hernan4429

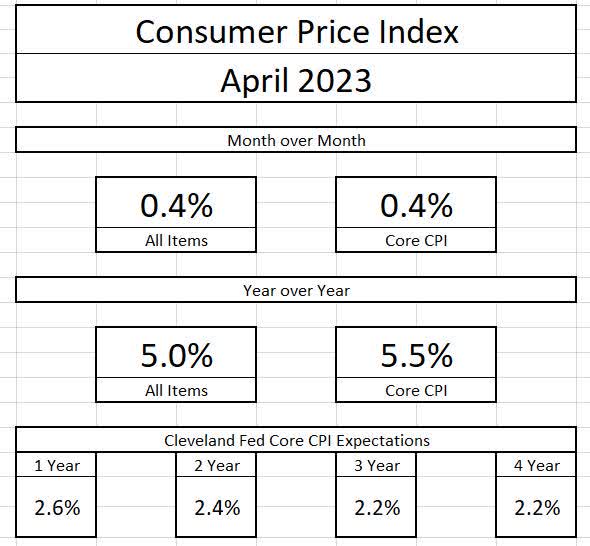

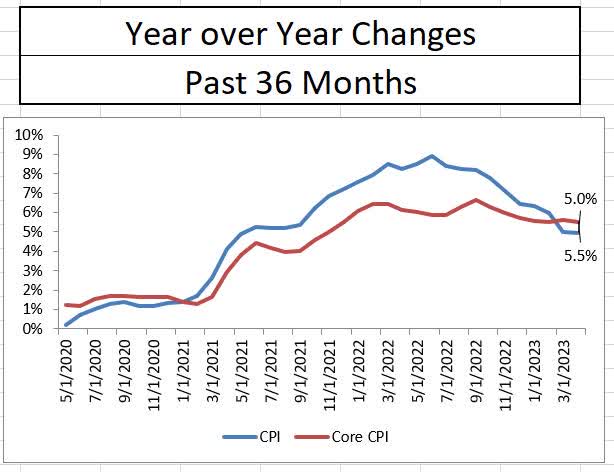

Earlier this morning, the Bureau of Labor Statistics released the consumer price index aka CPI for the month of April. The index is the most popular measure of inflation in the economy. The consumer price index rose 5% year-over-year for all items and 5.5% for core inflation (inflation without food and energy). While the decline from last month was not sharp, the report shows a continued gradual decline towards price stability. Based on the current trends and indications, I’m concerned about the ability of our economy to achieve price stability prior to a credit event.

Bureau of Labor Statistics Bureau of Labor Statistics

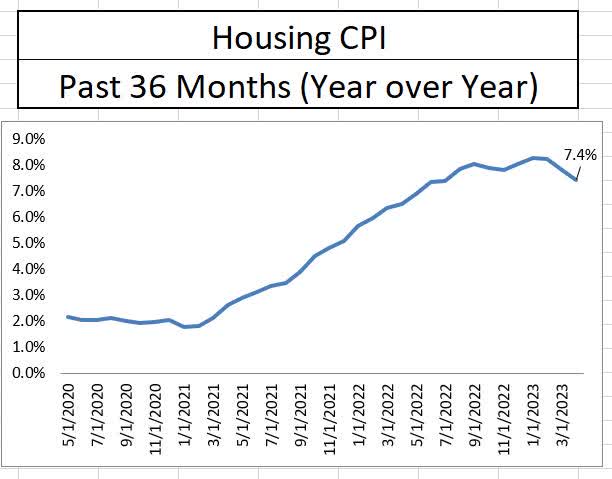

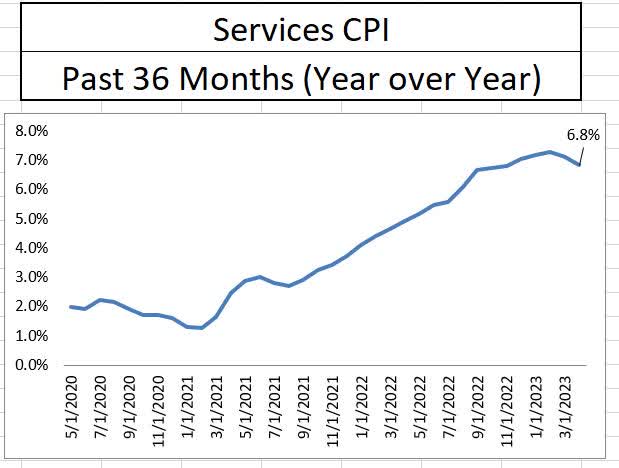

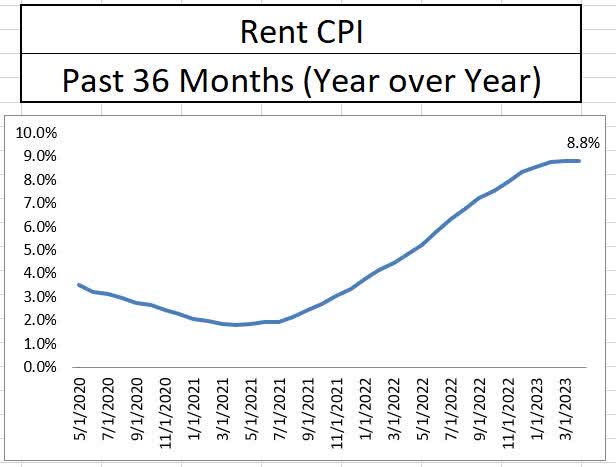

There are signs of disinflation building in the economy. First, the price index for housing and services have each pulled back. Housing has experienced a built-up shock over several months related to the increases in mortgage rates, but the price easing has come much slower than expected. Services are the stickiest segment in the inflation as their increases did not take hold until 2022. At 6.8%, service inflation has seen a healthy drop from 7.3% two months ago. Yet, rental inflation remains stubbornly high, logging its third consecutive month at 8.8%, a business cycle high.

Bureau of Labor Statistics Bureau of Labor Statistics Bureau of Labor Statistics

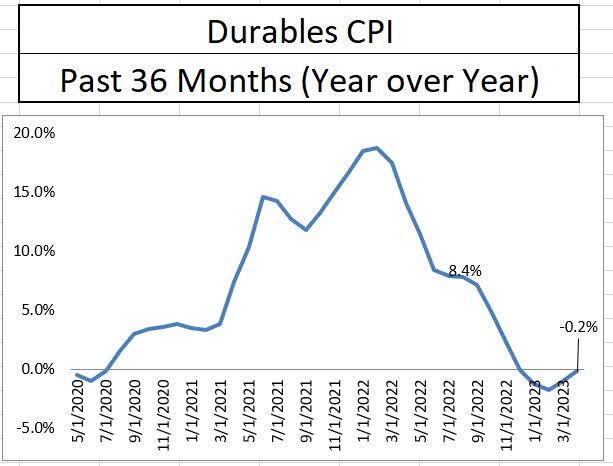

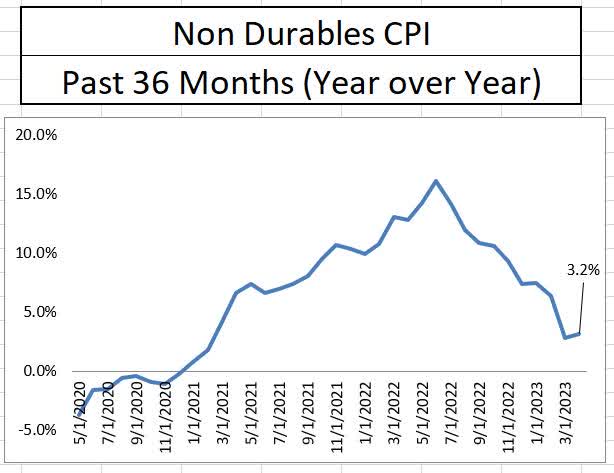

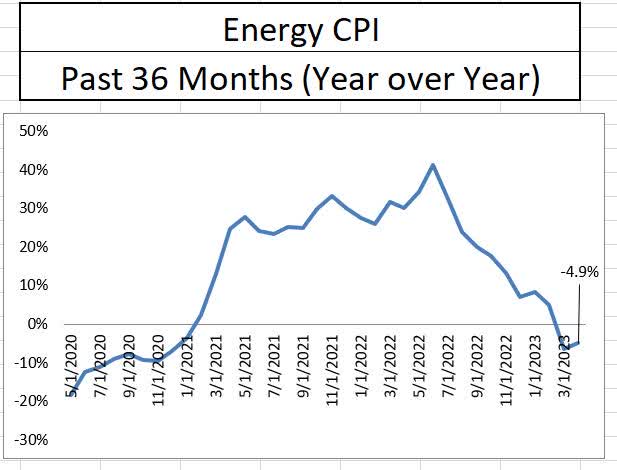

While the sectors that have represented the strongest push in inflation recently are starting to ease, the areas that provided the most disinflationary influence are beginning to reverse course upwards. Durable goods, which were the earliest inflationary pressure due to supply chain issues have been deflationary for the last five months, but in April, month-to-month durable goods inflation was a robust 0.8%. Non-durable goods ticked up 0.4% year over year to 3.2% and energy remained deflationary, but on its way up.

Bureau of Labor Statistics Bureau of Labor Statistics Bureau of Labor Statistics

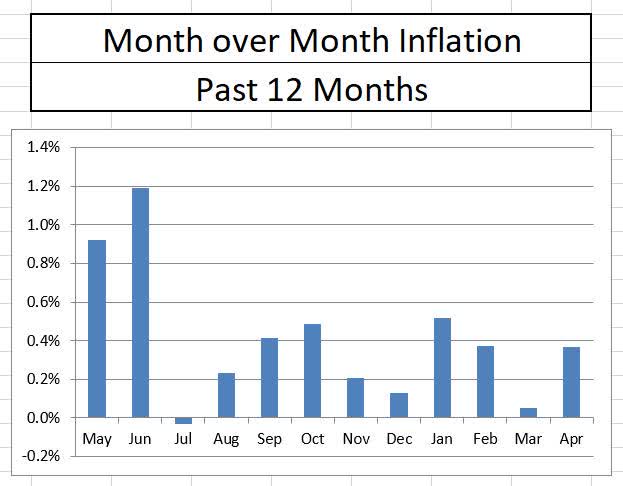

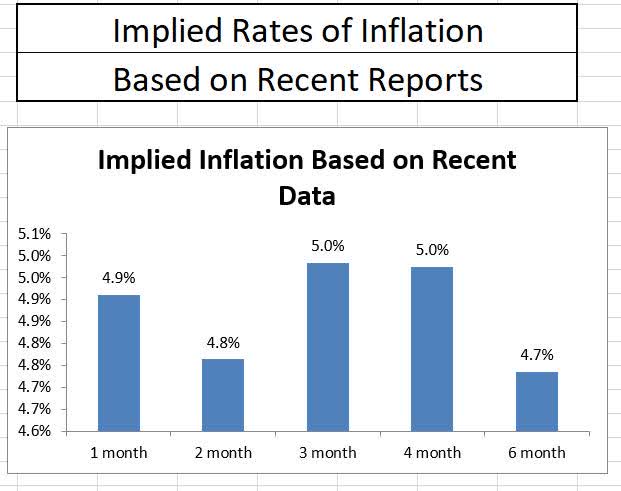

When looking forward to the next couple of inflation reports, there are signs of hope. The two largest month-over-month jumps in inflation occurred in May and June of last year. Each of these reports will roll off the year-over-year inflation calculation over the next two months, with hopes of bringing inflation down notably. Despite the promising signs, these reports only account for 16% of the total annual index and an analysis of the last six reports appears to show a floor building around 4.5%, meaning as inflation drops, it may take longer to achieve the next level of declines.

Bureau of Labor Statistics Bureau of Labor Statistics, Annualizing Month to Month Data

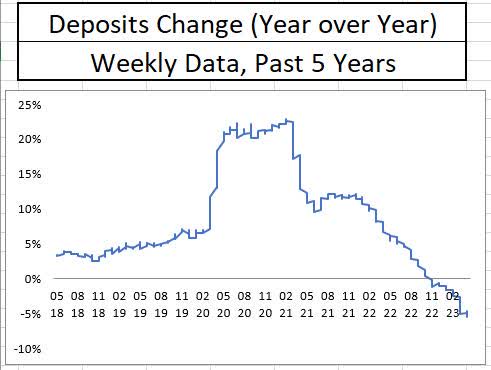

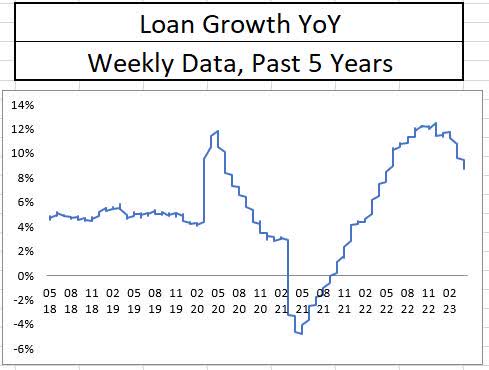

What’s concerning is that nothing in this report shows our economy heading to sub-4% inflation anytime this year, putting the Fed in a tough position when it comes to rate policy. It is becoming abundantly clear that credit has begun to tighten across the economy. The tightening of credit is a welcome sign by the Fed, but the pace of tightening could become problematic. If credit tightens at a faster pace than prices can stabilize, it will likely lead to a “credit event” hard landing (recession) to bring prices under control. Unfortunately, with the sharp decline in deposits and loan growth decelerating at a rapid pace, it appears that scenario is the one currently unfolding.

Federal Reserve, Asset and Liabilities of Commercial Banks Federal Reserve, Asset and Liabilities of Commercial Banks

I believe the current inflationary trends justify a pause in the Fed funds rate while we wait for further information regarding both prices and credit. Investors should be keen to the next two inflation reports. If inflation remains persistent, the chances of (and frankly the force of) a hard landing should bring volatility back to the stock market.

Credit: Source link