Justin Paget

First Solar (NASDAQ:FSLR) has long been a stalwart in the notoriously volatile solar industry. Despite the never-ending price wars in solar panel manufacturing, First Solar has been able to build a rock solid balance sheet over the past decade. Meanwhile, competitors have either gone bankrupt or experienced razor-thin to non-existent margins at best during the same period.

First Solar’s investments in the relatively niche cadmium telluride technology and focus on maintaining healthy financials have allowed the company to differentiate itself from a sea of crystalline silicon module manufacturers pricing themselves to bankruptcy. Increasingly strict tariffs on Chinese manufacturers have only bolstered First Solar’s increasingly dominant position in the US solar industry.

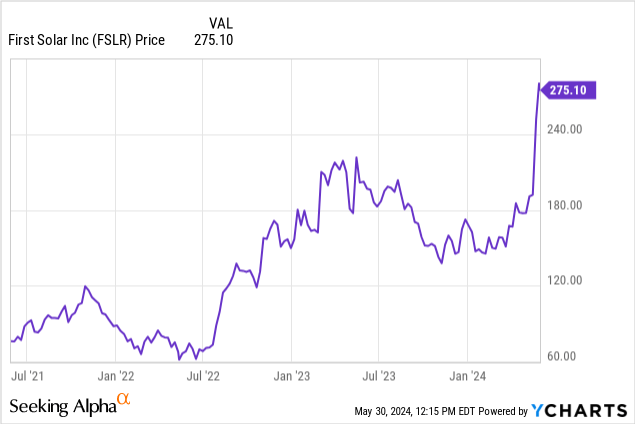

First Solar has seen its shares skyrocket in recent years.

Resurgence Comes at a Perfect Time

First Solar’s resurgence coincides with the rise of LLMs (Large Language Models). As the compute needed to power LLMs continues to rise at an exponential rate, the looming energy bottleneck is becoming an increasingly large concern for those at the forefront of the AI industry like Microsoft (MSFT) and Google (GOOGL). Solar PV is an ideal solution to address this growing concern.

Increasingly large AI-driven data center buildouts require cheap energy generation in order to remain cost competitive on the training and inference front. The growing energy demands of AI driven data centers is largely a result of the exponential increase in compute needed for linear parameter count growth. For instance, a 10x increase in parameter count requires approximately a 100x increase in compute power. This means that the arms race towards larger models translates into an exponential growth curve for energy demand.

Solar PV has now become more cost competitive than even coal and gas in an increasingly large number of areas. This makes utility-scale solar PV an ideal solution to meet the growing energy demands of AI pure plays like OpenAI and hyperscalers alike. First Solar is incredibly well-positioned to meet these growing energy demands, especially considering the fact that the company is far better capitalized than competitors in the US. Moreover, the AI companies running frontier models and the hyperscalers backing them are mostly located in the US, putting First Solar in an even better position.

Cadmium Telluride Perfect for Utility-Scale Demand

First Solar has proven that its Cadmium Telluride panels are more cost-competitive than its crystalline silicon counterparts when it comes to utility-scale projects, specifically in the US. In fact, many crystalline silicon manufacturers in the US have gone bankrupt or are on the verge of bankruptcy. While crystalline silicon panels coming from China are far cheaper, they are being subjected to increasing US tariffs.

Cadmium Telluride solar panels have proven to be more durable, which is a big advantage when considering many utility-scale solar projects are built in deserts. First Solar also has more resources to invest in research and development than the vast majority of crystalline silicon manufacturers, especially those headquartered in the US. This means that cadmium telluride will likely become increasingly cost-competitive.

Moreover, First Solar is a huge beneficiary of US government policies to bolster the renewable industry. While crystalline silicon panels still make up for a huge percentage of utility-scale solar buildouts in the US, many of these panels are directly shipped from China, or are manufactured in the US by Chinese companies. As such, First Solar oftentimes benefits disproportionately from US policies favorable to the domestic solar industry.

First Solar’s cadmium telluride technology is perfect for utility-scale solar projects needed for growing data center energy demand.

First Solar

Capitalizing on Strong Balance Sheet

First Solar arguably has the strongest balance sheet in the entire industry. The company has a net cash balance of $1.4 billion and a whopping backlog of 78.3 GW. While the company’s Q1 net sales of $794 decreased slightly from the previous quarter, this can be attributed to seasonal reductions in panel sales. The company’s healthy balance sheet should allow it to drive growth and capitalize on the AI energy boom.

First Solar’s only real competitors at the utility-scale are Chinese manufacturers, which are currently facing their own massive issues as a result of tariffs and supply gluts. This puts First Solar in a unique position as one of the few domestic solar companies capable of meeting the growing energy demands of increasingly large data centers.

According to Wells Fargo, AI data centers will require ~323 TW of energy, which will represent ~8% of total US electricity generation by 2030. Solar PV will be one of the few technologies that will be able to meet this demand, and First Solar is one of the few domestic manufacturers that is capable of deploying utility-scale projects at scale.

Risks Remain

First Solar is incredibly well-positioned in a resurgent domestic solar industry. However, much still has to go right in order for First Solar to outperform the market. Much of the bull thesis surrounding First Solar is its viability as an AI play, specifically on the energy side. If model performance starts to plateau, as we are already starting to witness in many domains, the AI industry as a whole could witness a significant pull back on data center expansions.

In addition, the debate has not been settled on whether or not Cadmium Telluride will be competitive with traditional solar technologies like crystalline silicon in the long-run. Even if First Solar is able to overcome these hurdles in the near-term, the scarcity of tellurium could pose a major bottleneck to the company’s growth.

Conclusion

First Solar has emerged as a clear winner in a resurgent domestic solar industry. The company still has more room to grow at its current valuation of ~$30 billion and forward PE ratio of 29. The company has a number of strong tailwinds, including favorable domestic policies, increasingly cost-competitive technology, and growing AI data center energy demand.

Credit: Source link