The Good Brigade

Summary

Following my coverage on Zoom Video Communications (NASDAQ:ZM), for which I recommended a hold rating, as I was waiting for the headline growth to start showing positive inflection, this post is to provide an update on my thoughts on the business and stock. The near-term outlook for ZM still remains weak and uncertain, with no positive catalyst in sight to drive a positive inflection. As such, I continue to recommend a hold rating for the stock.

Investment thesis

In ZM’s recent results, I give credit to ZM’s ability to achieve a better-than-expected pro forma EBIT of $444 million (consensus expected $413 million) and FCF of $351 million (consensus expected $213 million). However, there are still no signs of a positive inflection in ZM headline growth figures. In 4Q24, the business reported revenue of $1.146 billion, representing 2.6% growth. Although this is better than what consensus expected at 1.2%, the growth rate is a step down sequentially vs. 3.2% y/y growth saw in 3Q24 and 3.6% y/y growth saw in 2Q24. ZM’s underlying operating metrics also continue to suggest that the business is facing challenges. For instance, enterprise customers added slowed from 3,700 in 4Q23 and 1,600 in 3Q24 to 700 in 4Q24. Slowing does not only impact current growth; it also impacts the near-to-mid-term growth potential as ZM has a smaller customer base to cross-sell its other solutions. In fact, this appears to be happening already, as the TTM net dollar expansion rate [NDER] for customers declined from 105% in 3Q24 to 101% in 4Q24.

Touching more on cross/up selling traction, I have an increasing concern about ZM’s ability to sustain NDER above 100% in the near term, as ZM RPO was flat in 4Q24 vs. 3Q24, or just 4% growth vs. 4Q23, the lowest it has ever gotten, clearly signifying a slowdown in momentum and consumer willingness to pickup more modules. Given the uncertainty in growth, it does not help to know that margin is going to see further pressure in the near term as management continues their AI investments. In 4Q24, gross margins fell by 60bps to 79.2%, largely reflecting costs associated with AI Companion, and this pressure is expected to continue into FY25 as management’s revised FY25 outlook indicates another 90bps of decline.

Based on these, I am still not positive on ZM seeing any positive inflection in the near term. However, there is an interesting aspect of the business that is making me feel positive about the medium-term prospects (suppose this weak near-term is not stemmed from any structural issues). In the contact center business, new customers and larger average deals drove a 3x increase in Zoom contact center licenses, indicating that the business is still gaining momentum. This growth momentum is likely to continue given the current rate of adoption and ZM’s continuous investments in adding features, including GenAI capabilities through its AI Companion tool. Management has noted that existing features have helped them win market share against legacy solution providers. Something notable that could potentially accelerate growth here is the newly-launched tiered pricing, which widens the spectrum of users that it can attract (some users might not need all the customized features, so they are willing to use it after the lowered price).

“Bolstered by its expanding features, our Contact Center suite is beginning to win in head-to-head competition with legacy incumbents. Beyond that, it is competing on its own merits with customers completely new to Zoom, broadening the” 4Q24 earnings results call

Another positive point I am supportive of is that management is adopting a very shareholder-friendly approach to utilizing its balance sheet, which currently sits on almost $7 billion of cash. They have announced a stock repurchase program of up to $1.5 billion, and given the huge cash generation capability of the business, I have no doubts that they can sustain and potentially step up buying back shares in the future. For context, $1.5 billion is around 7.5% of the current market cap.

Valuation

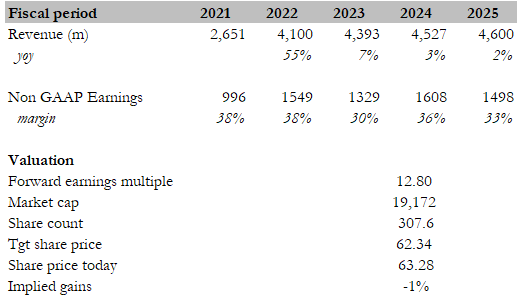

Own calculation

My target price for ZM based on my model is $62.34. My model assumptions are that ZM will grow 2% and achieve a 33% net margin in FY25. Both my estimates are based on management guidance, which historically has been accurate. Qualitatively, I think the recent growth performance and underlying operating metrics really show that ZM is still undergoing a tough period, with little visibility of any positive inflection. The ongoing investments in product innovation are also going to put pressure on margins, further dampening the near-term outlook. I believe the market is already pricing my view, as seen from the forward PE valuation that ZM is trading at today: 12.8x forward PE, which is near the all-time low since ZM got listed. With no positive catalyst in sight, I don’t see any reason for the market to drive this valuation upward.

Conclusion

In conclusion, my rating for ZM remains as hold. Despite exceeding expectations on profitability, ZM still lacks a near-term catalyst for growth. Slowing customer acquisition and declining net dollar expansion rate suggest that ZM is still facing challenges. While the contact center business shows promise, overall growth remains sluggish. The market also seems to be reflecting my view as it has de-rated ZM’s valuation to near all-time-low.

Credit: Source link