Shahid Jamil

Apple Inc. (NASDAQ:AAPL) trades today for around about $170 per share, giving it a market cap of roughly $2.7 trillion. I fully understand the law of large numbers, but I also still believe there’s a viable thesis to Apple stock gaining 30%+ over the next 3 years. I’d like to dig into that a little more.

The Lock-in

The Apple ecosystem is among the most cohesive and integrated product offerings in the technology sector. It often begins with an iPhone, followed by an iPad, an Apple Watch, and eventually an Apple TV. More recently, customers may have acquired an Apple credit card and even started depositing cash back into an Apple savings account for their next phone purchase.

This level of customer loyalty is what attracted Warren Buffett to invest in Apple in 2017, and the ecosystem has only grown stronger since then.

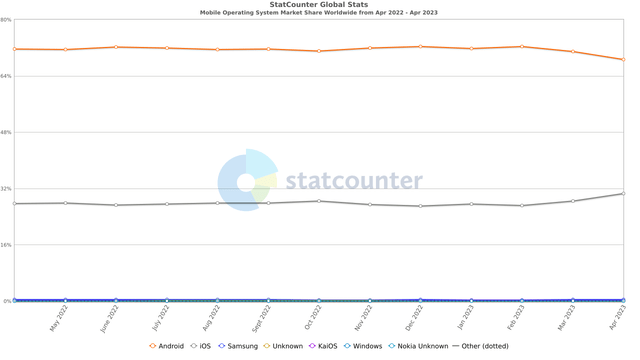

StatCounter Mobile OS Share (StatCounter)

Some critics might contend that the Apple brand has already established its customer base and those not currently using Apple products are unlikely to make the switch. However, recent data contradicts this assertion, with Apple capturing over 30% of the mobile OS market in the past month, and the trend showing signs of growth.

Services and Higher Margins

The growing number of users within the Apple ecosystem is driving an increase in services revenue. While this may not be surprising, it is a crucial component of Apple’s future growth.

In 2015, the company’s services sales amounted to less than $20 billion. This fiscal year, it is expected to reach $83-85 billion, representing a 5.5% growth. With gross margins between 70-71%, Apple’s services business will generate roughly $59 billion in gross income.

Is this a ground-breaking growth rate? No, but it is likely to continue without significant hindrance. This is because the existing customer base is stable, and as Apple’s services offerings improve, users are more likely to add new services rather than cancel existing ones.

To provide a balanced perspective, I would like to highlight a couple of concerns.

First, Apple is facing challenges in innovating within its service offerings. Apple Music struggles to compete with Spotify, while Apple TV has limited content that may lead cost-conscious customers to cancel and resubscribe as needed. Apple News and Fitness are niche products with numerous comparable alternatives available. Apple One, in my opinion, is priced too high and could be more appealing if reduced to $24.99 for the family plan, albeit with slightly lower margins.

Second, the App Store is a frequent target of regulators. Although Apple has maintained its 30% cut (15% in some cases), this situation may not last indefinitely. iOS 17 is expected to support sideloading, allowing users to install apps outside of the default store offerings.

The specifics of how sideloading will be implemented remain uncertain, but it is unlikely that Apple will make the process simple and straightforward. Furthermore, it is worth questioning how many consumers will actually go to the trouble of sideloading to save a few dollars on an app.

New Products

Apple has not introduced a completely new product in quite some time, but that is expected to change this year with the release of an AR/VR headset designed to compete directly with Meta Platforms, Inc.’s (META) Oculus offering.

Apple VR Headset (MacRumors)

As is typical with Apple, specific details about the product are scarce. However, we anticipate the headset will be unveiled at WWDC in June, feature mixed reality capabilities (both AR and VR), and carry a rumored price tag of around $3,000.

At $3,000, the product will likely appeal to a niche market during its first iteration. This has been the case for many of Apple’s previous offerings. The original iPhone, released in 2007, was ground-breaking, but it was the iPhone 3G, released a year later, that truly transformed Apple into the company we know today. The mixed-reality headset could follow a similar trajectory.

While the $3,000 price tag may be met with skepticism this holiday season, a second-generation headset could replace the Oculus under Christmas trees in 2024. This move may cannibalize some of Apple’s existing products, such as the iPad and Apple TV, but it also positions the company on a higher revenue trajectory.

Moreover, the technology developed for the headset will contribute to advancements and a better understanding of Apple Glasses, a futuristic product with the potential to eventually replace smartphones.

In summary, innovation is alive and well at Apple. The company’s focus on perfection before release, however, could be perceived as a drawback in some cases.

Buybacks & Cash Distributions

The effectiveness of Apple’s buyback strategy is a point of contention for investors. For those who have held the stock for an extended period, the buybacks are undoubtedly beneficial. However, for those observing from the outside, the question arises: “Why didn’t they invest that half-trillion dollars in new products?”

Regardless of the differing opinions, Apple and buybacks have become practically synonymous. The company reaffirmed this connection by announcing a $90 billion program during its Q2 earnings release.

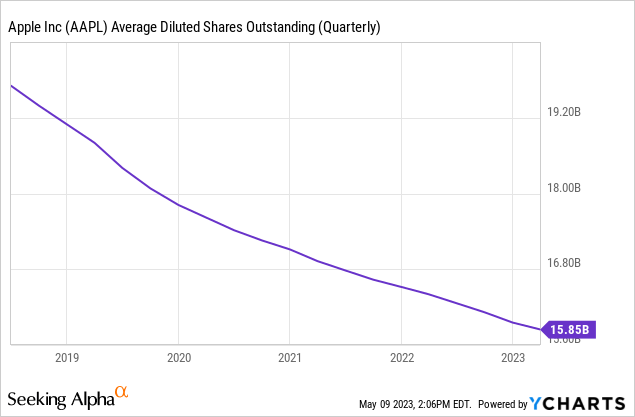

In the past five years, Apple has retired over 4 billion shares, representing a value of over $700 billion at today’s prices. This impressive accomplishment shows no signs of slowing down.

Is the current stock price too high for buybacks? Perhaps. Critics argue that the buybacks are occurring at inflated prices. However, it is worth noting that these skeptics have been making similar claims for years, and hopefully, they haven’t been shorting the stock with their own money.

Apple’s buyback program is expected to contribute approximately 3% of growth in the coming years. Coupled with expanding margins and a growing top line, this strategy could lead the stock price to reach $225.

The Path to $225

There are several key factors that could propel Apple’s stock price to $225 per share. Although the journey may be challenging, investors can find solace in the fact that they are holding one of the safest names in the market. Apple is so influential that it constitutes over 7% of the S&P 500’s weighting.

The first component is the ongoing reduction in outstanding shares. With approximately 15.9 billion shares currently outstanding, Apple aims to reduce that number to around 15 billion over the next three years. This move alone would increase the stock price to roughly $187, assuming all other factors remain constant.

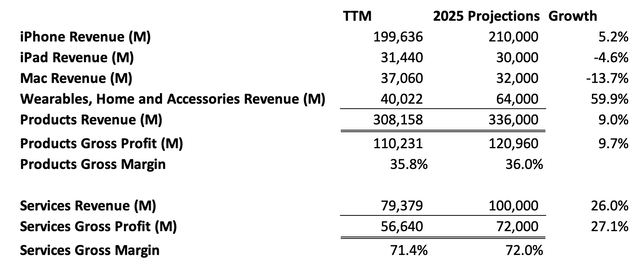

The second component is growth in top-line revenues, with services playing a crucial role. As Apple continues to expand its services division, the introduction of AR/VR technology will create new service opportunities. It is not unreasonable to expect services to become a $100 billion revenue business by FY2025, given a 5.5% growth rate this year, followed by 9% in each of the next two years. With a 72% gross margin, this amounts to $72 billion in gross profit.

Predicting AR/VR sales is more challenging, but it is unlikely that this new product will cannibalize any of Apple’s existing markets. In fact, it could increase service sales and potentially boost Apple Watch sales through fitness features.

A recent leak revealed that Meta has sold 20 million Quest headsets, suggesting that Apple may face stiff competition. However, Apple has a track record of dominating markets (e.g., Watch, AirPods, iPad, and iPhone). Despite the projected $3,000 price tag, Apple’s loyal customer base could help the company sell 2 million units in the first year, generating $6 billion in revenue. Taking cues from Apple Watch’s growth, which increased by 80% and 77% in its second and third years, respectively, Apple could sell approximately 6.3 million headsets in FY25 at an average price of $3,000, yielding ~$18.9 billion in revenue. With an estimated 35% gross margin on Apple products, this translates to an additional $3.5 billion in gross income, which is likely a conservative estimate.

Combining all these factors, we can envision a scenario where Apple’s various product lines maintain their current growth trajectory:

- Mac sales decrease from $40B in 2022 to $32B in 2025

- iPad sales remain relatively flat at $30B in 2025

- iPhone sales experience a slight increase, growing to $210B from $205B last year

- Wearables, including the AR/VR headset, evolve into a $64B business, up from around $41B today

- Services expand to $100B, up from approximately $80B today.

Author’s model (Author)

In this scenario, product sales would generate $336 billion annually, and services would contribute another $100 billion. This results in $192 billion in gross income and $112 billion in net income.

Although using a 30x price-to-earnings (P/E) multiple might seem aggressive, Apple has maintained an average multiple of 30x in recent years. Assuming this growth continues and the share count decreases, it is unlikely that the multiple will contract. Applying the 30x multiple yields a market capitalization of $3.35 trillion. With 14.9 billion shares outstanding, the stock price would reach $225 per share.

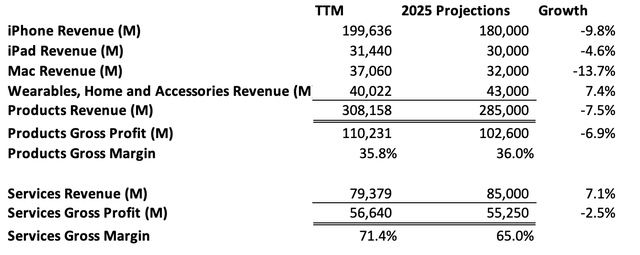

Or… The Path To $120

In an alternative scenario, Apple could face challenges such as shrinking revenue, a disappointing VR product launch, and contracting margins as the company’s popularity wanes.

In this less optimistic scenario, Apple might experience:

- Slower services growth, reaching only $85B by FY25

- Reduced services gross profits at 65%

- A wearables division that experiences modest growth to $43B due to underwhelming VR/AR performance

- Declining iPhone sales, dropping to $180B.

Author’s “Bad” Apple Model (Author)

Under these conditions, Apple Inc. would generate $285B in product revenue. With smaller margins, this would amount to $94B in gross profits and a net income of $82B. Share buybacks would still occur, so the same 14.9B share count remains appropriate. Applying a 22x multiple in this scenario would result in a stock price of $121 per share.

Conclusion

Apple Inc. commands a premium in the market due to its defensive nature. It is a stable company with the potential for significant future revenue growth, as outlined in the conservative 2025 vision above.

This vision assumes a substantially shrinking Mac base, flat iPad sales, flat wearables (excluding new products), and relatively stable iPhone sales. There may be debates surrounding the 30x price multiple, but if Apple achieves these targets, it could easily maintain such a multiple.

For those who are skeptical or concerned about broader economic factors negatively impacting Apple, consider selling put options in the $140-150 range. At the moment, a ~$2 premium can be obtained on the August 18th expiries.

The alternative, less optimistic vision is presented to demonstrate that even if things go awry in multiple areas, the downside risk for Apple Inc. appears to be around 30%.

Credit: Source link