JHVEPhoto

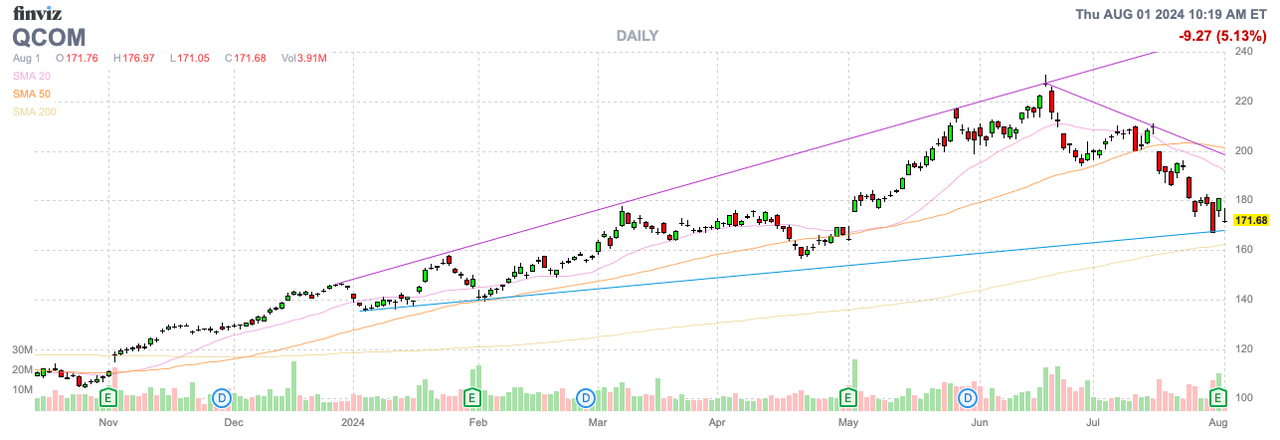

Qualcomm Incorporated (NASDAQ:QCOM) recently pulled back with the semiconductor after a massive rally in the last year. While some excitement subsided, the investment story is still based on the future in Automotive and AI PCs, not so much the current results. My investment thesis is ultra-Bullish on the stock, as even current results remain strong.

Source: Finviz

Ramping Back Up

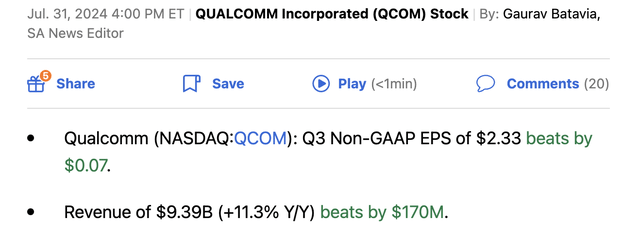

After a tough period, Qualcomm is ramping sales back up. The wireless chip company reported the following quarterly results for FQ3’24:

Source: Seeking Alpha

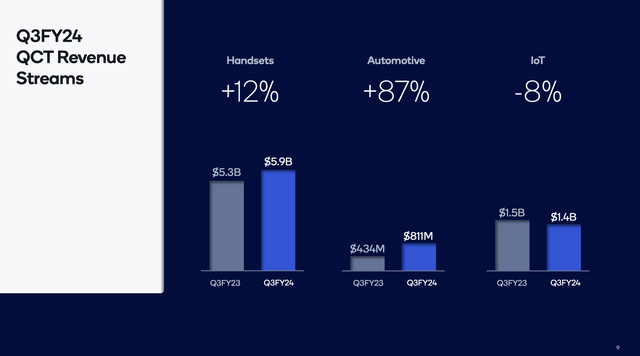

The key to the quarter is that Handsets provided a tailwind with 12% growth, while Automotive sales soared 87% to reach $811 million. The IoT segment is on the verge of massive growth with the launch of the AI PCs in June.

Source: Qualcomm FQ3’24 presentation

The company recently launched Copilot+ PCs powered by the Snapdragon X series at 47 retailers on 20 devices. Along with positive signs from Meta’s Ray Ban smart glasses integrated with AI, Qualcomm might finally have the products to return the IoT segment to growth exiting FY24.

These categories are very key to the investment story, considering the signs Apple (AAPL) might finally have a workable modem chip for some iPhones in 2025. The tech giant would still have to pay Qualcomm royalties from any smartphone sales, and the prime EPS boost comes from the license fees. No guarantees exist in Apple actually solving the 5G modem problems nagging the tech giant for years now.

Qualcomm guided to FQ4 revenues potentially topping $10 billion, though the guidance doesn’t provide any real indication of AI PC sales. Analyst estimates have generally not forecasted a major sales boost from the first mover advantage in this new market.

According to Bloomberg, Qualcomm captured 20% of the PC market on launch week due to long battery life, not so much on-device AI capabilities. AMD (AMD) currently generates around $1.5 billion in quarterly PC chip sales while Intel (INTC) has substantially higher revenues, so Qualcomm grabbing 20% of this market would be a substantial boost to sales.

JPMorgan analyst Samik Chatterjee has an estimate for Qualcomm producing $300 million in PC sales in 2024, ultimately reaching $3.7 billion in 2027. Some initial sales numbers would seem to support a much higher initial sales figure, with AMD producing $1.5 billion in quarterly PC-related revenues from ~20% market share.

Based on those numbers and when combined with the considerable ramp in Automotive on the way, Qualcomm is forecast to have a nearly $9 billion business from both Automotive and AI PCs. The wireless company has long forecast an Automotive order book of $30 billion, leading to sales of $4 billion in 2026 and a rough estimates of $5 billion for 2027 based on 25% annual growth. The official order book should be higher after the company reported 10 new design wins.

Qualcomm is targeted at just ~$38 billion in FY24 sales, with automotive sales surging to $2.8 billion. The wireless semi company is likely to easily top the automotive targets, leading to an Automotive and PC business actually topping $10 billion in FY27, versus a combined level of only $3 billion in FY24.

EPS Surge

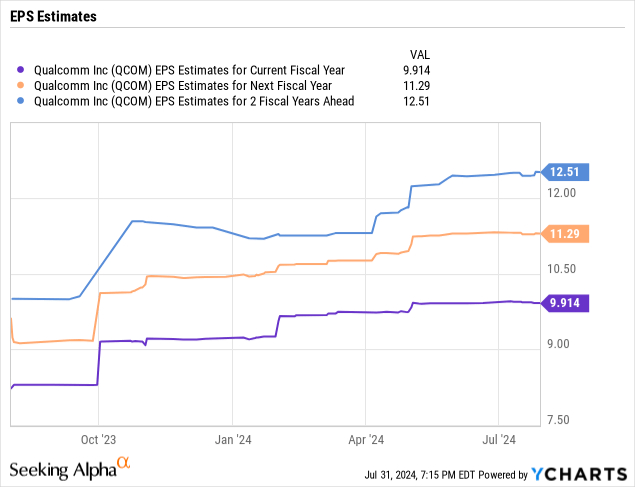

The stock has fallen back from a high of $230 to only $170 entering the earnings report. The solid FQ3 EPS beat and FQ4 guidance should provide some confidence in the FY25 EPS target of $11.29.

Qualcomm is insanely cheap here, trading at only 15x FY25 EPS targets, with consensus estimates for double-digit EPS growth going forward. The company is playing in massive growth areas of AR/VR devices, AI PCs and Automotive, while the stock trades at a submarket valuation multiple.

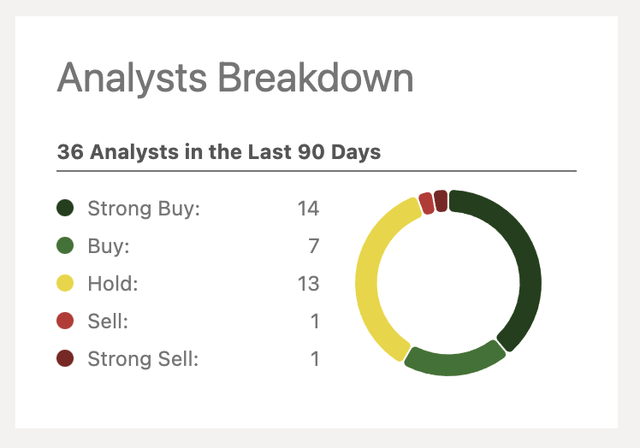

The opportunity exists for a far higher EPS and multiple expansion in the process. Most analysts aren’t even that Bullish on Qualcomm, with 15 ratings of either a Hold or Sell.

Source: Seeking Alpha

The JPMorgan analyst makes the case for a $235 price target on Qualcomm, and the analyst isn’t even exactly overly aggressive on the AI PC opportunity. At $235, the stock would only trade at slightly above 20x EPS targets.

Takeaway

The key investor takeaway is that Qualcomm shares remain absurdly cheap. The stock has continues to fall despite another strong quarter and guidance. The wireless semi company is well positioned in several major growth areas apparently ignored by the market, providing the opportunity to continue to buying Qualcomm on the cheap.

Investors should use any post-earnings weakness to load up on the stock.

Credit: Source link