tumsasedgars

The Schwab U.S. Dividend Equity ETF™ (NYSEARCA:SCHD) has a lot going for it. However, there are some meaningful headwinds that face it moving forward that investors should be clear-eyed about. In this article, we will recap the bull thesis for SCHD while also providing an important warning to investors in the fund.

SCHD ETF Bull Thesis

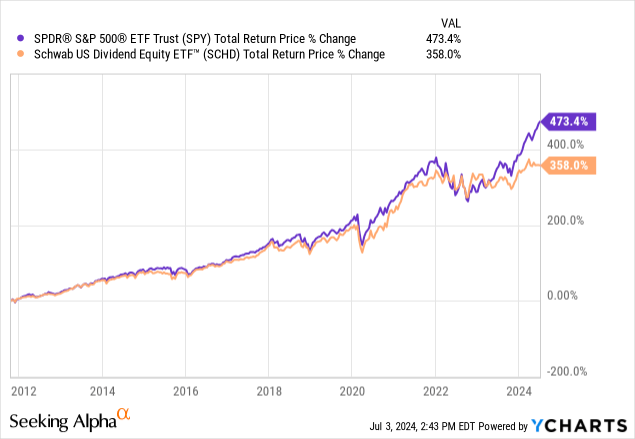

SCHD is one of the cheapest dividend ETFs you can buy, with a mere 0.06% expense ratio. Additionally, it has a very attractive dividend yield relative to the broader S&P 500 (SP500, SPY) as well as several of its other dividend growth ETF peers, with a 3.7% trailing 12-month yield. Moreover, over the long term, it has performed quite admirably on a total return basis, virtually matching the S&P 500 until recently, where the boom in the “Magnificent 7” fueled by the AI bonanza has pushed the S&P above SCHD’s total return performance.

Still, its total returns outperform many of its dividend growth peers, and anyone who bought it and held it for many years has done quite well, especially given the nice income they receive alongside it. This makes it a great fit for retirees who want to live off dividends, but also still generate very respectable long-term total returns.

Moreover, SCHD has a tremendous long-term dividend growth track record, having grown its dividend every year for 12 years in a row, boasting a 10-year dividend growth rate of 11% and a five-year dividend CAGR of nearly 13%. Finally, with the S&P 500 looking overvalued by virtually every metric right now, thanks in large part to the rich valuations of some of its largest mega-cap holdings, SCHD looks like a bargain by comparison.

SCHD ETF Warning

That being said, it’s not all sunshine and rainbows for SCHD right now, and investors need to have realistic expectations for the fund moving forward. First and foremost, with inflation moderating but still remaining quite sticky and the Federal Reserve continually stating that it is in no rush to cut rates, investors in SCHD should operate on the assumption that interest rates will remain higher for longer. This will likely pose a headwind for the dividend stocks SCHD focuses on, since many of them are viewed as bond proxies due to their high and stable yields. This, in turn, will likely weigh on price appreciation as well moving forward.

Additionally, SCHD has very little AI exposure as it has no major AI companies in its top ten holdings and has quite low technology exposure overall. This means that if AI continues to dominate markets moving forward, SCHD will very likely continue to lag from a total return perspective. Additionally, with tensions soaring between North Korea and South Korea, the threat of China invading Taiwan growing seemingly by the day, and Russia and Iran remaining actively engaged in conflicts in their respective regions, geopolitical risks are a major concern. Given that SCHD invests primarily in large American multinational corporations with very low exposure to precious metals, with only 1.8% exposure to basic materials, it has considerable risks if a war should break out, though perhaps its 3.97% position in Lockheed Martin (LMT) will help some.

Additionally, there are growing signs that the economy is weakening, with unemployment rising to about 4%, consumer sentiment and spending weakening, personal and corporate debt levels soaring, and credit conditions weakening, especially in the middle market sector, as Ares Capital Corporation’s (ARCC) CEO recently warned, and with the yield curve remaining sharply inverted, an economic downturn will still likely hit all stocks, including SCHD’s holdings. This is especially true given that about 40% of its portfolio is invested in consumer and industrial stocks.

Finally, investors should note that while its long-term dividend growth history is strong, recently its dividend growth rate has slowed somewhat, with its three-year dividend CAGR being 9% and its trailing 12-month dividend CAGR being 8.86%. While this is still well above the rate of inflation and combines nicely with its 3.7% trailing 12-month dividend yield to provide a compelling case for double-digit annualized total returns moving forward, it’s important to keep in mind that many of its top holdings are increasingly becoming slower-growing, mature stalwarts that will likely see their dividend growth rates slow moving forward.

For example, Verizon (VZ) is one of its top 10 holdings, occupying nearly 4% of its portfolio, and it’s not likely to grow its dividend at much more than a 1-2% annualized rate for the foreseeable future. United Parcel Service (UPS) is another dividend stalwart stock that has seen its dividend growth rate slow considerably over the past few years, with its three-year dividend CAGR being a whopping 17%, but its trailing 12-month dividend CAGR being a mere 5%. Its forward dividend per share growth outlook is an even more meager 2.35%. Coca-Cola (KO) is another top holding that has an impressive long-term dividend growth track record, but is likely to grow its dividend at less than 5% moving forward. Additionally, two of its top holdings, AbbVie (ABBV) and Amgen (AMGN), are both pharmaceutical stocks with inherently speculative business models due to the sensitivity of their dividend growth to their pipelines. Moreover, AbbVie is expected by analysts to grow at a sub-5% annualized rate moving forward. As a result, it would not surprise us to see SCHD’s overall dividend growth rate continue to decelerate into the mid-single digits moving forward, despite posting double-digit annualized dividend growth in its history.

Investor Takeaway

The takeaway from this is that we continue to like Schwab U.S. Dividend Equity ETF™ as a diversified passive income snowball for investors with a long time horizon who are not concerned about chasing the AI hype. It combines a solid current dividend yield with what is likely to be inflation-beating dividend growth for years to come.

However, investors in SCHD should do so with eyes wide open and realize that it could very well be a while before they enjoy any material total returns from stock price appreciation. They should also realize that they remain significantly exposed to geopolitical and macroeconomic risks while holding SCHD. Finally, they should not expect the fund to continue generating double-digit annualized dividend growth, though they should remain confident that it will continue to generate inflation-beating dividend growth for years to come.

Credit: Source link