Frazer Harrison

Lions Gate Entertainment (NYSE:LGF.A, NYSE:LGF.B) is a North American entertainment company with operations in films, television production, interactive activity and streaming products through its flagship ‘Starz’ brand.

The company has recorded TTM revenues to the tune of $3.70bn alongside a net income of -2.02bn.

Introduction

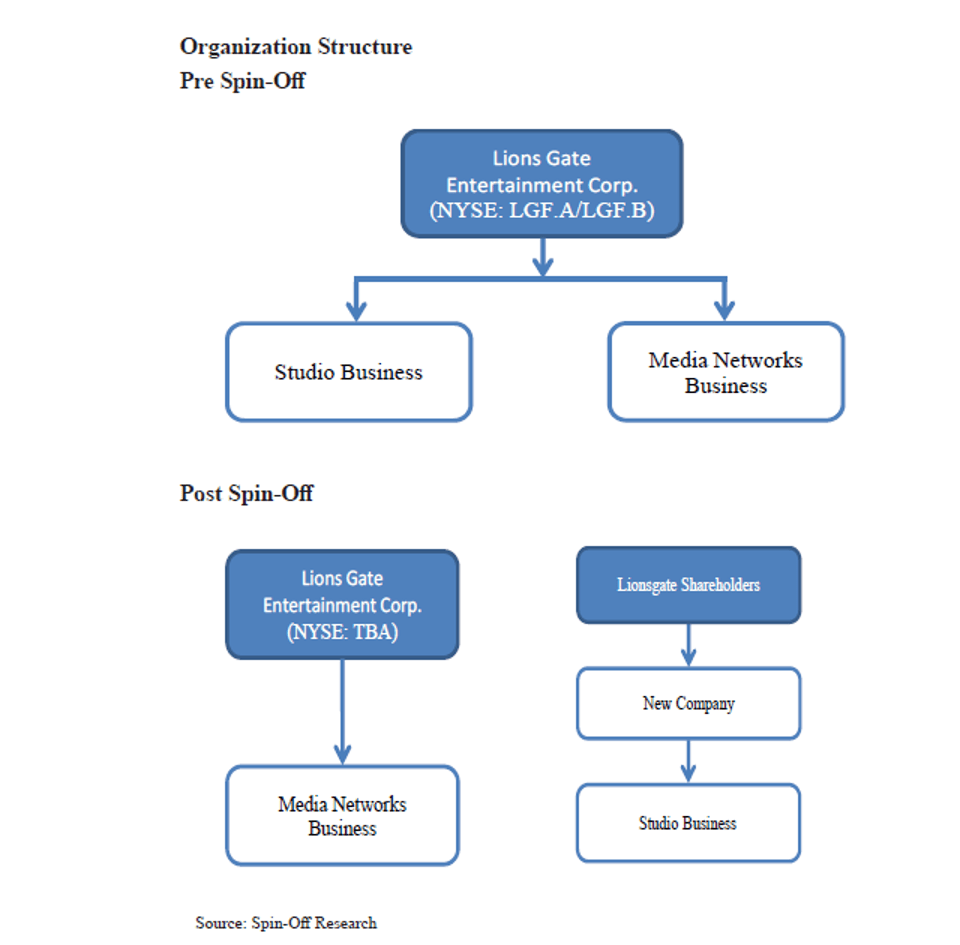

In the past quarter, Lions Gate illustrated a corporate strategy centred around the divestment and split of the entertainment company into two; Lions Gate would then be a movie-centric Studio Business and a streaming and television-centred Media Networks Business. This would enable a level of specialization, reducing overhead and ideally supporting increased content quality.

Lions Gate To Spin-Off Its Studio Business In September 2023 (Forbes)

As of current, Lions Gate’s revenues can be segmented into the following verticals; in the third quarter of 2023 (as Lions Gate defines Q1 2023 to Q3), Media Networks recorded $380.3mn in revenues, contrasted with Studio Business revenues of $894.2mn.

Valuation & Financials

General Overview

In the trailing twelve-month period, Lions Gate Entertainment (-19.14%) has experienced significantly poorer performance to both the broad market, represented by the SPY (-0.29%) and the Entertainment and Leisure Index, represented by Invesco’s PEJ ETF (-4.04%).

This is reflective of the company’s poor financial performance, with record declines in net incomes and free cash flow- in spite of a recovery theme from COVID-19.

Comparable Companies

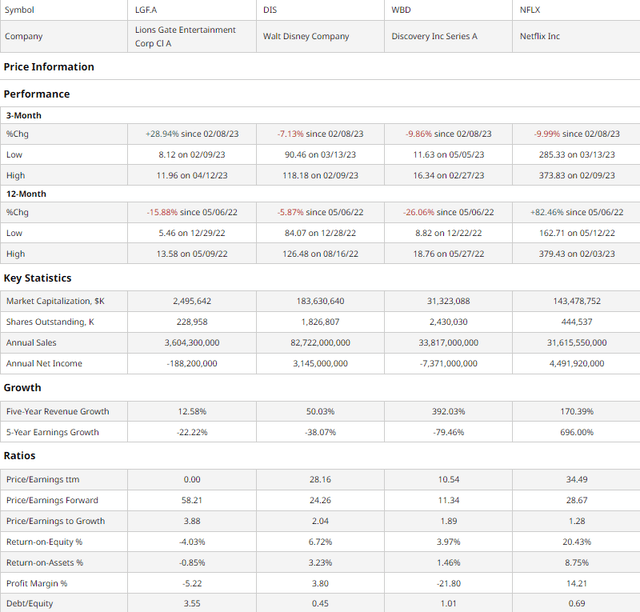

Although Lions Gate operates on a relatively small scale, similarly sized firms such as A23 and STX tend to be privately held; as such, production companies such as Warner Bros. Discovery (WBD) and Disney (DIS) and streaming-centred firms such as Netflix (NFLX) offer the best multiples-basis evaluations.

barchart.com

As demonstrated above, in terms of TTM price performance, Lions Gate is the poorest performer bar WBD, though WBD is undergoing a much more transformational period, with greater volatility thus being implied.

Moreover, Lions Gate’s subpar financial performance lowers the company’s value on a multiples basis, leading to a forward P/E poorer than all comparable companies at 58.21.

Said financial deficiencies are further emphasized by the lowest ROE and ROA and higher debt/equity ratio by far.

Valuation & Potential Acquisition Cost

According to my discounted cash flow model, at its base case, Lions Gate is undervalued by 23%, with its fair value being $14.18, up from $10.89 today.

My DCF was estimated over 5 years, without perpetual growth. Due to the company’s debt-heavy cap structure, I assumed a discount rate of 11%. However, in spite of Lions Gate’s poor current performance, I expect the firm to slowly revert to its original net margins of ~2-5%, driven by improved capital management and streamlined content distribution strategies.

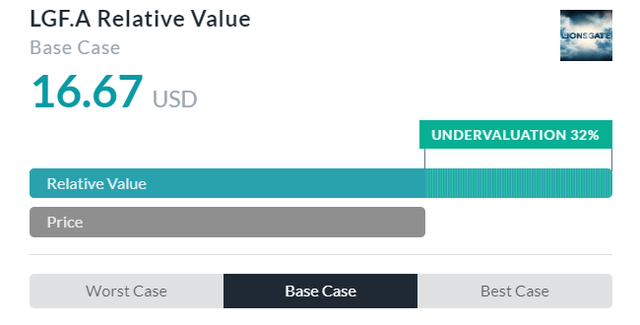

AlphaSpread

AlphaSpread’s relative valuation tools corroborate my theory of undervaluation, with the tool calculating a fair price, at its base case, of $16.67, meaning the company is currently undervalued by 32%.

Thus, averaging out my DCF and AlphaSpread’s relative valuation, Lions Gate’s fair value is $15.43, with the company currently undervalued by 27.5%.

Applying a benchmark acquisition cost at an EV of $4.37bn (as derived from TradingView), a buyer would be buying at a discount of nearly $2bn and would require a premium of 77.6% (calculated by taking the delta between EV and market cap and dividing by market cap) to payout investors at a fair EV value.

As such, in a potential acquisition, investors can expect a healthy upside.

High Potential Buyout Target

Now that we’ve established that shareholders can expect a sizeable premium and that potential buyers for the firm can purchase it for relatively cheap, let’s look at the operational advantages M&A involving Lions Gate can yield.

Lions Gate’s financial situation serves as a microcosm of the wider entertainment industry landscape; the company has experienced sequential declines in total global subscribers to STARZ and Lionsgate+ platforms, down to 37.2mn users. On the flip side, Lions Gate’s Studio Business segment profit increased by 25% from 2022 Q1 to 2023 Q1. This reflects a wider saturation of the streaming industry while demonstrating how, with its Studio Business, Lions Gate maintains a much-desired content library.

IndieWire

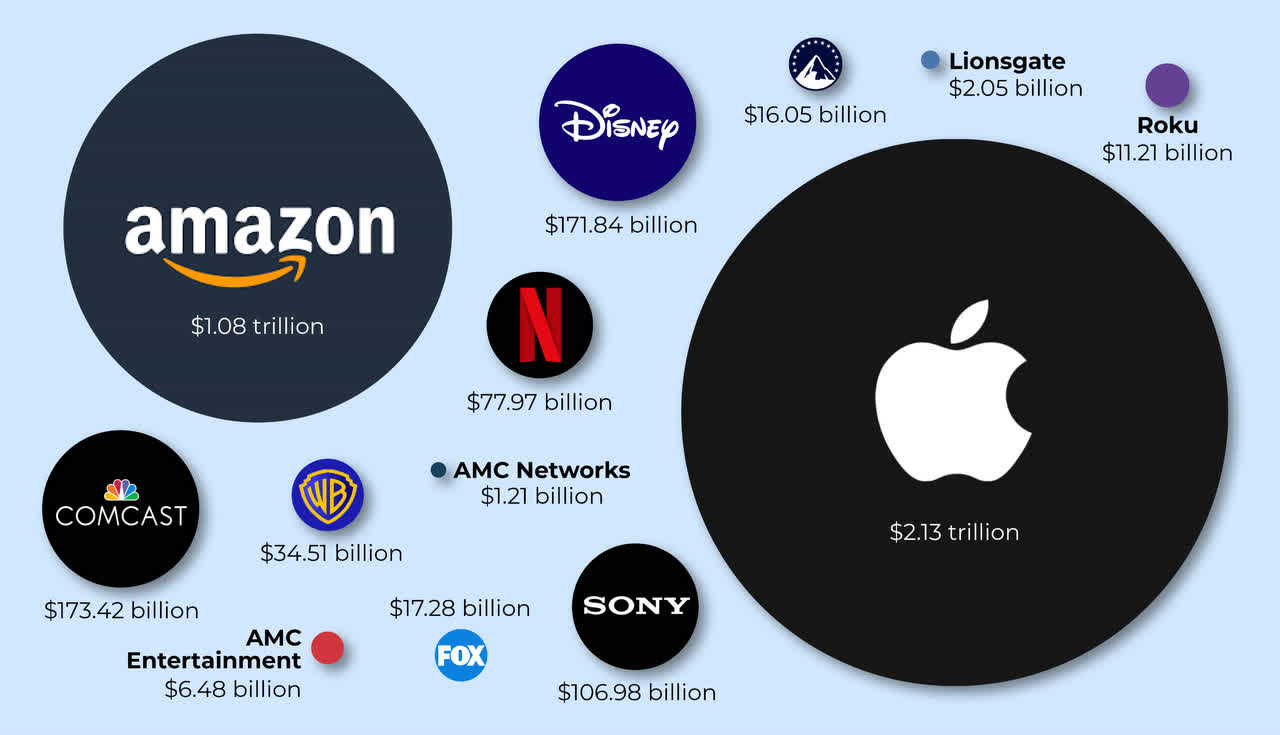

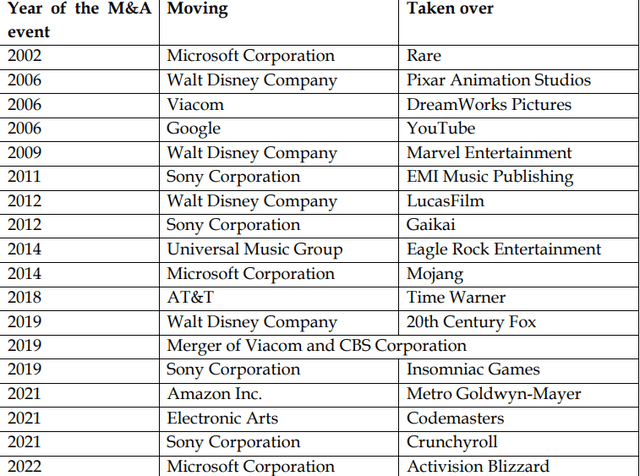

The image above expresses the sheer number of competitors within the present-day entertainment landscape. The logical conclusion to this intensity of competition is a level of industry consolidation, with 8 of 18 major entertainment industry M&A deals of the 21st century occurring in the past 5 years. And, according to S&P Global, this ‘content consolidation craze’ is only expected to accelerate in the coming years.

A world of mergers and acquisitions in the entertainment sector in the 21st century (SSRN)

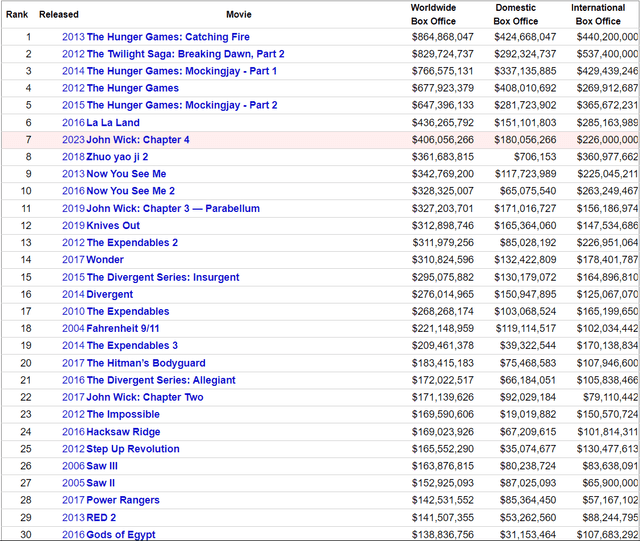

Among major media corporations, the likes of WBD, AMC (AMC), and Fox (FOX) can be ruled out due to factors such as a financial inability to commit to such a transaction or a lack of a need for Lions Gate’s intellectual property or talent. Conversely, firms such as Amazon, Apple, and Netflix are aggressively expanding their content offerings and have way more than sufficient financing to successfully execute a deal. Roku has additionally expressed interest in Lions Gate as a means of expanding verticals and acquiring a content library including, but not limited to the Hunger Games, Twilight, and John Wick.

Lionsgate Top 30 Grossing Movies (the-numbers.com)

Wall Street Consensus

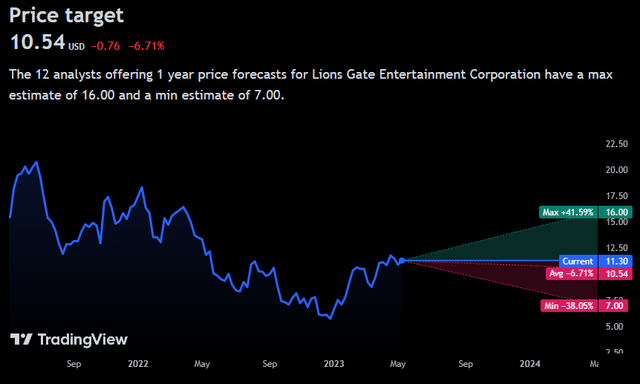

Analysts refute my positive view on the firm, projecting an average 1Y price decline of -6.71%, to a price of $10.54.

TradingView

This comes alongside a minimum price projection of -38.05% to a price of $7.00.

Largely a product of Lions Gate’s extremely poor financial performance over the past year, I believe analysts fail to price in the potential for acquisition.

Risks & Challenges

A Lack of M&A Interest

The whole valuation and bull case for Lions Gate rests upon its ability to be a buyout target. If there is insufficient interest in the company and its content offerings, Lions Gate likely will not appreciate to the expected level and may actually lose some priced in value.

Capital and Financial Restraints

As the company continues to generate both negative free cash flow and negative net income, Lions Gate is forced to continue depending on external debt or equity financing. With a debt/equity ratio of 3.55- significantly higher than the industry average, Lions Gate risks the ability to continue operating at any level.

Restructuring Plans May Negatively Impact Business

Although Lions Gate aims to streamline its businesses and support a leaner, less debt-laden business with its spinoffs, Lions Gate may encounter unforeseen circumstances and experience negative share price action. For example, there may be synergetic benefits to Lions Gate’s current model that they will lose out on given a divestment.

Conclusion

In the short term, even without an M&A deal, I expect the company’s fortunes to revert to a fiscal level better than today.

In the mid to long term, I project that Lions Gate will be the target of an acquisition and for investors to be paid a healthy premium on this buyout.

Credit: Source link