Gary Yeowell

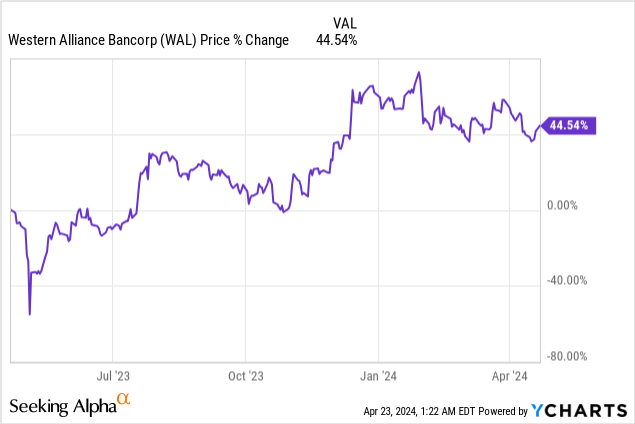

Western Alliance Bancorporation (NYSE:WAL) reported better than expected earnings for the first fiscal quarter on April 19, 2024. The regional bank posted almost flat net interest income year over year for Q1’24 due to a rapid repayment of outstanding borrowings that Western Alliance took on during last year’s crisis in the regional banking market. The bank’s deposits are also showing healthy growth, and the bank’s latest consolidation provides a new entry opportunity for investors. With shares trading below my fair value estimate of $68, I believe the risk profile for investors is favorable!

Previous rating

I recommended Western Alliance at the height of the crisis in the original banking market in 2023, but most recently rated shares a hold due to a higher valuation. I am upgrading shares of Western Alliance back to buy because the bank is seeing very strong growth in its deposit base and continued to make rapid progress in the first-quarter repaying a large chunk of its outstanding borrowings. Shares are also more attractively valued since I last covered WAL in January.

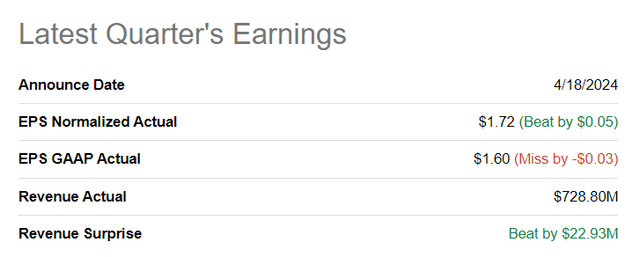

Western Alliance beats Q1’24 earnings

Western Alliance managed to deliver better than expected earnings last week, chiefly because of strong net interest income results that were driven by higher earning asset balances. The regional lender reported $1.72 per-share in adjusted earnings for the first-quarter, beating the consensus estimate by a solid $0.05 per-share. At the same time, Western Alliance’s revenues beat expectations by $23M.

Seeking Alpha

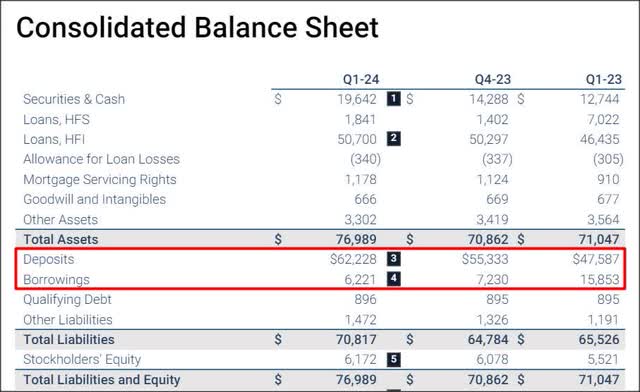

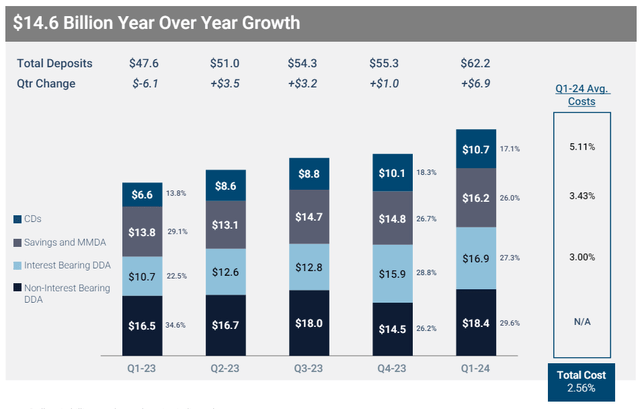

Deposit and borrowing picture

The deposit picture for Western Alliance is looking very good and the main reason why I am upgrading shares to buy from my previous hold rating. The bank reported a deposit balance of $62.2B, which was almost 31% higher than last year’s Q4’23, the quarter just before Silicon Valley went out of business and which triggered a major banking crisis in the U.S.

Since last year, Western Alliance reduced its high-cost borrowings, which I previously said could be an earnings lever for the bank, by a massive 61%. In the fourth-quarter, Western Alliance continued to reduce its borrowings by a solid $1.0B, which is set to take further pressure off of the bank’s net interest margin going forward.

Western Alliance

Deposits continued to flow to Western Alliance in the first fiscal quarter as well: the bank captured an additional $6.9B in deposits and posted a record balance of $62.2B. Compared to Q1’23, which is when the regional lender reported a decline in its deposit base, the deposit situation has more than just stabilized.

Western Alliance

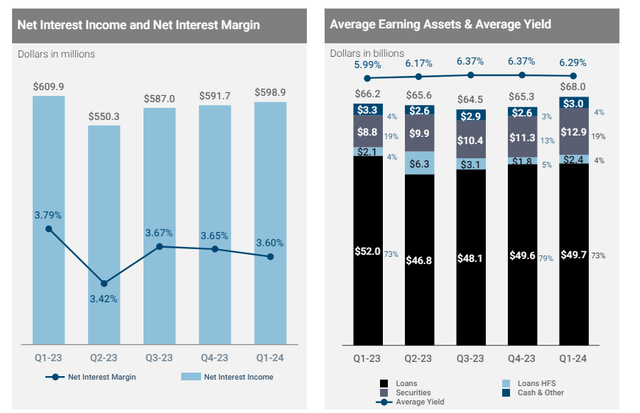

Strong net interest income, but weak outlook

Western Alliance generated $598.9M in net interest income in the first fiscal quarter, which translated to a net interest margin of 3.6%. Compared to last year, this net interest income has grown due to higher earning asset balances, but also because the bank reduced its outstanding borrowings. Since other banks have seen pressure on their net interest incomes lately, I believe from a NII perspective, Western Alliance submitted a very strong earnings sheet. Going forward, I expect Western Alliance to continue to pay down its short-term borrowings and thereby lift its net interest income.

Western Alliance

Western Alliance’s valuation, updated fair value

In my last work on Western Alliance, I estimated the bank’s fair value to be approximately $67, given its historical P/B average of 1.27X. The regional lender reported a book value of $53.33 per-share for the first-quarter, so applying this historical valuation average to the new book value yields a fair value estimate of approximately $68.

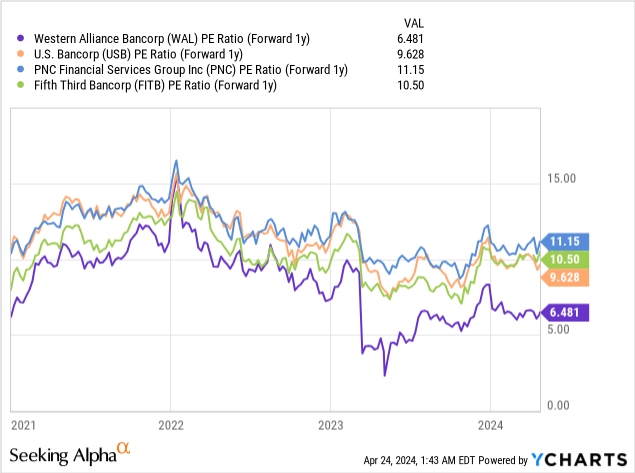

Based off of earnings, Western Alliance is also cheap relative to a group of regional bank rivals, with a P/E ratio of only 6.5X… which implies an attractive forward earnings yield of 15%. Other regional banks, like U.S. Bancorp (USB), Fifth Third Bancorp (FITB) and PNC Financial Services Group (PNC) trade at an average P/E ratio of 10.4X. Given the recent trends in borrowings and deposits, I believe Western Alliance offers investors an especially attractive risk profile.

Risks with Western Alliance

As the Federal Reserve lowers the federal fund rate, banks like Western Alliance will not be able to charge high rates for their loans anymore, indicating that banks in general will face weaker earnings prospects going forward. Western Alliance has also already made rapid progress in terms of lowering its borrowings, limiting further optimization potential. However, given the strong business trends in NII, deposits and borrowings in the first-quarter, and shares dropping back below $60 lately, I believe the risk profile is skewed to the upside.

Final thoughts

Western Alliance is a well-run regional lender that has managed to stage quite a comeback after the banking crisis last year. Most importantly, deposits soared 30.8% year over year and the bank reported a new deposit record in the first-quarter. Western Alliance has made considerable progress reducing its outstanding high-cost borrowings, and the reduction in borrowing costs has been a key driver for the bank’s very resilient net interest income. Given that shares are trading for a very compelling price-to-earnings ratio and below my fair value estimate, I believe the value proposition for Western Alliance has improved considerably since January. The higher for longer rate background obviously also helps the Western Alliance for the time being. With a 15% earnings yield and growth in its core metrics, I rate Western Alliance a buy.

Credit: Source link