Alexey Bakharev

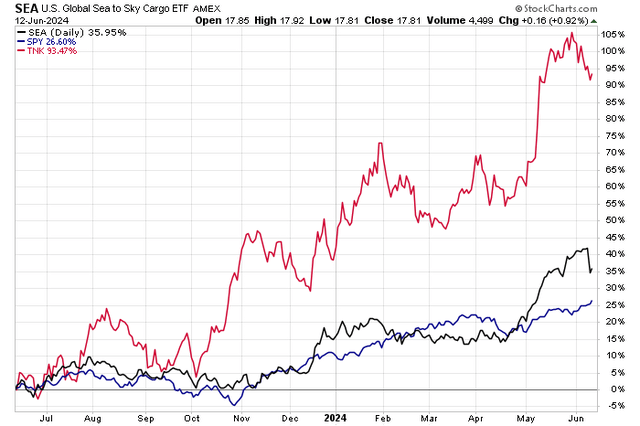

It’s hard to find niches of the global stock market that have outperformed the stout 1-year return on the S&P 500. While large-cap US equities, as measured by the S&P 500 Trust ETF (SPY) are up 27% from year-ago levels, one transportation-focused fund is higher by 36% with dividends included.

The US Global Sea to Sky Cargo ETF (SEA) has posted big performance gains despite the media’s spotlight continuing to be on AI and tech. One of the fund’s biggest positions, Teekay Tankers (NYSE:TNK), has led the way, up nearly 100% from June 2023.

I reiterate a buy rating on the stock, even after the major run-up. After positive balance sheet trends and continued strong EPS growth, I see a higher fair value for TNK compared to my previous analysis.

Global Transport Stocks & Shippers Outperforming the S&P 500 YoY

Stockcharts.com

According to Bank of America Global Research, Teekay Tankers is one of the world’s largest tanker owners and operators. It owns 53 mid-sized tanker vessels, and is a 50% joint-owner of one VLCC, charters-in 9, for an operational fleet of 54 tankers. The company owns a combination of Suezmax, Aframax, Product Tankers, support ships, and a 50% JV stake in one VLCC tanker.

Back in May, Teekay reported a solid set of quarterly numbers. Q1 non-GAAP EPS of $3.86 topped the Wall Street consensus estimate of $3.70 while revenue of $338 million, down 14% from the same period a year earlier, was a hefty $118 million beat. The company noted that its liquidity position was healthy at $692 million as of March 31, 2024.

The firm continued to benefit from a tight tanker market, leading to elevated spot rates and high ton-mile demand. Geopolitical conflicts also were supportive of industry pricing, and the management team anticipates higher demand for Aframax vessels with the Trans Mountain Pipelines having been commissioned.

While there was a modest dip in sequential Time Chart Equivalent (TCE) rates, net vessel revenue of $222 million was robust. Notably, the firm is now debt-free, according to BofA, as of the end of the first quarter after the repurchase of vessel sale-leasebacks. As a result, a $2 special dividend was issued.

Key risks for the company include volatility in the cyclical tanker and global transportation market, and oil production cuts that lower demand for the movement of oil around the globe.

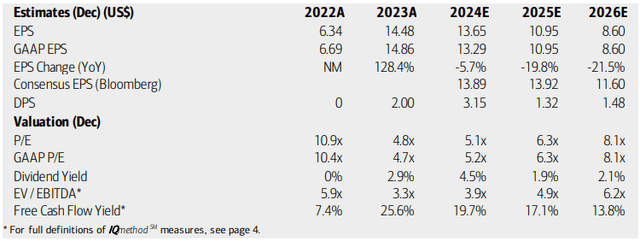

On the earnings outlook, analysts at BofA see EPS falling from peak levels notched last year, eventually dipping to under $9 by 2026. The consensus numbers, per Seeking Alpha, are more optimistic, though, with per-share operating earnings ranging from $13 to $14 from today through 2026. TNK’s top line is seen hovering around $800 million annually.

Dividends, meanwhile, are projected to be $1.32 in 2025, not inclusive of any special dividends, but I do suspect if cash flow is solid, the management team could issue another special payout, but that would likely not be for several more quarters. Still, free cash flow is extremely strong, at $16.90 million over the last 12 months, resulting in a 24% FCF yield looking back.

Teekay Tanker: Earnings, Dividend, Valuation, Free Cash Flow Forecasts

BofA Global Research

If we assume $13 of normalized non-GAAP EPS and apply the stock’s five-year average earnings multiple, then shares should trade near $95. But there is downside to the earnings view and with lackluster EPS growth ahead, bringing the multiple down is prudent. A six multiple would result in a fair value near $78 which is more appropriate in my view. High cash flow generation and a history of rewarding shareholders are upside considerations.

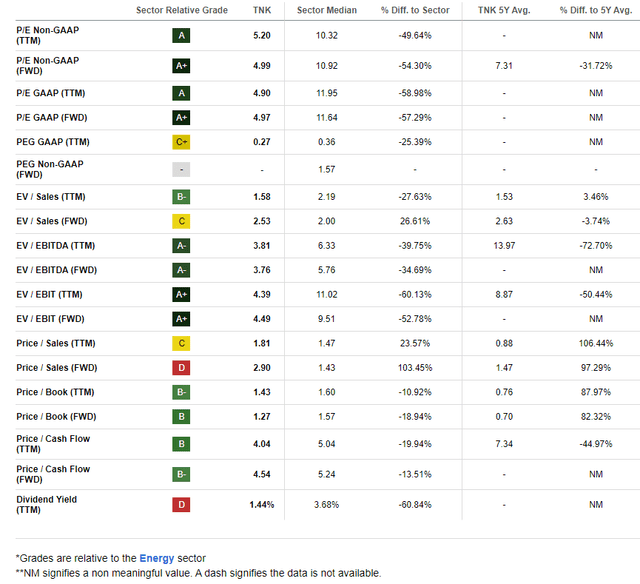

TNK: Still-Solid Valuation Multiples

Seeking Alpha

Compared to its peers, TNK sports a solid valuation grade while its growth trajectory is less impressive, and is the primary culprit for a subdued P/E. But the firm sports robust profitability trends and EPS revisions in the past 90 days have been decent, with three earnings upgrades compared with just a pair of downgrades.

Finally, share-price momentum has been stellar in the last several years, and I will note key price levels to monitor on the chart later in the article.

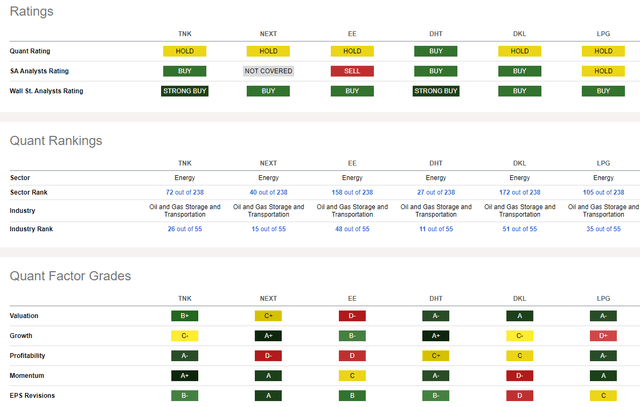

Competitor Analysis

Seeking Alpha

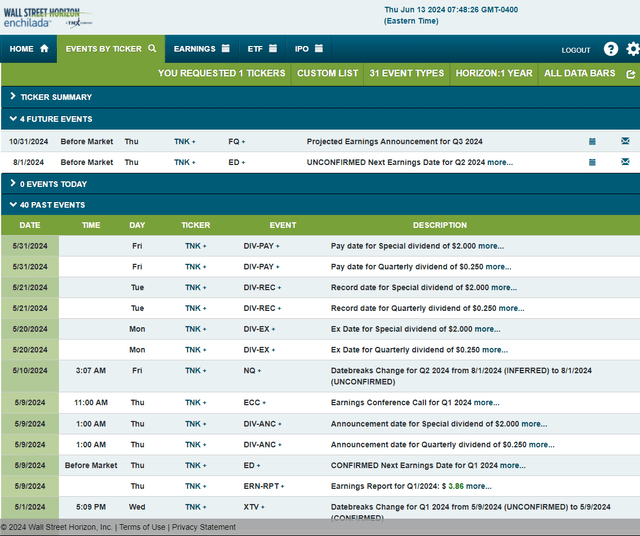

Looking ahead, corporate event data provided by Wall Street Horizon shows an unconfirmed Q2 2024 earnings date of Thursday, August 1 BMO. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

Wall Street Horizon

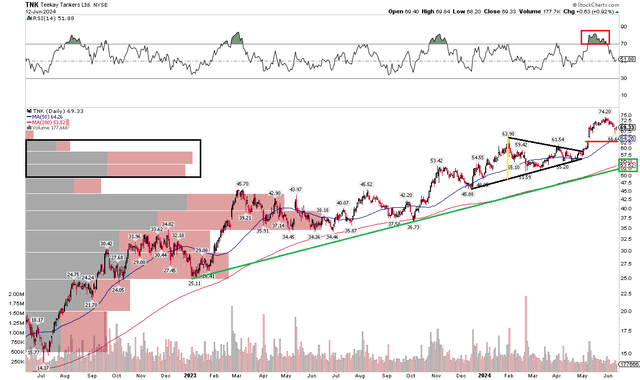

The Technical Take

TNK’s chart is very strong. Notice in the graph below that the log-scale chart reveals a solid uptrend going back to 2022. The long-term 200-day moving average remains positively sloped and is currently near where the uptrend support line comes into play. While TNK is below its Q2 peak, I see the dip as merely working off overbought conditions. There is the possibility of further weakness if price fills the earnings-related price gap just under the $65 mark.

I see support at the apex of a previous symmetrical triangle in the upper $50s, and that would represent a favorable buying opportunity from both a technical and fundamental perspective. Moreover, there’s a high amount of volume by price that is apparent in the low to mid $50s, which should be further support if a more protracted pullback occurs.

Overall, TNK’s trend has been powerful, and there are few indications that the stock’s bull run is over.

TNK: The Bull Run Persists, Shares Work Off Overbought Conditions

Stockcharts.com

The Bottom Line

I reiterate a buy rating on Teekay Tankers. With a strong tanker spot market, the firm’s solid balance sheet and free cash flow generation, and robust technicals, shares are still worth holding after a more than 60% climb from Q4 last year.

Credit: Source link