Edwin Tan/E+ via Getty Images

Investment Summary

My previous investment thesis (published on 15-Feb-24) was a buy rating for Newell Brands (NASDAQ:NWL) as I believed FY24 could see a turnaround for both revenue growth and margin expansion, especially since January ’24 performance was tracking well. I continue to attach a buy rating to NWL as the business seems on track to recover sales back to historical growth rates, and the margin outlook is now a lot healthier.

1Q24 Results Update

In 1Q24 (26th April), NWL reported core sales declined by 4.8%, coming in way above the high end of the guided range of -8% to -6%. By segment, Home & Commercial Solutions saw a 4.3% decline, Learning & Development saw 1.8% growth, and Outdoor & Recreation saw a 20.3% decline. Gross margin performance was spectacular, coming in at 31.2% up ~410 bps vs. 1Q23, marking the 2nd consecutive quarter of gross margin expansion since 3Q23. Consequently, EBIT margin saw an expansion of ~220 bps to 4.6%.

Sales Outlook Remains Bright

1Q24 core sales performance, while declining by 4.8%, was a very positive sign of sales improvement as it came above the high end of the guidance range of -8% to -6%. It was also a very significant sequential improvement from the 9.3% decline seen in 4Q23. The bears might point to reported growth still being down 8.4%, but let me note that the biggest cause of the delta between core growth and reported growth is FX (outside of NWL control), which was a 3% headwind. The better-than-expected 1Q24 performance led management to guide 2Q24 core sales expectations for -6% to -4%.

FY24 guidance was reiterated despite the outperformance in 1Q24, and I believe NWL can meet it. For the unaware, core sales guidance for FY24 expects a decline of -6% to -3%. This core sale guide bridges to expected reported sales growth of -8% to -5% for FY24, with a 200bps headwind from foreign exchange and the exit of certain categories driving the delta. First of all, from a cadence basis, given that this 1Q24 core sales came in at -4.8%, and 2Q24 is expected to be down -5% at the midpoint, NWL needs to achieve growth in the low single digits for 2H24 in order to meet the core sales decline of 4% at the midpoint of FY24. Achieving this goal shouldn’t be too difficult, especially considering how successfully the new business development team has been bringing in distribution from new retailers, channels, or categories to existing customers. Also, management shared very positive comments on recent distribution gains for Graco, Rubbermaid Brilliance, Calphalon, and commercial cleaning in the club channel. In 2H24, these gains should be visible in the P&L, along with gains in the dollar channels due to notable wins in Rubbermaid and NUK baby care products.

We are seeing green shoots from the decisive actions we are taking to strengthen Newell’s front-end commercial capabilities as we are beginning to bring consumer-driven innovation to market. The new business development team is gaining momentum and the international business is outpacing North America.

This team has delivered new distribution gains on Graco, Rubbermaid Brilliance, Calphalon and commercial cleaning in the club channel, which will set in the second half of 2024. 1Q24 earnings transcript

Regarding the baby care products, I am positive on management’s confident tone regarding NWL’s distribution expansion with specialty retailers. In addition to positive benefits from gains from Graco and NUK brands, NWL is also expected to benefit from being a feature in Kohl’s (KSS) newly announced Babies R Us store-in-store concept. All of these, in my opinion, will drive better top-line performance in 2H24 compared to 1H24. Looking further into the medium term, NWL should also see an unwinding of 200 bps in headwinds (incorporated in the FY24 core sales guide) in core sales, turning into tailwinds with the decision to exit certain businesses.

Margin Expansion Ahead Supported by Gross Margin Improvements

FY24 guidance EBIT margin was reiterated by a range of 7.8% to 8.2%, which translates to around 100 bps of margin expansion at the midpoint. This has multiple implications. Firstly, it implies that 1Q24 gross margin can sustain >30%, which means management efforts to exit less lucrative businesses, generate cost savings and productivity, and drive innovation (current intention is for eight Tier 1 and 2 launches in FY24) to improve gross margin are tracking well against expectations. We can also tell from the 2Q24 guide that gross margin is moving very well in the right direction, as the 2Q24 EBIT margin outlook range of 9.1%-9.6% assumes meaningful improvement in gross margin.

Valuation

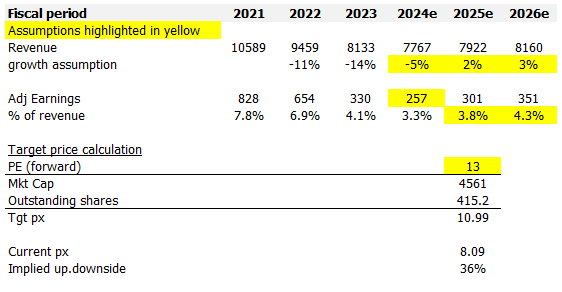

Redfox Capital Ideas

I model NWL using a forward PE approach and using my assumptions, I believe NWL is worth ~$11. My views on NWL’s topline have not changed. I expect NWL to easily meet the midpoint of its FY24 guidance, followed by a return to positive growth of 2% in FY25 and 3% in FY26 (in line with pre-Covid average core sales growth). What has changed this time around is that I expect better margin performance. With my positive gross margin outlook, I believe NWL can achieve the high end of its FY24 earnings guide and that 30 bps of incremental margin (the high end of FY24 guide implies 3.3% margin, which is 30bps ahead of my original expectations) to flow through FY25 and FY26, exiting FY26 with $351 million of earnings. Valuation-wise, the improved earnings outlook further solidifies my view that NWL should trade minimally at its 10Y historical average of 13x (a modest increase from the current 12.3x).

Risk

Gross margin is likely to see sequential deceleration due to the lapping of price increase action taken in July 2023 and no incremental pricing action planned in FY24. Bearish investors might bite on this and say that NWL’s ability to expand margins has softened and that EBIT margin guidance is hard to meet. From a sentiment perspective, this could put pressure on the stock price.

Conclusion

My view for NWL is a buy rating. Core sales outperformed guidance and showed a sequential improvement. The margin outlook is also a lot brighter now, with gross margin expanding for the second quarter in a row. I believe NWL is well on track to meet its FY24 core sales guidance, and distribution gains in key channels should lead to improved top-line performance in the latter half of the year. While there might be some deceleration in gross margin expansion due to lapping prior price increases, profitability should continue to expand throughout 2025 and 2026.

Credit: Source link