Travel Ink/DigitalVision via Getty Images

One of my absolute favorite companies on the market today is none other than pipeline/midstream firm Energy Transfer (NYSE:ET). Those who follow my work closely know that I have a very concentrated portfolio. I currently have only eight stocks in it. And it just so happens that Energy Transfer is my third largest, accounting for 13.3% of those assets. In the past, I’ve done quite well owning the stock. Excluding the hefty distributions that I have gotten from the firm, I am up 37.3% since initially purchasing them a little over two years ago.

Obviously, the fact that I own the stock can mean only that I have a ‘strong buy’ rating on it. That is what I reaffirmed my rating as when I last wrote about it in May of this year. Since then, the stock has barely budged, seeing appreciation of about 1.8%. But I think it would be a mistake for investors to confuse temporary stagnation with a lack of upside potential. Even though the stock has appreciated significantly since I first bought it, I would argue that shares deserve further upside from here.

Of course, this picture can always change. And it just so happens that, on August 7th, after the market closes, new data will come out covering the second quarter of the company’s 2024 fiscal year. Leading up to that point, investors expect revenue and earnings to rise on a year-over-year basis. But outside the traditional financial metrics that are reported, there are some other things that investors should be paying attention to.

What to expect

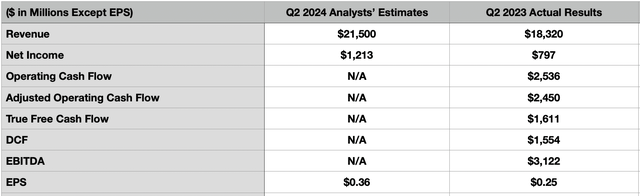

After the market closes on August 7th, the management team at Energy Transfer will be reporting financial results covering the second quarter of the company’s 2024 fiscal year. The current expectation is for sales to come in at about $21.50 billion. If this comes to fruition, it would represent an increase of 17.4% compared to the $18.32 billion generated one year earlier. Given the nature of companies in this space, I don’t actually think that revenue on its own is all that significant. But the good news is that what is important is likely to improve also.

Author – SEC EDGAR Data

If everything goes according to plan, earnings per share, per analysts, should come in at around $0.36. That would be well above the $0.25 in earnings reported for the second quarter of 2023. It would also translate to a growth in net income from $797 million up to $1.21 billion. Unfortunately, the things that are most important are things that analysts don’t provide estimates for. But if they are correct about revenue and earnings, these metrics will also improve nicely.

The first of these is operating cash flow. In the second quarter of 2023, this metric was $2.54 billion. If we adjust for changes in working capital, this number drops slightly to $2.45 billion. One metric that I calculate on my own when it comes to these companies is what I call ‘true free cash flow.’ This is what you get when you subtract from adjusted operating cash flow the maintenance capital spending for the company and its preferred distributions. We also subtract from this non-controlling interests. Last year, for the second quarter, this was $1.61 billion. Meanwhile, DCF, or distributable cash flow, happened to be $1.55 billion.

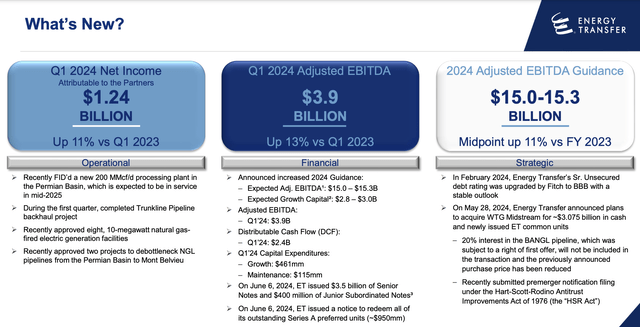

Energy Transfer

Outside of these headline news items, there are some other things that investors would be wise to pay attention to. Probably the most important would be guidance for the 2024 fiscal year. The most recent guidance provided by management calls for EBITDA to be somewhere between $15 billion and $15.3 billion. This was released in June. However, it is just a copy and paste from earlier guidance and does not seem to reflect some other changes that the company has made.

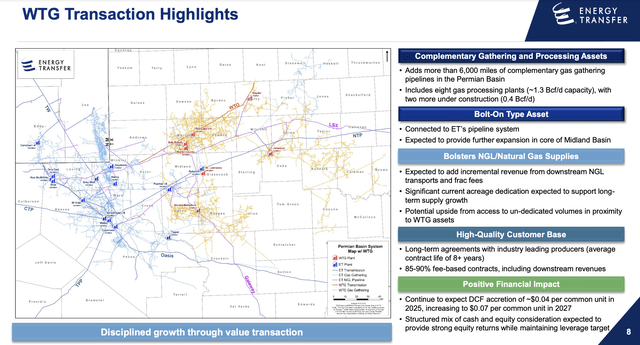

Energy Transfer

The biggest transaction would be the company’s purchase of WTG Midstream. This was originally announced late in May. The initial purchase price was $3.25 billion, which would come in the form of $2.45 billion worth of cash and 50.8 million shares. Ultimately, this was reduced to $3.075 billion. This is because the 20% interest in the BANGL pipeline there was owned by WTG Midstream and that was subject to a right of first offer ended up not being included in the transaction. The 50.8 million shares were still included in the purchase price, with the reduction being on the cash side to $2.275 billion. This transaction was closed on July 15th. Given the timing, this means that none of this will reflect in second quarter financial performance. However, it certainly will impact guidance to some extent. So any details that management can provide would be great to see.

Down the road, we do have some idea what this purchase might do for shareholders. But first, it would be helpful to talk a bit about what the company that Energy Transfer has purchased actually is and what it does. Management describes the acquisition as a bolt-on that will easily connect to the firm’s existing pipeline system. It is expected to provide further expansion into the core area of the prolific Midland Basin. And in one fell swoop, it will add over 6,000 miles of complementary gas gathering pipelines throughout the Permian Basin. The price also includes eight gas processing plants with about 1.3 Bcf per day of capacity, as well as two additional plants that are under construction that will have a combined capacity of 0.4 Bcf per day. The average contract life with customers for these assets is over eight years. In addition to this, somewhere between 85% and 90% of other contracts are fee-based. This means that there will still be some volume related risk involving the majority of the revenue coming from these pipelines. However, the structure will allow the company to avoid commodity price fluctuations that could ultimately hurt it.

As much as I like to see value-accretive purchases, this is one transaction that I am not a big fan of. We don’t know what the picture will end up looking like for the rest of this year. But management did say that, in 2025, DCF per share should be about $0.04 greater than it otherwise would be without the purchase. Based on my calculation for the number of shares outstanding following this purchase, that implies DCF of only $136.8 million for next year. This number should grow to $0.07 per share by 2027, which would translate to $239.5 million worth each year. That does take us from a very high EV to DCF multiple of 22.5 to a more reasonable one of 12.8. But that is still higher than I would like to see.

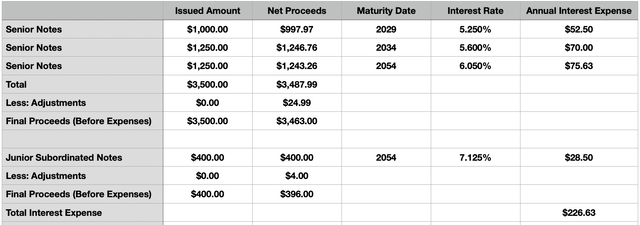

Author – SEC EDGAR Data

Even though EBITDA will not be impacted by changes in interest expense, we should also be looking for any updates regarding some other moves that the company has made. In June, management priced $3.50 billion worth of senior notes. This was in addition to another $400 million of fixed-to-fixed reset rate junior subordinated notes. In the table above, you can see the breakdown of these notes, including their interest rates, interest expense, and how much the company got in net proceeds. Most of this debt was used for the cash portion of the aforementioned acquisition. But the company also used a good chunk to redeem all of its Series A Preferred stock. There was $950 million worth of this outstanding. And while the rate of this was variable, the most recent cost to shareholders was 9.88% per annum. If we use the weighted average effective interest rate on the new debt issued, we get interest savings just for the amount of money that was allocated toward repurchasing these securities of $38.1 million. So the firm is getting some savings there. It is worth noting they had to pay a slight premium for these units, with the total redemption price being $959.4 million. But that’s a small price to pay for the reduction in payouts moving forward.

Management has also been making some other interesting moves. Most notably, last month, the company, alongside Sunoco (SUN), announced the formation of a joint venture to combine their crude oil and produced water gathering assets in the Permian Basin. The joint venture will operate over 5,000 miles of crude oil and water gathering pipelines and will have crude oil storage capacity greater than 11 million barrels. For its contributions, Energy Transfer will hold an interest in the joint venture of 67.5%. But seeing as how the effective date for this venture is July 1st of this year, any details provided by management in the second quarter earnings release will center around the impact this will have on guidance moving forward. The good news is that management did say that this maneuver will be immediately accretive to DCF on a per unit basis, not only for Energy Transfer, but also for Sunoco.

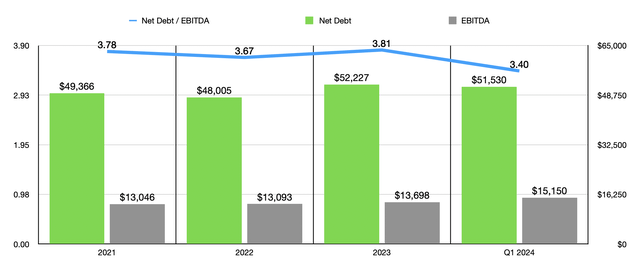

The last thing that I would like to touch on involves overall leverage for the company. Until we know the cash flows the business generated for the second quarter of the year, it doesn’t make sense to run all of these changes have been made into the picture. So we don’t really know what net debt will look like until new data comes out. We do know that, from the end of 2022 to the end of the first quarter of this year, net debt fell from $52.23 billion to $51.53 billion. But this was still higher than the $48.01 billion the company had on its books at the end of 2022. The good news is that, if we use the midpoint of guidance for this current fiscal year, the net leverage ratio for the enterprise comes in at 3.40. As the chart below illustrates, this is lower than what the company has ended any of the last three years at. So that is definitely encouraging. Hopefully, new guidance will help to offset the additional leverage the company is accepting as part of its acquisition. But only time will tell.

Author – SEC EDGAR Data

Takeaway

As part of my analysis, I thought about valuing Energy Transfer. However, since the stock has barely budged and since guidance has not changed since I last wrote about the firm, I think that would be redundant. Instead, I would refer you to my prior article on the business that I already linked to earlier in this piece. Assuming nothing significantly changes for the negative when new data does come out, Energy Transfer still seems to be one of the best opportunities the market has to offer. Shares are cheap, the company is growing, the firm’s cash flows are robust, and leverage has come down. All combined, this makes me comfortable keeping it rated a ‘strong buy’ for now.

Credit: Source link