Richard Drury

We previously covered DocuSign, Inc. (NASDAQ:DOCU) in January 2024, discussing the unlikely buyout rumor with the recent lifting market sentiments already triggering the stock’s overly rapid recovery, with the potential volatility offering interested investors a minimal margin of safety.

While the stock had been rated as a Buy then, attributed to its speculative turnaround story, we had also recommended a lower entry point at the $48s for improved upside potential.

It appears that the entry point materialized by mid-February 2024 after all, with the DOCU stock already rallying by +18% since then, well outperforming the wider market at +5.8% over the same time period.

Much of the SaaS company’s tailwinds are attributed to its ability to better monetize its existing user base while attracting new consumers through multiple growth initiatives.

Combined with the management’s promising FY2025 guidance and healthy balance sheet, there remain great opportunities for investors looking to add at every dip.

The DOCU Investment Thesis Remains Robust, As It Grows Beyond Its Hyper Pandemic Potential

For now, DOCU has reported a double beat FQ4’24 earnings call on March 07, 2024, with total revenues of $712.4M (+1.7% QoQ/ +8% YoY) and adj EPS of $0.76 (-3.7% QoQ/ +16.9% YoY), with FY2024 numbers of $2.76B (+9.9% YoY) and $2.98 (+46.7% YoY), respectively.

Much of the top-line tailwinds are attributed to the growing customer base of 1.5M (+7.1% QoQ/ +15.3% YoY) across Federal government and commercial markets, implying its ability to better monetize existing users while attracting new customers.

The sticky consumer base is also observed in DOCU’s expanding gross margins of 83% (+1 points YoY) in FY2024, with it being apparent that the management has competently driven growth across its well-diversified offerings, despite the normalization from the hyper-pandemic period.

We already see the management achieve excellent traction through Microsoft Corporation (MSFT) Azure’s cloud marketplace, with DOCU signing its first $1M customer through the channel.

This is on top of the Meta Platforms, Inc.’s (META) WhatsApp integration for e-signature launched in November 2023, with the management noting that contracts sent through the social media platform being signed “nearly seven times faster than those sent via e-mail.“

With WhatsApp being the leading mobile messaging app globally, with an estimated 3.03B users in 2024 (+9% YoY) and the projected user growth to 3.28B in 2025 (+8.2% YoY), it is unsurprising that the platform is increasingly adopted for business use, as similarly reported by the CFO of META in the recent FQ4’23 earnings call.

As a result of the strategic synergy for DOCU’s eSignature and CLM business growth globally, we can understand why the company has reported accelerating growth in the international market, with sales of $728.93M (+17.5% YoY) compared to the US at $2.03B (+7.4% YoY) in FY2024.

Based on the ambitious projection of $50B in global opportunity for the eSignature and Contract Lifecycle Management [CLM] markets, we believe that there are immense opportunities beyond the domestic market indeed.

This is given DOCU’s inherent position as the undisputed e-signature industry leader, versus 17 other vendors in IDC’s annual worldwide assessment, with the international market likely to be its growth driver moving forward.

Most importantly, DOCU continues to demonstrate robust operational cost efficiency, with the management recently announcing a headcount reduction of -6% after the buyout falls through, as both parties disagreed on a price after multiple rounds of negotiation.

Readers may also want to note that this optimization builds upon the YoY reduction by -6.6% from 7.33K employees reported in FY2023 to 6.84K in FY2024.

As a result, we can understand why DOCU is able to offer a promising FY2025 guidance, with revenues of $2.92B (+5.7% YoY) and adj operating margins of 27.2% at the midpoint (+1.4 points YoY), further demonstrating its ability to grow profitably as it improves its operational scale.

These numbers do not appear to be overly ambitious as well, given the multiple growth opportunities as discussed above, and the increased multi-year remaining performance obligation of $2.2B (+10% QoQ/ +15.7% YoY/ +189.4% from FY2019 levels) in FQ4’24, with over 56% expected to be realized over the next twelve months.

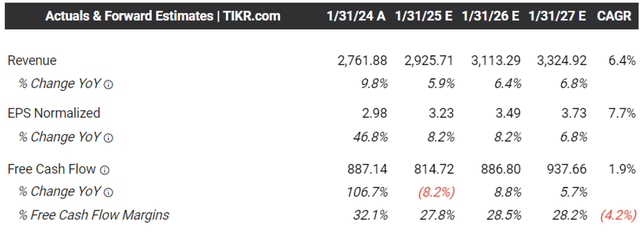

The Consensus Forward Estimates

Tikr Terminal

As a result of the management’s promising FY2025 guidance, we can understand why the consensus has upgraded DOCU’s top/ bottom line growth to a CAGR of +6.4%/ +7.7% through FY2027.

This is compared to the previous estimates of +5.1%/ +2.8%, while building upon the historical expansion at +31.6%/ +101.4% between FY2019 and FY2024, respectively.

Most importantly, with DOCU continuing its streak of growing Free Cash Flow generation of $887.13M (+106.7% YoY) and margins of 32.1% (+15 points YoY) in FY2024, it is unsurprising that the market has priced in a similar trend over the next few years.

As a result, we believe that the company’s balance sheet may continue to improve from the cash/ investments of $1.04B reported in FQ4’24 (inline YoY/ +445% from FY2020 levels), further aided by its inherent lack of debt.

This is on top of the management’s sustained share repurchases in balancing the growing stock-based compensations, triggering its relatively stable share count thus far.

So, Is DOCU Stock A Buy, Sell, or Hold?

DOCU 2Y Stock Price

TradingView

For now, DOCU has already recovered by +50% since the October 2023 bottom, well outperforming the wider market at +26%, further underscoring the stock’s immense bullish support thus far.

DOCU Valuations

Seeking Alpha

At the same time, due to its growing profitability, we can understand why the market has upgraded DOCU’s FWD P/E valuations to 18.77x and FWD Price/ Cash Flow valuations to 13.38x.

This is up from the October 2023 bottom of 15.16x/ 9.29x, while nearing where it was at the time of my previous article around 19.85x/ 13.17x and the 1Y mean of 19.68x/ 15.40, respectively.

Even when compared to its direct SaaS peer, Adobe Inc. (ADBE) trading at 27.59x/ 27.37x, fellow hyper-pandemic beneficiary, Zoom Video Communications, Inc. (ZM) at 12.94x/ 10.65x, and the sector median of 24.97x / 22.55x, respectively, we believe that DOCU is fairly valued here.

Based on the FY2024 adj EPS of $2.98 and the FWD P/E of 18.77x, the stock seems to be trading near our fair value estimate of $55.90.

Based on the consensus FY2026 adj EPS estimates of $3.73 (up by +19.1% from the previous estimates of $3.13) and the same P/E valuations, there seems to be a more than decent upside potential of +19% to our raised long-term price target from $62 to $70 as well.

As a result of the relatively attractive risk/ reward ratio, we are maintaining our Buy rating for the DOCU stock.

Moving forward, investors may want to take note of the management’s ability to introduce new in-house offerings to better cross-sell to the existing consumers and to improve the dollar net retention from the 98% last reported in the FQ4’24 earnings call (-2 points QoQ/ -9 YoY).

With its overall net new expansion continually impacted by the elongated sales cycle and uncertain macroeconomic outlook, we believe that it is unlikely for the SaaS company to replicate a similar growth opportunity as it has during the hyper-pandemic period.

Therefore, investors may want to temper their overall growth expectations accordingly.

Credit: Source link