shih-wei

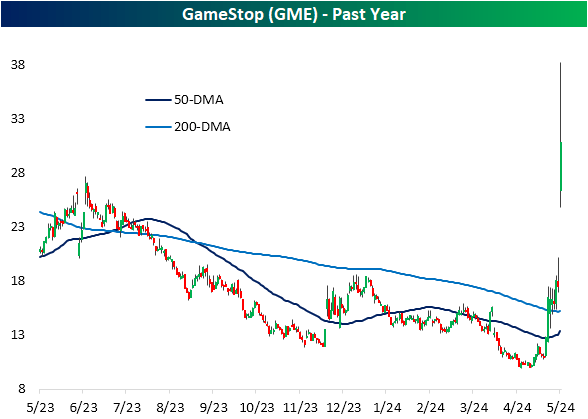

Thanks to a single tweet marking the return of the poster child of 2021’s meme stock mania, shares of GameStop (GME) are back in the news thanks to a soaring share price. As shown below, the stock that was at the center of the 2021 short squeeze is once again flying with gains of well over 70% in today’s session.

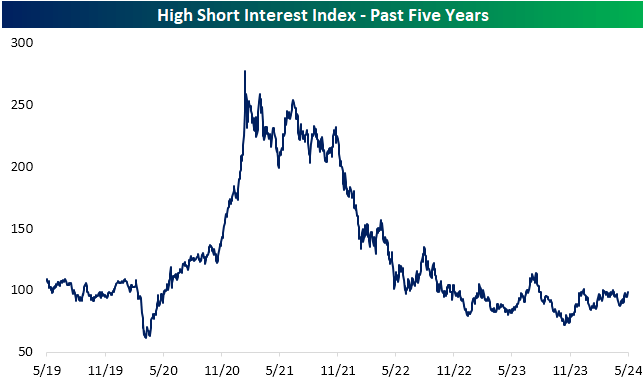

As always, one day does not make a trend. Although the massive rally in GME today is impressive, overall, highly shorted stocks have not done much since their heyday from a few years back.

Below we show an index comprised of the 100 most highly shorted Russell 3,000 members, rebalanced monthly over the past five years. As shown, while there have been a couple of higher lows in the past six months, the index has been range-bound at best over the past two years. Perhaps more importantly, current levels are still well below those from 2021.

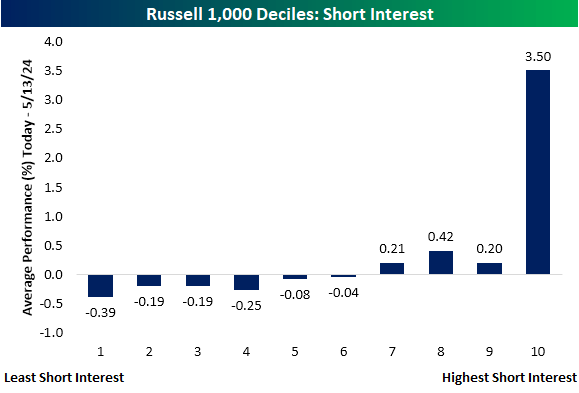

Moving back to the present, today’s outperformance of the most highly shorted names is remarkable. Below, we break down the Russell 1,000 into deciles based on their levels of short interest. Decile 1 represents the 100 stocks with the least short interest, while decile 10 is made up of the stocks with the most heavily shorted names.

As shown, whereas the average Russell 1,000 stock is up 31 bps today, the average gain of the 100 most shorted members is 3.5%. Of course, that includes GameStop, but even when that one name is removed, the average gain is still an impressive 2.75%.

Moving down the line, performance gets much less impressive. As shown, stocks in deciles 1 through 6 are all averaging declines today while deciles 7, 8, and 9 are averaging modest gains. The surge in GME, though, has caused traders to pile into other heavily shorted names in hopes of additional squeezes.

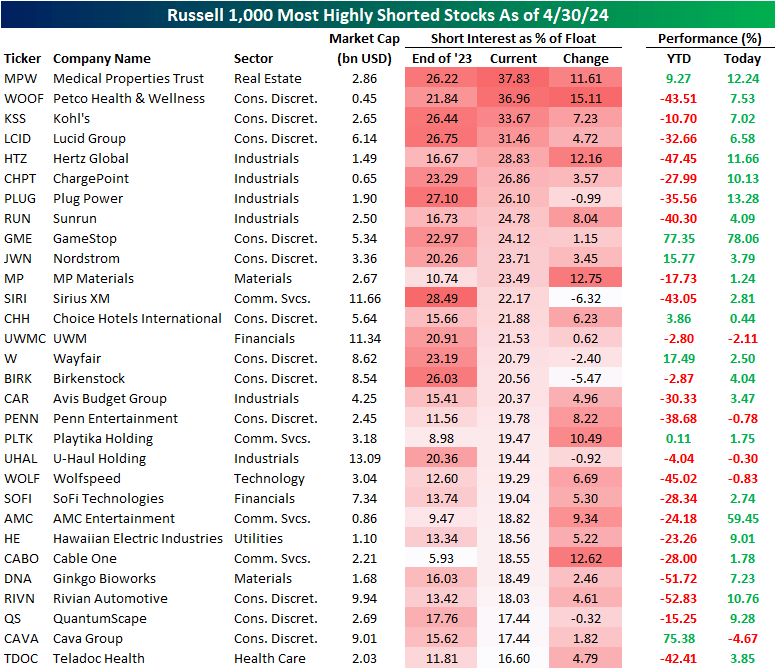

Late last week, the latest short-interest data was published with readings through the end of April. Below we show the Russell 1,000 members with the highest levels of short interest per that data.

Medical Properties (MPW), Petco (WOOF), and Kohl’s (KSS) top the list as each one has more than a third of its float sold short. Each of those are rallying hard today, but only MPW is up on the year.

Moving further down the list, there are multiple clean energy-related names – Lucid (LCID), ChargePoint (CHPT), Plug Power (PLUG), and Sunrun (RUN) -falling in the top ten most heavily-shorted names.

Right behind those names is, of course, GameStop. Worth noting is that after today’s gain, GME joins MPW and only a handful of others on this list that have year-to-date gains.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Credit: Source link