Leamus/iStock via Getty Images

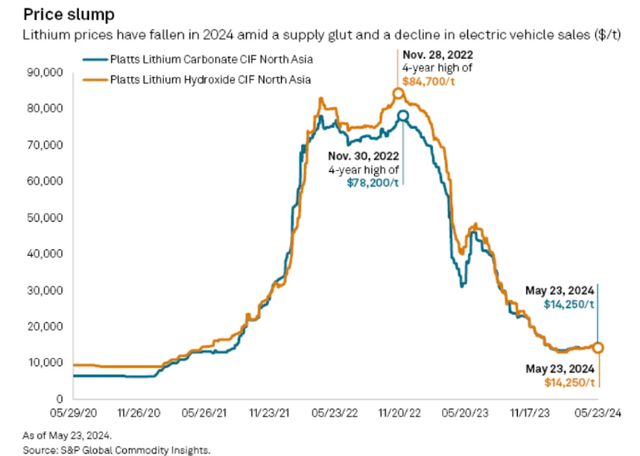

The story of Sigma Lithium Corporation (NASDAQ:SGML) began in 2012 with the company’s commitment to deliver clean lithium for electrification and technological battery material. The company’s share price has declined 68.37% [YoY] due to the volatile lithium price blows. As of May 2024, the price of metric tons of lithium carbonate and lithium hydroxide stood at $14,250, a decline of 81.8% and 83.2% respectively. November 2022 had seen both compounds reach peaks of $78,200 per metric ton and $84,700 per metric ton.

Carbon Credits

In this article, I explain why SGML is a hold as it seeks to support its valuation pending a sale of the company down the line. The company intends to raise its production capacity through 2024, given the rebounding of lithium prices.

Stable Quarter and Capacity Expansion

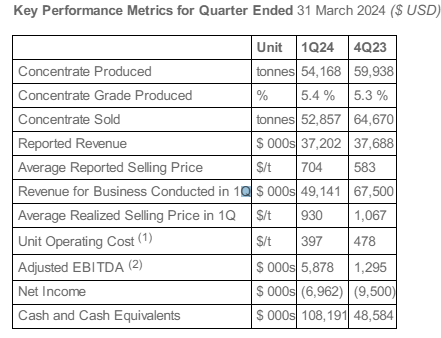

Sigma Lithium released its Q1 2024 financial report in May, indicating flat revenues of $37.2 million, almost at par with Q4 2023 revenues of $37.688 million. Despite the 1.29% [QoQ] decline in revenues, Sigma recorded a 20.75% increase in the average reported selling price (per ton) of lithium. This rise occurred despite the 18.27% [QoQ] decline in the amount of concentrate sold in Q1 2024.

Sigma Lithium Q1 2024 report

The company confirmed that it is in the process of commencing infrastructural builds in H2 2024 to increase its concentrate production. For instance, the “Quintuple Zero Green Lithium” project is set to rise almost 93% (YoY) to 520,000 tons per year from 270,000 tons per year. Sigma’s board also approved the Phase 2 project expansion of the Industrial Greentech Plant by 250,000 tons per year. Apart from the $100 million planned capital expense to support this project, the company also explained that it already has the environmental license to support the work.

While releasing the results, Sigma Lithium’s CEO Ana Cabral, stated,

During 2024, Sigma has delivered on several key milestones aimed at doubling industrial capacity by 2025. We made the final investment decision to initiate construction of a second Greentech plant, and we extended operational life to 25 years at Grota do Cirilo by increasing our audited proven and probable mineral reserve by 40%. Our entire team is focused on the execution of this industrial and mineral capacity expansion, repeating the success of Phase 1 by delivering this second stage of operational growth on time and within budget.

Sigma Lithium’s sales strategy

The year 2023 was rife with the imminent sale of SGML after the company indicated it was looking for potential buyers. However, in a recent interview, Sigma’s CEO stated that the current low lithium prices had put off the plans, with the company setting its eyes on expansion. The pullback in lithium prices had been caused by the slower adoption of electric vehicles that form the largest client base of the metal. While Sigma’s CEO also indicated an overproduction in China as a reason for the subdued prices, I believe the demand will continue to grow.

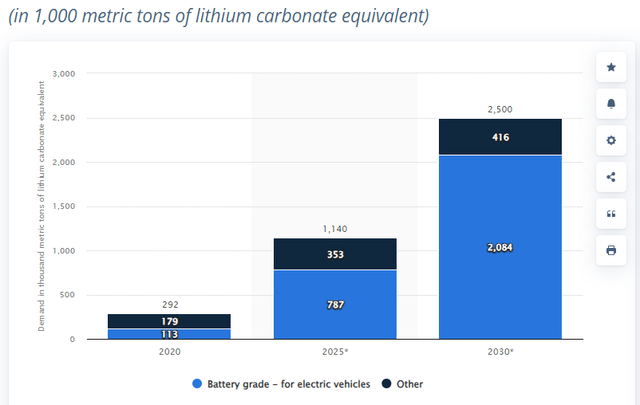

First of all, the current decarbonization efforts are not going away soon, with the sale of EVs set to reach up to an estimated 17 million in 2024 alone. Further, the demand for lithium is forecast to reach 2.5 million metric tons by 2030.

Statista

That said, Sigma Lithium’s Greentech lithium has paraded itself as a green resource that will make the company more attractive with its zero-carbon plan. The power used in the plant is “100% renewable as well as recycled water and dry-stacked tailings.” The overall goal of SGMLs is to enable the large-scale production of lithium, which will further drive down the cost of production.

In the prior sale consideration, SGML considered proposals from Chinese battery maker, CATL and Volkswagen. I believe CATL’s offer took the upper hand since, as we know, China has the highest share of EV market space. Still, we are looking at Sigma’s market capitalization of $1.40 billion, and it may be deduced that the company intends to increase the valuation before the sale. SGML’s expansion plan for its Phases 2 and 3 of the Grota do Cirilo mines.

We can also consider the inclusion of partners such as Glencore that serve as Sigma’s distributors of lithium that were not included in the deal. In October 2023, SGML announced that it had received a 50% prepayment for the 20,000 tons it had supplied from Glencore with the latter paying a premium pricing at 9% for the Lithium hydroxide (from its Triple Zero Green Lithium project) supplied at the London Metal Exchange (LME) in China, Japan and South Korea. Glencore is yet to pay the remaining 50% of the shipment, which may probably be finalized by the beginning of 2025. With these strategic assets, Sigma will be able to augment its valuation by integrating its potential for expansion.

As of January 2024, the Canadian SGML had raised the lithium estimates at the Grota do Cirilo by 27%, to at least 109 million tons hopefully by 2025. The expansion at Grota do Cirilo’s project seeks to add a further 22.2 million metric tons of lithium (representing a 40% increase in lithium deposits). In the Q1 2024 report, SGML clarified that it had managed to increase its proven and probable lithium reserves from 54.8 million tons to 77 million tons. I believe Sigma Lithium will maintain its low-cost operating model in phases 2 and 3 as it has been doing in Phase 1. Further, SGML has solidified its investment in Brazil which is the 5 th largest global producer of lithium, making it highly lucrative. All these factors taken into consideration will increase the company’s potential value before sale.

Valuation

SGML is trading slightly above $12 with a market cap of $1.4 billion and has lost almost 70% in the last 12 months. For its valuation, I will consider its P/E ratio as well as the enterprise value. The company’s forward price-to-earnings ratio is 28.07 against the industry average of 16.93 (giving off a difference of 65.78%). This metric indicates SGML is likely overvalued and we may see some downside. However, the situation may change with the increase in the price of lithium.

SGML’s cash balance is also at $108.08 million against a total debt of $204.92 million, bringing its enterprise value (EV) to about $1.50 billion. In its Q1 2024, the company reported “35.3% margins on pro forma EBITDA of $17.4 million and 15.8% margins on adjusted EBITDA of $5.9 million.” SGML’s forward EV/EBITDA stands at 13.47 against the industry average of 8.52. While this metric also shows the stock is slightly overvalued, it also brings in focus the impact of the company’s revaluation strategy that will increase its market standings. The value of the company stands to increase by more than 40% as per the company’s production strategy (since it is looking at upwards of more than 109 million tons in 2025).

Risk

SGML has about $108.08 million in cash. It has already planned for the expansion of the Phase 2 Greentech plant at a CapEx. The company does not have even money to cover the CapEx for this expansion as well as pay its debt of $204.92 million. It must also be remembered that the commercial production at the Greentech plant is expected to start in Q2 2025 with the engineering already in progress. I believe the company will need to utilize a huge part of its cash to meet this production deadline. The value of the stock will also be suppressed if the company opts for equity financing to raise CapEx.

Bottom Line

I have explained why Sigma Lithium is a hold, owing to its re-valuation strategy that involves production and sale increases of lithium. The company intends to expand its phase 2 project plan for the Greentech Plant to at least 520,000 tons per annum from 250,000 tons (an increase of more than 40%). Overall, it is projected that SGML will hit a production level of 109 million tons by 2025. The company is using 100% renewable power making it very attractive in the quest for carbon-zero production units. I have also considered the previous sale agreement that was abandoned after the company decided to focus on its expansion plan. I also believe that lithium prices will rebound as the demand for EVs grows on a global scale. Consequently, I have established that SGML is working to raise its potential valuation in tandem with the stabilization of lithium prices.

Credit: Source link