Shana Novak/DigitalVision via Getty Images

Summary

This post is to provide an update on my thoughts on Urban Outfitters’ (NASDAQ:URBN) business and stock. I give a buy rating to URBN, as 70% of the business continues to show very strong fundamental performance. Both the Free People and Anthropologie brands grew in the range of low to high teens, which sustained 2-year stack growth to 30+ and 20+%, respectively. Even in this state of macro backdrop, these brands were able to demonstrate such growth, leading me to believe that in a normalized environment, growth could easily continue at this level.

Business

URBN is a lifestyle product company that sells a wide assortment of products, from clothing to shoes to accessories, beauty, etc. It has three primary brands and five brands under its portfolio: Urban Outfitters, Anthropologie, and Free People. The business has historically performed well, where growth has always been positive for the past 10 years, averaging mid-to-high single-single digits growth (covid period FY20–22), and has generated positive profits and free cash flows over the same period.

Investment thesis

In 4Q24, URBN revenues grew 8% (in line with pre-announced guidance of high single-digits), driven by retail segment comparable sales growth of 4.9% and wholesale sales growth of 3%. Moving down the income statement, the adjusted gross margin expanded 290bps to 30.2%, led by higher initial merchandise markups driven by lower inbound transportation costs. However, operating expenses [opex] grew more than the top line at 10.6%, leading to an EBIT margin decline, resulting in 4Q EPS missing consensus expectations ($0.69 vs. $0.73).

I believe the market might have overly punished URBN based on this quarter of misses because the business is still doing very well. Looking at the brand’s performance, Free People grew 18.9% and Anthropologie grew 12%, which collectively represented ~70% of FY23 sales. On a 2-year stack basis, Free People growth accelerated from 31% in 3Q23 to 34% in 4Q24, and Anthropologie growth remained >20% (21% in 4Q24 and 26% in 3Q23). Even if we compare FY23 performance against FY19 (pre-covid), the growth performance of these two brands remained very strong at 8% CAGR and 12.4% CAGR, respectively. Importantly, this suggests that the health of URBN’s targeted consumer base is very positive. I think this point deserves more attention than it should because it means that URBN is not as impacted by inflation as any other normal retailer, and the reason is because of underlying consumers’ profiles (higher willingness to spend).

Turning now to the health of our customers. We believe they as a group are in good shape. They’re not as exuberant as they were when first coming out of the pandemic. They don’t have as many weddings and events to attend. They are less apt to move and have recently refurbished their living spaces. So, demand for categories like dressier, footwear and home furnishings are trending softer, but they do enjoy a secure job and are earning more money than ever. They tend to be optimistic, want the latest fashion, and are willing to spend some of those extra earnings to enjoy them. 4Q24 earnings call

Positively, there has been no slowdown in the demand momentum for the Anthropologie brand. In February, management reported an uptick in same-store sales, highlighting the continued optimism of consumers and their positive reactions to a variety of occasions and casual categories. The bigger driving force that gives me confidence for 1Q24/FY24 performance is that the brand now has an expanded customer base. In 4Q24, Anthropologie saw 26% new customer growth in North America, and these new customers are mainly customers under 40 (showing that the brand continues to stay relevant). Combining this expanded customer base notion and the fact that the two new product concepts are already driving positive retail segment comparable growth in February, I feel optimistic about ongoing growth momentum.

Next is the Free People brand. The recent performance suggests that the management growth strategy for attracting digital customers is working well. With this demand momentum, I would expect a similar demand profile for its retail stores, which is currently planned for 35 new openings in FY24 (~18% growth from the FY23 base of 198 stores). FY24 is an important period for this brand because this is the first time Free People has opened more than 30 stores in a single year. If growth does not see any major deceleration, it would really support management’s comment that Free People has the highest store count opportunity of all URBN brands, both in North America and globally.

All in all, based on the brand’s performance so far, URBN should have no issues meeting the management guide for 1Q25 net sales growth of mid-single digits, especially since quarter-to-date is tracking just a little softer than 4Q24.

Valuation

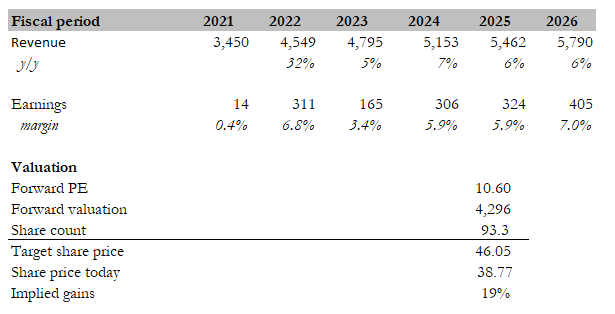

Own calculation

My target price for URBN, based on my model, is $46. My model assumptions are that revenue will grow by 6% in the near term. I used 6% because that is the historical growth rate over the past 10 years (excluding the COVID period), and based on the strength of URBN’s targeted consumer base, store openings, expanded product concepts, and a recovering US macro economy, it should easily replicate historical growth performance. Margins should stay flat in FY25 given the step-up in marketing expenses to drive growth, but I do expect margins to inflect upwards back to the historical average as revenue scales up, providing operating leverage. Note that pre-covid, the business generates around 7% net margin with a revenue size that is 20+% smaller than FY23. I would expect URBN to continue trading at its historical average multiple (10.6x forward PE), as my forecast is for URBN to revert to historical performance.

Risk

The biggest risk to the upside here is the Urban Outfitters brand continuing this sluggish performance. In the latest quarter, comparable sales were down 14% due to weakness in North America and Europe. The hope here is that Shea Jensen (the new North American President of the Urban Outfitters brand) can turn around the brand, and the guide for 4Q25 comps to be flat implies strong sequential improvements.

Conclusion

In conclusion, my rating for URBN is a buy rating. Despite a miss in 4Q24 earnings, URBN has strong growth potential driven by Free People and Anthropologie brands. These two brands represent 70% of the business and boast consistent growth even in a challenging environment. While the Urban Outfitters brand struggles, a new management team has been put in place to turn it around. Considering URBN’s historically strong performance and strong consumer base, I believe it is still well-positioned for continued growth.

Credit: Source link