my estimate of its fair price is around $214, about 40% above its current share price of $153 as of this writing and offering a wide margin of safety.

Author

Other risks and final thoughts

As aforementioned, the market has good reason to worry about the return on the massive AI capital investments made by AMZN (and other tech giants as well) recently. More specifically, the chart below compares the operating cash flow and capital expenditures for AMZN stock in the past few quarters. The chart presents Amazon’s cash flow from operations and capital expenditures from December 2021 to June 2024.

As seen, its capital expenditures have sharply surged recently. Its capital expenditures reached the 2nd highest level of record level of $17,620 million in Q2 since 2021 (when it reported a capital expenditure of $18,935 million. Q2’s capital expenditures are a whopping 54% above the figure a year ago ($11,455 million). The good news here is that its cash from operations also grew at about the same pace in tandem. To wit, its Q2 operating cash totaled $25.28 billion, about 53% higher than the figure a year ago ($16.47 billion).

Looking ahead, the return on capital investment in AWS can be uncertain due to the early stage of AI deployment. However, I am optimistic about the return of its other segments, such as the fulfillment center and various membership programs (the focus of my last article).

All told, my conclusion is that the Amazon.com, Inc. upside risks far outweigh the downside risks under current conditions. My thesis is that the selloff triggered by the market’s concern about the AI bubble is overblown in the case of AMZN.

And to recap, the key considerations behind my thesis are threefold. First, its Q2 results continue to show a stable moat and a superiority of its e-commerce. Second, AMZN boasts a well-balanced collection revenue stream. Finally, the recent price correction has created a wide margin of safety relative to its fair price.

Seeking Alpha

Credit: Source link