Editor’s note: Seeking Alpha is proud to welcome Thomas Shields as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Spencer Platt/Getty Images News

Investment Thesis

I evaluate companies through the lens of value investing and a focus on the fundamentals. Taking a page out of Warren Buffett’s approach, I want to buy great companies at fair prices, with a focus on earnings, free cash flow, and debt levels. If the preliminary scan through their fundamentals warrants further research, I will continue to read about the company to make a final decision before investing. Based on the current fundamentals, CAVA Group, Inc. (NYSE:CAVA) is at an extended valuation today and there is an increased risk of permanent loss of capital at this price. I expect a stock price retraction to occur in the short term (next 12 months) which will open a better buying opportunity with a larger margin of safety than the current price of the asset today. Further, compared to a similar company that has done well since IPO, CAVA is trading at a higher expected valuation than Chipotle Mexican Grill, Inc. (CMG) even though they are less profitable than CMG was at this time after their IPO based on their fundamentals in 2007. However, CAVA has significant revenue growth which is intriguing given that their growth is higher than CMG’s around the same time after IPO. Given that I start my personal investment analysis with fundamentals, we will start there for CAVA.

Company Overview

CAVA Group is a growing Mediterranean restaurant chain with a similar business structure to Chipotle Mexican Grill, Inc. where there is an assembly line of made to order bowls and pita wraps. Currently, CAVA Group, Inc. is about one-tenth the size of Chipotle Mexican Grill, Inc. based on enterprise value and is rapidly growing their operating restaurants in a highly competitive, but growing, industry. CAVA’s test markets in Boston, Dallas, and the Carolinas have gone well and will continue to expand in 2024 with increased customer loyalty from new reward programs offered by the company. This rapid restaurant growth, and growing customer base has caused a monstrous growth of the share price over the last 6 months which was also aided by an earnings beat in the last quarter. However, with the current state of the economy, there are risks associated with investing in CAVA today that should be considered before investing at this price.

Current Fundamentals: CAVA

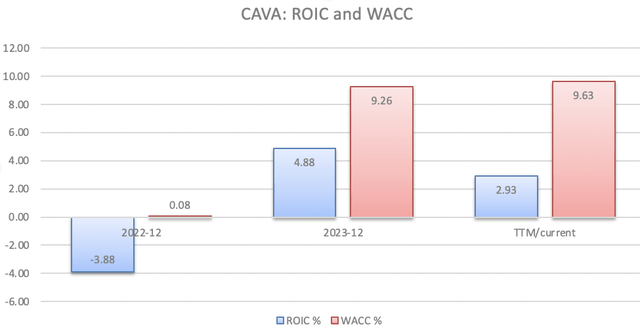

We have seen an incredible price appreciation in the stock over the last 6 months, as well as a nice return since the last earnings call. At the time of this writing CAVA is currently trading at a forward price to earnings ratio (PE) of about 300 and is trading at over an 83 EV/EBITDA ratio (enterprise value/earnings before interests, taxes, depreciation, and amortization). There is currently a negative free cash flow yield per share, negative free cash flow margin, and they are trading at a TTM price/sales ratio of over 5 times. The current forward price to book value is 12.67 times and there is currently a higher debt level per share than cash on hand. Further, the current return on invested capital is only 2.93% while the weighted cost of capital is at three times this amount at 9.63%. In my investment strategy, companies with these numbers are not good initial investments. With CAVA losing money on their invested capital (ROIC-WACC) and with rapid growth continuing, I do not want to pay over 300 times earnings for a net debt position (cash-debt). Although CAVA may be a great company, the risk here is current price of the asset. For the price to be justified, everything will need to go according to plan and even then, I am not sure it makes sense given a comparison to a previous winner, CMG.

CAVA ROIC% and WACC% since IPO. (GuruFocus)

CMG Post IPO Fundamentals

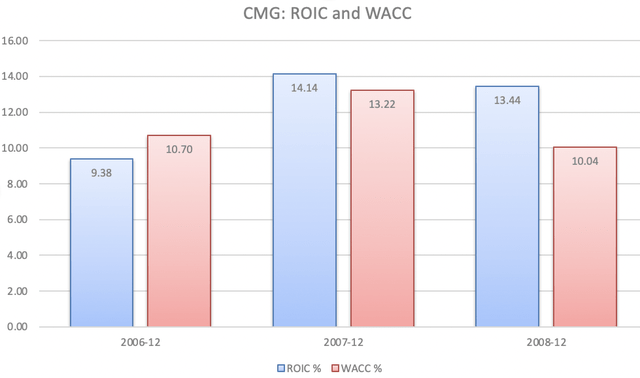

I think we would all agree that if we could go back to buy Chipotle Mexican Grill, Inc. around the time of their IPO, we would buy it without hesitation given the incredible price return since then. If you had bought CMG at the IPO, you would have over a 6000% return today. With the similarities in overall business operations between CMG and CAVA, I wanted to compare the previous fundamentals of CMG to see if it makes sense to invest in CAVA today at the current valuation. Some quick fundamentals on CMG around the time of their IPO and high growth stage early on; in 2007, CMG traded at a PE of 69, an EV/EBITDA value of just over 29, saw revenue growth of 32%, and had positive free cash flow. In that year, CMG also had a return on invested capital of just over 14%, and a weighted cost of capital of 13%. Around the same amount of time allowed since IPO, CMG was not trading as overvalued as CAVA is today. Given the fundamentals of CMG back in 2007 with positive free cash flow and a net positive return on their investments (ROIC-WACC), CMG would warrant further analysis to see if the estimated return would have been better than the risk-free rate at the time. CAVA is currently trading at about 4.3 times the PE ratio, 2.9 times the EV/EBITDA ratio, and is producing negative free cashflow compared to what we saw with CMG back in 2007 when it would have made sense to consider this restaurant chain as a long-term investment.

CMG: The ROIC and WACC values post IPO between 2006 and 2008. (GuruFocus)

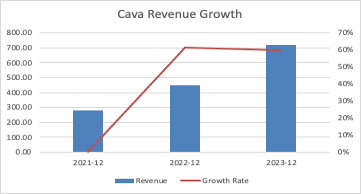

Risk Free Rate And Risk

When we currently have a risk-free rate of investment around 5% from short-term bond investments and money market funds, it is hard to justify an investment in CAVA with negative overall cashflow and invested capital in the short term. However, the only caveat to this is that CAVA has had higher revenue growth. From 2005 to 2007 CMG only had a 73% revenue growth compared to CAVA’s 158%. If CAVA can continue to grow at a substantial rate, earnings and revenue should be able to outpace their high new store growth costs, but keep in mind this financial situation is different than what we saw with CMG who also rapidly grew their restaurants early on. Based on this comparison, and the current state of the overall fundamentals of CAVA, I would not continue further analysis reading through the current news articles and financial statements of the company because there is a greater risk of losing my investment here than with an investment in other great companies or the current risk-free rate. However, I will continue with highlighting areas of concern to keep in mind when considering an investment today and pay close attention to for their bottom line.

CAVA’s Revenue Growth (GuruFocus)

Short-Term Company Growth

Back in 2018 CAVA acquired one of their direct competitors, Zoe’s Kitchen, and this has helped supplement growth by the conversion of Zoe’s Kitchen locations to CAVA locations. Going off data from last earnings call, CAVA now has 309 restaurant locations, and plans to expand this by opening 48 to 52 new locations in 2024. This would represent about a 15% increase in new locations; however, the estimated preopening costs are between 11.5 million and 12.5 million. The costs associated with opening new locations may have a drag on short term profitability and earnings of the company. Over the last few years, CAVA has benefit from their acquisition by the conversion of Zoe’s Kitchen locations to CAVA restaurants which has increased the short-term growth of the company, and this expansion was highlighted in their August 15 10-Q filing as well. However, CAVA is finishing up the conversion of Zoe’s Kitchen locations this year, with only a few locations remaining. I expect growth of new locations will rapidly slow down over the short term given the lack of remaining Zoe’s Kitchen locations to convert and associated preopening costs of planned new locations. With the current fundamentals pointing to overall negative free cash flow and negative returns on their investments, I would be concerned about accumulating a massive amount of debt to finance short term new restaurant growth given the preopening costs and lack of restaurants to convert.

Increased Labor Costs

During the earnings call, it was mentioned that there was a 3% increase in restaurant menu pricing as well as improved packaging which helped to decrease packaging costs by almost 29%. Although the 3% increase in price may represent some pricing power given that same store sales are still growing, labor costs increased almost 28%, or up 50 basis points since the same quarter in 2022. Further, there is a current risk of cost inflation on food products such as olives, chicken, and olive oil. CAVA saw the cost of these items increase throughout 2023, and they are anticipating further single digit cost inflation. Given the expected single digit sales growth per store in the 2024 outlook, and continued risk of food inflation over the short term, labor costs may have an impact on the bottom line if they are not able to further offset costs as they have in previous quarters.

Conclusion

In summary, CAVA Group, Inc. is a growing Mediterranean restaurant food chain that is focused on hospitality and providing good quality Mediterranean food. However, CAVA is trading at an extended valuation, and I expect there to be a decline in share price based on the fundamentals. I like the overall story behind CAVA given that I am not aware of another Mediterranean restaurant chain that is as successful, and I like the food. This, along with the rapid revenue and restaurant growth the company has displayed over the last year may be the reason the market has overpriced the asset with the fear of missing out on another CMG like restaurant company. However, based on my analysis above, I am going to stay away from starting a position in CAVA right now because there are better opportunities out there with less risk attached. This article is solely my opinion based on my brief analysis.

If the plan for company growth does not work out, which we will see in the next few quarters, I would expect a negative reaction in the share price that may open the opportunity for investment given the high revenue growth. Personally, I would not look to start a position until we saw significant drop in stock price due to the increased level of risk at the current valuation.

Credit: Source link