NicoElNino/iStock via Getty Images

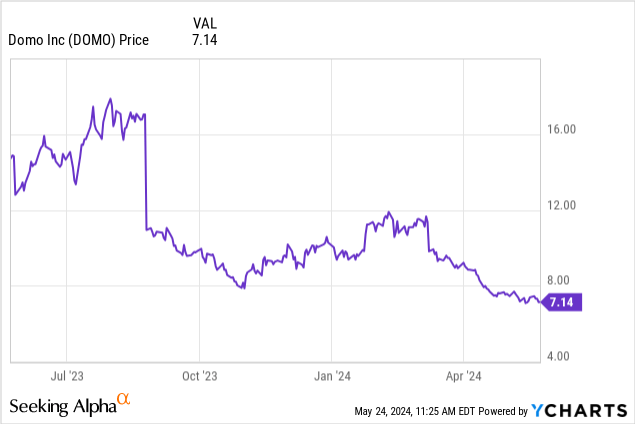

Once a tech stock gets dumped in the “penalty box,” it’s tough to get out. Domo, Inc. (NASDAQ:DOMO) is a leading example of this. The business intelligence software company was way more popular as a tech unicorn than as a public company. Over the past few years, struggling with competition and weakening demand, the stock has wiped out billions of dollars in market value.

Year to date, shares of Domo have fallen nearly 30%. A poor showing in the company’s recent Q1 earnings release (plus the fact that the company notably did not update its full-year outlook) sparked a fresh drop as well. The question for investors now is: can Domo rebound?

I last wrote a bearish note on Domo in March, when the stock was trading closer to $10 per share. Since then, the company has released Q1 results that essentially continued all the same issues Domo has been struggling with: lack of growth and low retention rates. But at the same time, the stock’s sharp drop from the $10 levels, in my view, already compensates for much of this downside risk. With this factored in, I no longer think there’s substantial downside left for Domo for the remainder of the year, and am now neutral on the name.

A couple of positive factors to note here:

- Domo notes that consumption customers have higher retention rates than subscription customers. Domo’s primary strategy for reversing its decline is to push its consumption-based billing model, which it says lowers barriers to entry for new adopters and also helps existing customers choose to downgrade their usage instead of simply exit Domo entirely.

- There’s still a chance Domo gets acquired. Management was pressured on the potential for a sale on the Q1 earnings call. CEO/Founder Josh James waffled on this topic, but the truth is that Domo may make more sense as a subsidiary to a larger, and better-funded software company that needs a BI product.

That being said, there are still a plethora of risks to consider:

- Billings and revenue are no longer growing. BI is “nice to have,” but not a “must have.” In this environment, where IT budgets are being cut, Domo implementations and deal closings are likely to get delayed, and in this time of weakness, larger players like Tableau/Salesforce and Microsoft Power BI, which are packaged as part of other “mission-critical” software products, may prevail.

- Software companies that can’t grow also can’t become profitable. In fact, we’re started to see margin deleverage. Cost cuts can only do so much, but Domo’s lack of top-line growth will rob it of the economies of scale it needs to hit profitability.

- Domo has limited liquidity and more debt than cash. An unexpected downturn in new deals or a sharp decline in renewals may put Domo into a pinch if it is forced to raise additional capital. Equity capital will be dilutive for Domo in this market as its stock sits well below pandemic-era highs, and debt capital will come at a huge interest cost that Domo may not be able to handle.

The main reason for my neutral assessment on Domo is valuation. At current share prices near $7, Domo trades at a market cap of $273.0 million; and after we net off the $61.1 million of cash and $114.1 million of debt on the company’s most recent balance sheet, Domo’s resulting enterprise value is $353.0 million.

Domo has withdrawn its full-year outlook (previously at $315-$323 million in revenue, or flat at the midpoint). Consensus is still targeting $319.3 million in revenue for the current year (+0% y/y), and $329.8 million in revenue in FY25, putting the company’s valuation multiples at:

- 1.1x EV/FY24 revenue

- 1.0x EV/FY25 revenue.

I find it difficult to imagine that Domo would simply disappear and implode rather than being sold strategically if it continued to flounder, hence why I think the stock has hit a near-term floor. I don’t think there’s much upside here (even in the case of an acquisition, I doubt the company has enough bargaining power to attain any sort of premium), so I wouldn’t risk a long-term hold here either.

Q1 download

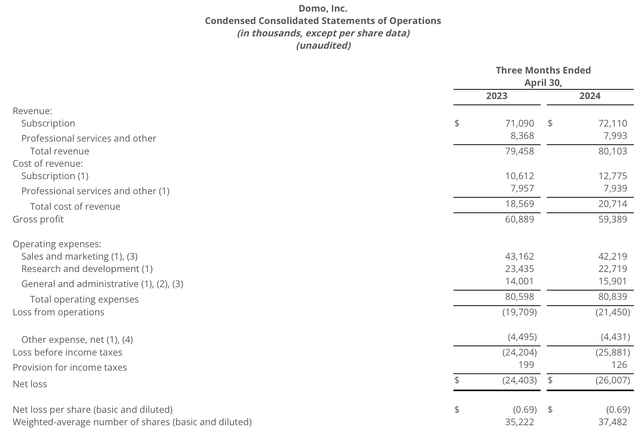

Let’s now go through Domo’s latest quarterly results in greater detail. The Q1 earnings summary is shown below:

Domo Q1 results (Domo Q1 earnings release)

Domo’s revenue grew just 1% y/y to $80.1 million, ever so slightly ahead of Wall Street’s expectations of $79.5 million (flat y/y) and matching last quarter’s 1% y/y growth pace.

Again, the company is pinning all of its hopes on consumption customers, which it notes had a 115% net revenue retention rate in the quarter (this metric may be biased toward smaller customers that didn’t have much of an existing revenue base to expand from). The company notes that its sample size of the consumption customer cohort will triple in Q2, so we’ll get a better and more stable read on how this business model is performing.

Management believes that this transition will help to reduce churn. Per CEO Josh James’ remarks on the Q1 earnings call:

Diving into consumption. Several years ago, we noticed that the relationships with some of our customers were as strong as we wanted them to be. We were having trouble getting in front of the CIO and had competitors and other departments also signing big contracts. As a result, we sometimes found ourselves stuck in a single use case. And even when customers wanted to try to expand to other use cases, the permissions required internally for our customers on a seat-based model made it difficult to do so. It limited our ability to spread virally and impeded our growth. This made it clear that something needed to change, which is why we began exploring a consumption model […]

Over the last three quarters, we had 16 renewals over $1 million, of which we lost to and had varying degrees of down sales at seven. Of the remaining seven, we either retained or expanded our relationship. For the losses and down sells, the common theme was being vulnerable to budget cuts and tech consolidation because we were only being utilized for a single use case or lacking wall-to-wall adoption. As we’ve said numerous times, getting more customers to embrace demo for multiple use cases with ELAs is the only model to move forward with. Unfortunately, we didn’t get this model implemented soon enough to mitigate some of the churn we’ve experienced. But it’s in place now.”

Driven by these improvements, the company expects gross retention rates to improve to 87-88% in Q2, up from 83% in Q1.

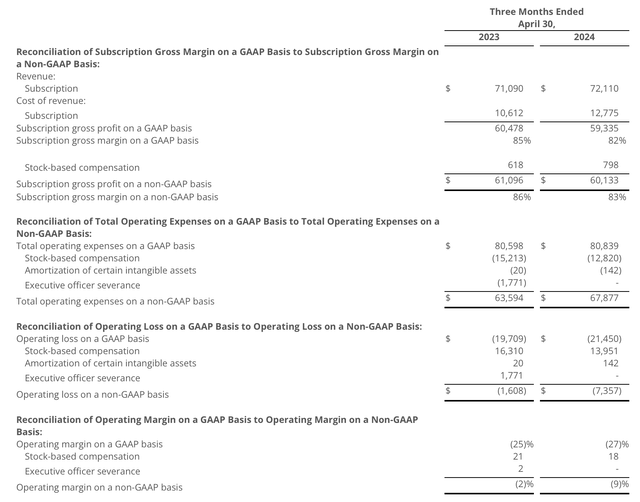

On the profitability side, however, there’s bad news at hand. As shown in the chart below, pro forma operating margin losses widened to -9%, from -2% in the year-ago Q1.

Domo margins (Domo Q1 earnings release)

In Q4, pro forma operating margins had been positive at +4% and improving y/y. The downside in Q1 was driven by a tough compare from the company’s annual customer conference, Domopalooza, which returned to an in-person format this year versus a virtual gathering in the prior year. We hope this is an anomaly that will self-correct in the remainder of this year, especially because Domo has precious little liquidity to work with.

Key takeaways

There’s no doubt that Domo, Inc. is in a tenuous situation currently, but its share price at ~1x revenue already reflects its struggles, in my view. From here on out, I think Domo, Inc. stock will be range-bound in the $7-$8 range. Domo makes for a great spectator sport, but I’m not confident enough in this stock to dive in.

Credit: Source link