gopixa

Amplify Alternative Harvest ETF (NYSEARCA:MJ) was the first cannabis ETF to start trading. The exchange-traded fund covers investments in a wide swath of cannabis stocks, but diversity is possibly not the best option in the space. My investment thesis is Bullish on the upside of the ETF based on positive trends in the cannabis space, with multiple catalysts to legalization and reduced costs in the space for beaten-up stocks.

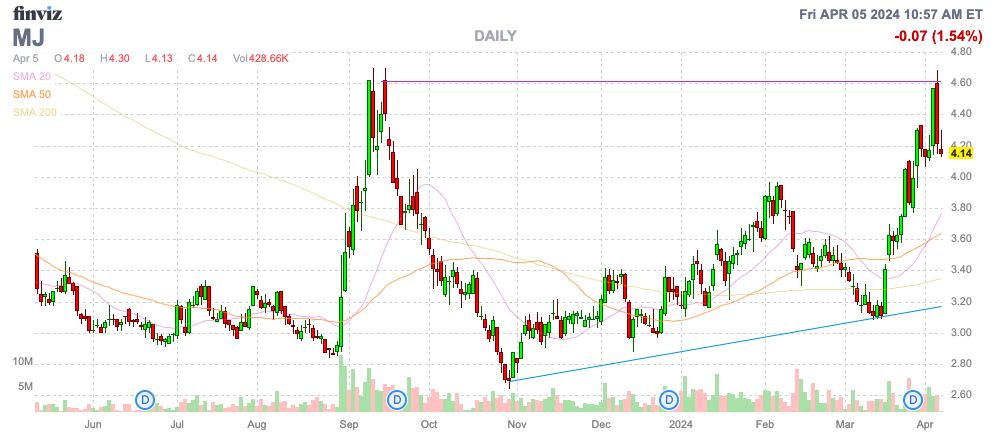

Source: Finviz

MJ ETF’s Diversified Investments

MJ has rallied recently due to multiple catalysts boosting the cannabis space. The ETF invests directly in the Canadian cannabis space, where the companies have generally struggled to even produce positive adjusted EBITDA due to overproduction and a highly competitive market on top of the large excise issue.

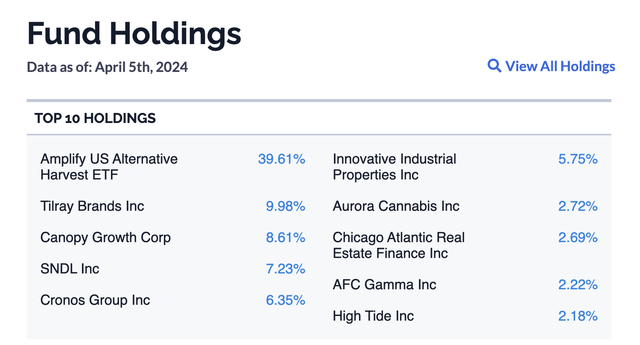

The ETF invests directly in Tilray Brands (TLRY), Canopy Growth (CGC) and SNDL, Inc. (SNDL) as some of the biggest LPs in Canada, but the ETF also includes investments in cannabis REITs like Innovative Industrial Properties (IIPR) adding up to 10% of the fund.

Source: Amplify ETFs

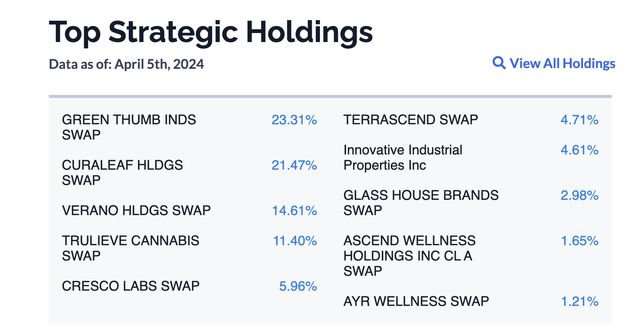

The other 40% of the fund is invested in Amplify U.S. Alternative Harvest ETF (MJUS), where the ETF invests in swap agreements to mirror the returns of the U.S. multi-state operators (MSOs) traded over-the-counter and directly investable by the ETF. This fund mostly invests in swaps for the bigger MSOs like Green Thumb Industries (OTCQX:GTBIF), Curaleaf (OTCPK:CURLF), Verano Holdings (OTCQX:VRNOF) and Trulieve Cannabis (OTCQX:TCNNF), accounting for over 70% of the ETFs investments.

Source: Amplify ETFs

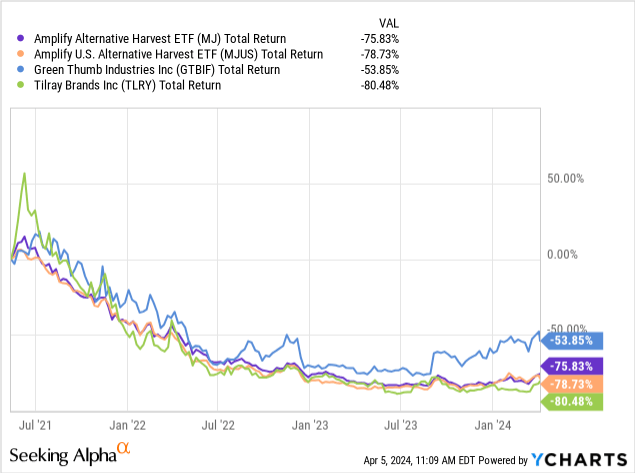

In the last few years, the cannabis space has generally traded in the same path with MJ and MJUS, replicating similar losses.

Positive Cannabis Market Trends

Due to legality issues, the cannabis stock market is segmented into 2 main groups: Canadian and U.S. MSOs. MJ generally invests directly into the 2 sectors evenly, with direct investments in the main Canadian LP stocks and nearly 40% of the fund invested indirectly in the MSOs through MJUS.

The majority of Canadian stocks trade on major U.S. stock exchanges with recreational cannabis legal in Canada. The MSOs don’t trade on major exchanges due to restrictions limiting companies trading with federally illegal operations, such as the cultivation and selling of cannabis.

The Canadian stocks have generally traded at higher valuations due to access to major stock exchanges while financials have been incredibly weak. The MSOS have tended towards weaker valuations while the larger companies have reported solid adjusted EBITDA numbers.

Either way, the cannabis market has seen more positive trends recently with both segments seeing various differing trends. The Canadian segment will possibly see a major benefit from a reduction in the effective excise tax to the effective target of 10%, while a large portion of the MSOs are likely set to see a big market like Florida approve recreational cannabis in November. New York continues to push forward with opening up the adult-use market.

Canadian Excise Tax

The country approved recreational cannabis back in 2018, and all of the big LP stocks have been crushed since those highs. Part of the issue the government is looking at correcting with the new budget due on April 16 is returning the excise tax to the intended 10% level.

Due to incorrectly assuming cannabis prices would stay elevated, the regulations required an excise tax of either C$1 per gram or 10% of the value of the gram, whichever is greater. The goal was to not charge high excise taxes on high cannabis prices, but the reality has been low cannabis prices leading to orders being charged C$1 in excise taxes, leading most companies to now pay 30-40% of reported gross domestic recreational revenues in excise taxes.

Due to the shifting dynamics in the Canadian space, the companies most impacted by high excise taxes aren’t always the more popular ones included in the MJ ETF. Tilray Brands could see a benefit of up to $100 million while Canopy Growth is no longer a market leader. A company like Organigram (OGI) benefitting by over $50 million via a reduction of the excise tax to 10% isn’t a big position in MJ.

Florida

The Florida Supreme Court just approved an initiative to legalize recreational cannabis with the referendum on the November ballot. The state will need 60% of voters to approve the amendment, setting up recreational cannabis to be legalized about six months after the election.

Trulieve Cannabis is the leader in the state by far with 134 dispensaries, far above the next closest competitor in Verano at 74 stores. An investor interested in playing Florida directly would want to invest in one of these stocks versus using the ETF tied to a lot of Canadian stocks that won’t benefit from the Florida cannabis market likely doubling to $4+ billion on the approval of recreational cannabis.

U.S. Cannabis Rescheduling

One major positive catalysts in the U.S. includes the possibility for federal rescheduling of cannabis from a narcotic under the Controlled Substances Act to a level 3 drug like Tylenol. The MSOs would see a major benefit, with the elimination of the 280E taxes that are causing the companies to pay excess taxes due to operating businesses technically illegal at the federal level.

The U.S. DEA continues to promise to announce the rescheduling plan, but the Department of Health and Human Services recommended the DEA approved the move back in 2023, yet the government regulator still hasn’t made a ruling. Now, Republican Senators are actively pushing the block the re-scheduling push.

All of these catalysts don’t even include the recent approval of cannabis regulations in Germany and the potential Safe Banking Act.

Takeaway

The key investor takeaway is that cannabis has a plethora of catalysts for the sector this year, and MJ offers an opportunity to make a blanket investment into the cannabis space. A more sophisticated investor might want to invest directly into one of the cannabis stocks depending on the catalyst, or directly into MJUS for more exposure into the U.S. market. Either way, the sector has a tendency to trade together over time, and MJ provides solid overall exposure to the cannabis sector and offers a great entry point down over 80%.

Credit: Source link